Aptamers Market Size and Trends

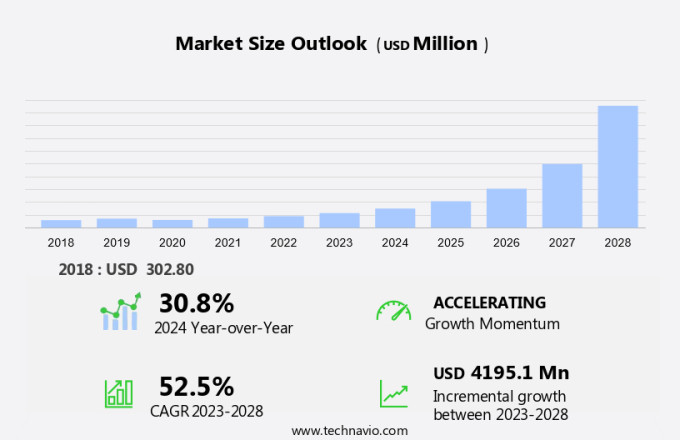

The aptamers market size is forecast to increase by USD 4.2 billion, at a CAGR of 52.5% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for novel diagnostic tools and therapeutics for chronic diseases. The ability of aptamers to selectively bind to target proteins makes them an attractive alternative to traditional antibodies in diagnostic procedures and diagnostic tests. In the field of therapeutics, aptamers offer potential advantages such as improved specificity and reduced side effects. However, challenges remain, including the inherent difficulties in developing and manufacturing aptamers at a large scale. Recent advancements in biotechnology, such as the use of graphene-based sensing systems, are driving innovation in aptamer-based diagnostics. For instance, aptamers have been successfully used for cortisol detection, a hormone associated with stress. The growth in venture capital funding for research on aptamers is also fueling the market's expansion. Despite these opportunities, challenges associated with the production and stability of aptamers must be addressed to fully realize their potential in various applications.

Oligonucleotide aptamers, a type of nucleic acid-based biomolecules, have gained significant attention in the biotechnology industry due to their unique properties and potential applications in various sectors. These aptamers, which are single-stranded oligonucleotides capable of binding to specific target proteins with high affinity and specificity, offer several advantages over traditional diagnostic and therapeutic methods, such as antibodies. One of the primary applications of aptamers is in the field of diagnostics. Aptamers can be used to detect biomarkers associated with chronic diseases and diagnostic procedures. For instance, aptamers have been developed for the detection of cortisol, a hormone that plays a crucial role in stress response, using a graphene-based sensing system. This technology holds immense potential for the development of accurate and sensitive diagnostic tests. Moreover, aptamers have shown promise in therapeutic development and drug discovery. Their small molecular size and low immunogenicity make them ideal candidates for drug delivery systems and targeting specific cells. Aptamers can also be used to identify genetic mutations, which is essential for precision and personalized medicine.

The SELEX (Systematic Evolution of Ligands by Exponential Enrichment) and Maras (Molecular Recognition and Affinity System) techniques are commonly used for the selection and optimization of aptamers. These methods enable the production of aptamers with high binding affinity and specificity towards various target proteins. Aptamers have also shown potential in the detection of SARS-CoV-2, the virus responsible for COVID-19. Aptamers can be used to develop diagnostic kits for the rapid and accurate detection of the virus, which is crucial for effective disease management. In the pharmaceutical industry, aptamers are being explored for their potential in therapeutic applications. Aptamex, a company specializing in aptamer-based therapeutics, has developed aptamers for various therapeutic areas, including oncology, inflammation, and cardiovascular diseases. These aptamers can act as therapeutic agents by inhibiting the function of specific target proteins or by delivering drugs to specific cells. oligonucleotide aptamers offer a promising solution for various applications in the biotechnology industry, including diagnostics, therapeutics, and drug discovery. Their unique properties, such as high binding affinity, specificity, and small molecular size, make them an attractive alternative to traditional methods, such as antibodies. The continued research and development of aptamers hold immense potential for advancing precision and personalized medicine and addressing various chronic diseases.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- Therapeutics development

- Research and development

- Diagnostic

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Application Insights

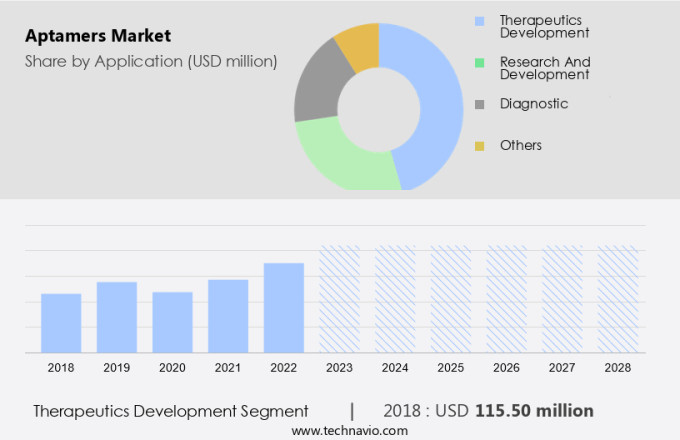

The therapeutics development segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to their potential applications in target proteins identification and manipulation, particularly in the field of chronic diseases and diagnostic procedures. Aptamers, which are small, single-stranded DNA or RNA molecules, can bind specifically to target proteins with high affinity and specificity, making them valuable alternatives to antibodies in various applications. In the therapeutics segment, aptamers are being extensively explored due to the increasing number of clinical trials evaluating their potential as new therapies. These molecules are modified and truncated to enhance their stability and reduce synthesis costs, and conjugated to polyethylene glycol or other entities to prolong their circulation time in the body.

Get a glance at the market share of various segments Download the PDF Sample

The therapeutics development segment was valued at USD 115.50 million in 2018. The first approved aptamer for therapeutic use was pegaptanib sodium, which was approved by the US Food and Drug Administration (FDA) in 2004 for the treatment of macular degeneration. However, the therapeutic use of aptamers is limited by their susceptibility to serum nucleases, rapid excretion by renal filtration, and insufficient in vivo binding affinity for their targets. In the diagnostic segment, aptamers are being used to develop sensitive and specific diagnostic tests, particularly for cortisol detection, using advanced sensing systems such as graphene-based platforms. The use of aptamers in diagnostics is expected to grow significantly due to their high specificity and ease of synthesis and modification. Overall, the aptamer market is poised for significant growth due to the increasing demand for targeted therapies and diagnostics, as well as the ongoing research and development efforts in the field of biotechnology.

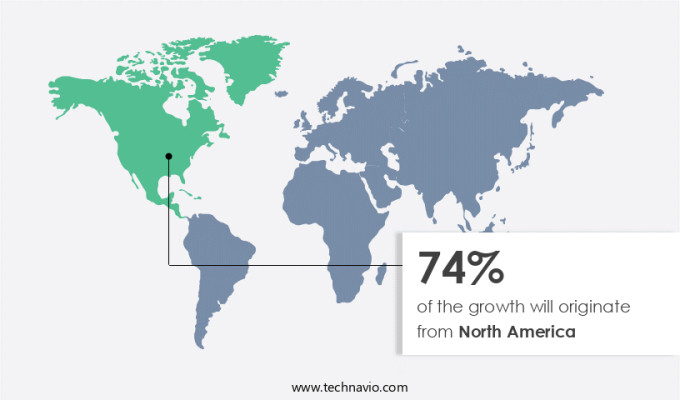

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 74% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In North America, the aptamers market holds a substantial share due to the region's advanced healthcare infrastructure and high disease burden in countries like the United States and Canada. The US, in particular, is a significant contributor to the market's revenue, driven by substantial investments in healthcare research and testing. The presence of several key companies in the country further boosts market growth. Canada is the second-largest market in the region, experiencing an increase in healthcare expenditure due to its growing economy and improved access to healthcare facilities. Peptide aptamers, a type of aptamers, are gaining popularity in various diagnostic applications, including the detection of biomarkers for diseases such as SARS-COV-2, cancer, and cardiovascular disease (CVD). The US Food and Drug Administration (FDA) has already approved some aptamer-based diagnostic tests, indicating the growing acceptance of this technology in the healthcare industry. In conclusion, the aptamers market in North America is expected to grow significantly due to the region's healthcare system, high disease burden, and increasing investments in healthcare research and testing. The use of aptamers in diagnostic applications, particularly in the detection of biomarkers for diseases like SARS-COV-2, cancer, and CVD, is a key driver of market growth.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Aptamers Market Driver

Increasing incidence of cancer boosts demand for novel diagnostics is notably driving market growth. Chronic diseases, including cancer, cardiovascular disease (CVD), diabetes, and autoimmune disorders, are on the rise in the US due to factors such as pollution and sedentary lifestyles. In 2022, 1.81 million new cancer cases and 606,520 cancer-related deaths were reported in the US alone. The increasing prevalence of these diseases necessitates the development of innovative therapeutics. Traditional diagnostic tests, primarily relying on antibody-antigen binding assays, have limitations, such as the inability to detect minor antibodies. Advancements in aptamer technology offer promising solutions to overcome these limitations. Companies like SomaLogic, with their SomaScan Assay, are pioneering the use of aptamers for multiparametric expression testing. Aptamers are single-stranded nucleic acid molecules that can bind to specific targets with high affinity and specificity, making them ideal for biosensor applications.

They are also resistant to nucleases, ensuring stability and longevity. The therapeutic potential of aptamers in protein therapeutics is significant. Aptamers can be engineered to target specific proteins, offering a more precise and effective treatment approach compared to traditional small molecule therapeutics. The aptamer market is expected to grow significantly due to its potential applications in diagnostics and therapeutics. This growth is driven by the increasing need for accurate and efficient diagnostic tools and the potential of aptamers to address the limitations of existing therapeutic modalities. Thus, such factors are driving the growth of the market during the forecast period.

Aptamers Market Trends

Growth in venture capital funding for research on aptamers is the key trend in the market. Aptamers, a type of single-stranded nucleic acid molecules, are gaining significant attention from the biotechnology industry due to their potential applications in renal filtration, diagnostics, drug development, and biosensors. Key market players, such as Aptamer Group, Base Pair Technologies, and SomaLogic, Inc., are actively seeking investment to expand their aptamer offerings and solidify their market positions. The influx of venture capital funding is anticipated to fuel market expansion during the forecast period.

This financial support enables companies to advance their research and development efforts, ultimately leading to innovations in aptamer technology. The diagnostic versatility of aptamers, coupled with their serum stability and chemical modification capabilities, make them an attractive alternative to traditional diagnostic methods. Furthermore, the potential for point-of-care testing and healthcare cost savings add to the market's appeal. The aptamer market's growth is poised to continue as research and development efforts progress, resulting in improved applications and increased market penetration. Thus, such trends will shape the growth of the market during the forecast period.

Aptamers Market Challen

Inherent challenges associated with oligonucleotide therapies is the major challenge that affects the growth of the market. Oligonucleotide therapy holds significant promise in advancing biomedical research, with applications predominantly found in academic studies. This field is anticipated to make strides in diagnostic and therapeutic development, particularly in the identification of molecular signatures and biomarkers for precision and personalized medicine. However, the transition from academic research to real-world medical applications remains a challenge. One area of potential is the use of oligonucleotides as therapeutic agents, such as in single-cell mRNA research. These molecules can act as valuable tools for therapeutic discovery and drug development.

Nevertheless, the translation of this technology from the lab to industry has yet to be fully realized. Another hurdle is the delivery of RNA-based drugs, including antisense and RNAi molecules, to the target site. This process cannot be self-administered and typically requires intravenous or similar methods. Addressing these challenges and improving the efficiency of oligonucleotide therapy could lead to significant advancements in the healthcare and pharmaceutical industries. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aptagen LLC - The company offers aptamers for biomarker discovery, cell-tissue targeting and imaging, drug discovery and delivery.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 2bind GmbH

- AMS Biotechnology Europe Ltd.

- Aptamer Group Ltd.

- Aptamer Sciences Inc.

- APTATARGETS SL

- APTUS BIOTECH S.L

- Barrick Lab

- Base Pair Biotechnologies Inc.

- Biotage AB

- Creative Biogene

- Donovan Biotechnology LLC

- IBA Lifesciences GmbH

- Kaneka Corp.

- Maravai LifeSciences Holdings Inc.

- NeoVentures Biotechnology Inc

- NOVAPTECH SAS

- Standard BioTools Inc.

- Vivonics Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Oligonucleotide aptamers are small, non-antibody proteins that bind to specific target proteins with high affinity and specificity. These biotechnology innovations have gained significant attention in various fields, including diagnostics, therapeutics, and research. Aptamers offer several advantages over traditional diagnostic tools such as antibodies, including smaller molecular size, lower immunogenicity, and higher stability. In diagnostics, aptamers have shown promise in the detection of chronic diseases and biomarkers. For instance, aptamers have been used in the development of a graphene-based sensing system for cortisol detection. In therapeutics, aptamers have been explored as drug delivery vehicles and therapeutic agents for target cells. Peptide aptamers, another type of aptamers, have been used in the development of diagnostic kits and second-generation diagnostic tests for diseases such as SARS-CoV-2, cancer, CVD, and AMD.

SELEX technology, a method for selecting aptamers, has been instrumental in the discovery of aptamers for various targets. Despite their advantages, aptamers face limitations such as renal filtration, serum stability, and nuclease susceptibility. To overcome these challenges, aptamers are being chemically modified to enhance their stability and diagnostic versatility. Point-of-care testing and healthcare expenditures are expected to drive the growth of the aptamers market. Aptamers have also shown potential in therapeutic development, particularly in protein therapeutics and drug discovery. Their high binding affinity and precision make them ideal for personalized medicine and molecular signatures-based therapeutic agents. However, the limitations of aptamers, such as nuclease resistance, must be addressed to fully realize their potential in therapeutics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 52.5% |

|

Market Growth 2024-2028 |

USD 4.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

30.8 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 74% |

|

Key countries |

US, Canada, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

2bind GmbH, AMS Biotechnology Europe Ltd., Aptagen LLC, Aptamer Group Ltd., Aptamer Sciences Inc., APTATARGETS SL, APTUS BIOTECH S.L, Barrick Lab, Base Pair Biotechnologies Inc., Biotage AB, Creative Biogene, Donovan Biotechnology LLC, IBA Lifesciences GmbH, Kaneka Corp., Maravai LifeSciences Holdings Inc., NeoVentures Biotechnology Inc, NOVAPTECH SAS, Standard BioTools Inc., and Vivonics Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch