APAC Industrial Coatings Market Size 2024-2028

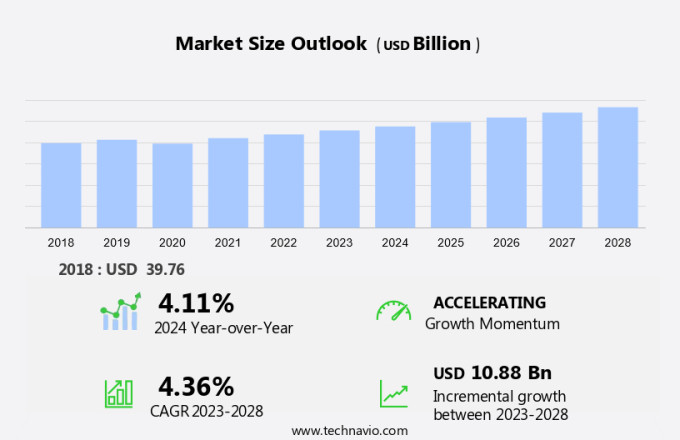

The APAC industrial coatings market size is forecast to increase by USD 10.88 billion at a CAGR of 4.36% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. One of the major drivers is the increasing demand for waterborne coatings, which are more environmentally friendly and comply with stringent regulations. Waterborne industrial coatings, including acrylic, epoxy, polyester, alkyd, fluoropolymer, thermoset, and thermoplastic, offer various advantages, such as low VOC formulations, reduced hazardous air pollutants (HAP) emissions, and improved cost efficiency. Another trend is the capacity expansion plans by companies to meet the rising demand and cater to the growing customer base. However, the market is also facing challenges such as volatile raw material prices, which can impact the profitability of manufacturers. To mitigate these challenges, companies are focusing on cost optimization strategies and exploring alternative raw material sources. Overall, the market is expected to continue its growth trajectory, driven by these trends and challenges.

What will be the size of the APAC Industrial Coatings Market during the forecast period?

- The market exhibits strong growth, driven by the expanding industries of electronics, aerospace, oil & gas, mining, marine, power generation, and large-scale infrastructure projects. These sectors demand protective coatings for improved performance, longevity, and resistance to harsh operating conditions. In response, manufacturers offer a diverse range of coatings, including eco-friendly solutions such as VOC-free powders and aqueous systems. Compliance with international regulations, like those In the EU, is a key consideration. Industrial coatings are essential for aesthetic appeal in commercial buildings and vehicle refinish while providing essential protective functions in industrial settings. Coatings play a crucial role In the preservation and enhancement of various assets, from bridges and roads to equipment In the aerospace and manufacturing industries.

How is this market segmented and which is the largest segment?

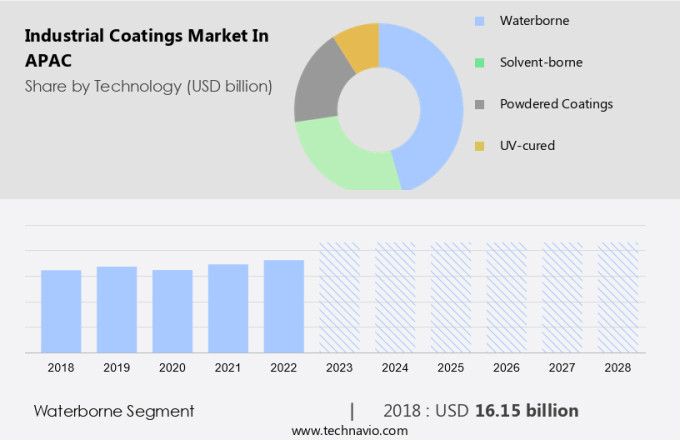

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Waterborne

- Solvent-borne

- Powdered coatings

- UV-cured

- Application

- General industrial

- Automotive OEMs

- Automotive refinishes

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- APAC

By Technology Insights

- The waterborne segment is estimated to witness significant growth during the forecast period.

Industrial coatings In the APAC region are witnessing significant growth due to the increasing adoption of eco-friendly and low VOC formulations, such as waterborne and powder coatings. These coatings contain maximum water as a solvent, making them easy to apply and environmentally friendly. However, waterborne coatings require specific environmental conditions for proper evaporation, while solvent-borne coatings release harmful fumes during the evaporation process. To address these concerns, regulatory policies, such as EU laws, are driving the demand for VOC-free coatings. The market for industrial coatings is diverse, catering to various industries, including automotive, aerospace, oil & gas, mining, marine, power generation, and furniture.

Coatings used In these industries require high durability and aesthetic appeal to withstand harsh environments and operating conditions. Products with self-healing capabilities, smart coatings, and protective coatings are gaining popularity due to their extended product lifetime and reduced maintenance requirements. Additionally, anti-corrosion coatings are essential in industries prone to corrosion, such as marine and oil & gas. The market for industrial coatings is expected to grow further due to the increasing focus on cost efficiency, performance, and lifespan in large-scale infrastructure projects, such as bridges, roads, and commercial buildings.

Get a glance at the market share of various segments Request Free Sample

The Waterborne segment was valued at USD 16.15 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of APAC Industrial Coatings Market?

Surging demand for waterborne coatings is the key driver of the market.

- Industrial coatings In the APAC region have seen a significant shift towards eco-friendly and VOC-free alternatives, driven by EU laws and increasing environmental awareness. Two popular types of coatings that cater to this trend are powder coatings and aqueous coatings. Powder coatings provide thin films with excellent durability and aesthetic appeal in industrial settings, while aqueous coatings offer waterborne solutions for various industries, including automotive refinish, furniture, and electronics. Moreover, advanced coatings such as self-healing, smart, and protective coatings are gaining traction due to their performance and lifespan advantages in harsh environments. Regulatory policies, such as the European Green Deal, are driving the demand for eco-friendly products like epoxy resin-based and polyurethane coatings in large-scale infrastructure projects, such as bridges, roads, and commercial buildings.

- Industries like automotive, aerospace, oil & gas, mining, marine, power generation, and urbanization continue to rely on industrial coatings for their protective and performance benefits. Coil coatings, containers coatings, and industrial wood coatings are other significant applications. Despite price volatility due to raw material availability and geopolitical tensions, cost efficiency remains a crucial factor In the selection of coatings. These coatings cater to diverse industries and applications, ensuring durability and aesthetic appeal under extreme temperatures, abrasion, corrosion, and other operating conditions.

What are the market trends shaping the APAC Industrial Coatings Market?

Extension plans by vendors to enhance capacity is the upcoming trend In the market.

- The market is witnessing significant growth, driven by the increasing demand for VOC-free coatings in response to EU laws and growing eco-friendly product preferences. This trend is leading major companies to expand their industrial coating manufacturing and storage facilities In the region. For instance, Berger Paints is investing in a new unit in India to enhance its market presence. Moreover, the market is witnessing the adoption of advanced technologies such as powder coatings, aqueous coatings, thin films, and smart coatings with self-healing capabilities. These coatings offer improved durability, performance, and aesthetic appeal, making them ideal for various industries including automotive, electronics, aerospace, oil & gas, mining, marine, power generation, and infrastructure projects.

- Epoxy resin-based coatings and polyurethane coatings are popular choices due to their long product lifetime and protective capabilities against harsh environments, chemicals, abrasion, corrosion, and extreme temperatures. Waterborne coatings and bio-based coatings are also gaining popularity due to their eco-friendliness and cost efficiency. Regulatory policies and environmental awareness, including the European Green Deal, are driving the demand for low VOC formulations and the replacement of solventborne coatings with water-based industrial coatings. The market is also witnessing the adoption of nanotechnology and thermoset/thermoplastic coatings for various applications. In summary, the market is experiencing significant growth due to various factors including regulatory policies, environmental awareness, and technological advancements.

- companies are expanding their manufacturing and storage facilities to meet the increasing demand for diverse product portfolios, while also focusing on offering eco-friendly and high-performance coatings for various industries.

What challenges does APAC Industrial Coatings Market face during the growth?

Volatile raw material prices is a key challenge affecting the market growth.

- Industrial coatings In the APAC region are utilized across various industries such as automotive, electronics, aerospace, oil & gas, mining, marine, power generation, and furniture, among others. VOC-free coatings, including waterborne and powder-based options, are gaining popularity due to EU laws and increasing eco-friendly product demand. Thin films, like self-healing and smart coatings, offer enhanced protective capabilities against harsh environments, chemicals, abrasion, corrosion, and extreme temperatures. Products like polyurethane resin and epoxy resin-based coatings provide durability and aesthetic appeal for large-scale infrastructure projects, such as bridges, roads, and commercial buildings. Industrial settings require protective coatings to ensure performance and longevity under challenging operating conditions.

- Key industrial coatings include acrylic, alkyd, epoxy, and fluoropolymer, among others. Powder coatings and coil coatings are widely used In the automotive industry for vehicle refinish and coil applications. Bio-based coatings and nanotechnology innovations are emerging trends In the market. Price volatility, driven by fluctuations in petrochemical feedstock costs, impacts the industrial coatings market. Crude oil and natural gas are essential raw materials for producing binders and solvents, such as polyesters, alcohols, and epoxy resins. The cost of feedstock significantly influences the pricing of resins, leading to market volatility. Regulatory policies, such as the European Green Deal, focuses on the importance of environmental awareness and the adoption of low VOC formulations.

- The coatings industry continues to innovate, with advancements in solventborne and water-based industrial coatings, as well as thermoset and thermoplastic options. CXOs In the industry focus on cost efficiency and geopolitical tensions to navigate market dynamics.

Exclusive APAC Industrial Coatings Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Akzo Nobel NV

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- BASF SE

- Beckers Group

- Chugoku Marine Paints Ltd.

- Hempel AS

- Jotun AS

- Kansai Paint Co. Ltd.

- KCC Co. Ltd.

- Nippon Paint Holdings Co. Ltd.

- NOROO Paint and Coatings Co. Ltd.

- Pidilite Industries Ltd

- PPG Industries Inc.

- RPM International Inc.

- SK Kaken Co. Ltd.

- The Sherwin Williams Co.

- TOA Paint Thailand Public Co. Ltd.

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial coatings play a crucial role in protecting various assets and structures from the harsh conditions of APAC's diverse industries. These coatings offer durability, aesthetic appeal, and performance in a range of operating conditions, including extreme temperatures, abrasion, corrosion, and chemical exposure. The market is driven by the demands of sectors such as aerospace, automotive, oil & gas, mining, marine, power generation, and infrastructure. These industries require protective coatings for their large-scale projects, including bridges, roads, commercial buildings, and industrial settings. Industrial coatings come in various forms, including waterborne and powder-based coatings. Waterborne coatings are increasingly popular due to their eco-friendly properties and lower volatile organic compound (VOC) emissions.

Powder coatings, on the other hand, offer excellent durability and are suitable for various applications, including coil coatings and industrial wood. The coatings market in APAC is also witnessing the emergence of advanced coatings, such as self-healing, smart, and thin films. Self-healing coatings have the ability to repair small damages on their own, while smart coatings can respond to environmental changes and adjust their properties accordingly. Thin films offer high performance in harsh environments and are suitable for various applications, including electronics and aerospace. Regulatory policies play a significant role In the market. There is a growing emphasis on eco-friendliness and sustainability, with initiatives such as the European Green Deal driving the demand for bio-based and low VOC formulations.

The use of raw materials, such as epoxy resin-based and polyurethane coatings, is subject to price volatility due to geopolitical tensions and supply chain disruptions. The market is diverse and dynamic, with various industries and applications driving the demand for different types of coatings. The market is also witnessing the adoption of nanotechnology and advanced materials, such as fluoropolymers, thermosets, and thermoplastics, to enhance the performance and lifespan of coatings. In summary, the market is a significant and growing market, driven by the demands of various industries and applications. The market is witnessing the adoption of advanced coatings and regulatory policies, with a focus on eco-friendliness and sustainability.

The market offers opportunities for cost efficiency and innovation, making it an exciting space for companies and investors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

161 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 10.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch