What is the Artificial Intelligence In Biotechnology Market Size?

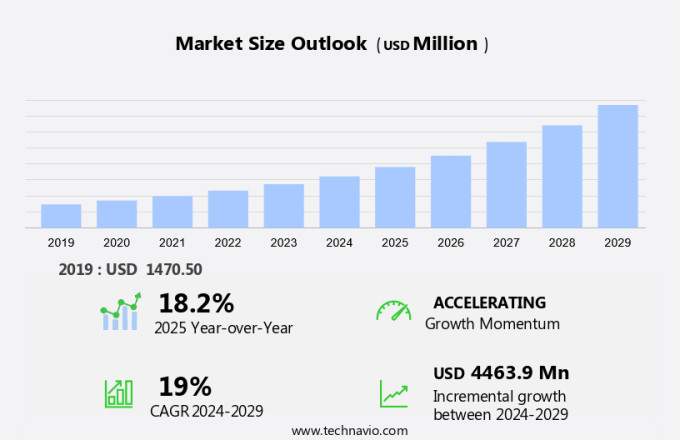

The artificial intelligence in biotechnology market size is forecast to increase by USD 4.46 billion, at a CAGR of 19% between 2024 and 2029. Artificial Intelligence (AI) is revolutionizing the biotechnology industry by enhancing research and development processes, enabling accurate diagnoses, and improving productivity. Key growth factors fueling the market include substantial investments in biotechnology advancements and strategic collaborations between industry players and tech companies. However, the high initial cost of implementing AI solutions remains a challenge for smaller organizations. The market is expected to witness significant growth due to the increasing adoption of AI in areas such as drug discovery, genetic research, and agricultural technology. Furthermore, advancements in machine learning algorithms and natural language processing are enabling more precise and efficient data analysis, leading to new discoveries and innovations. Overall, the integration of AI in biotechnology is transforming the industry and offering numerous opportunities for growth.

What will be the size of the Market during the forecast period?

Request Free Artificial Intelligence In Biotechnology Market Sample

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Application

- Drug discovery and development

- Clinical trials and optimization

- Medical imaging

- Diagnostics

- Others

- End-user

- Pharmaceutical companies

- Biotechnology companies

- Contract research organization (CRO)

- Healthcare providers

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Middle East and Africa

- North America

Which is the largest segment driving market growth?

The drug discovery and development segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth, particularly in drug discovery and development. AI technologies are transforming the drug discovery process by increasing accuracy and efficiency in identifying potential drug candidates.

Get a glance at the market share of various regions. Download the PDF Sample

The drug discovery and development segment was valued at USD 522.60 million in 2019. AI applications in biotechnology extend beyond drug discovery, including compound screening, personalized medicine, and environmental factors analysis. This growth is driven by the increasing demand for personalized treatments, the need for faster drug development, and the potential for AI to revolutionize various applications in biotech and pharmaceuticals.

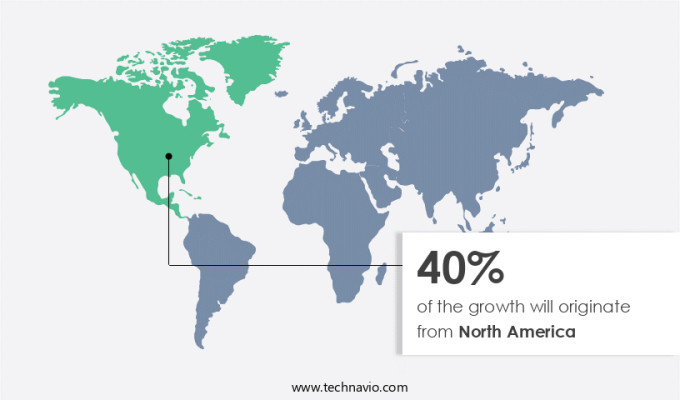

Which region is leading the market?

For more insights on the market share of various regions, Request Free Sample

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The North American region leads the global artificial intelligence (AI) market in biotechnology due to substantial investments, strategic collaborations, and technological advancements. With a strong infrastructure and a strong focus on innovation, the region is at the forefront of adopting and developing AI-driven biotechnological solutions. For example, in March 2023, Predictive Oncology partnered with Integra Therapeutics to enhance gene editing capabilities for cancer therapies. This collaboration leverages Predictive Oncology's expertise in protein expression to advance gene editing techniques, aiming to develop more effective cancer treatments. The partnership in Minnesota highlights the region's commitment to pioneering cancer research and therapeutic development through AI technology. In the life sciences sector, AI is utilized to analyze large datasets of genetic information, improve treatment outcomes, and increase productivity. Key players in the market include leading research institutions and biotechnology companies.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Abbott Laboratories - The company offers artificial intelligence in biotechnology solutions that include AI-driven medical imaging and predictive analytics for identifying individuals at risk of heart attacks.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- Amgen Inc.

- AstraZeneca Plc

- BeiGene Ltd.

- Biogen Inc.

- Bristol Myers Squibb Co.

- CareDx Inc.

- Clario

- F. Hoffmann La Roche Ltd.

- Genesis Therapeutics Inc.

- Insilico Medicine

- Johnson and Johnson Inc.

- Merck KGaA

- Novartis AG

- Novo Nordisk AS

- Pfizer Inc.

- Recursion Pharmaceuticals

- Roivant Sciences Ltd.

- Sage Therapeutics Inc.

- Sanofi SA

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

18.2 |

Market Dynamics

Artificial Intelligence (AI) is revolutionizing the biotechnology market by enhancing various aspects of drug discovery and development. The application of machine learning algorithms in biotechnology is leading to significant advancements in personalized medicine, where AI-powered systems identify the most effective treatments based on individual patient data. One of the key areas where AI is making a significant impact is in drug target identification. By analyzing vast amounts of data, deep learning models can identify potential drug targets with high accuracy, reducing the time and cost associated with traditional methods. Another area where AI is making a difference is in drug repurposing. By analyzing existing drugs and their interactions with various proteins and biomarkers, AI-powered systems can identify new uses for existing drugs, accelerating the drug development process. Healthcare data analytics is another area where AI is making a significant impact. By analyzing patient data, AI-powered systems can identify trends and patterns, leading to better clinical trial design and more effective patient engagement. Pharmacovigilance is another area where AI is being used to improve patient safety. By analyzing adverse event reports, AI-powered systems can identify potential safety issues and alert healthcare providers, reducing the risk of harm to patients.

Data-driven drug development is another area where AI is making a significant impact. By analyzing vast amounts of data, AI-powered systems can identify potential drug candidates and optimize the drug discovery pipeline. AI is also being used to develop AI-powered drug screening systems, which can analyze the structure of proteins and identify potential drug candidates. This can significantly reduce the time and cost associated with traditional drug screening methods. In addition to these applications, AI is also being used in areas such as healthcare policy, medical billing, health equity, healthcare cost reduction, virtual care, wellness programs, medical device integration, and public health. The use of AI in healthcare is leading to more efficient and effective healthcare delivery, improved patient outcomes, and reduced healthcare costs. Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

Investments in biotechnology advancements are notably driving market growth. The market is experiencing significant growth due to substantial investments in research and development. These investments are crucial for advancing biotech and pharma innovations, particularly in areas such as compound screening, toxicity testing, and personalized medicine. For example, in February 2023, Aera Therapeutics raised USD 193 million in Series B funding to enhance the capabilities of AI in the development of RNA interference, mRNA, gene therapies, and gene editing. This investment will accelerate the creation of more efficient and effective delivery mechanisms for these advanced treatments, ultimately increasing drug efficacy and patient outcomes. Furthermore, AI technologies, such as machine learning and predictive analytics, are being integrated into various aspects of biotech and pharma, including experimental design, patient data analysis, and wearable technology for preventive care.

The integration of AI in biotech and pharma is also driving innovation in areas such as image processing for diagnostics, behavioral modification for smoking cessation, and voice recognition for patient responses. The use of AI is expected to reduce costs, increase productivity, and provide healthcare solutions tailored to individual patients based on their genetic information and environmental factors. Overall, the integration of AI in biotech and pharma is revolutionizing the industry, enabling speedy drug discovery and improving patient care. Thus, such factors are driving the growth of the market during the forecast period.

What are the significant trends being witnessed in the market?

Strategic collaborations are an emerging trend shaping market growth. Thus, such market trends will shape the growth of the market during the forecast period. The Artificial Intelligence (AI) market in biotechnology is experiencing a notable trend towards strategic collaborations, which are propelling innovation and expediting the development of new therapeutics. These alliances are harnessing sophisticated AI technologies to amplify research capabilities and optimize the manufacturing process of novel biotech and pharma products. By combining machine learning algorithms with patient responses, environmental factors, and genetic information, these partnerships are enhancing the effectiveness of drug development, improving patient outcomes, and reducing costs.

Furthermore, AI technologies are being employed in various applications such as image processing, wearable technology, preventive care, and diagnostics, offering a competitive edge in the biotech and pharma industries. The integration of AI in research and development is also facilitating speedy drug discovery, enabling personalized medicine, and improving treatment outcomes in various clinical domains. By harnessing the power of AI, biotech and pharma companies are optimizing their R&D processes, enhancing productivity, and staying at the forefront of innovation.

What are the major market challenges?

The high initial cost is a significant challenge hindering the market growth. Artificial Intelligence (AI) is revolutionizing the biotechnology market by enhancing accuracy and effectiveness in various applications. Machine learning algorithms are being used to analyze patient responses, pharmacokinetics, and drug efficacy, enabling faster and more precise research and development. AI technologies are also employed in compound screening, toxicity prediction, and experimental design for speedy drug discovery. In the healthcare sector, AI is utilized in personalized medicine, environmental factors consideration, and preventive care through wearable technology and mobile healthcare applications. Predictive analytics and voice recognition systems facilitate better patient outcomes and productivity in the life sciences industry. The integration of AI in biotech and pharma industries requires substantial investment, with costs ranging from USD 10,000 to several million dollars. Factors influencing the cost include the complexity of the application, data volume, and customization. Data acquisition and processing are essential for AI model training, adding to the overall expense.

Despite the financial barrier, the benefits of AI in biotechnology, such as improved patient care, productivity, and innovation, make it a valuable investment for companies. AI technologies are transforming diagnostics, behavioral modification, image processing, and other areas in the biotech and healthcare industries. Key applications include smoking cessation, treatment outcomes prediction, and skin cancer detection. Structured and unstructured data analysis, clinical domain knowledge, and supervised learning are essential components of AI systems in these domains. In summary, AI technologies are significantly impacting the biotechnology market by improving research, development, and patient care through accurate data analysis, predictive analytics, and personalized medicine. Despite the substantial investment required, the benefits of AI in biotech and healthcare make it an essential tool for innovation and a competitive edge in the industry. Hence, the above factors will impede the growth of the market during the forecast period.

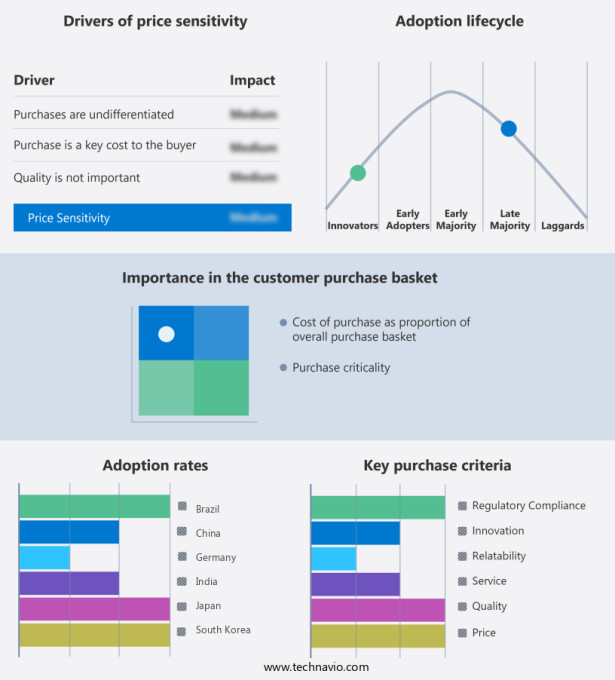

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

Artificial Intelligence (AI) is revolutionizing the biotechnology market by enhancing research and development (R&D) processes, improving patient outcomes, and accelerating drug discovery. AI technologies, including machine learning and deep learning, are being employed to analyze vast amounts of data from various sources, enabling more accurate predictions and insights. One significant application of AI in biotechnology is in the field of pharmacokinetics and drug efficacy. By analyzing patient responses to drugs and considering environmental factors, AI algorithms can help optimize dosages and treatment plans, leading to better patient outcomes and increased effectiveness. Moreover, AI can be used in compound screening to identify potential new drugs and predict their toxicity, reducing the time and cost of bringing new treatments to market. AI is also playing a crucial role in personalized medicine, allowing for the development of treatments tailored to individual patients based on their genetic information and lifestyle factors. Machine learning algorithms can analyze patient data, including symptoms, treatment history, and behavioral patterns, to provide healthcare solutions that are more effective and productive. In the manufacturing sector, AI is being used to streamline processes, improve quality control, and reduce costs. For instance, AI-powered image processing can be used to inspect products and identify defects, while predictive analytics can help optimize production schedules and reduce downtime. The use of AI in biotechnology is not limited to pharmaceuticals.

In diagnostics, AI-powered systems can analyze medical images, such as X-rays and MRIs, to identify diseases and abnormalities with greater accuracy than human experts. AI is also being used in wearable technology and mobile healthcare applications to monitor patient health in real-time, enabling preventive care and early intervention. The integration of AI in biotechnology is driving innovation in the life sciences, from biocomputing to neuro-linguistic programming. AI can process unstructured data, such as voice recordings and text, to extract valuable insights that would be difficult or impossible for humans to identify. For example, AI can be used to analyze patient feedback from social media to identify trends and improve treatment outcomes. Despite the many benefits of AI in biotechnology, there are also challenges. Ethical concerns around data privacy and security must be addressed, and there is a need for clinical domain knowledge to ensure that AI algorithms are making accurate predictions. Moreover, there is cost pressure to make AI technologies accessible to a wider audience, particularly in healthcare, where budgets are tight.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19% |

|

Market Growth 2025-2029 |

USD 4.46 billion |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 40% |

|

Key countries |

US, China, Germany, UK, Switzerland, The Netherlands, Japan, South Korea, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Abbott Laboratories, Amgen Inc., AstraZeneca Plc, BeiGene Ltd., Biogen Inc., Bristol Myers Squibb Co., CareDx Inc., Clario, F. Hoffmann La Roche Ltd., Genesis Therapeutics Inc., Insilico Medicine, Johnson and Johnson Inc., Merck KGaA, Novartis AG, Novo Nordisk AS, Pfizer Inc., Recursion Pharmaceuticals, Roivant Sciences Ltd., Sage Therapeutics Inc., and Sanofi SA |

|

Market Segmentation |

Application (Drug discovery and development, Clinical trials and optimization, Medical imaging, Diagnostics, and Others), End-user (Pharmaceutical companies, Biotechnology companies, Contract research organization (CRO), Healthcare providers, and Others), and Geography (North America, Europe, APAC, South America, and Middle East and Africa) |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the market forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies