Anhydrous Milk Fat Market Size 2024-2028

The anhydrous milk fat (butter oil) market size is forecast to increase by USD 1.57 billion at a CAGR of 7.51% between 2023 and 2028. The market is witnessing significant growth due to several key drivers. The refining process of AMF enhances its nutritional value, extending its shelf life and enabling its use in various applications. Consumers are increasingly seeking premium and specialty products, leading to a rise in demand for AMF. Furthermore, the market is witnessing a trend towards clean labels and natural products, which is positively impacting the AMF market. However, the price volatility of dairy products remains a challenge for market growth. AMF, also known as butter oil, is rich in vitamins A, D, E, and K2, calcium, and other essential nutrients. These nutrients contribute to bone health, arthritis prevention, and immunity boosting, making AMF a desirable ingredient for food and beverage manufacturers. Key market players are focusing on innovation and product development to cater to evolving consumer preferences and demands.

Anhydrous Milk Fat (AMF), also known as butter oil, is a high-value dairy ingredient used in various industries due to its unique properties and nutritional benefits. This product is derived from milk through a process involving centrifugation and removal of water content, resulting in a fat concentrate with a high butterfat content. The production of AMF requires significant capital investment in specialized machinery and raw materials. The process begins with the collection of fresh milk, which undergoes pasteurization to ensure food safety. The milk is then separated into skim milk and cream through centrifugation. The cream is then subjected to further processing, including chilling, standardizing, and churning, to produce butter.

Furthermore, the butter is then worked to remove water and create a consistent texture. The resulting butter is then subjected to various treatments such as vacuum treating, refining, and chilling to improve its shelf life and enhance its yellow color. The final product, AMF, is a fat concentrate with a water content of less than 0.1%. Product differentiation is a key factor in the AMF market. Manufacturers focus on producing AMF with specific characteristics, such as texture, color, and nutritional content, to cater to various industries and applications. For instance, AMF used in baking applications requires a different texture and color compared to AMF used in frying applications.

Moreover, the nutritional benefits of AMF are significant. It is rich in vitamins A, D, E, and K2, which are essential for bone health, arthritis prevention, and immune system support. AMF is also used in the production of recombined dairy products, soups and sauces, and in various culinary applications such as frying, deep frying, roasting, grilling, sauce-making, and baking. In the production of shortbread, AMF is used to create a distinctive texture and flavor. In the baking industry, AMF is used as a replacement for traditional butter in various applications, including laminated products, cakes, and pastries. The use of AMF in these applications provides several advantages, including improved texture, longer shelf life, and consistent performance.

Also, the demand for AMF is driven by its unique properties and nutritional benefits. The market for AMF is expected to grow due to its increasing use in various industries, including food and beverage, pharmaceuticals, and cosmetics. The production of AMF requires significant capital investment in specialized machinery and raw materials, making it a niche market with high barriers to entry. In conclusion, the AMF market is driven by the unique properties and nutritional benefits of this high-value dairy ingredient. The production process involves significant capital investment in specialized machinery and raw materials, resulting in a product with a high water content and consistent texture and color.

In conclusion, the demand for AMF is expected to grow due to its increasing use in various industries, making it a niche market with high growth potential. Key applications of AMF include baking, frying, and the production of recombined dairy products, soups and sauces. The nutritional benefits of AMF, including its rich content of vitamins and minerals, make it an attractive ingredient for various industries and applications.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Conventional

- Organic

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The market has witnessed significant growth in revenue through offline distribution channels. Factors such as the preference for instant product availability, personalized customer service, and the consumer tendency towards traditional purchasing methods are fueling this trend. Notable companies, like Fonterra and Dairy Farmers of America, are capitalizing on this development by expanding their presence in conventional retail stores. The proliferation of hypermarkets and supermarkets globally is projected to boost the expansion of the offline segment. For instance, Tesco, a leading UK supermarket chain, intends to establish 750 convenience stores in Thailand by 2022. This growth in offline sales is particularly relevant to industries producing recombined dairy products, as well as those involved in soups and sauces, frying, deep frying, roasting, grilling, and sauce-making. Companies can leverage this trend to enhance their market presence and cater to the diverse needs of their customer base.

Get a glance at the market share of various segments Request Free Sample

The offline segment accounted for USD 1.72 billion in 2018 and showed a gradual increase during the forecast period.

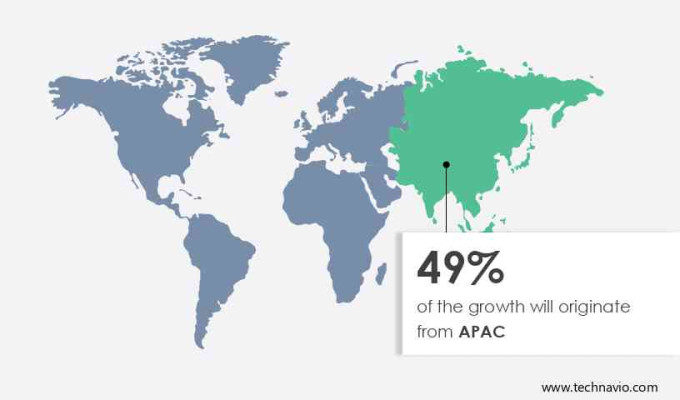

Regional Insights

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the Asia Pacific (APAC) region, the market has experienced significant growth. This expansion is attributed to several factors, including the rising demand for processed foods, the increasing preference for dairy products among consumers, and the expansion of the food and beverage industry. Key players such as Fonterra and Groupe Lactalis hold a strong regional presence, contributing to the market's growth. Anhydrous milk fat is essential for the burgeoning confectionery and baking industries in countries like China and India.

Furthermore, it is indispensable for the expanding food service industry in APAC, which encompasses fast-food franchises and restaurants, for various culinary applications such as baking, frying, sautéing, flavoring, and enriching recipes. Inventory management is crucial in this market due to the labor-intensive nature of the production process, which requires advanced machinery to ensure product consistency and quality. Raw material suppliers play a vital role in maintaining a steady supply chain to meet the increasing demand for anhydrous milk fat.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising consumer demand for premium and specialty products is the key driver of the market. The market is experiencing significant growth due to the increasing consumer preference for superior quality dairy products. This trend is primarily driven by the belief that anhydrous milk fat offers a richer flavor and enhanced nutritional value compared to regular dairy products. Companies have capitalized on this trend by producing superior butter oil that caters to consumers' demands for premium dairy ingredients.

Moreover, to meet the rising demand for high-quality butter oil, Fonterra and other industry players are investing in advanced machinery and raw materials, including compound, centrifugation, and fat concentrate processes. This investment in technology and resources is expected to fuel the expansion of the global anhydrous milk fat market during the forecast period. The market's growth is also influenced by the water content reduction in butter oil, which increases its shelf life and enhances its functionality in various food applications. Overall, the anhydrous milk fat market is poised for growth as companies continue to innovate and meet the evolving needs of consumers.

Market Trends

The increasing demand for clean label and natural products is the upcoming trend in the market. The market is witnessing a growing demand for natural and transparent ingredients, aligning with consumers' increasing focus on nutritious components. In response, manufacturers are prioritizing the natural origin and purity of their products. For instance, companies such as Fonterra and Royal FrieslandCampina are committed to sourcing milk from grass-fed cows and emphasizing the natural essence of their anhydrous milk fat (butter oil).

Additionally, these businesses are also adopting eco-friendly and sustainable practices to address customer concerns regarding the environment. To assure consumers of the inherent purity of their anhydrous milk fat (butter oil), they publicly declare their adherence to stringent quality and safety regulations. Anhydrous milk fat (butter oil) is a rich source of essential vitamins, calcium, and other nutrients, contributing to bone health, arthritis prevention, and immunity boosting. These health benefits further fuel the market's growth.

Market Challenge

The price volatility of dairy products is a key challenge affecting the market growth. Anhydrous milk fat, also known as butter oil, is a valuable dairy product in the global market. However, the market faces challenges due to the volatile pricing of raw materials and finished products. Factors such as fluctuating demand for dairy products, weather conditions, and supply swings impact the market unpredictably. For instance, adverse weather conditions like droughts can decrease milk production, limiting the availability of raw materials for anhydrous milk fat production. Moreover, sudden price fluctuations can occur due to shifts in consumer preferences or economic conditions, making it challenging for market players to plan their production, pricing, and supply chain logistics.

Moreover, these external factors can alter market dynamics and cost structures, potentially impacting profitability and competitive positioning in the anhydrous milk fat market. This volatility may hinder the market's growth during the forecast period. In the manufacturing process, anhydrous milk fat undergoes several processes such as chilling, standardizing, pasteurizing, aging, churning, and vacuum treating to achieve the desired yellow color and texture. Despite these challenges, the market is expected to grow due to increasing demand from various industries, including food, pharmaceuticals, and cosmetics.

Thus, to ensure product quality, it is essential to adhere to strict standards, including churning at specific temperatures and vacuum treating to remove moisture. Proper pasteurizing and aging processes are also crucial to maintain the butter oil's texture and flavor. These processes contribute to the overall cost and complexity of production, further emphasizing the importance of effective supply chain management and price forecasting in the anhydrous milk fat market.

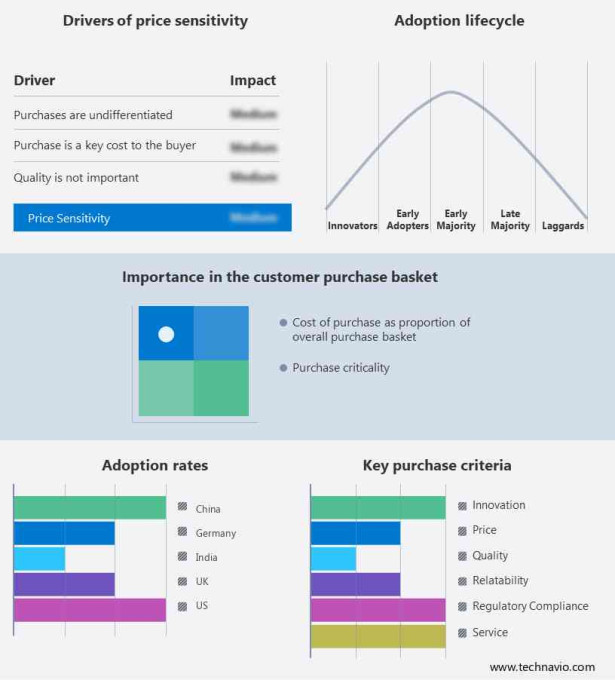

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Asha Ram and Sons Pvt. Ltd.: The company offers anhydrous milk fat used for dairy flavour and creaminess.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Corlasa

- DagangHalal.com

- Dairy Farmers of America Inc.

- Eximcan Canada

- Fonterra Cooperative Group Ltd.

- Food and Biotech Engineers India Pvt Ltd.

- Foodcom SA

- Geris

- Groupe Lactalis

- Inner Mongolia Yili Industrial Group Co. Ltd.

- Interfood Corp.

- NUMIDIA BV

- POLMLEK GROUP CENTRAL

- Royal FrieslandCampina NV

- Savencia SA

- SG Foods

- Synlait Ltd.

- Uelzena Group

- UGA Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Anhydrous Milk Fat (AMF), also known as butter oil, is a high-value dairy product renowned for its unique properties and diverse applications. This product differentiation makes it a lucrative investment for dairy processors. Capital-intensive machinery, such as centrifugation equipment, is essential for the production of AMF. Raw materials, primarily milk, are the foundation of AMF production. The fat concentrate obtained from milk undergoes various processes like chilling, standardizing, pasteurizing, aging, and churning to produce AMF. Vacuum treating, refining, and shelf life extension techniques are employed to enhance the product's quality. AMF's yellow color and desirable texture are crucial factors in its appeal.

In conclusion, nutritional benefits, including vitamins A, D, E, calcium, and bone health, contribute to its popularity in various industries. In the food sector, AMF is used in recombined dairy products, soups and sauces, frying, deep frying, roasting, grilling, sauce-making, baking, and confectionery applications. Dairy-based diets and health consciousness have fueled the demand for AMF. Organic AMF is a growing trend in response to consumer preferences. Input suppliers play a significant role in maintaining cattle health, ensuring the production of high-quality milk. AMF's versatility extends to fusion food products, offering opportunities for innovation in the dairy sector. A strong distribution network and effective inventory management are crucial for meeting market demands. Advanced machinery and raw material suppliers are key partners in ensuring a consistent supply of high-quality AMF.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.51% |

|

Market growth 2024-2028 |

USD 1.57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.35 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 49% |

|

Key countries |

US, India, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Asha Ram and Sons Pvt. Ltd., Corlasa, DagangHalal.com, Dairy Farmers of America Inc., Eximcan Canada, Fonterra Cooperative Group Ltd., Food and Biotech Engineers India Pvt Ltd., Foodcom SA, Geris, Groupe Lactalis, Inner Mongolia Yili Industrial Group Co. Ltd., Interfood Corp., NUMIDIA BV, POLMLEK GROUP CENTRAL, Royal FrieslandCampina NV, Savencia SA, SG Foods, Synlait Ltd., Uelzena Group, and UGA Group |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch

_Market_size_abstract_2024_v1.jpg)

_Market_segments_abstract_2024_v2.jpg)