APAC Automotive Wiring Harness Market Size 2024-2028

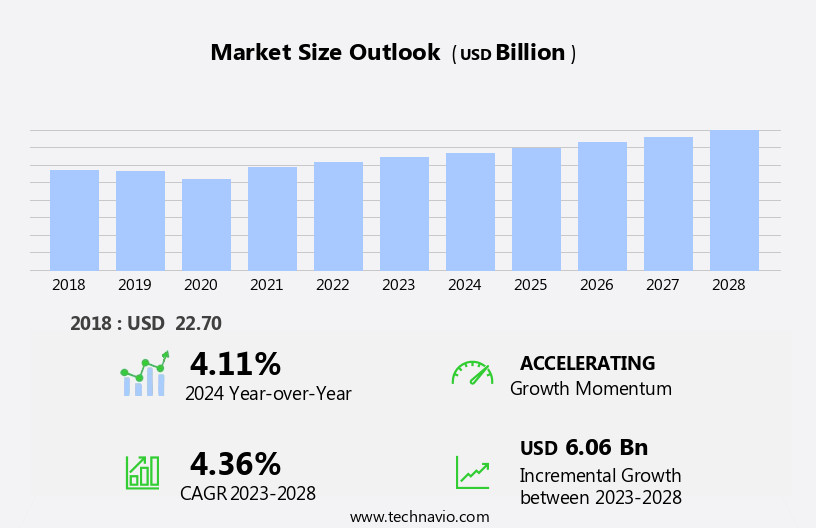

The APAC automotive wiring harness market size is forecast to increase by USD 6.06 billion, at a CAGR of 4.36% between 2023 and 2028.

- The market is driven by the increasing penetration of automotive electronics, which necessitates advanced wiring harness systems to support the growing number of electrical components in vehicles. This trend is particularly pronounced in China, where the government's push for electric vehicles and autonomous driving technologies is fueling demand for sophisticated wiring harnesses. However, the market faces challenges, including the declining sales of automobiles due to economic uncertainties and shifting consumer preferences towards ride-hailing and car-sharing services. Additionally, the complexities of developing wiring harnesses for electric and autonomous vehicles pose significant engineering challenges, requiring substantial investment in research and development.

- Companies must navigate these challenges while also addressing stringent regulatory requirements and rising labor costs to remain competitive in the market. To capitalize on opportunities and mitigate risks, market participants should focus on innovation, cost optimization, and strategic partnerships to meet the evolving demands of the automotive industry in APAC.

What will be the size of the APAC Automotive Wiring Harness Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

- In the APAC automotive wiring harness market, harness logistics optimization and compliance requirements are key considerations for manufacturers. The implementation of CAN bus and Lin Bus communication systems necessitates harness space optimization and efficient component sourcing. High-voltage wiring harnesses require specialized harness lifecycle management and reliability testing to ensure optimal performance. Harness material selection, scalability, and certification standards are essential for harness manufacturing processes, while harness assembly automation and simulation tools streamline production. Signal transmission and power distribution are critical aspects of harness design, with fiber optic and actuator control systems gaining popularity. EMI/RFI suppression techniques are essential for harness environmental testing to meet quality assurance standards.

- Harness durability testing, harness weight reduction, and sensor integration are crucial for enhancing harness performance and reducing vehicle weight. Harness customization and modularity are essential for catering to diverse automotive applications, while harness obsolescence management is vital for maintaining harness functionality and minimizing costs. Low-voltage wiring harnesses also require specialized testing equipment and harness design software for efficient manufacturing and certification. Overall, the APAC automotive wiring harness market is dynamic, with a focus on innovation, efficiency, and regulatory compliance.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger vehicles

- Commercial vehicles

- Application

- Chassis

- Engine

- HVAC

- Sensors

- Body

- Sale Channel

- OEM

- Aftermarket

- Component

- Wires

- Connectors

- Terminals

- Geography

- APAC

- China

- India

- Japan

- South Korea

- APAC

By Vehicle Type Insights

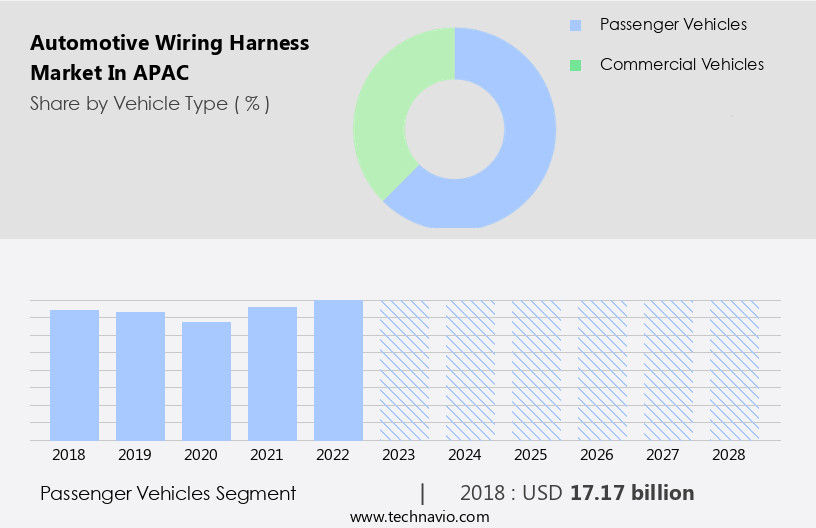

The passenger vehicles segment is estimated to witness significant growth during the forecast period.

The market is driven by the increasing demand for advanced systems in passenger vehicles (PVs). These systems, which include engines, chassis, brakes, transmission, steering, and others, rely on wiring harnesses for the transfer of data and signals from sensors to control units. The extensive use of electronic components in PVs, particularly in mid-segment and luxury-segment vehicles, significantly contributes to the market's growth. Wiring harnesses are essential components of these vehicles, with their usage varying across segments. Entry-segment vehicles, priced at USD15,000 or less, may have basic wiring harnesses. Mid-segment vehicles, priced between USD15,000 and USD40,000, may have more complex wiring harnesses due to additional features.

Premium or luxury-segment vehicles, priced at USD f40,000 and above, may have intricate wiring harnesses to accommodate advanced systems. Harness labeling, optimization, traceability, recycling, testing, cable assemblies, shields, wire gauge, insulation, reliability, manufacturing, materials, braiding, distribution, documentation, components, durability, heat shrink, aftermarket, replacement, assembly lines, tooling, design, customization, electrical connectors, cost analysis, engineering, sleeving, compliance, lifespan, strain relief, sub-systems, waterproofing, simulation, trends, software, sealing, terminal blocks, safety standards, routing, harnessing, logistics, innovation, wiring harnesses, integration, connectors, and automation are integral to the market. Harness optimization ensures efficient use of resources, while traceability and recycling promote sustainability. Harness testing and certification ensure safety and reliability.

Harness design and customization cater to specific vehicle requirements. Harness materials, such as wire gauge and insulation, impact harness durability and performance. Harness manufacturing and assembly lines utilize tooling and automation for mass production. Harness compliance with safety standards is crucial. Harness integration with sub-systems and automation streamlines vehicle production. Innovations in harness design, materials, and manufacturing techniques, such as harness simulation and 3D printing, are shaping the market. Harness software and sealing technologies enhance harness functionality and protection. Harness repair and quality control ensure long-term performance. Harness trends include the use of lighter, more flexible materials, and the integration of renewable energy systems.

The market is expected to continue growing as the demand for advanced automotive systems increases.

The Passenger vehicles segment was valued at USD 17.17 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the APAC Automotive Wiring Harness Market drivers leading to the rise in adoption of the Industry?

- The significant expansion of automotive electronics integration is the primary market catalyst.

- The market is experiencing significant growth due to the increasing integration of electronics in vehicle manufacturing. Over the past decade, the automotive industry has seen a surge in the adoption of electronic components and software, leading to a heightened demand for automotive wiring harnesses. These harnesses play a crucial role in connecting various electronic systems within a vehicle, ensuring harness reliability and optimal performance. Key factors driving this market include the emphasis on fuel efficiency, reduction of vehicular emissions, and the increasing demand for advanced safety systems. Harness optimization, harness labeling, harness traceability, harness recycling, and harness testing are essential aspects of the automotive wiring harness market, ensuring the highest quality and durability.

- Harness manufacturing involves the use of various materials, including wire gauge and wire insulation, as well as harness shields and harness braiding for enhanced protection against electromagnetic interference. Cable assemblies and harnesses are subjected to rigorous testing to ensure their ability to withstand extreme temperatures, vibrations, and other environmental factors. The focus on harness reliability and the implementation of advanced technologies are expected to further propel the growth of the market.

What are the APAC Automotive Wiring Harness Market trends shaping the Industry?

- The trend in the automotive industry is leaning towards advances in autonomous vehicle technology. This innovation represents a significant shift in transportation, offering increased safety, efficiency, and convenience.

- The market is experiencing significant growth due to the increasing development and testing of autonomous vehicles. Advanced connectivity and electronic systems in self-driving cars necessitate the use of sophisticated wiring harnesses. Over the past few years, the global autonomous vehicle industry has seen substantial progress, with automotive OEMs, tier-1 suppliers, and shared mobility service providers actively testing autonomous vehicles. Advanced wiring harnesses are essential for these vehicles due to their complex electronic systems. These harnesses require high durability and heat resistance, which is achieved through the use of harness terminals and heat shrink materials. Harness assembly lines and tooling have become crucial in meeting the high demand for these components.

- The harness supply chain has become more complex due to the need for customization and documentation. Harness design and customization are critical to meet the unique requirements of different vehicle models and brands. The aftermarket for harness replacement is also growing as older vehicles require upgrades to meet the demands of modern automotive technologies. In conclusion, the market is poised for growth due to the increasing development and commercialization of autonomous vehicles. The need for advanced wiring harnesses with high durability, heat resistance, and customization will continue to drive market demand.

How does APAC Automotive Wiring Harness Market faces challenges face during its growth?

- The automobile industry is confronted with a significant challenge due to decreasing sales, which negatively impacts industry growth.

- The market has experienced challenges due to the decline in automobile sales volume. Post the global financial crisis in 2008-2009, the automotive industry faced a significant setback. This trend has persisted, impacting various stakeholders in the market. Several factors have contributed to the decline in automobile sales, including trade tensions between major markets, such as the US and China, due to trade sanctions. In the context of the wiring harness market, factors like harness cost analysis, harness engineering, harness compliance, harness lifespan, harness strain relief, harness sub-systems, harness waterproofing, harness simulation, harness trends, harness software, and harness sealing are crucial.

- These elements determine the efficiency, durability, and overall performance of the wiring harness systems. Manufacturers focus on enhancing harness engineering to reduce harness weight and improve electrical connectors' performance. Harness sleeving and harness waterproofing are essential for ensuring the longevity of harnesses in harsh environments. Harness compliance with international standards is a critical aspect, as it ensures the safety and reliability of the vehicles. The market trends include the development of advanced harness simulation software for designing and testing harness systems. Additionally, the use of harness sealing techniques and materials to protect against environmental factors is gaining popularity.

- These trends contribute to the overall growth and development of the market. In conclusion, the market faces challenges due to the decline in automobile sales volume. However, the focus on improving harness engineering, enhancing compliance, and adopting advanced technologies offers opportunities for growth. The market's future looks promising, with a focus on innovation and efficiency.

Exclusive APAC Automotive Wiring Harness Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aptiv Plc

- Coroplast Fritz Muller GmbH and Co. KG

- DENSO Corp.

- Fujikura Co. Ltd.

- Furukawa Electric Co. Ltd.

- Lear Corp.

- Leoni AG

- Minda Corp. Ltd.

- Nexans SA

- Robert Bosch GmbH

- Samvardhana Motherson International Ltd.

- Schaeffler AG

- Sumitomo Electric Industries Ltd.

- Tianhai Auto Electronics Group Co. Ltd.

- Yazaki Corp.

- YURA Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Wiring Harness Market In APAC

- In March 2024, Bosch, a leading global technology company, announced the launch of its new electric vehicle (EV) wiring harness system, "Bosch EV-Cable," in China. This innovative product is designed to reduce the weight and complexity of wiring systems in EVs, thereby improving their overall efficiency and reducing production costs (Bosch press release, 2024).

- In June 2025, Magna International, a leading automotive supplier, formed a strategic partnership with Contemporary Amperex Technology Co. Limited (CATL), a prominent lithium-ion battery manufacturer, to develop advanced battery-electric vehicle (BEV) wiring harness systems. This collaboration aims to enhance Magna's offering in the BEV market and improve the integration of batteries and wiring harnesses (Magna International press release, 2025).

- In October 2024, Sumitomo Electric Industries, a major Japanese automotive components manufacturer, announced a significant investment of JPY 50 billion (approximately USD 450 million) in its Thai subsidiary, Sumitomo Wiring Systems (Thailand) Co., Ltd. This investment is intended to expand the company's production capacity for automotive wiring harnesses and other related components in response to increasing demand in the APAC market (Sumitomo Electric Industries press release, 2024).

- In January 2025, the Indian government announced the 'Fame II' (Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India) scheme, which includes incentives for the adoption of electric vehicles and their components, including wiring harnesses. This initiative is expected to boost the demand for wiring harnesses in the Indian automotive market (Ministry of Heavy Industries, Government of India press release, 2025).

Research Analyst Overview

The market is characterized by its continuous evolution and dynamic nature. Electrical connectors play a pivotal role in ensuring reliable transmission of electrical signals, while harness engineering and harness sleeving enhance durability and protection. Harness compliance with safety standards is a critical consideration, as is harness lifespan and harness strain relief to ensure optimal performance. Harness sub-systems, such as waterproofing and simulation, are integral to the overall functionality of the harness. Harness trends include automation, integration, and customization, which are driving innovation in the industry. Harness software and harness sealing are essential components of modern harness systems, providing advanced functionality and protection.

Harness manufacturing involves the use of various materials, including wire gauge and insulation, as well as harness braiding and distribution. Harness documentation and harness components are crucial for efficient harness assembly lines and effective quality control. Harness replacement and aftermarket opportunities are significant, with harness repair and certification ensuring the longevity and reliability of harness systems. The harness supply chain is complex, involving various stakeholders from raw material suppliers to OEMs and aftermarket providers. Harness logistics and harness tooling are essential for ensuring timely and cost-effective delivery of harnesses to customers. As the automotive industry continues to evolve, the demand for advanced harness systems is expected to grow, with ongoing research and development in harness technology driving innovation and growth in the APAC market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Wiring Harness Market in APAC insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 6.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch