Antimicrobial Packaging Market Size 2024-2028

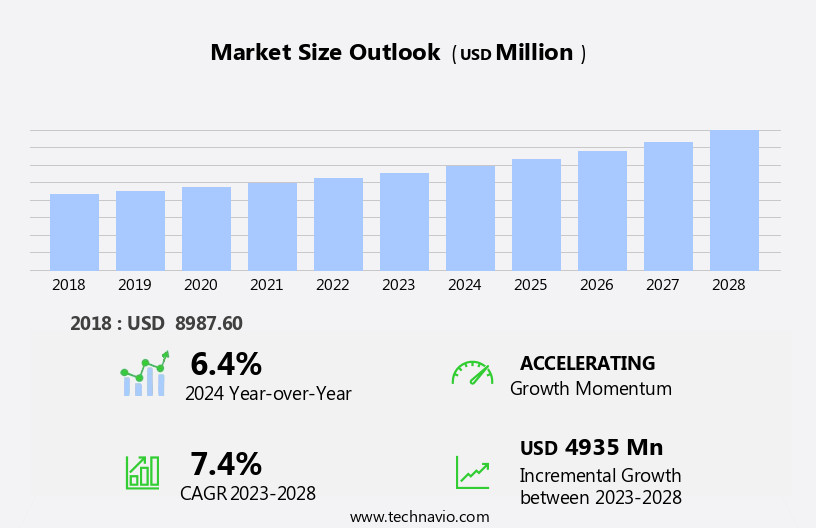

The antimicrobial packaging market size is forecast to increase by USD 4.94 billion at a CAGR of 7.4% between 2023 and 2028.

What will be the Size of the Antimicrobial Packaging Market During the Forecast Period?

How is this Antimicrobial Packaging Industry segmented and which is the largest segment?

The antimicrobial packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Plastic

- Biopolymer

- Paperboard

- Type

- Bags

- Pouches

- Trays

- Carton packages

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

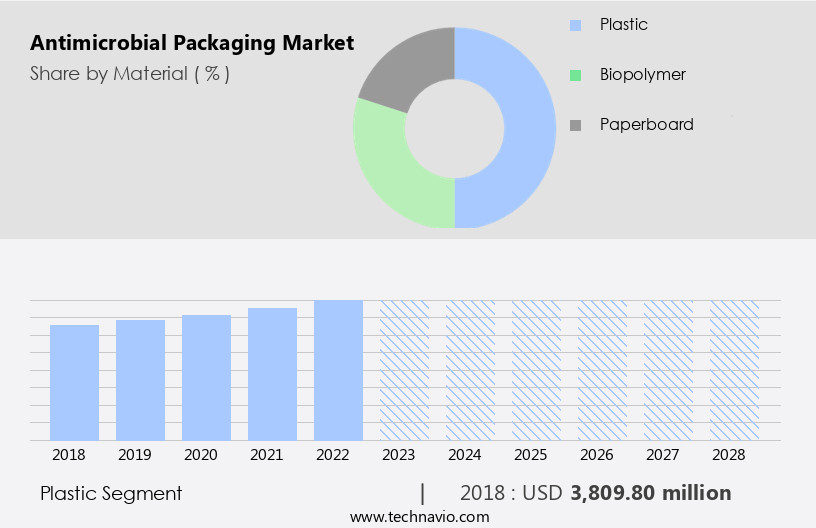

By Material Insights

The plastic segment is estimated to witness significant growth during the forecast period. The market witnessed significant growth In the plastic segment in 2023. Plastic's ease of manufacturing, affordability, flexibility, and resistance to moisture make it an ideal packaging material. The food and beverage industry's increasing demand for plastic is driving market growth, as antimicrobial-coated plastic is lightweight, cost-effective, and keeps products contamination-free for extended periods. Additionally, the rising production and consumption of perishable items, preservative-free and minimally processed products, meat, and personal care products have boosted the demand for antimicrobial plastic packaging. Antimicrobial agents such as organic acids, bacteriocins, enzymes, essential oils, and fungicides are used to enhance packaging functionality. Technologies like intelligent antimicrobial coatings, sensors, and microbes are also gaining popularity.

The market expansion is further fueled by health-related awareness, consumer preferences for freshness and convenience, and the need for product safety and quality. The packaging materials used include pouches, carton packages, trays, bags, cups and lids, cans, blister packs, and various others. The beverage packaging industry, including alcoholic and non-alcoholic beverages, fruit juices, and flavored milk, also contributes to market growth. The antimicrobial mediators inhibit the growth of bacteria, pathogens, and viruses, ensuring product freshness and consumer health. The market's growth is expected to continue due to the increasing consumption of ready-to-eat meals, RTE meals, and various other consumer goods.

The market encompasses various applications, including food preservation, medical devices, tubing, connectors, syringes, and molded parts. The market's growth is influenced by factors like price volatility, biodegradable substitutes, biopolymers, and the shift towards intelligent antimicrobial coatings.

Get a glance at the market report of various segments Request Free Sample

The Plastic segment was valued at USD 3.81 billion in 2018 and showed a gradual increase during the forecast period.

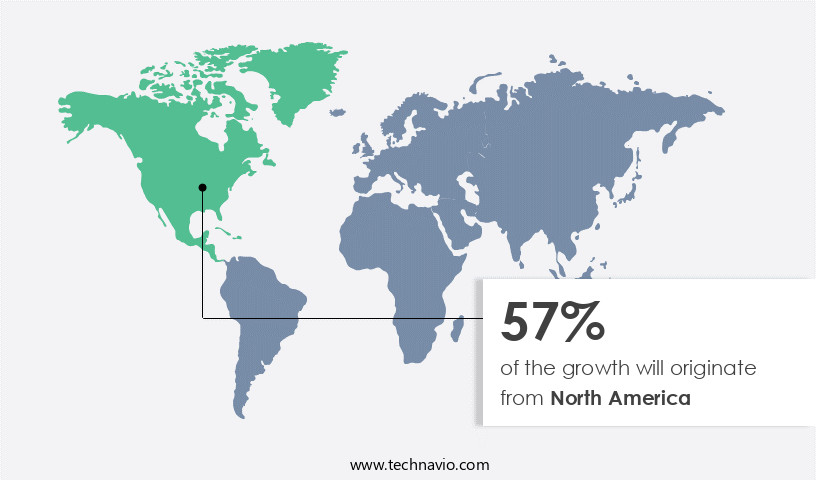

Regional Analysis

North America is estimated to contribute 57% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing growth due to the rising demand for antimicrobial packaging in various sectors, including household care products and food and beverages. This trend is particularly noticeable in countries like the US. companies are responding to this demand by expanding their production capabilities. Strategic alliances are also becoming increasingly common In the market, as companies seek to broaden their reach and customer base. Intense competition is driving established players to increase their market presence through strategic partnerships, mergers, and acquisitions. Antimicrobial agents used in packaging include organic acids, bacteriocins, enzymes, essential oils, and antimicrobial mediators.

Antimicrobial packaging extends the shelf life of perishable products, preservative-free and minimally processed goods, and protects against bacteria, pathogens, and contamination. The market encompasses various packaging types, such as pouches, carton packages, trays, bags, cups and lids, cans, blister packs, and films made from paper, paperboard, glass, metals, and bioplastics. The food industry, including meat products, personal care, consumer goods, agricultural products, and packaged food, is a significant end user. The beverage packaging industry, including alcoholic and non-alcoholic beverages, fruit juices, flavored milk, wines, dairy products, baked goods, and confectionary goods, also utilizes antimicrobial packaging. Antimicrobial packaging is essential for maintaining product quality, ensuring freshness, and promoting consumer health.

It is also used in clinical trial packaging, drug formulation, and various medical devices, such as tubing, connectors, syringes, and molded parts. The market is influenced by factors such as price volatility, biodegradable substitutes, and intelligent antimicrobial coatings, sensors, and microbes. Plastic usage is a concern due to environmental considerations, leading to the adoption of bioplastics and films. The market is expected to continue growing due to the increasing demand for convenience, fresh food, and consumer health.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Antimicrobial Packaging Industry?

- Growing consumption of packaged beverages is the key driver of the market.The market is witnessing significant growth due to the increasing consumption of perishable and preservative-free products, including meat, personal care, consumer goods, and agricultural products. The demand for extended shelf life and maintaining product freshness, especially for minimally processed items, is driving the market. Antimicrobial agents such as organic acids, bacteriocins, enzymes, essential oils, fungicides, natural extracts, antibiotics, and antimicrobial mediators are used to inhibit the growth of bacteria, pathogens, and other microbes that can cause contamination and spoilage. The packaging industry is focusing on developing advanced technologies like intelligent antimicrobial coatings, sensors, and microbes-resistant materials to ensure the quality and safety of packaged goods.

The market is witnessing a shift towards natural antimicrobial agents and biodegradable substitutes for petroleum-based materials due to health-related awareness and environmental concerns. The packaging market for food, healthcare, and medical devices, including pouches, carton packages, trays, bags, cups and lids, cans, blister packs, and films, is expected to grow significantly. The convenience and freshness of packaged food, particularly RTE meals, beverage packaging for alcoholic and nonalcoholic beverages, fruit juices, flavored milk, wines, dairy products, baked goods, and confectionery goods, are crucial factors driving the market. The risk of secondary infections from bacteria and viruses is a significant concern, especially in clinical trial packaging, drug formulation, and booklet labels.

The market is also witnessing a trend towards the use of antimicrobial plastics and bioplastics to reduce plastic usage and improve product safety and quality. The market dynamics are influenced by factors such as food contact regulations, price volatility, and the availability of biodegradable substitutes like biopolymers.

What are the market trends shaping the Antimicrobial Packaging market?

- Adoption of sustainable and biodegradable antimicrobial packaging solutions is the upcoming market trend.The market is witnessing significant growth due to the increasing demand for preservative-free and minimally processed perishable products, such as meat, personal care, consumer goods, agricultural products, and packaged food. Antimicrobial agents, including organic acids, bacteriocins, enzymes, essential oils, gases, fungicides, natural extracts, and antibiotics, are integrated into various packaging materials, such as pouches, carton packages, trays, bags, cups and lids, cans, blister packs, and films, to extend shelf life and maintain product quality and freshness. Health-related awareness and concerns over food safety, spillage, and contamination have fueled the adoption of antimicrobial packaging. Antimicrobial mediators, such as active compounds and intelligent antimicrobial coatings, sensors, and microbes, are essential components of active packaging that help prevent secondary infections and virus transmission in various industries, including the beverage packaging industry, clinical trial packaging, and drug formulation.

The market is also driven by the increasing consumption of ready-to-eat meals, RTE meals, and convenience foods, which require effective preservation methods to ensure product safety and taste. Bioplastics, films, paper, paperboard, glass, and metals are some of the commonly used packaging materials that incorporate antimicrobial agents to meet the evolving consumer demands and regulatory requirements. As the world focuses on reducing plastic usage and environmental impact, biodegradable substitutes, such as biopolymers, are gaining popularity In the market. These eco-friendly alternatives offer the benefits of antimicrobial properties and natural decomposition, making them an attractive option for brands and consumers alike.

The future of antimicrobial packaging lies in sustainable, biodegradable, and intelligent solutions that prioritize consumer health, safety, and the environment.

What challenges does the Antimicrobial Packaging Industry face during its growth?

- Stringent regulations related to usage of plastics is a key challenge affecting the industry growth.Antimicrobial packaging is a significant solution to address the issue of plastic waste and food contamination In the packaging market. With the increasing health-related awareness and the rise in consumption of perishable products, preservative-free, and minimally processed items, the demand for antimicrobial agents in packaging technology is on the rise. Meat products, personal care, consumer goods, agricultural products, and various food industries, including pouches, carton packages, trays, bags, cups and lids, cans, blister packs, and beverage packaging, are major applications for antimicrobial packaging. Antimicrobial agents such as organic acids, bacteriocins, enzymes, essential oils, fungicides, natural extracts, antibiotics, and antimicrobial mediators are used to prevent bacteria, pathogens, spillage, and contamination.

These agents ensure the quality and safety of packaged goods by maintaining freshness, extending product shelf lives, and preventing secondary infections. The packaging material functions by releasing active compounds that inhibit the growth of microbes, thereby enhancing the overall functioning of the packaging. The active packaging industry includes various sectors like food, healthcare, and personal care. Food preservation is a major application area, where antimicrobial packaging helps prevent taste degradation and virus contamination. In the healthcare sector, antimicrobial packaging is used for clinical trial packaging, drug formulation, and medical devices, including tubing, connectors, syringes, and molded parts. The convenience of antimicrobial packaging is particularly beneficial for working women and those with rural-urban mobility, as it ensures the freshness and safety of food and personal care products.

The use of antimicrobial plastics is a concern due to food contact regulations, but biodegradable substitutes like biopolymers and intelligent antimicrobial coatings are gaining popularity. Sensors and microbes are also being integrated into antimicrobial packaging to monitor the freshness and quality of packaged goods. The price volatility of petroleum-based materials and the increasing demand for sustainable packaging solutions are driving the market for bioplastics, films, paper, paperboard, glass, and metals. In conclusion, antimicrobial packaging is a vital solution to ensure the quality, safety, and freshness of packaged goods while addressing the environmental concerns associated with plastic waste. The market for antimicrobial packaging is expected to grow significantly due to its applications in various industries and the increasing consumer demand for healthier, safer, and more sustainable packaging solutions.

Exclusive Customer Landscape

The antimicrobial packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the antimicrobial packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, antimicrobial packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

API Group Corp. - Antimicrobial packaging, including antimicrobial coated films, plays a crucial role in inhibiting bacterial growth on various surfaces that necessitate antimicrobial protection. This innovative solution offers significant benefits by reducing the risk of contamination and ensuring product safety and longevity. The use of antimicrobial coatings is particularly relevant in industries such as food and beverage, healthcare, and personal care, where maintaining a sterile environment is essential. These coatings work by releasing antimicrobial agents that disrupt the bacterial growth process, providing long-lasting protection against a broad spectrum of microorganisms. The adoption of antimicrobial packaging is expected to increase due to growing consumer awareness of food safety and the rising demand for convenient and hygienic solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- API Group Corp.

- AptarGroup Inc.

- Avient Corp.

- BASF SE

- Berry Global Inc.

- BioCote Ltd.

- COEXPAN SA

- Dow Inc.

- Ecoduka

- Great American Packaging

- KP Holding GmbH and Co. KG

- Lageen Tubes

- MicrobeGuard Corp.

- Mondi Plc

- Parx Materials N.V

- RTP Co.

- Saudi Basic Industries Corp.

- Sciessent LLC

- Tekni Plex Inc.

- Xiamen Changsu Industrial Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses various types of packaging solutions that incorporate antimicrobial agents to extend the shelf life and maintaIn the freshness of perishable products. These agents are particularly essential for preservative-free and minimally processed items, which are increasingly popular among health-conscious consumers. The use of antimicrobial packaging is not limited to food products but also extends to various consumer goods, including personal care items and agricultural products. The primary objective of antimicrobial packaging is to inhibit the growth of bacteria, pathogens, and other microbes that can lead to spoilage, contamination, and secondary infections. Antimicrobial agents used in packaging technology include organic acids, bacteriocins, enzymes, essential oils, gases, fungicides, natural extracts, and antibiotics.

These active compounds are integrated into packaging materials such as pouches, carton packages, trays, bags, cups and lids, cans, blister packs, and various types of films, paper, paperboard, glass, metals, and bioplastics. The market dynamics for antimicrobial packaging are driven by several factors, including health-related awareness, consumer demand for freshness, convenience, and longer product shelf lives. The rise of RTE meals and the beverage packaging industry, including alcoholic and nonalcoholic beverages, fruit juices, flavored milk, wines, dairy products, baked goods, and confectionary goods, has significantly contributed to the growth of the market. The use of antimicrobial packaging is not limited to food and consumer goods but also extends to healthcare applications, including clinical trial packaging, drug formulation, booklet labels, and paperwork.

In healthcare, antimicrobial packaging is crucial for maintaining the quality and safety of medical devices, such as tubing, connectors, syringes, and molded parts. The antimicrobial agents used in packaging materials function by releasing active compounds that inhibit the growth of microbes. Intelligent antimicrobial coatings and sensors are also being developed to provide real-time monitoring of microbial growth and contamination. The use of biodegradable substitutes and biopolymers is gaining popularity due to concerns over plastic usage and its environmental impact. The market is subject to various regulations related to food contact and health and safety standards. These regulations ensure the quality and safety of packaged goods, preventing potential health risks associated with contamination and spillage.

The market is also influenced by price volatility and the availability of bioplastics and other sustainable alternatives. In conclusion, the market is a dynamic and growing industry that offers various benefits, including extended shelf life, improved product freshness, and enhanced consumer health and safety. The market is driven by several factors, including health-related awareness, consumer demand, and regulatory requirements. The use of antimicrobial packaging is not limited to food and consumer goods but also extends to healthcare applications, making it a crucial component of various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2024-2028 |

USD 4935 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Antimicrobial Packaging Market Research and Growth Report?

- CAGR of the Antimicrobial Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the antimicrobial packaging market growth of industry companies

We can help! Our analysts can customize this antimicrobial packaging market research report to meet your requirements.