Artificial Organs Market Size 2024-2028

The artificial organs market size is forecast to increase by USD 14.85 billion, at a CAGR of 9.49% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing prevalence of chronic disorders and the emergence of total artificial hearts (TAH). Chronic disorders, such as end-stage renal disease, diabetes, and cardiovascular diseases, continue to rise globally, fueling the demand for artificial organs. TAH, a promising development, offers a potential solution for patients with heart failure, providing an alternative to heart transplants. However, the high cost of artificial organs remains a significant challenge, limiting their accessibility to a large population. Companies in this market must focus on cost reduction strategies, such as economies of scale and technological advancements, to address this challenge and expand their reach.

- Additionally, collaborations and partnerships with healthcare providers and insurance companies can help offset the financial burden for patients and increase market penetration. In summary, the market presents significant growth opportunities for companies that can effectively navigate the challenges and capitalize on the increasing demand for these life-saving solutions.

What will be the Size of the Artificial Organs Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in bioreactor design, cellular therapies, and organ transplantation. Bioreactor systems, which provide optimal conditions for cell growth and tissue development, are a key focus. Perfusion bioreactors, in particular, enable the continuous culture of cells and tissues, advancing the field of regenerative medicine. Biocompatibility testing, mechanical properties, and in vitro testing are essential components of bioreactor development. Biomaterial compatibility and biocompatibility assays play a crucial role in ensuring the success of these systems. Mechanical properties must mimic those of natural organs, while in vitro testing provides valuable insights into the performance of bioreactors.

Artificial heart valves, bioartificial liver, and bioartificial pancreas are just a few applications of these technologies. Stem cell differentiation and scaffold design are critical areas of research, with the goal of creating functional, long-term stable organs. Regulatory approval and clinical trials are ongoing processes that ensure the safety and efficacy of these innovations. Bioprinting resolution and cell seeding methods are advancing rapidly, enabling the creation of complex tissue structures. In vivo testing and implant integration are the next frontiers, with drug delivery systems and surgical techniques playing essential roles in the successful implementation of these technologies.

Organ perfusion and 3D bioprinting are further expanding the potential applications of artificial organs. Tissue engineering and bioartificial organs are revolutionizing the medical landscape, offering new solutions for organ failure and chronic diseases. The continuous dynamism of this market is fueled by the ongoing research and development efforts in these areas.

How is this Artificial Organs Industry segmented?

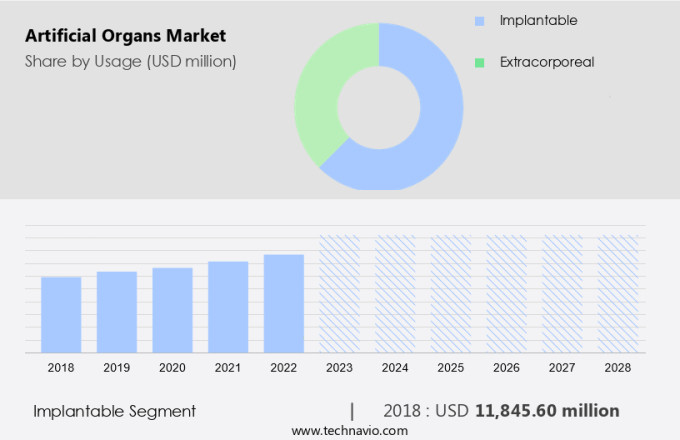

The artificial organs industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Usage

- Implantable

- Extracorporeal

- Product

- Artificial heart

- Artificial kidney

- Cochlear implants

- Artificial pancreas

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- Japan

- Rest of World (ROW)

- North America

By Usage Insights

The implantable segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing prevalence of organ failure and advancements in technology. With a limited supply of donor organs, there is a pressing need for alternatives, leading to the development of bioartificial organs such as bioartificial livers and pancreas. Bioreactor design and cellular therapies, including stem cell differentiation and scaffold design, are at the forefront of this innovation. Biocompatibility testing and mechanical properties assessment are crucial in ensuring the success of these advanced solutions. In vitro testing plays a vital role in evaluating the performance of artificial heart valves and perfusion bioreactors.

Regulatory approval and clinical trials are essential steps in bringing these technologies to market, with regenerative medicine and long-term stability being key considerations. Companies are investing in research and development to create more sophisticated solutions, such as drug delivery systems and surgical techniques for organ perfusion. For instance, Abbott's Aveir DR, the world's first dual-chamber leadless pacemaker system, received FDA approval in July 2023. The market is further propelled by advances in 3D bioprinting and tissue engineering, offering potential for organ-specific cell seeding methods and bioprinting resolution. These trends underscore the market's potential for continued growth and innovation.

The Implantable segment was valued at USD 11.85 billion in 2018 and showed a gradual increase during the forecast period.

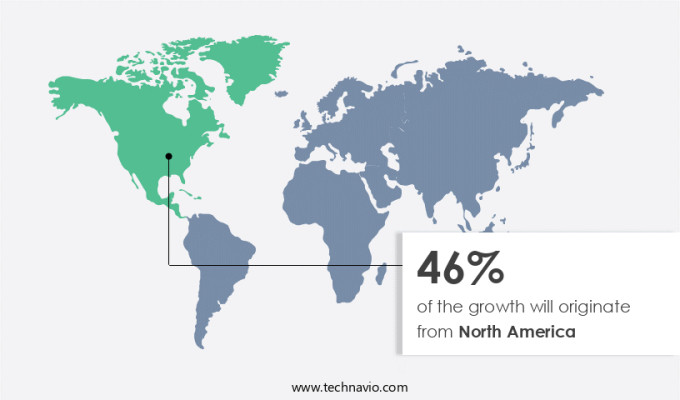

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing substantial growth, with the United States and Canada leading the charge. Factors fueling this expansion include the rising adoption of technologically advanced devices, an increasing number of product launches, and a robust presence of industry players. Chronic diseases such as diabetes, cardiovascular diseases, and chronic kidney disease (CKD) are on the rise, further propelling market growth. For example, Tandem Diabetes Care Inc. Has introduced advanced insulin pumps, while bioreactor design and 3D bioprinting technologies are revolutionizing organ engineering. Biocompatibility testing, mechanical properties evaluation, and in vitro testing are crucial elements in ensuring the success of these innovative solutions.

As regenerative medicine advances, long-term stability, implant integration, and drug delivery systems are becoming increasingly important. Clinical trials and regulatory approval processes are ongoing, with a focus on improving organ perfusion and creating bioartificial livers, pancreas, and kidneys. In vivo testing and surgical techniques are also undergoing refinement to enhance the effectiveness of these bioartificial organs.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The development of bioartificial organs presents numerous challenges that must be addressed to ensure their successful implementation in clinical settings. One of the major hurdles is the scale-up of bioreactor systems for organ production, which requires optimizing the design parameters to maintain the structural integrity and functionality of the tissue. Immunosuppressive drug regimens must also be optimized to minimize the risk of organ rejection, and 3D bioprinting of vascularized tissues offers a promising solution for creating complex structures with intricate vasculature. Biomaterial surface modification techniques are essential for enhancing the in-vivo biocompatibility of bioartificial organs. The evaluation of their biocompatibility using in-vivo models is crucial to assess their long-term stability and effectiveness. Bioartificial organ failure detection systems are being developed to monitor organ function and detect any anomalies in real-time. Decellularized matrices are being explored as scaffolds for organ regeneration, and cell seeding methods such as perfusion bioreactors are being optimized for bioartificial liver production. Tissue engineering approaches are being used to develop artificial heart valves, and regulatory pathways for bioartificial organs are being established to ensure market adherence to research report standards. Bioartificial pancreas cell encapsulation and immunomodulatory strategies are being investigated to minimize the risk of organ rejection. Long-term stability analysis is crucial to ensure the durability of bioartificial organs, and cost-effectiveness is a significant consideration for their widespread adoption. The design of perfusion bioreactor systems and bioreactor control and monitoring systems are essential components of the production process. Bioartificial kidney transplantation protocols are being developed to minimize the risks associated with traditional kidney transplants. The optimization of immunosuppressive drug regimens and the development of immunomodulatory strategies are critical to ensuring the success of these procedures. The market is expected to grow significantly in the coming years, and continued research and innovation are necessary to address the challenges and bring these life-saving technologies to patients.

What are the key market drivers leading to the rise in the adoption of Artificial Organs Industry?

- The rising prevalence of chronic disorders serves as the primary market driver, significantly expanding the market scope.

- The demand for artificial organs is projected to grow significantly due to the increasing prevalence of chronic diseases, such as diabetes, kidney diseases, hearing disorders, and cardiovascular diseases (CVDs), as well as the aging population. Unhealthy lifestyles leading to conditions like hypertension, obesity, abnormal cholesterol, and diabetes are major contributors to the rise in cardiac disorders, particularly among individuals aged 60 and above. According to the CDC, approximately 795,000 Americans experience a stroke each year. Advancements in technology, such as device miniaturization and bioreactor design, are driving innovation in the field of artificial organs. Bioreactor systems, which provide an artificial environment for the growth and maintenance of cells, are increasingly being used in cellular therapies.

- Biocompatibility testing and ensuring biomaterial compatibility are crucial aspects of developing artificial organs with optimal mechanical properties. These advancements are expected to address the challenges associated with organ transplantation and organ donation, providing viable solutions for those in need.

What are the market trends shaping the Artificial Organs Industry?

- The trend in the market is leaning towards the emergence of TAH technology. This advanced innovation is gaining significant attention and recognition.

- Artificial hearts have gained significant attention as a potential solution for patients with end-stage biventricular heart failure who are awaiting orthotopic heart transplantation. Due to the increasing incidence of cardiovascular diseases, the number of patients in need of a heart transplant exceeds the available donor hearts. Consequently, there is a growing demand for mechanical circulatory support devices, such as total artificial hearts (TAH), which can serve as a bridge to transplantation (BTT) for patients at imminent risk of death. Companies like SynCardia offer TAH with advanced features, such as a pulsatile system capable of handling flows greater than 9 L/min.

- This technology is designed to provide adequate circulatory support until a donor heart becomes available. SynCardia's TAH is pneumatically driven and approved for use as a BTT worldwide. In vitro testing plays a crucial role in the development of artificial organs, ensuring their biocompatibility and functionality. Biocompatibility assays and scaffold design are essential components of the in vitro testing process. Stem cell differentiation and the creation of bioartificial organs, such as bioartificial livers and pancreas, are also areas of active research. Extracorporeal support systems are being developed to provide temporary organ replacement and bridge the gap until a transplant can be performed.

- These advancements offer hope for patients with end-stage organ failure, expanding the possibilities for life-saving treatments.

What challenges does the Artificial Organs Industry face during its growth?

- The exorbitant costs associated with producing artificial organs represents a significant barrier to growth within the industry.

- Artificial organs, a crucial advancement in regenerative medicine, offer solutions for individuals suffering from organ failure. The creation of these organs involves intricate processes such as perfusion bioreactors, which maintain the viability of cells during growth. Bioprinting resolution and cell seeding methods are essential in building the organ structure, ensuring long-term stability. However, the production of artificial organs comes with substantial costs. The process involves the use of specialized biomaterials, time, and care, leading to high expenses. For instance, an artificial heart's total cost includes the surgical procedure, device and console, and ongoing medical surveillance, amounting to approximately USD 17,500 to USD 120,000 annually.

- Navigating the regulatory approval process and clinical trials further adds to the costs. Despite these challenges, the potential benefits of artificial organs make the investment worthwhile for those in need. As the field advances, researchers continue to explore ways to optimize production methods and reduce costs without compromising quality.

Exclusive Customer Landscape

The artificial organs market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial organs market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial organs market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - Artificial organs developed by this company incorporate the gut microbiome, an intricate ecosystem of microbes, including bacteria, fungi, and viruses, that naturally exist within US.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Asahi Kasei Corp.

- B.Braun SE

- Baxter International Inc.

- BioTelemetry Inc.

- BIOTRONIK SE and Co. KG

- BiVACOR Inc.

- Boston Scientific Corp.

- Cochlear Ltd.

- F. Hoffmann La Roche Ltd.

- Fresenius Medical Care AG and Co. KGaA

- Insulet Corp.

- MED EL Elektromedizinische Gerate GmbH

- Medtronic Plc

- Nihon Kohden Corp.

- Nikkiso Co. Ltd.

- Nipro Corp.

- Sonova AG

- SynCardia Systems LLC

- Tandem Diabetes Care Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Organs Market

- In January 2024, Medtronic plc, a global healthcare solutions company, announced the U.S. Food and Drug Administration (FDA) approval of its new HeartMate 3 LVAD (Left Ventricular Assist Device) system. This advanced technology offers improved patient outcomes and extended battery life, making it a significant advancement in the market (Medtronic Press Release, 2024).

- In March 2024, Thermo Fisher Scientific and Organovo Holdings, Inc., a leading 3D bioprinting company, entered into a strategic collaboration to develop functional human tissues for research and therapeutic applications. This partnership combines Thermo Fisher's expertise in cell culture and bioprocessing with Organovo's 3D bioprinting capabilities, marking a significant step forward in the development of artificial organs (Thermo Fisher Scientific Press Release, 2024).

- In May 2024, German biotech company, Cytosurge AG, raised â¬25 million in a Series C funding round. This investment will support the commercialization of its organ-on-chip technology, which mimics the structure and function of human organs, enabling more accurate drug testing and toxicology studies (Cytosurge Press Release, 2024).

- In April 2025, the European Commission approved the market authorization for the RenalGuard System, a novel, portable kidney protection device developed by Fresenius Medical Care. This device helps prevent kidney damage during cardiovascular procedures, expanding the company's product portfolio and increasing its presence in the market (Fresenius Medical Care Press Release, 2025).

Research Analyst Overview

- The market encompasses innovative solutions for addressing organ failure, including drug eluting stents and surgical approaches. Advanced technologies, such as bioartificial hearts, are under development to improve patient outcomes. Failure analysis and decellularized matrix research are crucial for understanding cell signaling and perfusion technology in creating functional organs. Post-operative care, bioreactor optimization, and scaffold degradation are essential aspects of long-term efficacy.

- Hybrid organs, tissue remodeling, and patient selection are key trends in the market. System integration, quality control, and device sterilization are crucial for ensuring performance monitoring and clinical outcomes. Microfluidic devices, bioprinting materials, and vascular network development are advancing the field. Immunological tolerance, bioartificial lung, complications management, and cell culture techniques are critical areas of research.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Organs Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.49% |

|

Market growth 2024-2028 |

USD 14854.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.79 |

|

Key countries |

US, Germany, UK, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Organs Market Research and Growth Report?

- CAGR of the Artificial Organs industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial organs market growth of industry companies

We can help! Our analysts can customize this artificial organs market research report to meet your requirements.