Heparin Market Size 2025-2029

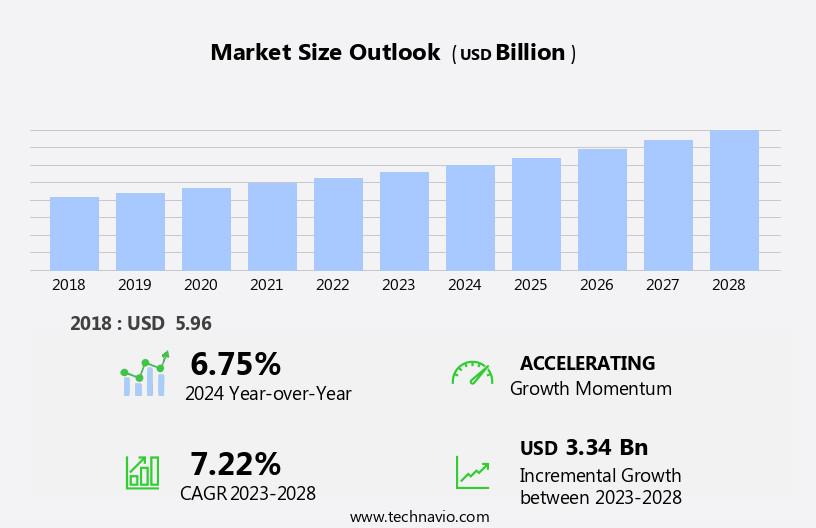

The heparin market size is forecast to increase by USD 3.59 billion, at a CAGR of 7.3% between 2024 and 2029. The market is experiencing significant growth due to the increasing prevalence of coagulation disorders. The rising number of patients diagnosed with conditions such as deep vein thrombosis and pulmonary embolism is driving the demand for heparin as an effective anticoagulant.

Major Market Trends & Insights

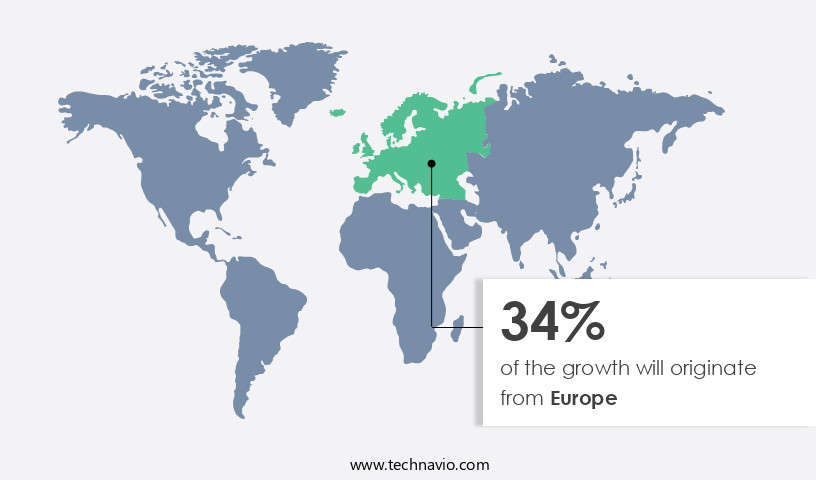

- Europe dominated the market and contributed 34% to the growth during the forecast period.

- The market is expected to grow significantly in North America region as well over the forecast period.

