Arak Market Size 2024-2028

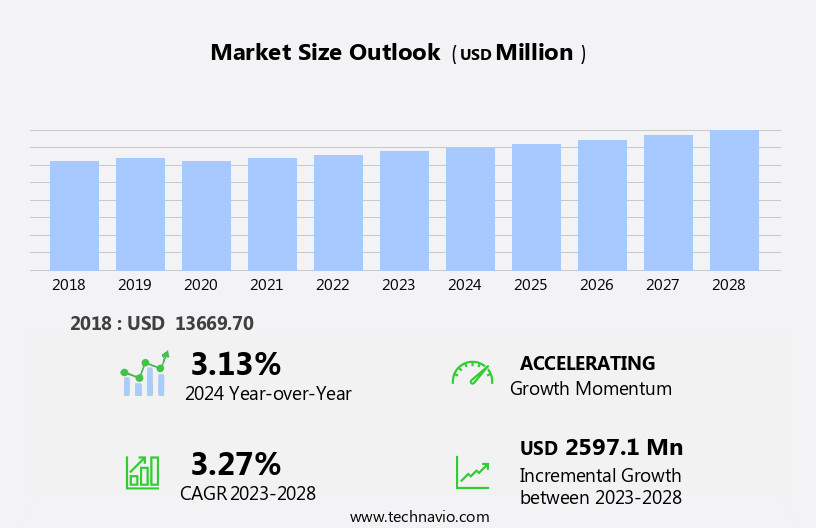

The arak market size is forecast to increase by USD 2.6 billion at a CAGR of 3.27% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing number of distilleries and the expansion of exports. This trend is further fueled by the rise in online sales, as consumers increasingly turn to e-commerce platforms for convenience and accessibility. However, the market is not without challenges, with fluctuations in raw material prices posing a significant threat to profitability.

- Producers must navigate these price volatilities to maintain profitability and meet consumer demand for alcoholic beverages. As the market continues to evolve, staying informed of these trends and challenges is crucial for success.

What will be the Size of the Arak Market During the Forecast Period?

- The market is a significant segment of the global alcoholic beverage sector, characterized by the production and consumption of this distilled spirit made primarily from grapes and anise seeds. The market's size is substantial, with producers, wholesalers, and retailers catering to diverse consumer preferences. The production process involves distillation, often using jorda, a traditional method that adds to the unique character of this anise-flavored beverage.

- Despite regulatory procedures and production costs, the market is developing steadily, with nightclubs and liquor stores playing crucial roles in distribution. Merwah grapes, known for their citrusy flavor, are a common product type segment.

- However, other grape varieties and even grains are also used in the production of Arak and spirits like wine. Product innovation and consumer trends continue to shape the market's direction, making it an intriguing area for further exploration In the alcoholic beverage industry.

How is this Arak Industry segmented and which is the largest segment?

The arak industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Raw Material

- Grapes

- Aniseed

- Others

- Geography

- Middle East and Africa

- North America

- Canada

- US

- Europe

- APAC

- Japan

- South America

- Middle East and Africa

By Raw Material Insights

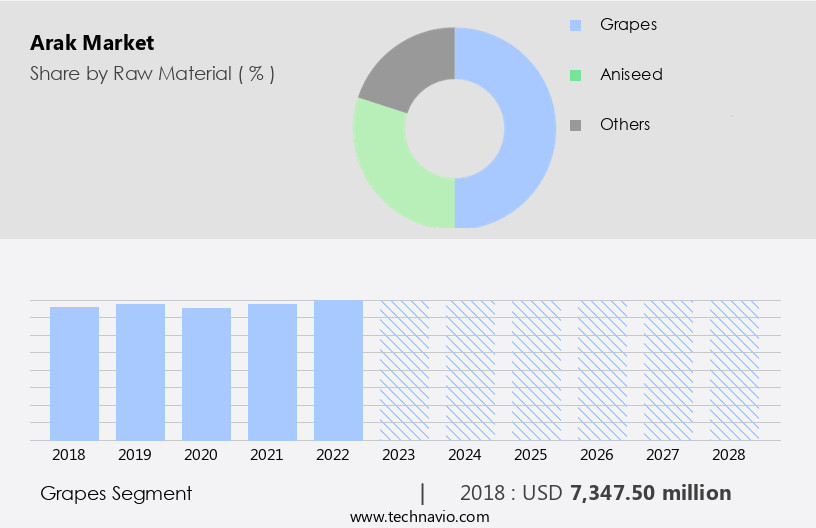

- The grapes segment is estimated to witness significant growth during the forecast period.

The market primarily revolves around grapes as the primary raw material, accounting for the largest revenue share in 2023. Arak's production process involves several stages, including primary and secondary fermentation, pressing, and distillation. Anise seeds, Jorda, and grains are also used In the production of certain arak types. The market is expected to expand due to the significant consumption of arak spirits in countries like Lebanon, Syria, Israel, and Iraq. Factors such as the rise in online sales through established distribution networks and the proliferation of distilleries worldwide will fuel market growth. Consumer preferences for original flavors, sustainable business methods, and innovative packaging ideas further contribute to market expansion.

The alcoholic beverage sector's economic variables and legal frameworks influence the market's development. Producers, wholesalers, and retailers cater to both residential and commercial markets, including liquor shops, pubs, bars and nightclubs, and travel retail. Arak's versatility extends to cocktails, bartenders, and various product innovations.

Get a glance at the Arak Industry report of share of various segments Request Free Sample

The Grapes segment was valued at USD 7.35 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

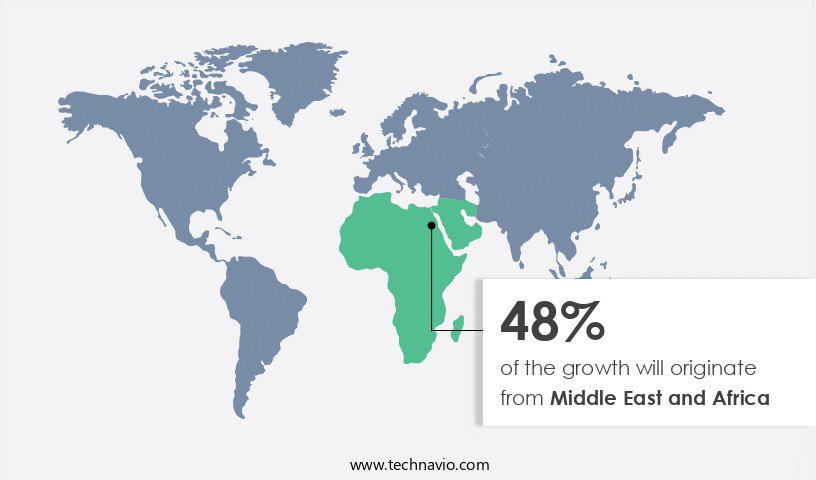

- Middle East and Africa is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Middle East and Africa (MEA) the market is projected to expand during the forecast period, driven by the rise in local distillers and the growing preference for anise-flavored drinks, such as arak. Major contributors to the regional market include Lebanon, Jordan, Israel, Saudi Arabia, and Syria. Arak is primarily consumed In the Middle East and is incorporated into various cocktail drinks in Lebanon and Jordan. However, the prohibition of alcohol consumption in certain MEA countries may hinder market growth. Arak is a distilled spirit, typically made from grapes, anise seeds, and jorda. Producers range from artisanal methods to large-scale commercial operations.

Consumer preferences, regulatory procedures, and economic variables influence market trends. Product innovation, sustainable business methods, and packaging ideas are key areas of focus for market players. Younger drinkers and social media are driving demand for new cocktail recipes and bartender creativity. The alcoholic beverage sector, including grains and distillation processes, is a significant economic factor. Adherence to legal frameworks and economic variables are crucial considerations for market development.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Arak Industry?

Increasing number of distilleries and growth in exports of arak is the key driver of the market.

- The market is experiencing growth due to the rising number of distilleries producing this anise-flavored distilled spirit in countries like the US and the UK. Miami Arak, a Miami-based distillery, recently announced its plans to expand both domestically and internationally, reflecting the expanding market. Similarly, Rechmaya Distillery in Lebanon intends to increase its export of spirits, including arak, to the US. This trend is driven by consumer preferences for original flavors and innovative product types In the alcoholic beverage sector. Producers, wholesalers, and retailers are developing strategies to meet this demand, with sustainable business methods and creative packaging ideas playing a significant role.

- The regulatory procedures for arak production vary by region, and economic variables influence the market dynamics. Arak's unique taste, derived from anise seeds and grapes, is gaining popularity among younger drinkers and is being incorporated into cocktails by bartenders in residential, commercial, and travel retail settings. The market's growth is further fueled by the increasing presence of arak in nightclubs, liquor stores, bars, pubs, and liquor shops.

What are the market trends shaping the Arak Industry?

Growing online sales is the upcoming market trend.

- Arak, a distilled spirit originating from the Middle East, is gaining popularity In the global alcoholic beverage sector. This anise-flavored liquor is primarily produced from grapes, particularly Merwah grapes, which lend it a citrusy flavor. Arak's production involves distillation of grapes and anise seeds, known as Jorda. The market for arak is developing, with various players, including producers, wholesalers, and retailers, catering to the evolving consumer preferences. The regulatory procedures for selling arak online are similar to those for offline retailers, with age restrictions and state licensing requirements. Innovation is a key driver In the market. Producers are exploring artisanal production methods to offer original flavors and packaging ideas that resonate with younger drinkers.

- The alcoholic beverage sector is embracing sustainable business methods to meet the demands of environmentally conscious consumers. Online sales channels, such as liquor stores, nightclubs, and bars, are increasingly popular. Social media platforms are used to engage consumers through contests and promotions. Cocktails featuring arak are gaining traction, with bartenders experimenting with new recipes. The economic variables influencing the market include production costs, consumer trends, and legal frameworks. As the market continues to grow, it is essential for businesses to stay informed about these factors and adapt to the changing landscape.

What challenges does the Arak Industry face during its growth?

Fluctuations in raw material price is a key challenge affecting the industry growth.

- Arak, a popular distilled spirit In the alcoholic beverage sector, relies heavily on raw materials such as grapes and anise seeds for production. However, the price volatility of these commodities poses a significant challenge to manufacturers. Production costs are influenced by economic variables, including the cost of grapes and anise seeds, which can fluctuate due to natural disasters and adverse weather conditions. Producers must navigate regulatory procedures to ensure the authenticity and quality of their arak. In the product type segment, Merwah grapes are widely used due to their citrusy flavor. Arak production methods range from industrial to artisanal, with the latter emphasizing original flavors and sustainable business methods.

- Wholesalers and retailers cater to consumer preferences, offering various packaging ideas to attract younger drinkers. The market encompasses a wide range of channels, including nightclubs, liquor stores, residential and commercial establishments, bars, pubs, travel retail, and cocktail culture. Bartenders innovate with new recipes and presentations, showcasing arak's versatility and unique taste profile. The regulatory framework for arak production and sales varies by region, necessitating a strong understanding of local legal requirements.

Exclusive Customer Landscape

The arak market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the arak market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, arak market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Chateau Ksara - The Lebanese company provides a selection of arak offerings, including Chateau Ksara's Ksarak Arak in a 750ml bottle. Arak is a traditional Middle Eastern anise-flavored spirit, and this company's offerings showcase its rich, complex flavors. The Chateau Ksara brand is renowned for its high-quality production methods and commitment to preserving the authentic taste of arak. This company's arak products are ideal for those seeking an authentic Middle Eastern beverage experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Chateau Ksara

- Domaine des Tourelles

- El Massaya

- Haddad Distilleries

- Kawar Arak

- Lebanese Arak Corp.

- Lebanese Fine Wines Ltd.

- LibanonWeine

- Zumot Distilleries

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a distinct segment withIn the broader alcoholic beverage sector, characterized by the production and consumption of a distilled spirit derived primarily from grapes, anise seeds, and jorda. This market exhibits dynamic growth, driven by various factors influencing its development. Production costs have been a significant consideration for producers, with ongoing efforts to optimize processes and reduce expenses. In the developing stages of Arak production, grapes and anise seeds are combined, followed by distillation. The resulting spirit is infused with the unique citrusy flavor imparted by jorda. The market caters to diverse consumer preferences related to premium spirits, with various product type segments catering to different demographics.

Producers employing artisanal production methods have gained traction, as consumers increasingly seek out original flavors and sustainable business practices. Regulatory procedures play a crucial role In the market, with legal frameworks varying from region to region. Economic variables, such as exchange rates and tariffs, also impact the market's dynamics. In the alcoholic beverage sector, Arak competes with other distilled spirits, grains-based beverages, and wine. Producers, wholesalers, and retailers strive to differentiate their offerings through innovative product ideas, packaging, and marketing strategies. Younger drinkers have emerged as a significant consumer group, with social media playing a pivotal role in shaping their preferences and driving trends.

Bartenders and mixologists continue to innovate, creating new cocktails and experimenting with Arak in various applications. Arak is consumed in both residential and commercial settings, with liquor shops, bars, pubs, and nightclubs serving as key distribution channels. Travel retail also represents a growing opportunity for Arak producers, as tourists seek unique and authentic experiences. The market's growth is influenced by various economic, social, and regulatory factors. Producers must navigate these complexities while maintaining a focus on product quality, innovation, and sustainability to remain competitive.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

128 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 2597.1 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

3.13 |

|

Key countries |

Lebanon, US, Jordan, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Arak Market Research and Growth Report?

- CAGR of the Arak industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, North America, Europe, APAC, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the arak market growth of industry companies

We can help! Our analysts can customize this arak market research report to meet your requirements.