Artificial Intelligence (AI) In Food And Beverage Industry Market Size 2025-2029

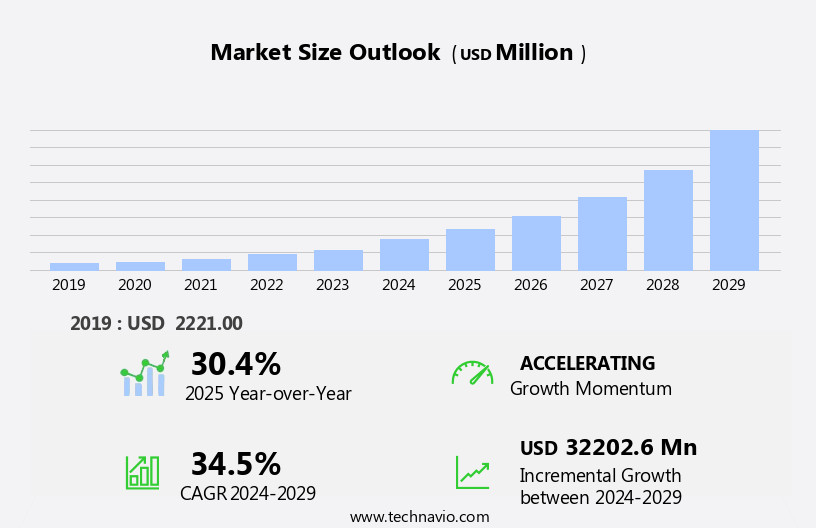

The artificial intelligence (AI) in food and beverage industry market size is forecast to increase by USD 32.2 billion, at a CAGR of 34.5% between 2024 and 2029.

- The Artificial Intelligence (AI) market in the Food and Beverage industry is witnessing significant growth, driven by the rising demand for automation to enhance productivity and streamline operations. The integration of Industrial Internet of Things (IIoT) in food and beverage processing is a key trend, enabling real-time monitoring and predictive maintenance, leading to improved efficiency and quality. However, the lack of skilled personnel poses a significant challenge in implementing and managing AI technologies, necessitating investments in training and development programs.

- Companies in the food and beverage sector seeking to capitalize on the opportunities presented by AI must focus on addressing this talent gap while also ensuring compliance with data security regulations and ethical considerations in the use of AI technologies. Effective collaboration between industry players, academia, and governments can help bridge the skills gap and foster innovation in the sector.

What will be the Size of the Artificial Intelligence (AI) In Food And Beverage Industry Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The food and beverage industry continues to experience dynamic market activities, driven by the integration of artificial intelligence (AI) technologies. From recipe development to production efficiency, AI applications span various sectors, shaping the industry's evolving landscape. Robotics and automation streamline processes, ensuring consistent product quality and reducing labor costs. Smart packaging with embedded sensors monitors food freshness and safety, enhancing consumer trust. AI-driven trend forecasting and social media marketing strategies help businesses stay competitive. Deep learning models optimize ingredient usage, improve demand forecasting, and enable personalized nutrition recommendations. Computer vision algorithms facilitate image recognition for food labeling regulations and allergen detection.

AI-powered sensory analysis refines flavor profiling and dietary recommendations. Sustainability reporting, precision fermentation, and food waste reduction are key areas where AI contributes to industry innovation. Business model development and supply chain management are optimized through AI-driven data analytics platforms and e-commerce solutions. AI's role in the food and beverage industry extends to food safety, consumer insights, and competitive landscape analysis. Food fraud detection and cloud-based solutions further enhance transparency and efficiency. The continuous integration of AI technologies promises a future of smart, sustainable, and personalized food production and delivery.

How is this Artificial Intelligence (AI) In Food And Beverage Industry Industry segmented?

The artificial intelligence (AI) in food and beverage industry industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Transportation and logistics