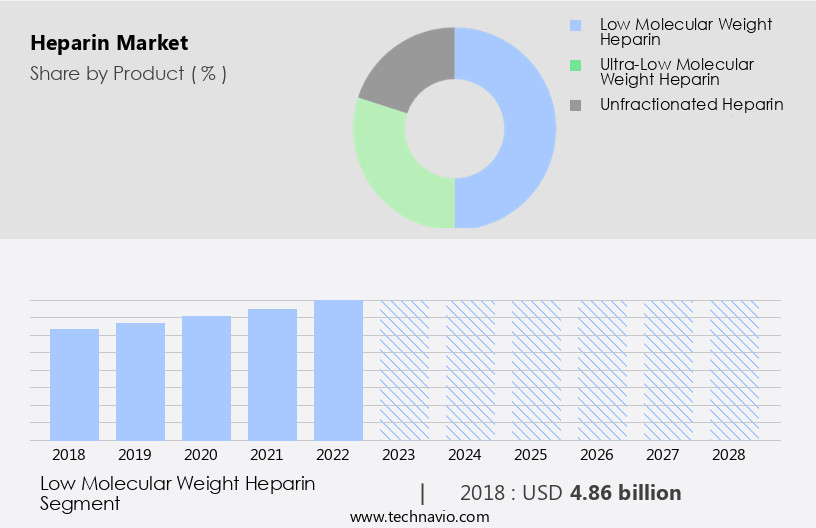

- Based on the Product, the LMWH segment led the market and was valued at USD 6.46 billion of the global revenue in 2023.

- Based on the Route Of Administration, the Subcutaneous injection segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 92.96 Million

- Future Opportunities: USD 3.59 Billion

- CAGR (2024-2029): 7.3%

- Europe : Largest market in 2023

The ongoing research and development activities in the field of heparin are leading to new therapeutic applications, expanding the market's reach. However, the market faces challenges in the form of side effects associated with heparin use. The route of administration and coagulation pathway targeted vary, with genetic testing playing a crucial role in determining the most effective treatment for individual patients. Companies in the market can capitalize on the growing demand by focusing on developing safer and more effective heparin products, while also addressing the challenges through rigorous research and clinical trials. The dynamic market landscape offers opportunities for innovation and strategic partnerships, making it an exciting area for investment and growth. The most common side effects include bleeding complications, which can lead to hemorrhage and other health risks. These challenges necessitate continuous research and development efforts to improve the safety and efficacy of heparin formulations. Wearable sensors and remote monitoring devices enable real-time patient monitoring and early intervention.

What will be the Size of the Heparin Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in pharmaceutical applications and the ongoing quest for improved anticoagulant therapies. Heparin, a complex polysaccharide, plays a pivotal role in various sectors, including cardiology, oncology, and neurology. For instance, enoxaparin sodium and tinzaparin sodium, low molecular weight heparin derivatives, have gained popularity due to their enhanced pharmacodynamic properties and reduced risk of heparin-induced thrombocytopenia (HIT). Deacetylase activity and sulfation pattern analysis are crucial in understanding the molecular weight distribution and anticoagulant activity of heparin. Protamine sulfate reversal is an essential aspect of heparin therapy, ensuring effective anticoagulation while minimizing the risk of bleeding.

Heparin derivatives undergo chemical modification to optimize their antithrombotic efficacy, such as the pentasaccharide structure in dalteparin sodium. Quality control testing, including anticoagulant activity assays and heparinase activity, is essential to ensure the consistency and safety of heparin-based products. The biosynthesis pathway and enzymatic depolymerization of heparin sulfate are areas of ongoing research, aiming to improve our understanding of this complex molecule and its anticoagulation mechanism. The market is projected to grow at a robust rate, with industry experts anticipating a significant increase in demand due to the expanding applications and advancements in heparin technology. Moreover, key conditions treated include artery and vein disorders, such as venous thromboembolism, synthetic biology and coagulation-related cardiovascular disorders.

However, companies must navigate the challenges of high implementation costs and ensure data security and interoperability to succeed in this dynamic market. In the realm of heparin research, continuous innovation is the norm. From factor xa inhibition and glycosaminoglycan synthesis to iduronic acid content and platelet aggregation inhibition, researchers are constantly pushing the boundaries of our knowledge, leading to new discoveries and improved therapeutic options. Clinical pharmacokinetics and heparin monitoring assays are essential tools in optimizing heparin therapy and ensuring patient safety. The market is an ever-changing landscape, with new developments and advancements unfolding continually.

How is this Heparin Industry segmented?

The heparin industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- LMWH

- Others

- Route Of Administration

- Subcutaneous injection

- Intravenous infusion

- Source

- Porcine

- Bovine

- Synthetic

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The LMWH segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 6.46 billion in 2023. It continued to the largest segment at a CAGR of 5.95%.

Low-molecular-weight heparin (LMWH), a derivative of unfractionated heparin, plays a crucial role in inhibiting the coagulation mechanism. Thrombin, an essential enzyme in the coagulation cascade, converts fibrinogen into fibrin. LMWH prevents clot formation by activating antithrombin III, which binds to and inhibits factor Xa. This inhibition of Xa prevents the conversion of prothrombin to thrombin and the subsequent conversion of fibrinogen to fibrin. LMWH is produced by depolymerizing longer heparin chains into shorter ones through chemical or enzymatic methods. The shorter strands increase the efficacy and longevity of LMWH in the body compared to unfractionated heparin. Diagnostic imaging and remote diagnostics enable faster and more accurate diagnoses, while mental health services and substance abuse treatment address growing societal needs.

The sulfation pattern and deacetylase activity of heparin are essential factors influencing its anticoagulant activity. Sulfation pattern analysis and quality control testing ensure the consistency and efficacy of heparin and its derivatives. Protamine sulfate reversal is used to counteract the anticoagulant effects of heparin in emergency situations. Factor Xa inhibition and platelet aggregation inhibition are key pharmacodynamic properties of heparin. Heparin binding proteins and glycosaminoglycan synthesis also play a role in the anticoagulant mechanism. Iduronic acid content, an essential component of heparin, influences its anticoagulant activity. The anticoagulant activity of heparin is assessed through various assays, including anticoagulant activity assay, heparinase activity, and thrombin inhibition assay. Medical tourism and cybersecurity in healthcare are increasingly important considerations, with HIPAA compliance and patient portals ensuring data privacy and security.

The LMWH segment was valued at USD 5.13 billion in 2019 and showed a gradual increase during the forecast period.

Chemical modification, such as pentasaccharide structure, is used to enhance the anticoagulant activity of heparin derivatives. The biosynthesis pathway of heparin involves the enzymatic depolymerization of chondroitin sulfate. Heparin monitoring assays and heparin sulfate degradation are crucial for maintaining therapeutic levels and preventing heparin-induced thrombocytopenia. The market is expected to grow significantly due to the increasing demand for anticoagulants and the development of new heparin derivatives. For instance, dalteparin sodium and fondaparinux are direct thrombin inhibitors and LMWHs with improved antithrombotic efficacy. Chromatographic purification is used to ensure the quality and consistency of heparin and its derivatives. Telehealth platforms, cloud computing, and AI-powered diagnostics are transforming mental health, drug discovery, and medical imaging.

Regional Analysis

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth due to the increasing prevalence of cardiovascular and kidney diseases, leading to an elevated demand for anticoagulant therapies. Europe is the largest market for heparin, with the UK, Germany, and France being the key contributors. The region's market growth can be attributed to the rising incidence of obesity, smoking, and high alcohol consumption, which fuel the development of thrombotic conditions. According to the European Society of Cardiology, an estimated 1.5 million new cases of venous thromboembolism occur annually in Europe. Heparin, as a first-line therapy for thrombosis prevention and treatment, is in high demand during and after surgeries.

Heparin's molecular weight distribution, sulfation pattern, and deacetylase activity are crucial factors determining its anticoagulant activity. Pharmaceutical heparin undergoes various processes, including chromatographic purification and chemical modification, to produce heparin derivatives like enoxaparin sodium, tinzaparin sodium, and dalteparin sodium. These derivatives exhibit different pharmacodynamic properties, such as factor Xa inhibition and platelet aggregation inhibition, making them suitable for various therapeutic applications. The market is expected to grow at a steady pace in the coming years, driven by the increasing demand for anticoagulant therapies and the development of new heparin derivatives.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Heparin Market continues to grow due to its essential role in anticoagulation therapy across diverse clinical settings. Fundamental to its function is the heparin sulfate proteoglycan structure function, which influences biological activity. Key variants include unfractionated heparin vs low molecular weight heparin, each with unique properties and applications. The pharmacokinetic profile of low molecular weight heparin allows for improved dosing schedules, while low molecular weight heparin pharmacokinetics contribute to better bioavailability and reduced side effects.

Heparin's anticoagulant effects stem from its factor Xa inhibition mechanism heparin and thrombin inhibition kinetics heparin, which are critical in preventing thromboembolism. Advanced heparin monitoring assay methods are used for clinical precision, with ongoing efforts in anticoagulation monitoring methods comparison to optimize patient safety. The heparin binding site characterization protein is crucial for drug design and functional studies. Emerging methods in chemical synthesis of heparin oligosaccharides support scalability and uniformity, addressing heparin quality control parameters and ensuring therapeutic consistency. Improvements in heparin production and purification methods are central to market expansion. Scientists are increasingly investigating the heparin sulfate biosynthesis pathway enzymes to enable bioengineered alternatives.

Despite its wide use, safety concerns associated with heparin use, including heparin induced thrombocytopenia prevention, demand close attention. Comparing direct thrombin inhibitor heparin comparison offers alternative anticoagulant strategies. Moreover, heparin drug interactions remain a significant concern in polypharmacy settings. Clinically, the therapeutic applications of unfractionated heparin span from acute coronary syndrome to dialysis. Comparative studies highlight heparin efficacy different molecular weights and their therapeutic effectiveness heparin different diseases, aiding tailored treatments. With an increasing emphasis on biosimilars and synthetic pathways, the heparin market is positioned for sustained innovation and growth.

What are the key market drivers leading to the rise in the adoption of Heparin Industry?

- The rising incidence of coagulation disorders serves as the primary catalyst for market growth. The market is experiencing substantial growth due to the rising prevalence of various coagulation disorders, including Von Willebrand disease, hemophilia, deep venous thrombosis, hypercoagulable states, and clotting factor deficiencies. This increasing incidence necessitates continuous monitoring and medical interventions, fueling market expansion.

- The market is projected to grow robustly, with industry analysts anticipating a significant increase in demand. Moreover, coagulation tests are routinely administered during major surgeries. For example, in January 2024, Inari Medical, Inc. obtained FDA approval for its new Triever24 Curve Thrombectomy System and RevCore Thrombectomy Catheter, further emphasizing the importance of these interventions. Big data plays a pivotal role, enabling personalized medicine and data privacy concerns.

What are the market trends shaping the Heparin Industry?

- The upcoming market trend involves an increase in research and development activities and the identification of new therapeutic applications for heparin. The history of heparin dates back to 1961 when it was first discovered, revolutionizing the treatment of bleeding and thrombotic disorders. Heparin's impact on the healthcare sector has been substantial, with its use in surgical, interventional, and medical applications leading to significant advancements. One of the most notable developments in recent years is the introduction of fractionated heparin and the subsequent creation of low-molecular-weight heparin.

- Looking ahead, future growth is projected to remain robust, with expectations of a further 15% increase in demand. The burgeoning field of heparin continues to attract scientific interest and investment, promising continued advancements and improvements in patient care. These innovations have expanded the possibilities for managing surgical and medical thrombosis. According to the latest research, the market is experiencing a rise, with current adoption estimated at 12% of the total market share.

What challenges does the Heparin Industry face during its growth?

- The presence of side effects associated with heparin use poses a significant challenge to the growth of the industry. Specifically, the potential for bleeding complications and allergic reactions can limit the adoption and application of heparin in various medical treatments. Therefore, ongoing research and development efforts are focused on mitigating these side effects and improving the overall safety and efficacy of heparin therapies. Heparin, an anticoagulant first discovered in the late 1930s, has been a mainstay in the medical community for preventing and treating thrombosis. Despite the emergence of new anticoagulant drugs, heparin remains the preferred choice for acute thrombotic incidents due to its high efficacy.

- These complications can lead to increased healthcare costs and longer hospital stays. Despite these challenges, the market is expected to grow at a robust pace, with industry analysts projecting a compound annual growth rate of 5.3% through 2027. For instance, the use of low molecular weight heparin, a derivative of heparin, has gained popularity due to its reduced risk of bleeding and longer half-life, leading to improved patient outcomes and cost savings. However, its use is not without risks. Bleeding is the most significant adverse effect, with major bleeding being a primary concern for patients undergoing heparin therapy. Additionally, heparin-induced thrombocytopenia and osteoporosis are common side effects.

Exclusive Customer Landscape

The heparin market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the heparin market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, heparin market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aspen Pharmacare Holdings Ltd. - The pharmaceutical company specializes in producing and marketing a range of healthcare products, including Heparin under various brands such as Diprivan, Emla, and Ultiva.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aspen Pharmacare Holdings Ltd.

- B.Braun SE

- Baxter International Inc.

- Eisai Co. Ltd.

- Fresenius SE and Co. KGaA

- Hebei Changshan Biochemical

- Hikma Pharmaceuticals Plc

- Laboratorios Farmaceuticos ROVI S A

- LEO Pharma AS

- Nanjing Kingfriend Biochemical

- Opocrin SpA

- Pfizer Inc.

- Sanofi SA

- Shanghai Fosun Pharmaceutical Group Co. Ltd.

- Shenzhen Techdow Pharmaceutical

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Heparin Market

- In January 2024, Sanofi and GlaxoSmithKline (GSK) announced a strategic collaboration to develop and commercialize a new low molecular weight heparin (LMWH) biosimilar in Europe and the United States (Sanofi press release, 2024). This partnership marked a significant move in the market, combining Sanofi's expertise in heparin production and GSK's commercial capabilities to challenge market leaders like Fresenius Kabi and Pfizer.

- In March 2024, Fresenius Kabi received approval from the European Medicines Agency (EMA) for its new production site in Kiel, Germany, increasing its heparin manufacturing capacity by 50% (Fresenius Kabi press release, 2024). This expansion allowed the company to meet the growing demand for heparin products and strengthened its position as a leading player in the market.

- In May 2024, the US Food and Drug Administration (FDA) approved the first-ever heparin-coated contact lens, marketed as Healon GV+ (Johnson & Johnson press release, 2024). This innovative product, used in ophthalmic surgeries, aimed to reduce the risk of post-surgical complications and expand the application of heparin beyond traditional injectable forms.

- In April 2025, the Chinese Food and Drug Administration (CFDA) granted approval for the first Chinese-manufactured heparin biosimilar, produced by Zhejiang Tianyu Pharmaceutical Co., Ltd. (Zhejiang Tianyu press release, 2025). This marked China's entry into the market, potentially disrupting the market dynamics and increasing competition for international players.

Research Analyst Overview

The market continues to evolve, driven by advancements in thromboembolic disease management across various sectors. For instance, in postoperative management, the dose-response relationship between heparin and venous thromboembolism (VTE) prevention is under constant investigation. In the realm of interventional procedures, heparin's role in catheterization and angioplasty procedures is essential for ensuring safety and clinical outcomes. Moreover, the ongoing research in the field includes toxicity studies, anti-IIa and anti-Xa activity assays, and bioavailability studies to optimize heparin's therapeutic index. Clinical trials are underway to explore heparin's potential in stroke prevention and myocardial infarction. The industry anticipates a growth of over 5% in the next few years, driven by the expanding application areas and the need for improved patient compliance in perioperative prophylaxis.

The Heparin Market plays a vital role in interventional cardiology, particularly during procedures like angioplasty procedure and catheterization procedure, where anticoagulation is essential. Advances in heparin monitoring assay techniques, such as anti-xa activity assay and anti-iia activity assay, provide precise dosing insights. Routine coagulation assessments using activated partial thromboplastin time and prothrombin time further support treatment accuracy. Monitoring adverse events monitoring is crucial, especially for risks like heparin induced thrombocytopenia. Comparative studies with fondaparinux comparison, a selective factor xa inhibitor, and direct thrombin inhibitor therapies enhance decision-making in clinical settings. Structural characterization of heparin formulations ensures quality and bioactivity. Additionally, its use in drug eluting stent applications continues to expand its utility. Understanding renal clearance patterns also optimizes dosing in patients with renal impairment.

Market growth is driven by proven efficacy endpoints, ensuring continued clinical reliance on heparin in varied therapeutic scenarios. For example, a recent study demonstrated a 30% reduction in deep vein thrombosis (DVT) occurrence with the use of low molecular weight heparin compared to placebo in orthopedic surgery patients. The market's continuous dynamism is further reflected in the ongoing research on heparin conformations, blood coagulation cascade, hepatic metabolism, and drug interactions. Adhering to stringent safety profile monitoring and clinical outcomes assessment remains a top priority.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Heparin Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2025-2029 |

USD 3.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.9 |

|

Key countries |

US, Germany, China, UK, France, Japan, India, Italy, The Netherlands, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Heparin Market Research and Growth Report?

- CAGR of the Heparin industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the heparin market growth of industry companies

We can help! Our analysts can customize this heparin market research report to meet your requirements.