Aloe Vera Juice Market Size 2024-2028

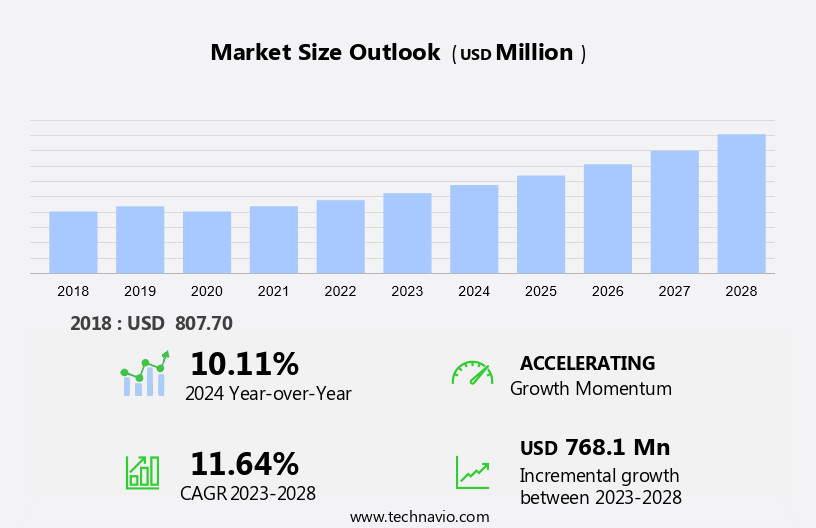

The aloe vera juice market size is forecast to increase by USD 768.1 million, at a CAGR of 11.64% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing number of organized retail outlets. These retail channels provide easy accessibility and convenience to consumers, thereby fueling the demand for Aloe Vera juice. Another key trend shaping the market is the adoption of innovative and sustainable food packaging solutions. Producers are focusing on eco-friendly and recyclable packaging to cater to the growing consumer preference for environmentally friendly products. However, the market faces challenges due to stringent regulations on the production and labeling of Aloe Vera juice.

- Compliance with these regulations can add to the production costs, potentially impacting the competitiveness of market players. Companies seeking to capitalize on market opportunities should focus on adhering to regulatory requirements and offering innovative, sustainable packaging solutions to meet evolving consumer preferences. Additionally, strategic partnerships and collaborations with retailers can help expand market reach and increase brand visibility.

What will be the Size of the Aloe Vera Juice Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The dynamic the market continues to evolve, driven by the diverse applications of this versatile plant across various sectors. Aloe vera, renowned for its natural ingredients and amino acids, is increasingly sought after in skincare products for its ability to enhance skin hydration and promote elastin synthesis. In the realm of health and wellness, aloe vera gel finds its place as a functional food ingredient, contributing to digestive health and immune system support. The supply chain management of aloe vera juice is a critical aspect of the market, with a focus on maintaining quality control through leaf processing techniques such as outer leaf fillet extraction and aseptic processing.

These methods ensure the preservation of the antioxidant properties and antimicrobial benefits of the aloe vera plant. Retail channels have played a significant role in the market's growth, with an increasing number of supermarkets and health food stores stocking aloe vera juice and related products. Consumer perception continues to shift towards natural ingredients, driving demand for organic aloe vera and cold-pressed juice. The market's unfolding patterns extend to the pharmaceutical industry, where aloe vera concentrate and extracts are used in herbal remedies and cosmeceutical ingredients for wound healing and skin regeneration. The potential for product differentiation through pricing strategies and brand positioning is significant, as companies explore new applications for aloe vera in areas such as hair care and collagen synthesis.

The evolving nature of the market is further highlighted by the development of new technologies, such as gel stabilization and aloe vera powder production, which enhance the product's shelf life and functionality. The market's continuous dynamism underscores the potential for ongoing innovation and growth in this sector.

How is this Aloe Vera Juice Industry segmented?

The aloe vera juice industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Beverages

- Nutraceuticals

- Cosmetics

- Pharmaceuticals

- Consumer Segment

- Health-Conscious Consumers

- General Consumers

- Fitness Enthusiasts

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Indonesia

- Japan

- Malaysia

- South Korea

- Thailand

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

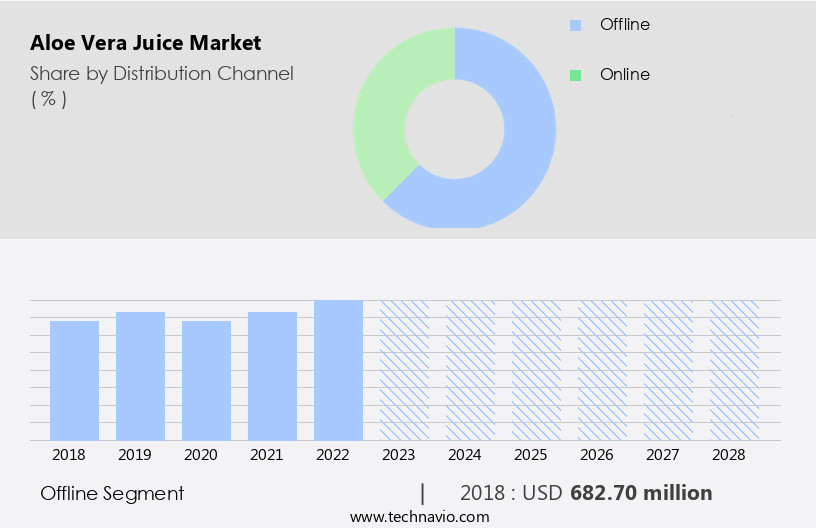

The offline segment is estimated to witness significant growth during the forecast period.

The market is characterized by the dominance of the offline distribution channel, which includes brick-and-mortar outlets such as hypermarkets, supermarkets, grocery stores, and convenience stores. In 2023, this segment accounted for the largest market share. Organized retail, which includes hypermarkets and supermarkets, offers consumers ease of purchase and a wide range of options. Major players in this sector, like Tesco Plc (Tesco), Carrefour Group, and Target Brands Corp. (Target), offer various brands of aloe vera juice worldwide. Aloe vera juice is prized for its antioxidant properties, making it a popular choice for health and wellness enthusiasts. Its anti-inflammatory properties make it a valuable ingredient in hair care and skincare products.

Aloe vera gel, derived from the leaf fillet through fillet extraction and aseptic processing, is used in various applications, including beverages, dietary supplements, and functional foods. Quality control is crucial in the production of aloe vera juice, as it involves leaf processing, gel stabilization, and extract concentration. Natural ingredients, such as amino acids and elastin synthesis, contribute to the product's health benefits. The market also includes conventional aloe vera, organic aloe vera, and aloe vera pharmaceuticals. The market's growth is driven by consumer perception, with an increasing focus on natural ingredients and immune system support. The market also caters to the demand for sunburn relief, digestive health, and collagen synthesis.

Cold-pressed juice and cosmeceutical ingredients are emerging trends. Product differentiation is essential in the market, with various brands offering unique selling propositions. Distribution networks play a crucial role in reaching consumers, with e-commerce platforms and traditional retail channels coexisting. Storage conditions and shelf life are critical factors in maintaining product quality. In conclusion, the market is a dynamic and evolving industry, driven by consumer demand for natural ingredients and health benefits. The market's growth is underpinned by various trends, including the increasing popularity of functional foods, natural ingredients, and cosmeceuticals. The market's future looks promising, with opportunities for innovation and product differentiation.

The Offline segment was valued at USD 682.70 million in 2018 and showed a gradual increase during the forecast period.