- Production planning

- Quality control

- Others

- End-user

- Food processing industry

- Hotels and restaurants

- Beverage industry

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

By Type Insights

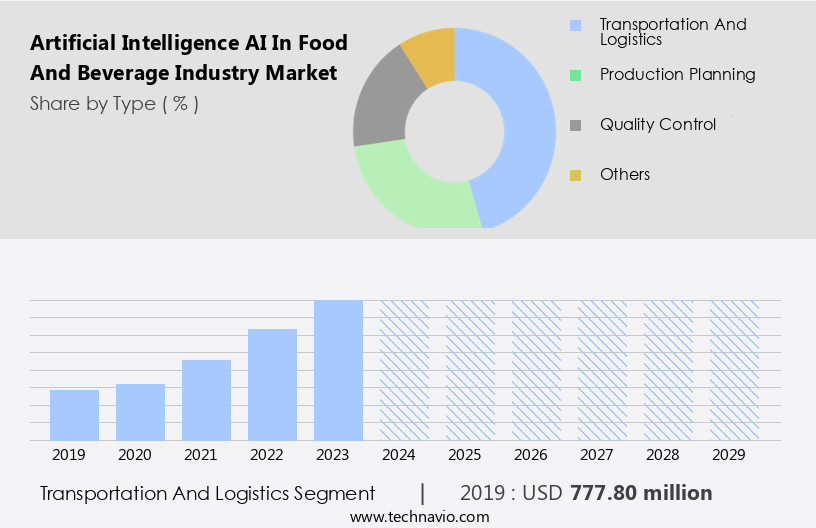

The transportation and logistics segment is estimated to witness significant growth during the forecast period.

In the food and beverage industry, automation is becoming a key trend as players seek to optimize operations and improve production efficiency. This is particularly evident in intralogistics, where manufacturers, beverage wholesalers, breweries, and bottling plants are employing advanced technologies such as machine vision systems, robotics, and automation to streamline their warehousing and distribution processes. The need for flexibility and swift returns processing is also driving demand for these solutions. The transportation and logistics segment of the global AI market in food and beverage industry is poised for growth, with manufacturers investing in precision fermentation, deep learning models, and other advanced technologies to enhance their manufacturing processes.

The emergence of digitization and new business models is bringing about a paradigm shift in the industry. Food labeling regulations and product traceability are also major considerations for players in the sector. AI-powered solutions are being used to analyze consumer behavior and develop personalized nutrition recommendations, as well as to optimize inventory levels and reduce food waste. Image recognition and natural language processing are being used to improve recipe development and process automation, while deep learning models are being employed for demand forecasting and trend forecasting. Sustainability initiatives and food safety are also key concerns for the industry.

AI is being used to detect allergens, monitor food safety, and reduce food waste through supply chain management and demand forecasting. Smart packaging and 3D food printing are also gaining traction, offering opportunities for innovation and differentiation. The competitive landscape in the food and beverage industry is dynamic, with players constantly seeking to differentiate themselves through product offerings and marketing strategies. Digital marketing, social media marketing, and e-commerce platforms are increasingly important channels for reaching consumers and building brand loyalty. Sentiment analysis and consumer insights are being used to inform marketing strategies and product development, while food fraud detection and cloud-based solutions are being employed to ensure supply chain transparency and trust.

In conclusion, the food and beverage industry is undergoing a digital transformation, with AI playing a key role in optimizing operations, improving production efficiency, and enhancing consumer experiences. From ingredient optimization and inventory management to consumer behavior analysis and sustainability reporting, AI is enabling players to stay competitive and meet evolving consumer demands. The industry is also seeing the emergence of alternative protein sources, such as cell-based meat and plant-based alternatives, which are being developed using precision fermentation and other advanced technologies. Overall, the food and beverage industry is an exciting and dynamic space, with numerous opportunities for innovation and growth.

The Transportation and logistics segment was valued at USD 777.80 billion in 2019 and showed a gradual increase during the forecast period.

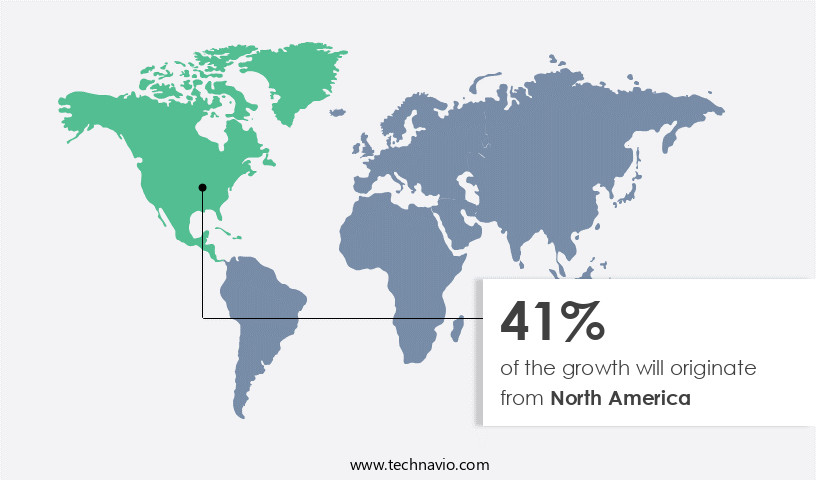

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The AI market in the North American food and beverage industry is experiencing significant growth due to the increasing adoption of automation in manufacturing. Food safety is a top priority, with manufacturers implementing process controls to ensure consistency in product quality, smell, and taste. Both large corporations and small-to-midsize enterprises (SMEs) are investing in advanced technologies such as machine vision systems, robotics and automation, and deep learning models for production efficiency, demand forecasting, and inventory optimization. Consumer behavior analysis, image recognition, and sentiment analysis are crucial for digital marketing strategies and online food ordering systems. The emergence of cell-based meat, alternative protein sources, and plant-based alternatives is driving innovation in recipe development and process automation.

Sustainability reporting, sensory analysis, and computer vision algorithms are essential for maintaining industry standards and quality control. Trend forecasting and precision fermentation are key areas of focus for business model development and nutritional value analysis. Food waste reduction and personalized nutrition are also gaining importance, with AI-driven solutions for supply chain management, allergen detection, and 3D food printing. Food safety and consumer insights are critical for competitive landscape analysis and e-commerce platforms. Cloud-based solutions and data analytics platforms are enabling food delivery services and food fraud detection. Natural language processing and innovation strategies are essential for staying competitive and meeting evolving consumer demands.

Sustainability initiatives, such as precision agriculture and circular economy, are also becoming increasingly important. Overall, the AI market in the North American food and beverage industry is dynamic and innovative, with a strong focus on improving efficiency, ensuring food safety, and meeting consumer preferences.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Artificial Intelligence (AI) In Food And Beverage Industry?

- The increasing need for automation to enhance productivity serves as the primary market catalyst.

- Artificial Intelligence (AI) is revolutionizing the food and beverage industry by enhancing production efficiency and performance. AI solutions enable food and beverage companies to comply with food labeling regulations and ensure product traceability. With AI, ingredient optimization becomes more accurate, reducing waste and improving product quality. AI's investment opportunities extend to inventory optimization, enabling real-time monitoring and automated reordering. Machine vision systems and image recognition technology streamline quality control processes, while consumer behavior analysis provides valuable insights for digital marketing strategies. The integration of AI into legacy systems may be costly and time-consuming, but the benefits include intelligent automation, labor and capital growth, and innovation.

- For instance, predictive maintenance alerts plant managers to potential machinery issues and recommends alternative solutions, ultimately saving time and resources. AI's impact on the food and beverage industry is significant, with advancements in cell-based meat production and market research analysis. These advancements offer opportunities for increased production efficiency and product innovation. Overall, AI is a game-changer for the food and beverage industry, providing valuable insights and automation to enhance business operations and meet the evolving demands of consumers.

What are the market trends shaping the Artificial Intelligence (AI) In Food And Beverage Industry?

- The IIoT (Industrial Internet of Things) is an emerging market trend, gaining significant traction in industries for enhancing operational efficiency and productivity. This technological advancement connects physical machinery, processes, and people through the internet, enabling real-time data collection, analysis, and actionable insights.

- Artificial Intelligence (AI) is revolutionizing the food and beverage industry by enhancing various operations and processes. Demand forecasting is a significant area where AI is making an impact, enabling accurate predictions based on historical data and market trends. Robotics and automation, including collaborative robots, are being adopted for process automation, ensuring efficiency and consistency in production. Smart packaging is another area where AI is making strides, with computer vision algorithms used for quality control and sensory analysis. AI-driven trend forecasting is helping businesses stay ahead of consumer preferences and market trends. Social media marketing is being optimized through deep learning models, enabling targeted campaigns and personalized customer engagement.

- Business model development is also being facilitated by AI, with predictive analytics and machine learning algorithms helping to identify new revenue streams and opportunities. Sustainability reporting is being made more transparent and accurate through AI-driven data analysis. Overall, the integration of AI in the food and beverage industry is enhancing efficiency, reducing costs, and improving product quality.

What challenges does the Artificial Intelligence (AI) In Food And Beverage Industry face during its growth?

- The insufficient availability of skilled personnel poses a significant challenge to the industry's growth trajectory.

- The integration of Artificial Intelligence (AI) in the food and beverage industry presents numerous opportunities for enhancing operational efficiency and product innovation. AI applications in this sector include precision fermentation for creating new flavors, nutritional value analysis for dietary recommendations, and allergen detection for food safety. Furthermore, AI is instrumental in reducing food waste through supply chain management and optimizing inventory levels. Plant-based alternative production relies heavily on AI for flavor profiling and nutritional analysis to meet industry standards. Personalized nutrition is another area where AI plays a crucial role in analyzing consumer data to provide customized recommendations. In addition, AI-driven 3D food printing technology offers the potential for creating innovative food products.

- However, the adoption of AI in the food and beverage industry faces challenges due to the lack of technical expertise among the workforce. companies must address this issue by providing comprehensive training and consultation services to ensure seamless implementation and operation of AI systems. Overall, the future of AI in the food and beverage industry lies in its ability to improve product quality, enhance operational efficiency, and provide personalized solutions for consumers.

Exclusive Customer Landscape

The artificial intelligence (AI) in food and beverage industry market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial intelligence (AI) in food and beverage industry market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial intelligence (AI) in food and beverage industry market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The food and beverage industry benefits from our advanced artificial intelligence technology, delivering industry expertise spanning sugar production to beverage bottling.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Aboard Software

- AGCO Corp.

- Ailytic Holdings Pty Ltd.

- Analytical Flavor Systems Inc.

- Buhler AG

- De Greefs Wagen Carrosserie en Machinebouw BV

- Duravant LLC

- Foodable Network LLC

- Honeywell International Inc.

- Key Technology Inc.

- Martec Of Whitwell Ltd.

- Ravenwood Packaging Ltd.

- Raytec Vision S.p.A.

- Rockwell Automation Inc.

- Sesotec GmbH

- Siemens AG

- Sight Machine

- The Not Co. Inc.

- Tomra Systems ASA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Intelligence (AI) In Food And Beverage Industry Market

- In February 2023, Nestle, a leading global food and beverage company, announced the launch of its new AI-powered ice cream flavor creation tool, "Creavit," in collaboration with startup, Senseable Cities Lab at MIT Media Lab (Nestle press release, 2023). This tool uses AI to analyze consumer preferences and create unique ice cream flavors based on real-time data.

- In April 2024, Microsoft and Oatly, the plant-based milk company, entered into a strategic partnership to integrate Microsoft's AI technology into Oatly's production processes and supply chain management (Microsoft News Center, 2024). This collaboration aims to optimize production, reduce waste, and improve overall efficiency.

- In January 2025, Dabur India, a major food and beverage company, completed the acquisition of AI-based foodtech startup, 'FoodScience Labs' (Business Standard, 2025). This acquisition will enable Dabur to leverage FoodScience Labs' AI technology for product development, quality control, and supply chain optimization.

- In March 2025, the European Union (EU) approved the use of AI in food production, marking a significant regulatory milestone for the industry (European Commission, 2025). This approval will pave the way for increased adoption of AI in various food and beverage applications, from production to supply chain management and consumer engagement.

Research Analyst Overview

- In the food and beverage industry, AI is revolutionizing various aspects, from sustainable agriculture to consumer psychology. Compostable materials and sustainable farming practices are being optimized using precision agriculture and food engineering. Consumer trust is being fostered through food labeling standards, transparency in the supply chain, and food safety certifications. Sensory science and food microbiology are enhanced with simulation modeling and quality assurance, ensuring the highest standards. Industry collaborations and startup ventures are leveraging AI in waste management, circular economy, and food ethics. Packaging technology is evolving with blockchain technology, ensuring traceability and authenticity. Food security is bolstered with process optimization and ingredient sourcing, while food safety is maintained through food chemistry and innovation ecosystems.

- AI is also transforming food safety certifications, enabling real-time monitoring and predictive analysis. Circular economy and waste management are being optimized with digital twin technology and process optimization. Food engineering and food chemistry are being advanced with simulation modeling and quality assurance, ensuring the production of safe and nutritious food. Moreover, AI is being used to improve food labeling standards, enabling consumers to make informed choices based on their preferences and dietary needs. Consumer psychology is being studied to create personalized food experiences, enhancing brand loyalty and customer engagement. In summary, AI is transforming the food and beverage industry, from sustainable agriculture to consumer psychology, by optimizing processes, enhancing product quality, and improving transparency and trust.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Intelligence (AI) In Food and Beverage Industry Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 34.5% |

|

Market growth 2025-2029 |

USD 32202.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

30.4 |

|

Key countries |

US, Canada, Germany, UK, China, France, Japan, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Intelligence (AI) In Food And Beverage Industry Market Research and Growth Report?

- CAGR of the Artificial Intelligence (AI) In Food And Beverage Industry industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial intelligence (ai) in food and beverage industry market growth of industry companies

We can help! Our analysts can customize this artificial intelligence (ai) in food and beverage industry market research report to meet your requirements.