Artificial Pancreas Market Size 2024-2028

The artificial pancreas market size is forecast to increase by USD 476.7 million, at a CAGR of 19.9% between 2023 and 2028.

- The market is experiencing significant growth, driven by the rising global burden of diabetes and increasing awareness programs for diabetes management. The artificial pancreas, an advanced medical device, offers continuous glucose monitoring and insulin delivery, providing better control over diabetes management. The increasing prevalence of diabetes, particularly type 1 and type 2, fuels the demand for these devices. However, the market faces challenges due to stringent regulatory frameworks for artificial pancreas manufacturing. Regulatory bodies, such as the FDA, require rigorous clinical trials and extensive data to ensure safety and efficacy.

- These requirements increase the time and cost of bringing new products to market. Additionally, the high cost of these devices and limited reimbursement policies pose challenges for patient accessibility. Companies seeking to capitalize on market opportunities must navigate these regulatory hurdles and develop cost-effective solutions to expand their reach.

What will be the Size of the Artificial Pancreas Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in hypoglycemia prevention and glucose management. These systems integrate various components, including continuous glucose monitors (CGMs), insulin delivery systems, and data analytics dashboards, to provide real-time glucose prediction and automated insulin dosing. Patient compliance metrics and algorithm accuracy are crucial factors, with user interface design and bolus insulin calculator features optimized for ease of use. CGM integration methods, remote monitoring capabilities, and device lifespan metrics are also essential considerations. Wearable technology integration and closed-loop algorithms are at the forefront of innovation, enabling seamless data logging and real-time system maintenance.

Medical device regulation and patient safety protocols ensure the reliability and long-term efficacy of these systems. Ongoing clinical trials explore new sensor calibration methods, insulin sensitivity factors, and hyperglycemia management techniques. The market's dynamism is further reflected in the integration of smartphone connectivity, battery life optimization, and data analytics capabilities, providing users with valuable insights into their glucose levels and treatment plans.

How is this Artificial Pancreas Industry segmented?

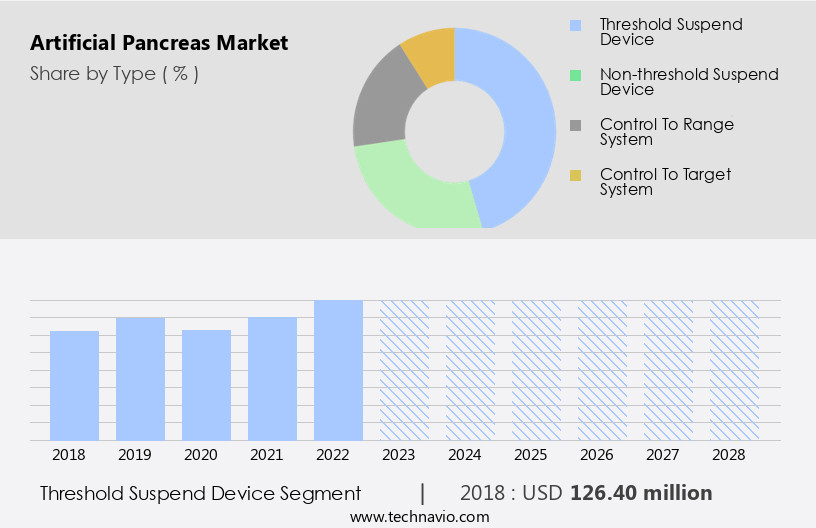

The artificial pancreas industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Threshold suspend device

- Non-threshold suspend device

- Control to range system

- Control to target system

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The threshold suspend device segment is estimated to witness significant growth during the forecast period.

Artificial pancreas systems, which include threshold suspend devices, are revolutionizing diabetes management by providing advanced features for improved glycemic control. These systems utilize a closed-loop algorithm to automatically adjust basal insulin delivery based on real-time blood glucose predictions from continuous glucose monitors. Threshold suspend devices, also known as low glucose suspend systems, offer an additional safety feature by temporarily halting insulin delivery when blood glucose levels drop below a certain threshold, preventing hypoglycemia. Patients using these systems must still monitor their blood glucose levels and adhere to proper sensor calibration methods for accurate readings. companies, such as Medtronic Plc, integrate smartphone connectivity and data analytics dashboards to enable remote monitoring and patient compliance tracking.

Algorithm accuracy metrics and user interface design are crucial considerations to ensure system reliability and ease of use. Insulin sensitivity factor and patient safety protocols are essential factors in the development of these systems. Wearable technology integration and long-term efficacy studies are ongoing areas of research to enhance system capabilities and improve patient outcomes. Medical device regulation, data logging capabilities, and system maintenance protocols are essential aspects of the market. companies focus on battery life optimization and device lifespan metrics to ensure user convenience and minimize interruptions. Remote monitoring features and cgm integration methods enable healthcare providers to closely monitor patient health and intervene when necessary.

Clinical trial results and automated insulin dosing demonstrate the potential of these systems to significantly improve glycemic control for people with diabetes.

The Threshold suspend device segment was valued at USD 126.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to technological advancements and the high prevalence of type 1 and type 2 diabetes. According to the Centers for Disease Control and Prevention (CDC), approximately 38 million Americans had diabetes in 2023, with type 2 diabetes accounting for 90-95% of cases. The aging population and rising obesity levels will further fuel this trend. The artificial pancreas system integrates various components, including carbohydrate ratio factors, basal insulin rates, blood glucose prediction, data analytics dashboards, sensor calibration methods, smartphone connectivity, insulin delivery systems, battery life optimization, hypoglycemia prevention, patient compliance metrics, algorithm accuracy metrics, user interface design, bolus insulin calculators, cgm integration methods, remote monitoring features, device lifespan metrics, mobile app interfaces, closed-loop algorithms, wearable technology integration, clinical trial results, automated insulin dosing, insulin sensitivity factors, patient safety protocols, glucose sensor technology, continuous glucose monitors, medical device regulation, data logging capabilities, system maintenance protocols, long-term efficacy studies, glycemic control algorithms, system reliability testing, and hyperglycemia management.

These components work together to provide advanced diabetes management solutions, ensuring optimal glycemic control and improved patient outcomes.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses innovative technologies designed to automate insulin delivery in people with diabetes, offering enhanced glycemic control and improved quality of life. These systems, such as closed-loop artificial pancreas systems and hybrid closed-loop systems, focus on integrating continuous glucose monitoring (CGM) and insulin delivery, providing real-time adjustments based on glucose levels. Long-term benefits of artificial pancreas systems include reducing the risk of hypoglycemia and hyperglycemia, minimizing the burden of frequent insulin injections, and improving overall diabetes management. Applications of artificial pancreas technology extend beyond type 1 diabetes, with potential use in type 2 diabetes and gestational diabetes. Moreover, artificial pancreas systems are gaining significant attention in critical care settings, where maintaining stable glucose levels is crucial for patient safety and recovery. Long-term care facilities and military applications are also exploring the use of artificial pancreas systems to manage diabetes in elderly populations and deployed personnel, respectively. Incorporating advanced algorithms and machine learning, artificial pancreas systems aim to optimize insulin delivery, personalize treatment plans, and enhance overall diabetes management. The future of artificial pancreas technology lies in continuous improvement, integration with other health data, and expanding applications to a broader population.

What are the key market drivers leading to the rise in the adoption of Artificial Pancreas Industry?

- The escalating global prevalence of diabetes serves as the primary market driver.

- Diabetes, a chronic condition characterized by the body's inability to produce or effectively use insulin, affects an estimated 537 million adults worldwide in the age group of 20-79 years, according to International Diabetes Federation (IDF) statistics from 2023. This number is projected to rise to 700 million by 2045. Over 79% of these patients reside in low- and middle-income countries. Among adults aged above 65 years, one in five are diagnosed with diabetes. The escalating prevalence of both type 1 and type 2 diabetes poses a significant challenge to healthcare systems globally, with mounting costs to manage the disease.

- This trend underscores the urgent need for advanced solutions to effectively manage hyperglycemia and mitigate the potential complications. The global market for artificial pancreas systems is expected to expand in response to this demand, offering immersive, harmonious, and emphasized solutions to improve diabetes care.

What are the market trends shaping the Artificial Pancreas Industry?

- The growing importance of diabetes awareness programs represents a significant market trend. It is essential for organizations to invest in and promote these initiatives to foster greater understanding and effective management of diabetes.

- Artificial pancreas systems, which integrate continuous glucose monitoring and insulin delivery, are revolutionizing diabetes management. These advanced systems use carbohydrate ratio factors and basal insulin rates to optimize blood glucose prediction and insulin delivery. Data analytics dashboards enable users to monitor trends and patterns, while sensor calibration methods ensure accurate readings. Smartphone connectivity offers convenience and ease of use. companies focus on battery life optimization to enhance user experience.

- In the diabetes technology landscape, organizations such as the European Foundation for the Study of Diabetes (EFSD) and the Juvenile Diabetes Research Foundation (JDRF) are driving innovation through research and advocacy. By fostering collaboration and knowledge exchange, these entities contribute significantly to the development of next-generation artificial pancreas systems.

What challenges does the Artificial Pancreas Industry face during its growth?

- The stringent regulatory framework for manufacturing artificial pancreas systems poses a significant challenge to the industry's growth, requiring companies to adhere to rigorous standards and guidelines to ensure product safety and efficacy.

- The market is witnessing significant growth due to the increasing prevalence of hypoglycemia in diabetes patients and the need for advanced technologies to prevent it. companies in this market face challenges related to patient compliance metrics, algorithm accuracy, user interface design, bolus insulin calculator integration, CGM (Continuous Glucose Monitoring) methods, remote monitoring features, and device lifespan metrics. Regulatory bodies, such as the US FDA, require stringent clinical trials and regulatory approvals to ensure patient safety and efficient devices. Artificial pancreas systems, which include insulin pumps, CGMs, and advanced algorithms, are classified as Class II medical devices in the US.

- These devices must meet rigorous regulatory requirements before entering the market. The market dynamics are driven by the need for accurate and reliable diabetes management solutions that can improve patient outcomes and quality of life. companies must focus on developing user-friendly interfaces, ensuring algorithm accuracy, and integrating CGM technology seamlessly to meet the evolving needs of patients and healthcare providers.

Exclusive Customer Landscape

The artificial pancreas market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial pancreas market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial pancreas market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Admetsys Corp. - The company specializes in advanced diabetes management solutions, including closed-loop artificial pancreas systems. These innovative technologies automate insulin delivery, improving glucose control for individuals with diabetes. The closed-loop system continuously monitors glucose levels and adjusts insulin doses accordingly, offering enhanced convenience and effectiveness.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Admetsys Corp.

- Beta Bionics Inc.

- Beta o2 Technologies Ltd.

- Bigfoot Biomedical Inc.

- Defymed SAS

- Dexcom Inc.

- Inreda Diabetic B.V.

- Insulet Corp.

- LenoMed Medical

- Medtronic Plc

- Nikkiso Co. Ltd.

- Progress Srl

- Tandem Diabetes Care Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Artificial Pancreas Market

- In January 2024, Medtronic, a leading medical technology company, announced the FDA approval of its MiniMed⢠U-100 System, an advanced artificial pancreas system that integrates insulin pump technology with continuous glucose monitoring and automated insulin delivery (Medtronic Press Release, 2024).

- In March 2024, Abbott, another major player in the diabetes care industry, partnered with Google to integrate its FreeStyle Libre glucose monitoring system with Google Fit, enabling seamless data sharing and analysis for diabetes management (Abbott Press Release, 2024).

- In April 2025, Bigfoot Biomedical, a pioneering artificial pancreas technology company, secured a USD110 million Series C funding round, led by new investor PerkinElmer, to further develop and commercialize its system (Bigfoot Biomedical Press Release, 2025).

- In May 2025, Dexcom, a leading continuous glucose monitoring company, received CE Mark approval for its G6 CGM system, which is compatible with various artificial pancreas systems, expanding the interoperability of these devices and improving overall system effectiveness (Dexcom Press Release, 2025).

Research Analyst Overview

- The market is witnessing significant advancements in real-time glucose monitoring and personalized insulin delivery systems. System performance optimization through wireless communication and cost-effectiveness analysis are key trends driving market growth. Regulatory approval processes are underway for advanced control algorithms and data integration solutions, enabling remote patient support and longitudinal data analysis. Device miniaturization and power consumption reduction are essential for enhancing user experience and improving device durability. Hypoglycemia detection and data security measures are crucial components, ensuring patient safety and data privacy.

- User-friendly interfaces and machine learning algorithms facilitate predictive modeling and system usability testing. Clinical validation studies and system interoperability are essential for ensuring quality control procedures and insulin pump technology effectiveness. Patient education materials and advanced control algorithms are vital for improving system performance and overall system functionality.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Artificial Pancreas Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19.9% |

|

Market growth 2024-2028 |

USD 476.7 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

16.3 |

|

Key countries |

US, Canada, Germany, France, China, UK, Italy, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Pancreas Market Research and Growth Report?

- CAGR of the Artificial Pancreas industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial pancreas market growth of industry companies

We can help! Our analysts can customize this artificial pancreas market research report to meet your requirements.