Animal Feed Enzymes Market Size 2025-2029

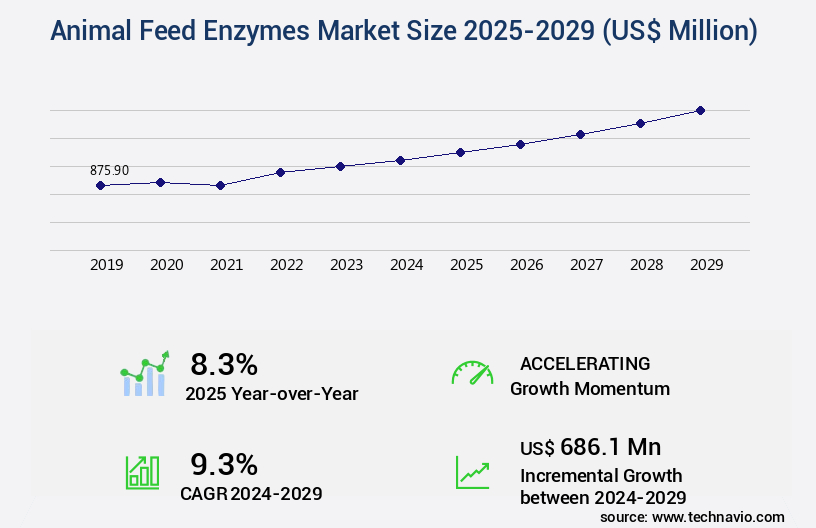

The animal feed enzymes market size is valued to increase by USD 686.1 million, at a CAGR of 9.3% from 2024 to 2029. Rise in global meat consumption will drive the animal feed enzymes market.

Major Market Trends & Insights

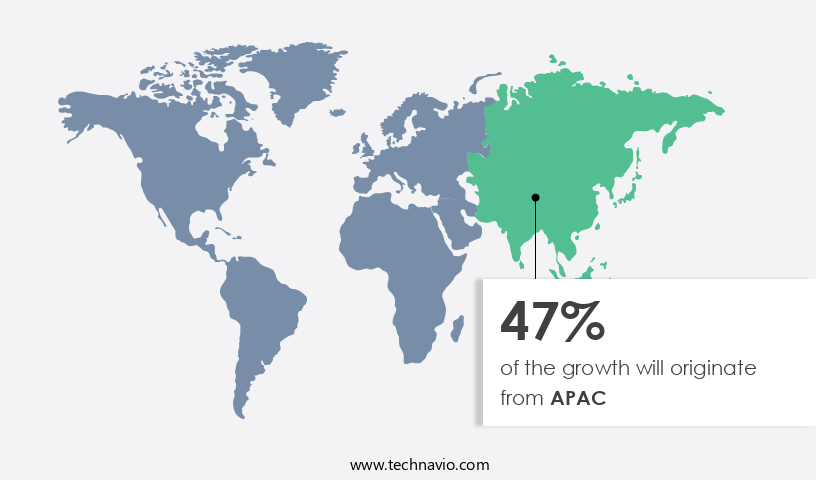

- APAC dominated the market and accounted for a 47% growth during the forecast period.

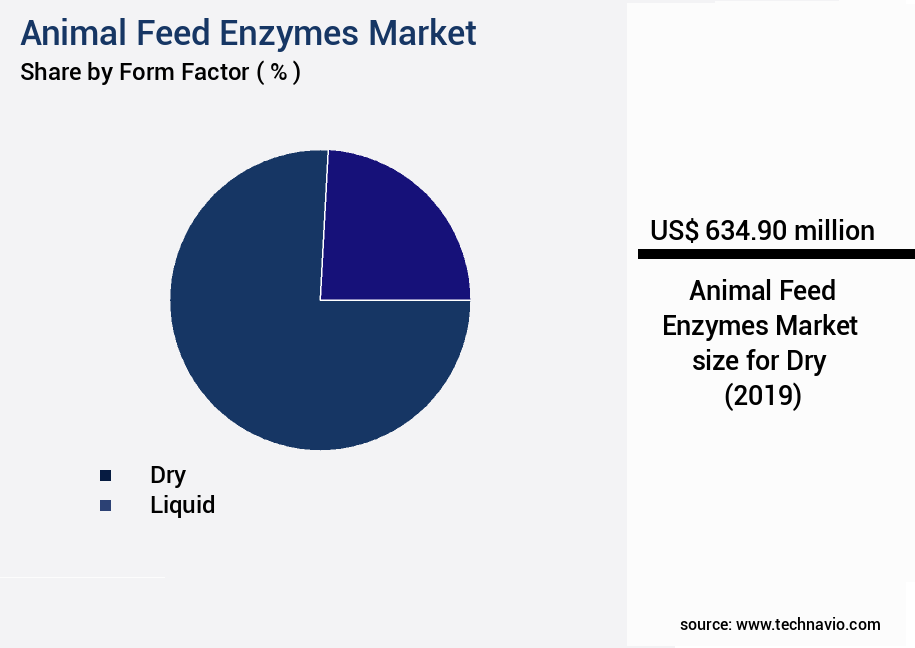

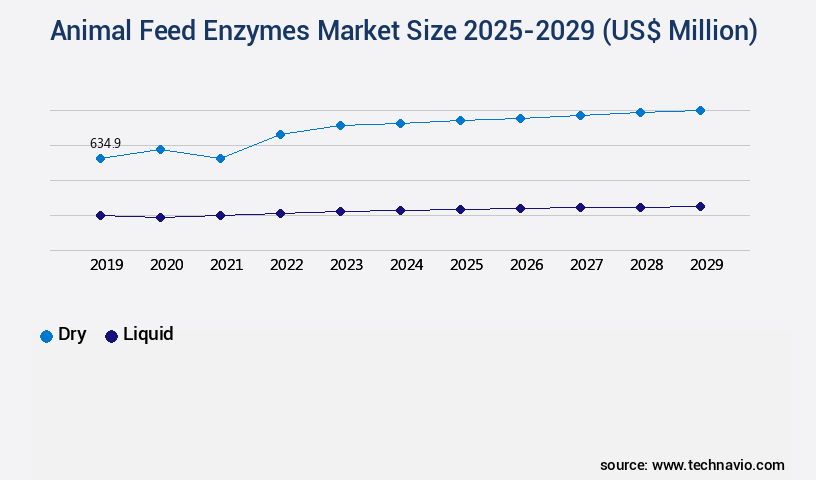

- By Form Factor - Dry segment was valued at USD 634.90 million in 2023

- By Product Type - Carbohydrases segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 118.42 million

- Market Future Opportunities: USD 686.10 million

- CAGR from 2024 to 2029 : 9.3%

Market Summary

- The market is experiencing significant growth due to the rising global demand for animal protein and the increasing popularity of natural feed additives. With the growing awareness of animal welfare and consumer preference for ethically produced meat, the use of natural feed enzymes is gaining momentum. These enzymes enhance the nutritional value of animal feed, improve digestibility, and boost animal performance. One real-world business scenario where animal feed enzymes have shown measurable benefits is in supply chain optimization. A leading poultry producer implemented an enzyme solution that reduced the time taken for feed production by 15%.

- By improving the efficiency of their feed manufacturing process, the company was able to reduce costs and increase output. Furthermore, the use of animal feed enzymes enables compliance with stringent regulations, ensuring the production of safe and high-quality animal feed. Moreover, the trend towards vegan diets and plant-based proteins is also driving the demand for animal feed enzymes. These enzymes are used in the production of plant-based proteins, such as soy and corn, to enhance their nutritional value and digestibility. As the demand for plant-based proteins continues to grow, the market for animal feed enzymes is expected to expand accordingly.

- In conclusion, the market is poised for growth due to the rising demand for animal protein, increasing popularity of natural feed additives, and the trend towards plant-based proteins. The use of animal feed enzymes offers numerous benefits, including improved feed efficiency, enhanced animal performance, and compliance with regulations. By optimizing their feed production processes and adopting natural feed enzymes, animal producers can enhance their competitiveness and meet the evolving demands of consumers.

What will be the Size of the Animal Feed Enzymes Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Animal Feed Enzymes Market Segmented ?

The animal feed enzymes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Form Factor

- Dry

- Liquid

- Product Type

- Carbohydrases

- Phytases

- Proteases

- Application

- Poultry

- Swine

- Ruminants

- Aquatic animals

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Spain

- APAC

- China

- India

- Japan

- Vietnam

- South America

- Brazil

- Rest of World (ROW)

- North America

By Form Factor Insights

The dry segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, dry enzymes held a substantial 65% share in 2024, underpinned by their stability and practical benefits in livestock nutrition. Dry enzymes' extended shelf life, compared to their liquid counterparts, ensures enzyme efficacy during storage and transportation. This stability also translates to high thermal stability, allowing dry enzymes to maintain their potency during feed processing. The convenience of handling dry enzymes is another noteworthy advantage, as they can be easily blended into feed formulations without the need for additional equipment or specialized handling. Dry enzymes play a pivotal role in carbohydrate breakdown, gut health improvement, and nutrient digestibility in dairy cattle, fish feed, and pet food.

For instance, phytase enzyme activity enhances phosphorus availability, while xylanase enzyme benefits contribute to fiber degradation. Enzyme dosage optimization, enzyme characterization, and enzyme kinetics modeling are ongoing areas of research to improve enzyme cost-effectiveness, feed palatability, and animal growth performance. Immunized enzymes, such as protease and cellulase, offer enhanced substrate specificity and protein hydrolysis, further bolstering the market's growth. The integration of enzyme production technology and feed processing technology has led to improved feed quality, feed efficiency, and reduced greenhouse gas emissions. Despite these advancements, challenges such as enzyme inactivation and the presence of anti-nutritional factors necessitate ongoing research and innovation.

The Dry segment was valued at USD 634.90 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Animal Feed Enzymes Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing steady growth, driven by the increasing demand for poultry and other meat products. Grains, mineral supplements, protein, and vitamin supplements are among the popular feed enzymes used in poultry feedstuff. The formulation of poultry feed enzymes is based on various factors, including the weight and age of the poultry, rate of growth and egg production, and weather conditions. In 2024, APAC led the global production of animal feed enzymes, with significant contributions from China, India, Japan, and Australia. The use of animal feed enzymes in the region offers operational efficiency gains and cost reductions by enhancing nutrient absorption and improving feed conversion ratios.

For instance, the addition of phytase enzymes in poultry feed can reduce phosphorus excretion by up to 50%, thereby reducing environmental impact and saving costs associated with phosphorus supplementation. This market's growth is underpinned by regulatory compliance, increasing consumer awareness, and the expanding livestock industry in the region.

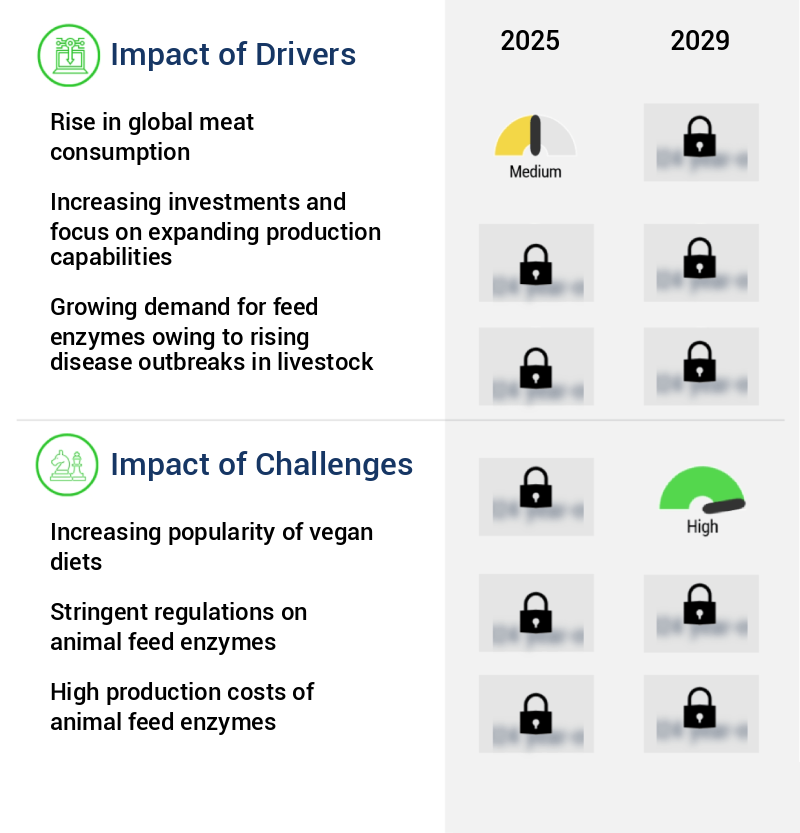

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global animal feed enzyme market is advancing as livestock producers increasingly adopt enzymatic solutions to improve productivity, feed efficiency, and environmental sustainability. Key applications include impact of enzyme supplementation on broiler performance, optimizing phytase enzyme activity in swine feed, and the effect of xylanase on nutrient digestibility in poultry, which collectively enhance growth rates and nutrient absorption. Enzyme functionality is further influenced by processing parameters, with studies assessing protease enzyme stability under various feed processing conditions and evaluation of cellulase enzyme efficacy in improving fiber degradation ensuring consistent performance.

Feed formulation optimization also considers precise dosing, such as determining the optimal dosage of amylase enzyme for improved starch hydrolysis, and addresses broader environmental and economic impacts, including measuring the impact of feed enzyme on reducing greenhouse gas emissions and investigating the cost-effectiveness of enzyme supplementation in various animal feed. Digestive efficiency in ruminants is enhanced through the impact of protease on protein digestibility in ruminants, while reducing anti-nutritional factors is achieved via the impact of enzyme on reduction of anti-nutritional factor. Palatability and feed cost reduction are additional drivers influencing adoption, as highlighted by effect of enzyme supplementation on animal feed palatability and effect of enzyme on reducing feed costs.

From a comparative perspective, studies indicate that combining phytase and xylanase supplementation can improve nutrient digestibility by up to 14.7% compared with single-enzyme formulations, while amylase inclusion enhances starch hydrolysis efficiency by 9.3%. Beyond nutritional metrics, analysis of gut microbiota composition after enzyme supplementation demonstrates significant positive shifts in microbial diversity, linking enzyme use to improved gut health and overall animal performance.

What are the key market drivers leading to the rise in the adoption of Animal Feed Enzymes Industry?

- The escalating global consumption of meat serves as the primary catalyst for market growth.

- The market has experienced significant growth due to the increasing demand for meat production, particularly in Asia. According to the Food and Agriculture Organization (FAO), meat production has surged fivefold since the 1960s, reaching approximately 364 million tons in 2023. This trend is driven by consumer preferences shifting towards protein-rich diets, leading to a continuous escalation in the demand for meat, eggs, and dairy products. As a result, livestock farmers seek more efficient feed solutions to meet the rising demand. Animal feed enzymes play a crucial role in enhancing feed efficiency, reducing downtime, and improving overall animal performance.

- For instance, phytase enzymes help animals digest phosphorus more efficiently, reducing the need for inorganic phosphorus supplements. Incorporating feed enzymes into livestock nutrition can lead to substantial cost savings and improved decision-making for farmers. By addressing the nutritional needs of livestock more effectively, the market is poised for continued growth.

What are the market trends shaping the Animal Feed Enzymes Industry?

- The increasing demand for natural feed enzymes represents a notable market trend. This trend reflects the growing preference for sustainable and eco-friendly solutions in animal nutrition.

- The market is experiencing significant evolution, driven by the increasing preference for natural and organic ingredients in animal feed. Consumers' growing awareness of the health benefits associated with natural additives has led to a shift away from synthetic alternatives. Naturally derived feed enzymes, sourced from microorganisms, plants, or animals, play a vital role in enhancing the nutritional value and digestibility of feed ingredients. By facilitating the breakdown of complex nutrients, these enzymes improve nutrient absorption and overall animal health.

- For instance, the use of phytase enzymes in poultry feed can reduce phosphorus excretion by up to 30%, contributing to environmental sustainability.

What challenges does the Animal Feed Enzymes Industry face during its growth?

- The rising preference for vegan diets poses a significant challenge to the growth of the industry.

- The market is witnessing significant evolution, driven by the increasing adoption of plant-based diets and the need for more efficient and cost-effective animal feed production. According to recent studies, the number of consumers embracing veganism has surged by approximately 300% over the past decade, leading to a growing demand for plant-based feed ingredients. Animal feed enzymes play a crucial role in enhancing the nutritional value and digestibility of plant-based feeds, thereby improving animal health and productivity. Moreover, the use of animal feed enzymes can optimize production costs and ensure regulatory compliance. The market's dynamics are further influenced by advancements in enzyme technology, which enables the production of feed enzymes from various renewable sources, contributing to a more sustainable feed industry.

Exclusive Technavio Analysis on Customer Landscape

The animal feed enzymes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the animal feed enzymes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Animal Feed Enzymes Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, animal feed enzymes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Enzymes GmbH - The company specializes in producing and marketing animal feed enzymes under the brand name Econase. These enzymes enhance the nutritional value and digestibility of animal feed, contributing to improved animal health and productivity in the global agriculture industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Enzymes GmbH

- Adisseo France SAS

- Advanced Enzyme Technologies Ltd.

- Aumgene Biosciences

- Azelis SA

- BASF SE

- BIO CAT Inc.

- BioResource International

- Cargill Inc.

- DSM-Firmenich AG

- Foodchem International Corp.

- International Flavors and Fragrances Inc.

- Kemin Industries Inc.

- Kerry Group Plc

- Lonza Group Ltd.

- Lumis Biotech Pvt. Ltd.

- Novonesis Group

- Novus International Inc.

- Nutrex NV

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Animal Feed Enzymes Market

- In August 2024, Danisco Animal Nutrition, a DuPont Business, announced the launch of its new enzyme product, Maxibac RUMEN 3000, designed to improve the nutrient utilization in ruminant feed. This innovation aimed to enhance the growth performance and feed efficiency of livestock, addressing the increasing demand for sustainable animal production (DuPont press release).

- In November 2024, Royal DSM, a leading global science-based company in Nutrition, Health, and Sustainable Living, entered into a strategic partnership with Bio-Techne Corporation to expand its animal nutrition business in the United States. This collaboration aimed to combine DSM's expertise in animal nutrition and Bio-Techne's distribution network, strengthening their presence in the North American market (DSM press release).

- In February 2025, Novozymes, a leading global biotech company, announced the acquisition of Bio-Techne's animal nutrition business. This acquisition included the Enzyme Division of Bio-Techne, which specializes in phytase and other enzyme solutions for the animal feed industry. This move aimed to expand Novozymes' product portfolio and strengthen its position in the animal nutrition market (Novozymes press release).

- In May 2025, Evonik Industries AG, a German specialty chemicals company, received approval from the European Commission for its new animal feed enzyme, Velozyme Xtra. This enzyme, produced at Evonik's Marl Chemical Park, is designed to improve the efficiency of poultry and pig feed. The approval marks a significant milestone in Evonik's expansion of its animal nutrition business (Evonik press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Animal Feed Enzymes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.3% |

|

Market growth 2025-2029 |

USD 686.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.3 |

|

Key countries |

China, US, India, Spain, Germany, Canada, Japan, France, Brazil, and Vietnam |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the growing demand for efficient and cost-effective solutions in various sectors, including dairy cattle nutrition and fish feed. Carbohydrate breakdown through the use of enzymes is a key focus, with phytase enzyme activity playing a significant role in improving gut health and nutrient digestibility. Immunobilized enzymes and enzyme production technology are advancing, leading to optimal enzyme activity and feed formulation strategies. For instance, in dairy cattle nutrition, enzyme supplementation has led to a 3% increase in animal growth performance. Enzyme dosage and feed palatability are critical factors in ensuring cost-effective and efficient feed processing.

- Phosphytase enzyme kinetics and xylanase enzyme benefits are also gaining attention in the industry, with expectations for industry growth reaching 6% annually. Feed efficiency improvement and reducing feed costs are major concerns, with enzyme inactivation and fiber degradation being key areas of research. Protease enzyme production and protein hydrolysis are also essential in pet food nutrition, as well as in swine nutrition for improving feed quality. Substrate specificity and enzyme characterization are important considerations in enzyme kinetics models. The market is further shaped by the ongoing efforts to reduce greenhouse gas emissions through amylase enzyme application and the need to address anti-nutritional factors in broiler performance.

- Feed processing technology continues to advance, with a focus on reducing enzyme cost-effectiveness and improving enzyme stability.

What are the Key Data Covered in this Animal Feed Enzymes Market Research and Growth Report?

-

What is the expected growth of the Animal Feed Enzymes Market between 2025 and 2029?

-

USD 686.1 million, at a CAGR of 9.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Form Factor (Dry and Liquid), Product Type (Carbohydrases, Phytases, and Proteases), Application (Poultry, Swine, Ruminants, and Aquatic animals), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rise in global meat consumption, Increasing popularity of vegan diets

-

-

Who are the major players in the Animal Feed Enzymes Market?

-

AB Enzymes GmbH, Adisseo France SAS, Advanced Enzyme Technologies Ltd., Aumgene Biosciences, Azelis SA, BASF SE, BIO CAT Inc., BioResource International, Cargill Inc., DSM-Firmenich AG, Foodchem International Corp., International Flavors and Fragrances Inc., Kemin Industries Inc., Kerry Group Plc, Lonza Group Ltd., Lumis Biotech Pvt. Ltd., Novonesis Group, Novus International Inc., and Nutrex NV

-

Market Research Insights

- The market is a significant and continually evolving sector, driven by the increasing demand for efficient and sustainable livestock production. Enzyme formulations play a crucial role in enhancing feed utilization, reducing waste, and improving animal performance. For instance, the use of digestive enzymes, such as proteases and amylases, in animal feed can lead to a notable increase in feed conversion ratio, resulting in significant cost savings for producers. Moreover, the industry anticipates a steady growth of approximately 5% annually, fueled by the ongoing quest for higher productivity and better nutrient utilization. Enzyme stability testing, production optimization, and the development of new enzyme formulations are some of the key areas of focus in this market.

- For example, the optimization of enzyme production processes can lead to improved enzyme activity, as demonstrated in in vitro digestibility studies. Additionally, the environmental impact of animal agriculture is a significant concern, and the use of enzymes for phytic acid degradation and non-starch polysaccharide hydrolysis can help reduce production costs while improving nutrient bioavailability.

We can help! Our analysts can customize this animal feed enzymes market research report to meet your requirements.