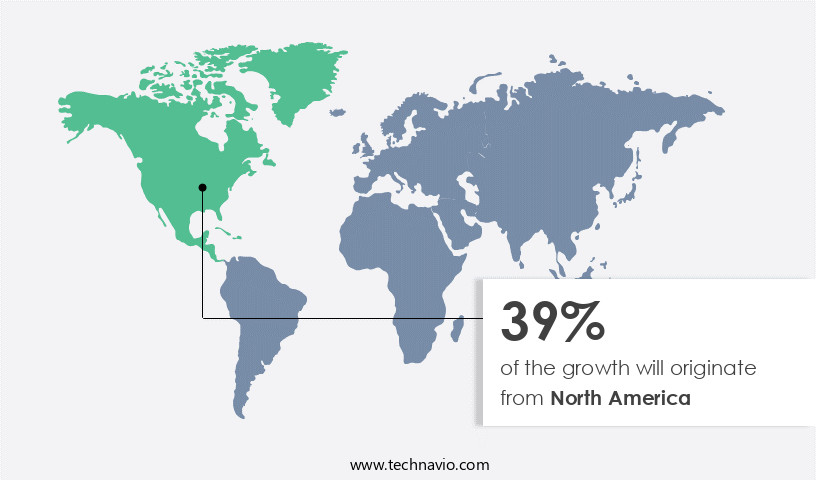

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

B2B aloe beverage solutions utilize natural extraction technologies for wellness benefits. Aloe vera juice opportunities 2024 include aloe drinks for health stores and organic aloe beverages, meeting consumer needs. Aloe supply chain tools enhance distribution, while aloe vera competitive insights highlight key suppliers. Sustainable aloe farming supports eco-friendly beverage trends. Aloe vera regulatory standards 2024-2028 shape aloe juice demand in Asia-Pacific 2024. Premium aloe juice products and aloe market forecasts drive adoption. Aloe beverages for retail and custom aloe formulations target niches. Aloe juice market barriers and strategies address taste challenges, with aloe sourcing innovations and aloe cost efficiency boosting margins. Aloe market intelligence and functional beverage advancements fuel expansion.

What are the key market drivers leading to the rise in the adoption of Aloe Vera Juice Industry?

- The expanding presence of well-organized retail outlets serves as the primary catalyst for market growth.

- The market has experienced significant growth due to the increasing penetration of organized retailing in major countries such as the US and India. Supermarkets, hypermarkets, convenience stores, and discount stores have emerged as key distribution and marketing channels for aloe vera juice. The rise in urbanization in regions like APAC and South America has led to an increase in the number of organized retailing outlets in these areas, further boosting market growth. In the US alone, the number of supermarkets grew by 6% between 2018 and 2021.

- Some major countries with a high degree of organized retailing penetration include Brazil, the UK, Germany, Italy, Spain, China, Canada, France, Australia, and Japan. This trend is beneficial for companies operating in the market.

What are the market trends shaping the Aloe Vera Juice Industry?

- The increasing preference for innovative and sustainable packaging solutions is a notable trend in the current market. This shift towards eco-friendly and technologically advanced packaging is mandatory for businesses seeking to stay competitive.

- The market has experienced significant growth due to increasing consumer awareness about the health benefits of this natural beverage. The outer leaf fillet is extracted through fillet processing, ensuring the highest quality of the gel. Aloe Vera juice is known for its antioxidant properties, making it an excellent ingredient for various health and wellness products, including dietary supplements and hair care items. companies are focusing on aseptic processing to maintain the juice's quality and freshness. This method ensures that the juice is free from contamination and preserves its nutritional value. Moreover, the juice's anti-inflammatory properties make it a popular ingredient in beverage formulations.

- To attract consumers, companies are implementing pricing strategies that cater to various market segments. They are also emphasizing quality control measures to meet consumer expectations and maintain brand reputation. Innovative packaging solutions are essential in the market, as they not only protect the juice but also enhance its appeal to consumers. Eco-friendly and recyclable packaging options are gaining popularity due to growing concerns about sustainability. In conclusion, the market is driven by increasing consumer demand for natural and healthy beverage options. companies are focusing on product innovation, quality, and sustainable packaging to meet consumer preferences and stay competitive.

What challenges does the Aloe Vera Juice Industry face during its growth?

- The strict regulations imposed on the production and marketing of aloe vera juice represent a significant challenge to the industry's growth. In order to comply with these stringent rules, companies must invest heavily in research and development, as well as adhere to rigorous quality control measures. This not only increases production costs but also limits the industry's ability to scale up and reach larger markets. Therefore, finding ways to navigate these regulations while maintaining product quality and consumer trust is essential for the continued growth and success of the aloe vera juice industry.

- Aloe Vera juice, derived from the succulent aloe vera plant, is a popular natural beverage and functional food recognized for its numerous health benefits. The market for this product is driven by consumer demand for natural ingredients and functional foods. Aloe Vera juice contains essential amino acids, antioxidants, and minerals, making it an excellent addition to a healthy diet. The production and supply chain management of Aloe Vera juice involve careful handling of the plant to ensure the highest quality gel. Retail channels, including supermarkets and health food stores, are the primary outlets for this product.

- Proper storage conditions are crucial to preserve its nutritional value and antimicrobial properties. Regulations play a significant role in the production and marketing of Aloe Vera juice. In the US, the USDA enforces guidelines for product description, packaging, and labeling. The European Union (EU) has similar regulations, such as Council Directive 2001/112/EC, which sets standards for production, composition, and labeling of fruit juices and similar products. The skincare industry also utilizes Aloe Vera gel as a key ingredient due to its ability to promote elastin synthesis and improve skin hydration. As a result, Aloe Vera juice finds applications in both food and cosmetic industries.

- In conclusion, the market is fueled by consumer perception, health benefits, and regulatory compliance. Proper supply chain management and storage conditions are essential to maintain the product's quality and meet consumer expectations.

Exclusive Customer Landscape

The aloe vera juice market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aloe vera juice market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aloe vera juice market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALO Drinks - The company specializes in producing high-quality aloe vera juice, including the popular Alo Original product. This beverage offers numerous health benefits, making it a top choice for consumers seeking natural and effective hydration solutions. With a commitment to purity and sustainability, the company's aloe vera juice undergoes rigorous testing to ensure the highest standards of quality and consistency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALO Drinks

- Aloe Drink For Life

- Aloe Farms Inc.

- AlterFood

- Atlantia Aloe

- ESI srl

- Forever Living Products International LLC

- Fruit of the Earth

- GraceKennedy Ltd.

- Keumkang B and F Co. Ltd.

- Lily of the Desert

- OKF Co.

- Patanjali Ayurved Ltd.

- RITA Food and Drink Co. Ltd.

- Savia

- Simplee

- Suja Life LLC

- Tulip International Inc.

- Vitamin Well Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aloe Vera Juice Market

- In January 2024, PepsiCo's Quaker Oats division announced the launch of a new line of Aloe Vera flavored oatmeal, incorporating the health benefits of Aloe Vera into their popular breakfast product (Quaker Press Release). This strategic move aimed to cater to the growing consumer trend towards functional foods and beverages.

- In March 2024, Herbalife Nutrition, a leading nutrition company, entered into a partnership with a major South Korean retailer, Emart, to expand its distribution network in the Asian market (Herbalife Nutrition Press Release). This collaboration marked a significant geographic expansion for the company, increasing its reach and market share in the region.

- In May 2024, Aloe Gloe, a leading Aloe Vera juice brand, secured a strategic investment of USD15 million from a prominent venture capital firm, Signia Venture Partners (VentureBeat). The funding would be used to accelerate product innovation, marketing efforts, and geographic expansion.

- In April 2025, the European Food Safety Authority (EFSA) approved the health claim for Aloe Vera's role in maintaining normal bowel function (EFSA Press Release). This regulatory approval opened the door for Aloe Vera juice manufacturers to make this claim on their product labels in the European Union, potentially driving growth within the region.

Research Analyst Overview

- Aloe Vera juice, a popular health beverage, experiences dynamic market activity driven by various factors. Retail partnerships expand distribution channels, enabling wider reach for consumers. Tax regulations and import/export restrictions impact production capacity and pricing strategies. Intellectual property protection through patent filings and licensing agreements ensure brand awareness and product innovation. Harvesting methods and cultivation techniques influence product formulations and efficacy testing. Safety and toxicity testing are crucial for regulatory affairs, while marketing communications engage customer loyalty. Sales promotion and packaging design attract consumers, and distribution channels include wholesale and direct sales. Joint ventures and manufacturing processes optimize production capacity, while raw material supply and ingredient sourcing ensure quality.

- Clinical trials and efficacy testing validate product benefits, and sustainability practices enhance brand reputation. Pricing strategies balance affordability and profitability, and patent protection safeguards formulation development. Distribution channels, customs duties, and export regulations shape international trade, and ingredient sourcing and raw material supply influence formulation development. Regulatory affairs and safety testing ensure compliance, and product innovation drives market growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aloe Vera Juice Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

130 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.64% |

|

Market growth 2024-2028 |

USD 768.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.11 |

|

Key countries |

US, China, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aloe Vera Juice Market Research and Growth Report?

- CAGR of the Aloe Vera Juice industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aloe vera juice market growth of industry companies

We can help! Our analysts can customize this aloe vera juice market research report to meet your requirements.