Pharmacovigilance Market Size and Trends

The pharmacovigilance market size is forecast to increase by USD 2.87 billion at a CAGR of 5.8% between 2023 and 2028. Pharmacovigilance is a critical aspect of ensuring drug safety and effectiveness. The market for pharmacovigilance services is experiencing significant growth due to several factors. Firstly, the increasing incidence rates of adverse drug events necessitate pharmacovigilance systems. Secondly, marketing authorization holders are increasingly outsourcing pharmacovigilance activities to Contract Research Organizations (CROs) to reduce costs and improve efficiency. Regulatory authorities, such as the Food and Drug Administration (FDA) in the US, enforce strict regulations through Directives like the EU Pharmacovigilance Legislation. Pre-clinical and clinical trials are crucial stages in drug therapy development. The importance of data safety and security in clinical studies and for managing health and diseases further fuels the demand for advanced pharmacovigilance solutions. This market analysis report provides an in-depth examination of these trends and challenges.

Market Overview

Pharmacovigilance is a critical aspect of pharmacological science that ensures the safety of medicinal products. It involves the collection, detection, assessment, monitoring, prevention, and reporting of adverse effects. This process is essential to ensure the continued safety and efficacy of medicinal products. The legal framework for pharmacovigilance is established by regulatory authorities worldwide. Marketing authorization holders are responsible for implementing a system for pharmacovigilance to comply with these regulations. This system includes reporting schemes such as the Yellow Card Scheme in the US, which allows healthcare professionals and patients to report suspected adverse reactions. The detection of adverse effects relies on various sources, including clinical studies, medical literature, morbidity databases, and mortality databases. These sources provide valuable safety data on the use of medicinal products in various populations and health conditions. Regulatory authorities worldwide play a crucial role in the pharmacovigilance process. They establish directives and guidelines for marketing authorization holders to follow. These directives include requirements for post-marketing safety studies and regular safety updates.

Furthermore, pharmacovigilance is essential for the prevention of adverse effects and the early detection of safety issues. It helps to minimize the risk of spontaneous safety events and ensure the safety of medicinal products. The assessment and monitoring of adverse effects are ongoing processes that require continuous attention and resources. The safety of products is a top priority for regulatory authorities and marketing authorization holders. Pharmacovigilance plays a crucial role in maintaining the safety of medicinal products and protecting public health. It is an essential component of the pharmacological science that ensures the continued safety and efficacy of medicinal products. In conclusion, pharmacovigilance is a critical process in ensuring the safety of medicinal products. It involves the collection, detection, assessment, monitoring, prevention, and reporting of adverse effects. Regulatory authorities worldwide establish the legal framework for pharmacovigilance, and marketing authorization holders are responsible for implementing the necessary systems to comply with these regulations. Pharmacovigilance is an ongoing process that requires continuous attention and resources to ensure the safety and efficacy of medicinal products.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Service

- In-house

- Contract outsourcing

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

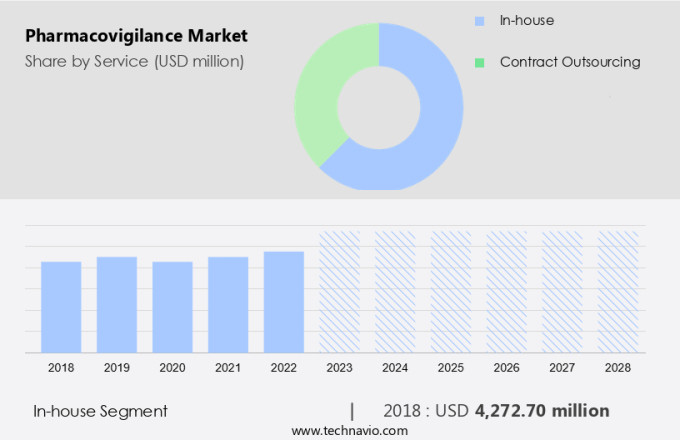

By Service Insights

The In-house segment is estimated to witness significant growth during the forecast period. Pharmacovigilance plays a crucial role in ensuring the safety and effectiveness of medicines. Detecting and assessing medicine-related problems or risks is essential for preventing adverse events and maintaining patient safety. Pharmaceutical companies prioritize having a thorough understanding of these risks to minimize harm to their consumers. In-house pharmacovigilance units within major pharmaceutical organizations offer several advantages over contract research organizations (CROs).

