Alternating Current Power System Market Size 2024-2028

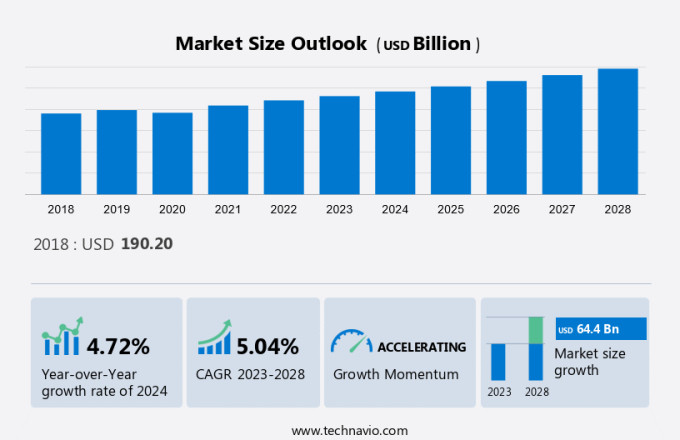

The alternating current power system market size is forecast to increase by USD 64.4 billion, at a CAGR of 5.04% between 2023 and 2028. The market is experiencing significant growth, driven by the increasing use of AC in high-voltage power transmission and the rising integration of renewable energy sources with the grid. AC power transmission systems offer several advantages, including greater efficiency and the ability to transmit power over long distances. However, there are also challenges to the market's growth. Disadvantages of AC power transmission systems include the need for expensive transformers to step up or step down voltage levels and the potential for power station issues, such as voltage fluctuations and harmonics. Despite these challenges, the market is expected to continue growing due to the increasing demand for reliable and efficient power transmission solutions and the integration of renewable energy sources into the grid. Additionally, advancements in technology, such as smart grids and flexible AC transmission systems, are expected to address some of the challenges associated with AC power transmission and further drive market growth.

What will be the size of the Market During the Forecast Period?

View the Bestselling Sample Report

Market Dynamics and Customer Landscape

The market is witnessing significant growth due to the increasing demand for reliable power supply in telecom towers, remote locations, and the expansion of LTE networks and 5G networks. The market is driven by the need for uninterrupted telecommunication services, especially during power disruptions. Digital disruptive technologies, such as Wi-Fi power and Smart Grids, are also contributing to the market's growth. The market is segmented into Wireless broadband access, Telecom towers, and Telecommunication services. The Telecom towers segment is expected to dominate the market due to the growing number of cell power systems being installed to support the increasing demand for connectivity infrastructure. The market is witnessing the adoption of advanced telecom power systems, such as Diesel-battery, Diesel-wind, and Diesel-solar, to reduce the carbon footprint and improve controllability and reliability. Power electronic devices, such as Static Var Compensator and Static Synchronous Compensator, are being used for voltage regulation and power flow stability. The market is also witnessing the integration of Renewable energy into AC power systems to improve efficiency and reduce dependence on traditional power sources. Transmission Lines are being upgraded to support the increasing power demands and ensure reliable power flow. In conclusion, the Alternating Current Power System Market is expected to continue its growth trajectory due to the increasing demand for reliable power supply, the adoption of digital disruptive technologies, and the integration of renewable energy sources. The market is expected to remain dynamic due to the evolving power landscape and the ongoing development of advanced power systems.

Key Market Driver

The rising demand from the telecom industry is notably driving market growth. The telecom industry has grown tremendously over the past decade, supported by advanced technologies. Telecom companies are now managing their voice networks along with data, broadband, mobile, and TV-related services. The industry has become highly disruptive, and customers' expectations continue to rise. This has highlighted the need for maintaining smooth operations and efficient management of assets for telecom operators. Power is the basic requirement for all the equipment and components in the telecom industry, therefore, the industry is highly reliant on generators and uninterruptible power supply (UPS) systems to protect assets from power outages, as minor power outages can also lead to huge revenue losses for telecom companies.

Further, the telecom industry is growing because of factors such as a rise in mobile subscriptions due to network expansions by operators and the declining cost of smartphones. Thus, mobile subscriptions are becoming affordable for all income groups. In addition, the growing use of the IoT in the telecom ecosystem and the introduction of 4G and 5G technologies have increased the demand for power demand from the industry. Hence, these factors will boost the global AC power system market during the forecast period.

Significant Market Trend

The growing use of e-commerce is an emerging trend in the market. The growing digitalization and e-commerce industry have compelled several companies operating in the global market to take their products online to increase their market share and profits. Several companies are also displaying their products on their websites. E-commerce is viewed by many companies and customers as being more effective than traditional brick-and-mortar establishments. Businesses cut costs, and customers have a wide range of product options and can purchase whenever they want, from anywhere in the world.

Further, e-commerce benefits companies by enabling them to gather customer information. Businesses can sell their products more effectively by using consumer purchasing patterns, demographics, and preferences. Companies can lessen the risk of overstocking or understocking a product by using e-commerce data to forecast when demand for a product will be higher or lower. Additionally, businesses may utilize this data to facilitate customers' buying experiences. Thus, factors like these are expected to drive the growth of the global AC power system market during the forecast period.

Major Market Challenge

Difficulties in keeping pace with changing customer demand are major challenges impeding market growth. AC power system manufacturers are subject to heavy cost pressures due to a demanding consumer base. With the lack of product differentiation of AC power systems, there is a marked variation in prices among manufacturers. There are multiple small and non-branded players that rival major brands. Major players such as ABB, Delta Electronics, and Lite-on Power System Solutions contribute significantly to the worldwide demand for AC power systems. These companies have the resources to push their products to wider end-users. Major players differentiate their products by offering high quality, which increases the manufacturing cost and product price. As most customers are price-sensitive, they prefer small companies. This acts as a challenge for companies operating in the market as they have to balance both the quality and price of their products.

However, product differentiation can only be achieved through R&D. However, major players are reluctant to invest in R&D to avoid a further rise in manufacturing costs. All the factors mentioned above reduce the profit margin of companies. Hence, such factors will hinder the growth of the global AC power system market during the forecast period.

Key Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the alternating current (AC) power system market.

LS ELECTRIC Co. Ltd. -.The key offerings of the company include alternating current power systems.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- ABB Ltd.

- Advanced Energy Industries Inc.

- AEG Power Solutions BV

- Delta Electronics Inc.

- Eaton Corp. Plc

- EnerSys

- General Electric Co.

- Hitachi Ltd.

- Infineon Technologies AG

- Itech Electronic Co. Ltd.

- Joe Powell and Associates Inc.

- MEAN WELL Enterprises Co. Ltd.

- Mitsubishi Electric Corp.

- Myers Power Products Inc.

- Powertek US Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

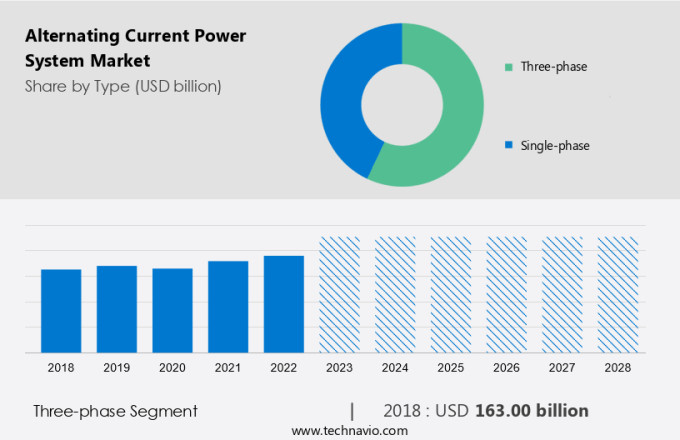

What is the Fastest-Growing Segment in the Market?

The market share growth by the three-phase segment will be significant during the forecast period. Three current-carrying conductors are the main component of three-phase power systems. These power supplies' circuits might be set up in a wye or delta configuration.

Get a glance at the market contribution of various segments View PDF Sample

The three-phase segment was valued at USD 163.00 billion in 2018. There is a neutral wire in wye designs. Three sine waves, one for each conductor, with a phase difference of 1200, are used to depict a three-phase electrical system. Each phase has a frequency and amplitude that are equal. In this power system, the waves twice reach the peak voltage for each full cycle, and the net voltage never falls below zero. As a result, the load receives a consistent stream of electricity at a nearly constant rate. When carrying the same load, a three-phase power supply's efficiency is much higher than that of a single power supply. Heavy-duty industrial equipment with high power requirements uses three-phase power systems. They are frequently employed to power motors, electric heaters, pumps, and other devices. Their operation is more cost-effective. Thus, increasing high power requirements are expected to drive the growth of the segment in the global market during the forecast period.

Key Regions

For more insights on the market share of various regions View PDF Sample now!

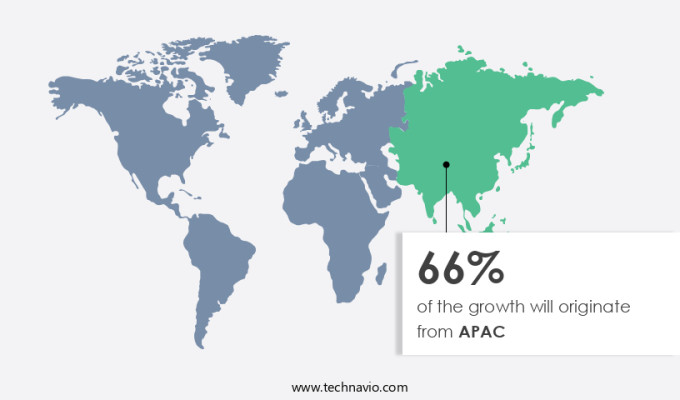

APAC is estimated to contribute 66% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market in APAC is anticipated to grow during the forecast period due to the fact that nations such as China, India, and Japan have a strong demand for electricity. Power transmission and distribution infrastructures are receiving a major investment from governments of Asia-Pacific nations. This is expected to increase the demand for flexible AC transmission systems in the near future. The demand for power in the Asia Pacific region is also significantly influenced by consistent economic expansion, rapid urbanization, and rising living standards. The world's largest manufacturing hub, China, has grown to be an important market for alternating current power systems. Power generation capacity increased substantially in 2020, which flooded the need for power transformers, switchgear, and related accessories in the country. In addition, the country had planned to add a major amount of hydropower and wind power capacity by 2020, thereby boosting the need for alternating current power systems.

Furthermore, India contributes immensely to the AC power system market in the region. Rapid developments in both commercial and industrial infrastructures are taking place in the country. The government highlights the expansion of T&D networks to improve the existing infrastructure that will propel the demand for AC power systems such as power transformers and switch gears in the country during the forecast period. Moreover, programs such as Make in India are anticipated to strengthen India's industrial manufacturing and processing sectors, placing the nation as one of the most promising markets for alternating current power systems during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- Type Outlook

- Three-phase

- Single-phase

- End-user Outlook

- Non-residential

- Residential

- Product Outlook

- Generator

- Switchgear

- UPS

- PDU

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Brazil

- Argentina

- North America

Market Analyst Overview

The market is evolving with significant advancements in energy efficiency and digital electricity. Hybrid power plants, combining renewable power generation and hybrid energy sources, are pivotal in enhancing clean energy generation and reducing environmental impact. Technologies such as PowerPOD 3 and 400G QPSK are driving innovations in AC power sources and high-power systems. Smart meters and on-grid systems facilitate better data consumption and integration with telecommunication networks, including mobile networks and ICT systems. The market's competitive environment is influenced by factors like product reliability, repair, and maintenance needs, as well as brand reputation. Local manufacturers face price competitiveness challenges while adapting to advanced solutions like Unified Power Flow Controllers (FACTS) and Thyristor-Controlled Series Capacitors. Smart factories and digital factories are reshaping manufacturing innovations, incorporating energy-efficient devices and smart city concepts. The rise in electric vehicles (EVs) and EV charging stations highlights the growing demand for sophisticated AC power solutions. Additionally, with the increasing use of smartphones and unmanned aircraft systems (UAVs), the emphasis on energy-efficient and reliable AC power systems continues to grow.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

202 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.04% |

|

Market growth 2024-2028 |

USD 64.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.72 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 66% |

|

Key countries |

China, US, India, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd., Advanced Energy Industries Inc., AEG Power Solutions BV, Delta Electronics Inc., EnerSys, General Electric Co., Hitachi Ltd., Infineon Technologies AG, Itech Electronic Co. Ltd., Joe Powell and Associates Inc., LITE ON Technology Corp., LS ELECTRIC Co. Ltd., MEAN WELL Enterprises Co. Ltd., Mitsubishi Electric Corp., Schaefer Inc., Schneider Electric SE, Siemens AG, Vertiv Holdings Co., Vicor Corp., and Zhejiang CHINT Electrics Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Forecasting Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this report to meet your requirements. Get in touch