Anticoagulants Market Size 2024-2028

The anticoagulants market size is forecast to increase by USD 20.14 billion at a CAGR of 8.68% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The introduction of novel oral anticoagulants (NOACs) is one such trend, offering advantages over traditional anticoagulants in terms of efficacy, safety, and convenience. Another trend is the advent of anticoagulant antidotes, which have become essential in managing bleeding complications associated with knee replacement and anticoagulant therapy. The route of administration and coagulation pathway targeted vary, with genetic testing playing a crucial role in determining the most effective treatment for individual patients. However, the market also faces challenges, including the strong side-effects of anticoagulants, such as bleeding risks, and the need for regular monitoring and dose adjustments. These factors necessitate careful consideration of patient risk factors and close monitoring to ensure optimal outcomes. Overall, the market is poised for growth, driven by these trends and the ongoing development of innovative treatments and solutions.

What will be the Size of the Anticoagulants Market During the Forecast Period?

- The market encompasses a range of drugs used to prevent and manage various chronic disorders associated with blood clot formation, including deep vein thrombosis, cardiovascular diseases, and conditions like atrial fibrillation, myocardial infarction, and pulmonary embolism. Novel oral anticoagulants and injectable anticoagulants, collectively referred to as anticoagulant drugs or blood thinners, are the primary drug categories in this market. The prevalence of chronic disorders, particularly In the geriatric population and those with obesity, drives market growth.

- Moreover, key conditions treated include artery and vein disorders, such as venous thromboembolism, synthetic biology and coagulation-related cardiovascular disorders. Product penetration In the market is influenced by factors like patient compliance, safety, and efficacy. Anticoagulants are essential in preventing blood clotting time extension, thereby reducing the risk of complications from blood clots.

How is this Anticoagulants Industry segmented and which is the largest segment?

The anticoagulants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Route Of Administration

- Oral anticoagulants

- Injectable anticoagulants

- Type

- Factor Xa inhibitors

- DTIs

- Heparin

- Vitamin K antagonists

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- Japan

- Rest of World (ROW)

- North America

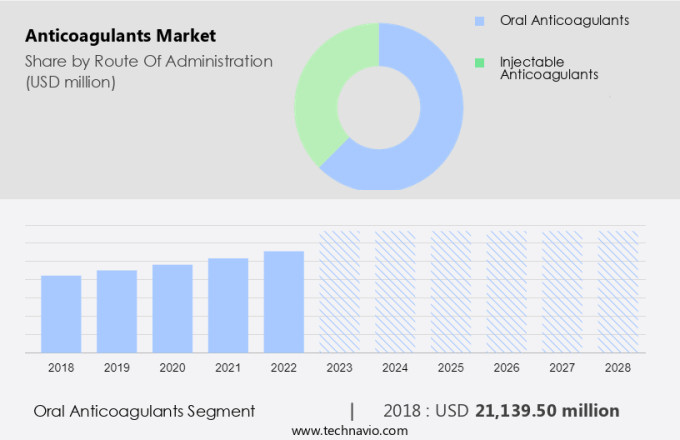

By Route Of Administration Insights

- The oral anticoagulants segment is estimated to witness significant growth during the forecast period.

Traditional oral anticoagulants such as warfarin (COUMADIN) and generic warfarin have been on the market for the past 50 years. These drugs belong to vitamin K antagonists and prevent the activation of vitamin K. Warfarin is used for various indications, including DVT/PE, AF, paroxysmal nocturnal hemoglobinuria (PNH), mitral stenosis or regurgitation, dilated cardiomyopathy, arterial grafts, and during placement of artificial valves.

Get a glance at the Anticoagulants Industry report of share of various segments Request Free Sample

The oral anticoagulants segment was valued at USD 21.14 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

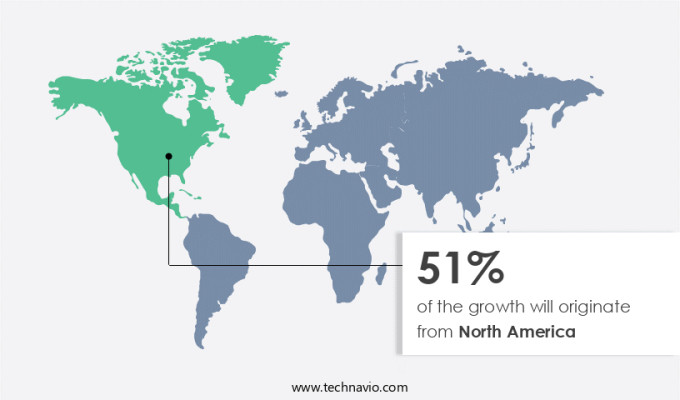

- North America is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is witnessing notable expansion due to the rising incidence of deep vein thrombosis (DVT) and venous thromboembolism (VTE) In the region. The US, in particular, has a high prevalence of these chronic disorders, contributing approximately 22.98% to the global market revenue. According to the Centers for Disease Control and Prevention (CDC), there are nearly 900,000 new cases of DVT and pulmonary embolism In the US annually. Factors such as heightened awareness of these conditions and an advanced healthcare system are fueling market growth. Anticoagulant drugs, including novel oral anticoagulants (NOACs), warfarin, and heparin, are used to prevent blood clot formation in cardiovascular diseases such as atrial fibrillation, myocardial infarction, and stroke. Genetic testing and pharmacogenomics play a crucial role in optimizing anticoagulant therapy. The geriatric population and the increasing prevalence of obesity further boost market demand. The market caters to various sectors, including hospital pharmacies, online pharmacies, and retail pharmacies, providing diverse options for patients with orthotic conditions or those at risk of thrombotic complications.

Market Dynamics

Our anticoagulants market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Anticoagulants Industry?

Introduction of novel oral anticoagulants is the key driver of the market.

- Anticoagulants are essential medications used to prevent the coagulation of blood and the formation of harmful clots in blood vessels, particularly in individuals with chronic disorders such as deep vein thrombosis (DVT) and cardiovascular diseases. The market for anticoagulants has seen significant growth due to the introduction of novel oral anticoagulants (NOACs) In the last decade. These drugs, which include direct thrombin inhibitors like dabigatran and anti-Xa agents such as apixaban, edoxaban, and rivaroxaban, are preferred over traditional vitamin K antagonists like warfarin due to their ease of administration and improved patient adherence. The prevalence of obesity and an aging geriatric population increase the risk of thrombotic complications, further driving the demand for anticoagulants.

- Moreover, the market is competitive, with leading companies such as Aspen Holdings focusing on product penetration and strategic alliances to expand their market share. NOACs are available in various forms, including oral anticoagulants and injectable anticoagulants, and are used to treat conditions such as atrial fibrillation, venous thromboembolism, and artery thrombosis, including ischemic stroke, myocardial infarction, and pulmonary embolism. The coagulation pathway is complex, involving various factors, including thrombin and clots, and genetic testing and pharmacogenomics play crucial roles in determining the most effective anticoagulant for individual patients. Hospitals, online pharmacies, and retail pharmacies are significant distribution channels for anticoagulants. Conditions like Von Willebrand disease and orthotic conditions may require specialized anticoagulants and monitoring.

What are the market trends shaping the Anticoagulants Industry?

Advent of anticoagulant antidotes is the upcoming market trend.

- The market has experienced significant growth in recent years due to the increasing prevalence of chronic disorders such as deep vein thrombosis (DVT) and cardiovascular diseases, which are major contributors to blood clot formation. Novel oral anticoagulants, including Factor Xa inhibitors (Rivaroxaban, Betrixaban, Apixaban, and Edoxaban) and Direct thrombin inhibitors (Dabigatran), have gained popularity as alternatives to traditional anticoagulant drugs. These new drug categories offer several advantages, such as fewer dietary restrictions and predictable anticoagulant effects. However, the market's growth was previously hindered by the absence of antidotes for these novel oral anticoagulants.

- Furthermore, antidotes are crucial in reversing the effects of anticoagulants during thrombotic complications, such as stroke, venous thrombosis, coronary heart disease, and pulmonary embolism. The lack of antidotes posed a significant challenge to the market, as there were no drugs available to slow down excess bleeding or inhibit side effects. Pharmaceutical companies are now investing in research and development to create antidotes for these oral anticoagulants. This trend is expected to boost the market's growth, as antidotes will provide a safety net for patients, enabling them to receive the benefits of anticoagulant therapy while minimizing the risks. The geriatric population, with a higher prevalence of chronic disorders and increased risk of thrombotic complications, is a significant target demographic for anticoagulant drugs.

What challenges does the Anticoagulants Industry face during its growth?

Strong side-effects of anticoagulants is a key challenge affecting the industry growth.

- Anticoagulants, also known as blood thinners, are essential medications used to prevent and treat various chronic disorders related to cardiovascular diseases, including deep vein thrombosis (DVT) and venous thromboembolism (VTE). These conditions involve the formation of blood clots In the arteries and veins, which can lead to thromboembolic events such as stroke, pulmonary embolism, and myocardial infarction. The market for anticoagulants is diverse, with different drug categories, including novel oral anticoagulants (NOACs) and traditional vitamin K antagonists.

- In addition, these drugs inhibit specific coagulation factors, either Factor Xa or thrombin, to prevent blood clot formation. Warfarin, a vitamin K antagonist, has been a long-standing anticoagulant drug used to treat various cardiovascular disorders, including atrial fibrillation. The prevalence of chronic disorders, such as obesity and aging, In the geriatric population, has increased the demand for anticoagulants. The market for anticoagulants is dynamic, with strategic alliances and collaborations between leading companies to expand their product penetration. Genetic testing and pharmacogenomics play a crucial role in understanding the individual response to anticoagulants, ensuring optimal dosing and minimizing adverse effects. Anticoagulants are available in various forms, including oral anticoagulants and injectable anticoagulants.

Exclusive Customer Landscape

The anticoagulants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the anticoagulants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, anticoagulants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Amphastar Pharmaceuticals Inc.

- Aspen Pharmacare Holdings Ltd.

- AstraZeneca Plc

- Bayer AG

- Boehringer Ingelheim International GmbH

- Bristol Myers Squibb Co.

- Daiichi Sankyo Co. Ltd.

- Dr Reddys Laboratories Ltd.

- GlaxoSmithKline Plc

- Johnson and Johnson Services Inc.

- Laboratorios Farmaceuticos ROVI S A

- LEO Pharma AS

- Novartis AG

- Pfizer Inc.

- Sanofi SA

- Shenzhen Hepalink Pharmaceutical Co. Ltd.

- Teva Pharmaceutical Industries Ltd.

- United Therapeutics Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Anticoagulants, a vital class of drugs, play a significant role In the prevention and treatment of various chronic disorders associated with blood clot formation. These disorders encompass deep vein thrombosis (DVT), cardiovascular diseases, and artery-related conditions such as stroke and myocardial infarction. The primary function of anticoagulants, also known as blood thinners, is to inhibit the coagulation of blood and prevent the formation of harmful clots. The anticoagulant market consists of two primary categories: novel oral anticoagulants (NOACs) and traditional vitamin K antagonists. NOACs, including factor Xa inhibitors (rivaroxaban, betrixaban, apixaban, and edoxaban) and direct thrombin inhibitors (dabigatran), have gained popularity due to their superior efficacy and ease of administration.

Furthermore, genetic testing and pharmacogenomics have emerged as essential tools in optimizing anticoagulant therapy. These advances allow for personalized treatment plans based on individual genetic makeup, ensuring better outcomes and minimizing the risk of adverse events. Cardiovascular diseases, including atrial fibrillation, coronary heart disease, and venous thromboembolism, are among the leading indications for anticoagulant use. The geriatric population, with its increased prevalence of obesity and coagulation disorders, is a significant target demographic for anticoagulant therapy. The anticoagulant market is marked by strategic alliances and collaborations between leading companies to expand their product offerings and increase market penetration. The market is further influenced by the growing prevalence of thrombotic complications and the rising awareness of the importance of anticoagulant therapy in managing cardiovascular disorders.

In addition, anticoagulant drugs are available in various forms, including oral and injectable options. Hospital pharmacies, online pharmacies, and retail pharmacies serve as essential distribution channels for these medications. Orthotic conditions and thromboembolic events necessitate the use of anticoagulants, further driving the market growth. The coagulation pathway plays a crucial role in understanding the mechanism of action for anticoagulants. Thrombin, a key enzyme In the coagulation cascade, is targeted by both NOACs and vitamin K antagonists to prevent clot formation. Warfarin, a long-standing vitamin K antagonist, has been a mainstay in anticoagulant therapy for decades. However, the emergence of NOACs has led to a shift in market dynamics, with NOACs gaining favor due to their more predictable dosing and fewer drug-food interactions.

Furthermore, Heparin, a traditional injectable anticoagulant, continues to be used in certain indications, such as von Willebrand disease and DVT treatment. However, its use is limited due to the need for frequent dosing and monitoring. Therefore, the anticoagulant market is a dynamic and evolving landscape driven by the growing prevalence of chronic disorders, advancements in genetic testing and pharmacogenomics, and the emergence of NOACs as a superior alternative to traditional anticoagulants. The market is expected to continue growing as the importance of anticoagulant therapy in managing various cardiovascular and coagulation disorders becomes increasingly recognized.

|

Anticoagulants Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.68% |

|

Market growth 2024-2028 |

USD 20.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.8 |

|

Key countries |

US, Germany, UK, Japan, and Canada |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Anticoagulants Market Research and Growth Report?

- CAGR of the Anticoagulants industry during the forecast period

- Detailed information on factors that will drive the Anticoagulants growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the anticoagulants market growth of industry companies

We can help! Our analysts can customize this anticoagulants market research report to meet your requirements.