Get a glance at the market share of various segments Download the PDF Sample

The In-house segment was the largest segment and was valued at USD 4.27 billion in 2018. With extensive resources and expertise, these in-house teams can provide more comprehensive and personalized services. By keeping pharmacovigilance in-house, companies maintain complete control over their safety data. Confidential information is safeguarded, reducing the need to rely on external organizations. Moreover, in-house resources help companies protect and monitor their data more closely, minimizing dependencies on third parties. These advantages enable pharmaceutical companies to ensure the safe and effective use of their medicines, ultimately benefiting patients and the industry as a whole.

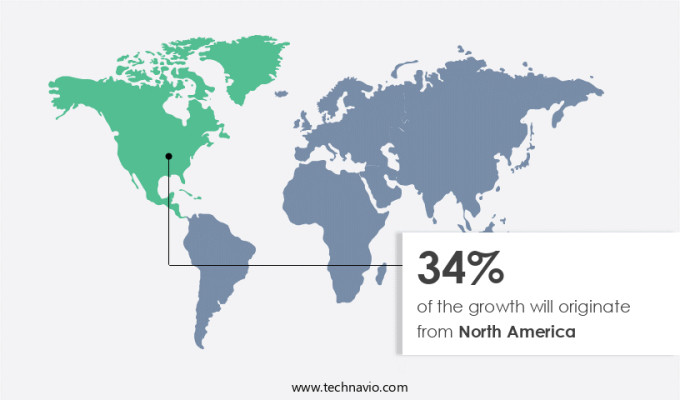

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. In the global pharmacovigilance market, North America emerged as the largest revenue generator in 2023, with the US being the primary contributor. The escalating number of clinical trials and life science research activities in the US and Canada fuel the demand for pharmacovigilance in this region. The US, in particular, is a significant market due to the high prevalence of clinical trials for pharmaceutical, biologics, and medical device companies. The increasing demand for new drug discoveries and the vast opportunities for pharmaceutical product sales in the US have attracted numerous companies, making it one of the largest pharmaceutical markets worldwide.

However, post-marketing surveillance is equally essential to ensure long-term safety. Animal testing in a controlled setting is an integral part of the pre-clinical phase, while voluntary reporting systems facilitate post-marketing safety monitoring. Lawsuits arising from drug therapy complications underscore the importance of robust pharmacovigilance systems.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Pharmacovigilance Market Driver

Rising incidence rates of adverse drug events is notably driving market growth. Pharmacovigilance, the process of monitoring and identifying adverse effects of drugs post-marketing, has gained significant importance due to the increasing global consumption of medical devices and pharmaceuticals.

Furthermore, the US Food and Drug Administration (FDA) enforces stringent regulations, such as Title 21 of the Code of Federal Regulations, requiring manufacturers to report and provide data on any adverse drug events. This is crucial to ensure drug safety and minimize unwanted medical occurrences and side effects that may lead to discontinuation or modification of generic drugs. Thus, such factors are driving the growth of the market during the forecast period.

Pharmacovigilance Market Trends

Rising outsourcing of pharmacovigilance to CROs is the key trend in the market. Pharmaceutical companies are increasingly focusing on expansion strategies, drug discovery and research, and product development, leading to an increased workload and significant consumption of human resources. In response to the growing importance of patient safety, regulatory authorities have intensified their efforts to enforce stringent pharmacovigilance policies. These policies include various reporting schemes, such as the Yellow Card scheme in Europe, which require marketing authorization holders to report adverse drug reactions. Maintaining consistency in product quality and safety while navigating variations in regulatory frameworks and standardization across regional markets presents additional challenges for pharmaceutical companies. To address these challenges, many firms are outsourcing tasks related to clinical research, drug designing, drug safety testing, and pharmacovigilance to Contract Research Organizations (CROs). This trend is prevalent worldwide and has become a standard practice in the industry.

Furthermore, pharmacovigilance, or the system for ensuring drug safety, plays a crucial role in maintaining patient safety and regulatory compliance. It involves continuous monitoring, identification, assessment, understanding, and prevention of adverse effects or any potential risks associated with pharmaceutical products. Effective pharmacovigilance requires a reporting system, rigorous data analysis, and prompt communication between regulatory authorities, marketing authorization holders, and healthcare professionals. These initiatives are essential for maintaining public health and trust in the pharmaceutical industry. By adhering to these regulations and collaborating with CROs, pharmaceutical companies can effectively manage their pharmacovigilance responsibilities and focus on their core business objectives. Thus, such trends will shape the growth of the market during the forecast period.

Pharmacovigilance Market Challenge

Concerns related to data safety and security is the major challenge that affects the growth of the market. Pharmacovigilance involves the collection, detection, assessment, monitoring, and prevention of adverse effects associated with medicinal products. This process relies on extensive data mining from a large database of reports detailing drug safety information. The data includes sensitive personal information, such as email addresses and contact details, which must comply with data protection acts like the UK Data Protection Act (1998) and the EU General Data Protection Regulation ((EU) 2016/679).

Furthermore, strict adherence to these regulations is essential to maintain data security and protect against civil proceedings and criminal enforcement. However, concerns over healthcare and medical data breaches have emerged as a significant challenge to the widespread adoption of pharmacovigilance. Companies must prioritize data protection compliance to ensure the confidentiality, integrity, and availability of critical pharmacovigilance data. By implementing security measures and adhering to legal frameworks, pharmacovigilance service providers can build trust with end-users and promote the effective use of pharmacological science in ensuring drug safety. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Accenture PLC - The company offers pharmacovigilance such as INTIENT Pharmacovigilance, a comprehensive platform that collects, manages, and analyzes pharmacovigilance data to enhance patient safety and compliance.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArisGlobal LLC

- Capgemini Services SAS

- ClinChoice

- Cognizant Technology Solutions Corp.

- eResearchTechnology GmbH

- ICON plc

- International Business Machines Corp.

- IQVIA Holdings Inc.

- ITClinical

- Laboratory Corp. of America Holdings

- Linical Co. Ltd.

- Medpace Holdings Inc.

- Parexel International Corp.

- SIRO Clinpharm Pvt. Ltd.

- Symogen Ltd.

- TAKE Solutions Ltd.

- Thermo Fisher Scientific Inc.

- United BioSource LLC

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

Pharmacological science plays a crucial role in the development and use of medicinal products. The collection, detection, assessment, monitoring, prevention, and mitigation of adverse effects are essential aspects of pharmacovigilance, which ensures the safety and effectiveness of medicines. A pharmacovigilance system is necessary to understand and address medicine-related problems, risks, and safety concerns. Regulatory authorities worldwide have established legal frameworks, directives, and marketing authorization holder requirements for pharmacovigilance. These frameworks include reporting schemes, such as the Yellow Card Scheme in the European Union, and morbidity and mortality databases.

Furthermore, regulatory authorities and marketing authorization holders collaborate to ensure the safety of products and protect patients from adverse effects. Pharmacovigilance encompasses the safety of medicines throughout their entire life cycle, from pre-clinical studies to clinical trials and post-marketing surveillance. Spontaneous safety events and safety data are continuously monitored and assessed to update the drug safety profile. Drug therapy, drug abuse, diversion, product liability, lawsuits, and drug therapy risks are also considered in pharmacovigilance. Pharmacovigilance involves detecting, assessing, and preventing medicine-related problems in a controlled setting. It includes the safety assessment of medicinal products and medical devices, as well as understanding the risks associated with drug therapy, pre-clinical testing, and clinical trials. Pharmacovigilance is essential for ensuring the safe and effective use of medicines and protecting patient health and wellbeing.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2024-2028 |

USD 2.87 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.4 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 34% |

|

Key countries |

US, Canada, Germany, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Accenture PLC, ArisGlobal LLC, Capgemini Services SAS, ClinChoice, Cognizant Technology Solutions Corp., eResearchTechnology GmbH, ICON plc, International Business Machines Corp., IQVIA Holdings Inc., ITClinical, Laboratory Corp. of America Holdings, Linical Co. Ltd., Medpace Holdings Inc., Parexel International Corp., SIRO Clinpharm Pvt. Ltd., Symogen Ltd., TAKE Solutions Ltd., Thermo Fisher Scientific Inc., United BioSource LLC, and Wipro Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch