Arsine Removal Absorbents Market Size 2024-2028

The arsine removal absorbents market size is forecast to increase by USD 486.5 million, at a CAGR of 1.3% between 2023 and 2028.

- The market is driven by several key factors. With the rising demand for air separation in various industries such as gas refining, semiconductor manufacturing, and refrigeration, the need for effective arsine absorbents has increased. Sources of arsine include the production of hydrocarbons and the presence of sulfur and fluoride compounds. Arsine is highly toxic and can cause serious health hazards, making the need for efficient removal systems crucial. Clay and silica gel are commonly used absorbents for arsine removal due to their high affinity for the gas. However, the limited availability of effective arsine absorbents poses a challenge to market growth. Additionally, the increasing investment in the semiconductor industry and the use of catalysts in dehydration processes further boost the demand for arsine removal absorbents. Propane and other hydrocarbons, which are often used as reducing agents in various industrial processes, can also produce arsine as a byproduct, necessitating the use of arsine removal absorbents.

What will be the Size of the Market During the Forecast Period?

- Arsine, a highly toxic and flammable gas, poses significant risks to human health and the environment. Consequently, the demand for effective arsine removal absorbents is increasing, driven by stringent regulations and the need for sustainable and efficient processes. Arsine removal absorbents play a vital role in engineering controls, management, and compliance with safety protocols. These materials are designed to adsorb arsine gas, preventing its release into the environment and ensuring the safety of workers and communities. The arsine removal process involves chemical reactions between the absorbent and arsine gas, resulting in the formation of stable compounds that can be safely disposed of. The market encompasses various applications, including arsine filtration, abatement, and purification. These processes are integral to arsine risk assessment, containment, and mitigation. In addition, arsine removal absorbents are used in wastewater treatment and gas purification systems, where they help remove nitrogen and sulfur compounds, among others. Adsorption design and process optimization are essential aspects of the market.

- The adsorption process relies on the ability of the absorbent material to attract and retain arsine molecules through physical or chemical interactions. Nanomaterials for adsorption and adsorbent regeneration are emerging trends in this market, offering improved efficiency and sustainability. Moisture prevention is another critical consideration in the market. Moisture can reduce the effectiveness of absorbents, leading to increased costs and potential safety risks. Desiccant materials are commonly used to mitigate moisture and ensure the optimal performance of arsine removal absorbents. The market is undergoing significant innovation, with research focusing on developing advanced materials and technologies. For instance, air purification technology is being explored to enhance the efficiency and sustainability of arsine removal processes.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Metal oxide based absorbents

- Activated carbon based absorbents

- Others

- End-user

- Semiconductor and electronics

- Oil and gas

- Metals and mining

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South Korea

- South America

- Middle East and Africa

- North America

By Type Insights

- The metal oxide based absorbents segment is estimated to witness significant growth during the forecast period.

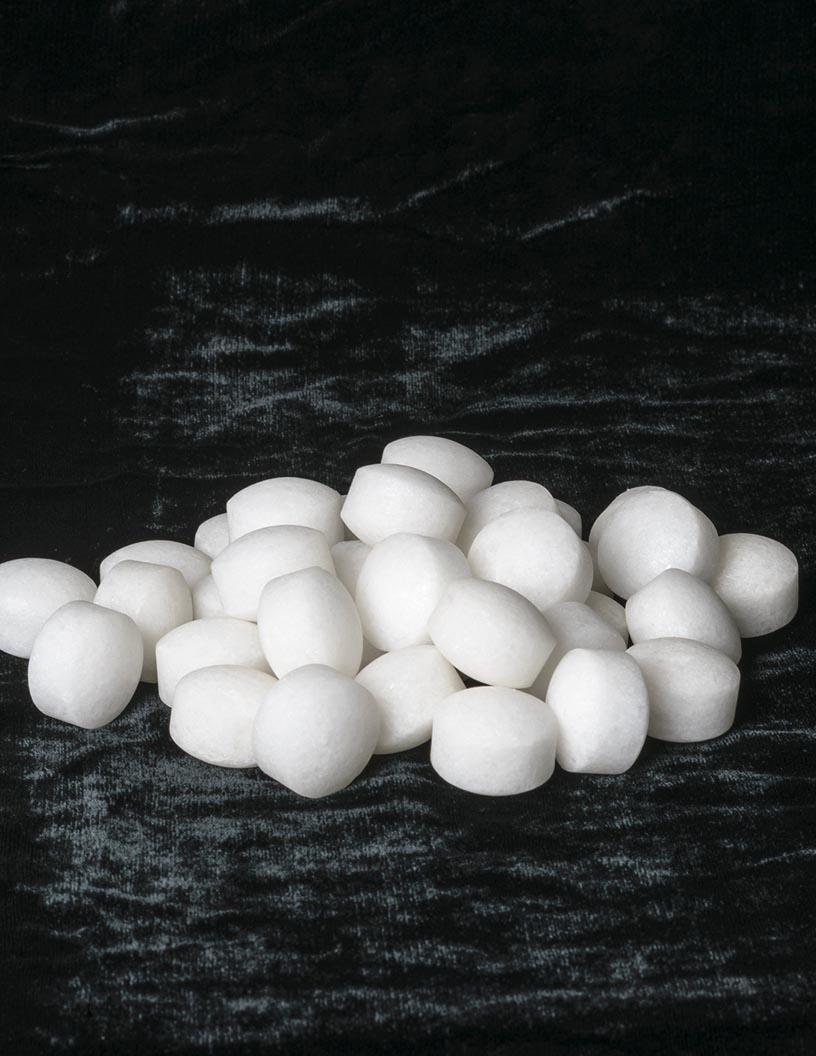

Metal oxide arsine removal absorbents hold a significant position in the global market for arsine removal absorbents. These absorbents exhibit exceptional efficiency and specific reactivity towards arsine gas, making them an ideal choice for various industries. Commonly utilized materials, such as zinc oxide, iron oxide, and titanium dioxide, are preferred due to their superior adsorption properties. These metal oxides chemically react with arsine, forming stable compounds that effectively neutralize the toxic gas. The high efficacy of metal oxide absorbents is particularly valuable in sectors like semiconductor manufacturing, chemical processing, and others, where arsine is commonly found. Arsine gas poses significant risks due to its toxicity, and the use of these absorbents helps mitigate these risks.

Moreover, they are cost-effective compared to other adsorbents, making them a popular choice for industries dealing with arsine. In addition to industrial applications, metal oxide arsine removal absorbents find use in water treatment, petroleum refining, and medical purposes. In water treatment, they help eliminate arsine from water sources, ensuring the safety of drinking water. In petroleum refining, they protect against sulfur poisoning and contribute to the drying and refining processes. In medical applications, they play a crucial role in purification and occupational health risks mitigation. In summary, the market for metal oxide arsine removal absorbents is driven by their efficiency, cost-effectiveness, and versatility.

Get a glance at the market report of share of various segments Request Free Sample

The metal oxide based absorbents segment was valued at USD 3.31 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Arsine removal absorbents are in high demand in North America due to the region's strong semiconductor industry and stringent safety regulations. The US, with its advanced technological infrastructure and numerous research centers, is a significant contributor to this market. The need for high-purity gas handling systems in technology hubs like Silicon Valley drives the demand for efficient arsine removal solutions. OSHA regulations and environmental protection standards in North America mandate comprehensive toxic gas management systems. Companies prioritize workplace safety and environmental sustainability, leading to the adoption of advanced arsine removal technologies. These include high-capacity activated carbon, specialized polymers, and advanced metal oxides.

In addition, the oil refining industry in North America also utilizes arsine removal absorbents to manage arsine exposure during the production process. The region's regulatory bodies continue to enforce strict guidelines to ensure worker protection and minimize environmental impact. As a result, the market for arsine removal absorbents is expected to grow steadfastly in North America. In conclusion, the North American market for arsine removal absorbents is thriving due to the region's strong industrial base, stringent safety regulations, and commitment to environmental sustainability. Companies in the region prioritize workplace safety and environmental responsibility, making the adoption of advanced arsine removal technologies a priority.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the market?

Increasing awareness of industrial safety is the key driver of the market.

- In the realm of materials science, international bodies continue to prioritize environmental safety and regulatory compliance, leading to substantial market growth for arsine removal absorbents. Arsine gas, a highly toxic compound, is prevalent in various industries, including electronics manufacturing, petrochemical processing, mining, and others. The potential health hazards of arsine exposure have prompted regulatory bodies to establish stringent safety standards and exposure limits. As a result, industries are increasingly investing in advanced arsine removal solutions, primarily adsorption-based technologies utilizing materials such as metal oxides and polymers. These absorbents effectively neutralize arsine gas, ensuring a clean and safe industrial environment.

- The semiconductor sector, in particular, has shown significant adoption of these absorbents due to the high prevalence of arsine gas in the manufacturing process. The importance of maintaining a clean industrial process extends beyond health and safety concerns. Compliance with regulatory requirements not only protects workers and the environment but also safeguards a company's reputation. Incorporating high-quality arsine removal absorbents into industrial processes is a proactive measure that enhances overall operational efficiency and sustainability.

What are the market trends shaping the market?

High investment in the semiconductor industry is the upcoming trend in the market.

- The market is witnessing notable expansion due to the increasing investment in air separation processes for various industries, particularly in semiconductor manufacturing. For instance, Taiwan Semiconductor Manufacturing Company (TSMC) received a substantial USD 6.6 billion investment from the US Department of Commerce on November 15, 2024, to construct new semiconductor fabrication plants. This investment underscores the importance of semiconductor manufacturing in the global economy and the growing demand for high-purity production environments. Furthermore, Arsine is a toxic gas commonly produced during the semiconductor fabrication process, requiring efficient removal to ensure a safe and productive work environment.

- Arsine removal absorbents, such as clay, silica gel, and fluoride-based materials, play a crucial role in this process. These absorbents are also used in gas refining, refrigeration, and hydrocarbon industries to eliminate arsine and other impurities. Catalysts and dehydration processes are also employed to optimize the efficiency of arsine removal. Propane and other hydrocarbons are often used as reducing agents in semiconductor manufacturing, leading to the production of arsine. The growing demand for high-performance semiconductors in various industries, including consumer electronics, automotive, and telecommunications, is driving the need for advanced arsine removal technologies. The market is expected to continue its growth trajectory, offering significant opportunities for manufacturers and investors.

What challenges does the market face during the growth?

The limited availability of effective materials is a key challenge affecting market growth.

- Arsine gas, a toxic byproduct of industrial processes, poses a significant health risk to workers and requires effective removal to ensure air quality. Arsine interacts with various chemicals during industrial processes, making its removal a complex challenge. Activated carbon and molecular sieves are commonly used absorbents, but their efficiency in arsine removal is limited, especially at low concentrations and in diverse industrial settings. The development of specialized adsorbent materials with high selectivity, thermal stability, and regenerability for arsine removal is a complex scientific and engineering task. Strict technical requirements, such as high adsorption capacity, minimal breakthrough concentrations, chemical resistance, and cost-effectiveness, create substantial barriers to material innovation.

- The semiconductor and industrial gas processing sectors, in particular, demand increasingly sophisticated arsine removal solutions. The global market faces challenges due to the limited availability of effective materials. Addressing these challenges requires ongoing research and development efforts to create advanced adsorbents that meet the stringent technical requirements for arsine removal while maintaining cost-effectiveness. By focusing on innovation and collaboration between industry and academia, the market can overcome these challenges and drive growth. In conclusion, The market faces significant challenges due to the complexities of arsine removal and the need for specialized adsorbents that meet stringent technical requirements.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Alchemy Trading Company - The company offers arsine removal absorbents which is UOP GB-238 is a high-capacity, non-regenerative spherical adsorbent designed to remove arsine and phosphine from hydrocarbon streams.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Axens group

- BASF SE

- BIEMMECHEMICALS Srl

- Clariant International Ltd

- CLS Industrial Purification

- Dorf Ketal Chemicals India Pvt. Ltd.

- Envitrack s.r.o

- Euro Adsorbent

- Evonik Industries AG

- Johnson Matthey Plc

- Minerex AG

- Shanghai Houdry Catalyst Technology Co Ltd.

- SINOCATA

- Sorbchem India Pvt Ltd.

- Sud-Chemie India Pvt. Ltd.

- UNICAT Catalyst Technologies LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Arsine gas, a highly toxic and flammable compound, is a byproduct of various industrial processes such as oil refining, electronics manufacturing, and gas refining. Exposure to arsine can lead to serious health effects, including death, and poses significant environmental hazards. To mitigate arsine risks, industries rely on specialized arsine removal absorbents. High-capacity activated carbon and advanced metal oxides are commonly used arsine removal absorbents. Materials science has led to the development of specialized polymers and molecular sieves for effective arsine adsorption. These absorbents play a crucial role in ensuring workplace safety and regulatory compliance. Environmental sustainability is a growing concern in arsine handling. International bodies and regulators have set stringent environmental safety regulations for industries dealing with arsine gas.

Further, these regulations require industries to adopt advanced adsorbent technologies and sustainable practices. Industries dealing with arsine gas include petrochemical processing, mining, and gas separation. Arsine removal absorbents are used in various applications, including air quality control in industrial processes, deactivation of catalysts, and water treatment. In addition to arsine, these absorbents are also effective in removing other toxic gases, nitrogen compounds, and sulfur compounds. The use of low-cost adsorbents and compliance with industrial safety standards ensure productivity and worker health. The market for arsine removal absorbents is driven by the increasing demand for clean industrial processes, environmental protection, and regulatory requirements. Technological advancements in adsorbent materials continue to improve arsine removal efficiency and reduce costs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.3% |

|

Market Growth 2024-2028 |

USD 486.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

1.2 |

|

Key countries |

US, China, Canada, Germany, UK, Italy, Japan, South Korea, India, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.