Audio And Video Editing Software Market Size 2025-2029

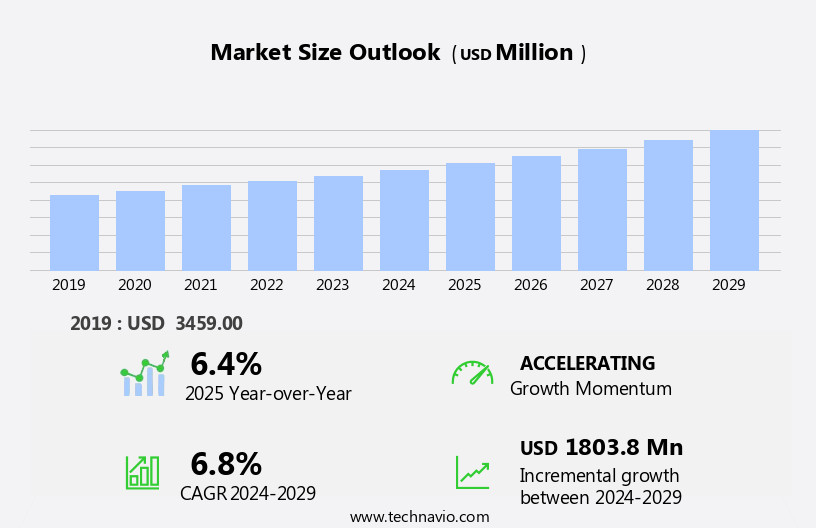

The audio and video editing software market size is forecast to increase by USD 1.8 billion, at a CAGR of 6.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing rate of content generation across various industries and the emergence of Over-The-Top (OTT) platforms. The demand for high-quality audio and video content is on the rise, fueled by the growing popularity of streaming services and the increasing number of content creators. A notable trend in the market is the shift toward cloud-based delivery models, enabling users to access editing software from anywhere, at any time. This flexibility is particularly appealing to content creators who require the ability to edit on-the-go. Additionally, the rise of open-source and free editing software poses a challenge for market players, as these solutions offer cost-effective alternatives to proprietary software.

- Companies must differentiate themselves through unique features, user experience, and robust support to remain competitive in this dynamic market. To capitalize on opportunities and navigate challenges effectively, players should focus on innovation, flexibility, and cost-effectiveness.

What will be the Size of the Audio And Video Editing Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The dynamic market continues to evolve, integrating advanced features to cater to various sectors. These include 3D animation, technical support, virtual production, screen recording, collaboration tools, HDR video editing, video effects, user interface (UI), linear editing, workflow automation, version control, color grading, and audio mixing. Hardware acceleration, video compression, and real-time rendering are essential components, enhancing the user experience (UX) and enabling 8k video editing. AI video enhancement and visual effects (VFX) add value, with 2D animation and special effects (SFX) further expanding creative possibilities. Project management tools streamline workflows, while perpetual licenses and subscription models cater to diverse business needs.

Frame rate conversion, audio restoration, and sound design are essential for professional-grade output. Machine learning and GPU acceleration drive innovation, with software updates and cloud rendering enabling seamless collaboration and efficient rendering. The ongoing integration of AI-powered features, audio mixing consoles, and multi-core processing ensures continuous improvement, shaping the future of the market.

How is this Audio And Video Editing Software Industry segmented?

The audio and video editing software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Commercial

- Personal

- Device

- Laptop/Desktop

- Mobile

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

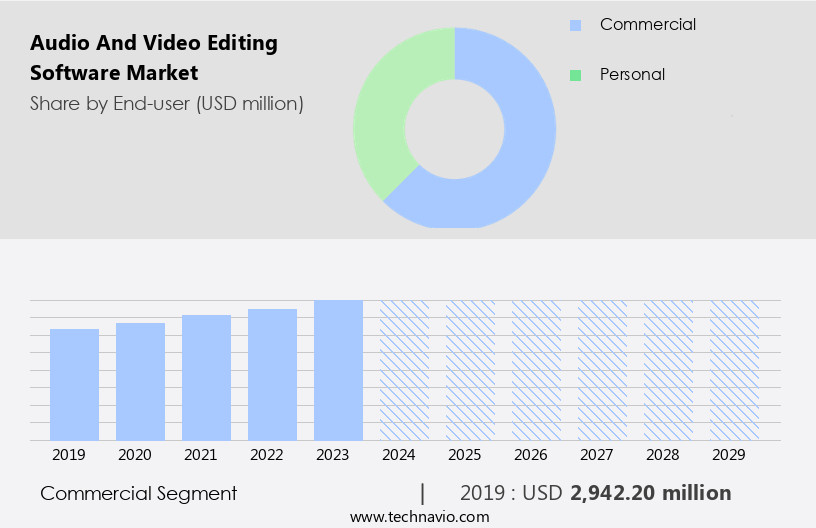

The commercial segment is estimated to witness significant growth during the forecast period.

The market caters to commercial end-users, encompassing the media and entertainment industry, enterprises, digital marketing agencies, and advertisement sector. This segment is projected to experience moderate growth during the forecast period, fueled by the expansion of the film industry and OTT video streaming services. Content creators, including movie producers and OTT video providers, invest in advanced editing software to produce high-quality content and capture market shares. The integration of hardware acceleration, real-time rendering, and AI-powered features in video editing software enhances the user experience, enabling faster processing and more efficient workflows. Additionally, the growing demand for 8k video editing, HDR video editing, and live streaming further propels market growth.

Project management tools, collaboration features, and technical support ensure seamless production processes, while audio effects, color grading, and audio mixing consoles cater to the evolving needs of content creators. The market also embraces machine learning and AI video enhancement for intelligent frame rate conversion, audio restoration, and sound design. Subscription models and perpetual licenses cater to various business requirements, with offline rendering and version control ensuring data security and project continuity. The market's evolution reflects the industry's focus on workflow automation, motion graphics, and resolution scaling to meet the evolving demands of content creators.

The Commercial segment was valued at USD 2.94 billion in 2019 and showed a gradual increase during the forecast period.

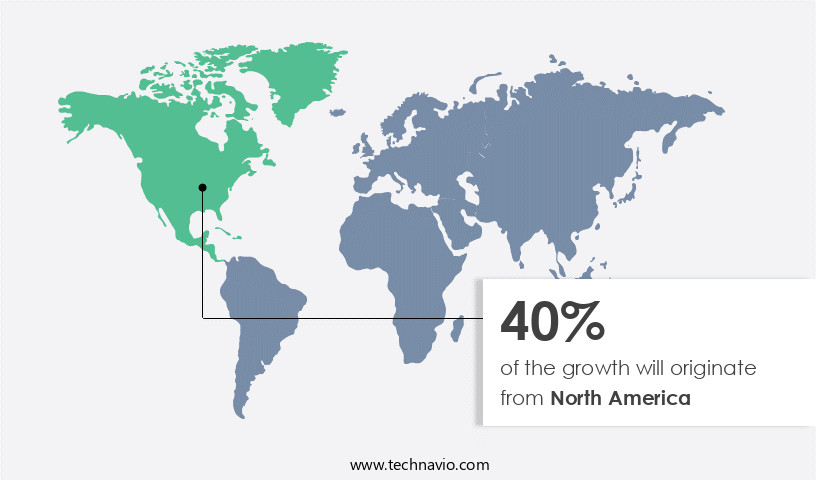

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market for audio and video editing software leads the global industry, driven by the media and entertainment sector's significant demand. The US, as the region's economic powerhouse, is the primary contributor to this market's growth. The US and Canada generated over USD 11.80 billion from film production in 2021, with over 1.32 billion tickets sold. Movies, shows, and documentaries have been the primary applications for video editing software, with continued usage expected during the forecast period. Advancements in technology have influenced the market's evolution. Hardware acceleration and real-time rendering have streamlined the editing process, while 8k video editing and HDR video editing cater to the industry's evolving needs.

User experience (UX) and user interface (UI) have gained importance, with collaboration tools and project management systems enhancing productivity. Audio effects, sound design, and machine learning have transformed audio editing software, offering AI-powered features, noise reduction, and audio mastering. Visual effects (VFX), special effects (SFX), 2d animation, and 3d animation have revolutionized content creation. Frame rate conversion, version control, and workflow automation have optimized the editing process. Technical support, color grading, and audio mixing consoles ensure seamless post-production. Live streaming, cloud rendering, and gpu acceleration have expanded the software's capabilities. Subscription models and perpetual licenses cater to various business requirements.

Market trends include the integration of AI, machine learning, and deep learning technologies. Linear editing, non-linear editing (NLE), and motion graphics have become essential tools for content creators. Resolution scaling and AV codecs ensure compatibility and flexibility. The market's future looks promising, with ongoing advancements in technology and increasing demand for high-quality content.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market caters to creatives and professionals seeking to produce high-quality multimedia content. These tools enable users to record, edit, enhance, and export audio and video files with ease. Key features include non-linear editing, multi-track recording, real-time effects, color correction, and transitions. Popular formats like MP4, AVI, and WAV are supported, ensuring versatility in content creation. Advanced users benefit from robust features such as 360-degree video editing, virtual reality support, and professional-grade color grading. Additionally, collaboration tools and cloud services facilitate teamwork and remote editing, making these software solutions indispensable for modern media production.

What are the key market drivers leading to the rise in the adoption of Audio And Video Editing Software Industry?

- The surge in content generation rates and the emergence of over-the-top (OTT) platforms are primary market drivers, significantly shaping the media and entertainment industry landscape.

- The market for video editing software continues to evolve, driven by advancements in technology and the growing demand for digital content creation. Asset management, user experience (UX), and project management are key focus areas for companies in this market. Hardware acceleration and real-time rendering enable efficient video editing, while video compression supports the handling of large files, including 8K video editing. Moreover, the integration of artificial intelligence (AI) for video enhancement, audio effects, visual effects (VFX), special effects (SFX), and 2D animation is becoming increasingly popular. The market is also witnessing the adoption of immersive and harmonious features, such as AI-driven color correction and automatic video stabilization.

- These advancements aim to streamline the editing process and enhance the overall user experience. The extensive use of social media platforms and the growing trend of remote work have further fueled the demand for video editing software. As digital media consumption continues to rise, the need for high-quality, engaging content is increasingly important for businesses and individuals alike. In summary, the video editing software market is experiencing significant growth, driven by technological advancements, increasing demand for digital content, and the integration of AI and other innovative features.

What are the market trends shaping the Audio And Video Editing Software Industry?

- The transition towards cloud-based delivery models is an emerging market trend. It is essential for businesses to adopt this approach to remain competitive and efficient in today's digital landscape.

- In today's business landscape, cloud adoption is a global trend that offers numerous benefits, including reliability, enhanced uptime, and increased flexibility of data access. Consequently, many industries, including audio and video editing, are embracing cloud-based solutions. Adobe, a leading software company, has responded to this trend by introducing Creative Cloud, a cloud-based platform that supports both mobile and desktop devices. This subscription-based service allows customers to pay based on usage, leading to an increase in subscribers. The software offers advanced features such as 3D animation, technical support, virtual production, screen recording, collaboration tools, HDR video editing, video effects, user interface (UI) enhancements, workflow automation, version control, color grading, and audio mixing.

- These capabilities enable professionals to create high-quality content more efficiently and collaborate seamlessly with their teams. The adoption of cloud-based audio and video editing software is expected to continue, driven by the need for more efficient and flexible production workflows.

What challenges does the Audio And Video Editing Software Industry face during its growth?

- The proliferation of open-source and free editing software poses a significant challenge to the industry's growth by increasing competition and potentially reducing the demand for proprietary solutions.

- The market is driven by the increasing demand for non-linear editing (NLE) solutions, frame rate conversion, and audio restoration. Professional users, including filmmakers, broadcasters, and content creators, prefer NLE software for its flexibility and ability to edit audio and video in a more creative and efficient way. Moreover, the integration of AI-powered features, such as machine learning and sound design tools, has enhanced the functionality of these software solutions. However, the availability of free and open-source software poses a challenge to market growth. Many small and medium-sized enterprises (SMEs) and non-professional users opt for these free alternatives due to their lower cost.

- The purchase of audio and video editing software can involve a significant upfront investment, making the subscription model an attractive option for price-conscious buyers. To cater to the evolving needs of users, software companies are focusing on adding advanced features like GPU acceleration, live streaming, and video encoding. These features enable users to edit high-definition videos and audio in real-time and stream live content to various platforms. Furthermore, the integration of audio mixing consoles and other professional-grade tools has made these software solutions more versatile and suitable for a wider range of applications.

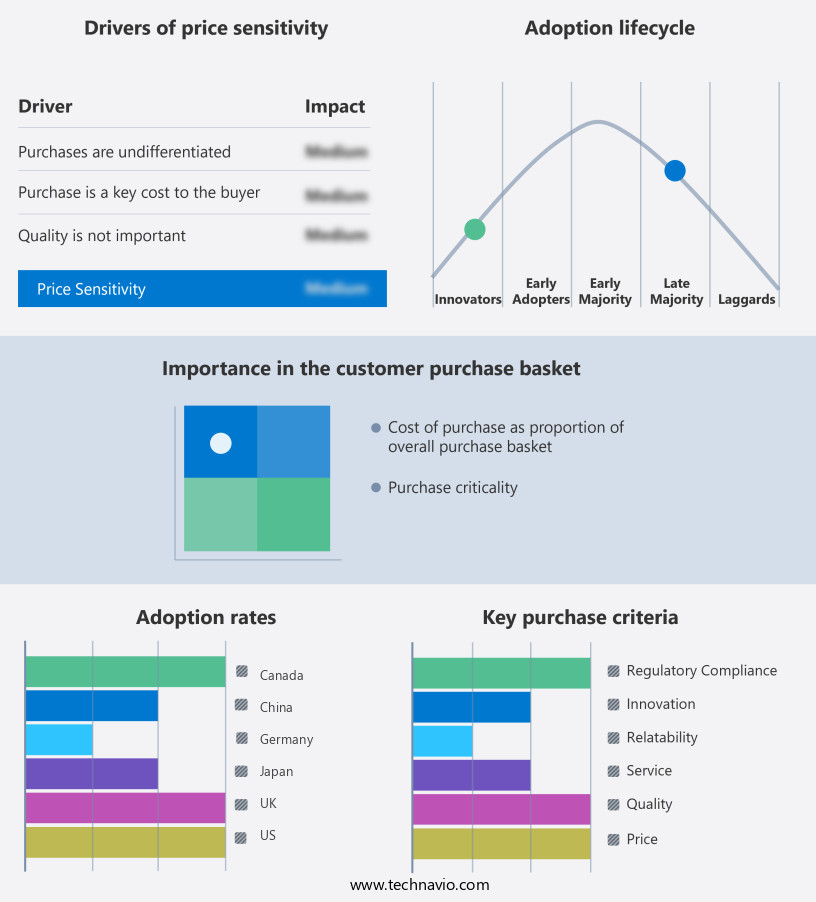

Exclusive Customer Landscape

The audio and video editing software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the audio and video editing software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, audio and video editing software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acon AS - This company specializes in advanced audio and video editing solutions, enabling users to restore and transfer high-fidelity audio from LP records and tapes to CD format.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acon AS

- Adobe Inc.

- Animoto Inc.

- Apple Inc.

- Autodesk Inc.

- Avid Technology Inc.

- Blackmagic Design Pty. Ltd.

- Corel Corp.

- CyberLink Corp.

- Flowplayer AB

- KineMaster Corp.

- MAGIX Software GmbH

- Microsoft Corp.

- Movavi Software Ltd.

- Online Media Technologies Ltd.

- Sony Group Corp.

- Steinberg Media Technologies GmbH

- TechSmith Corp.

- WeVideo Inc.

- Wondershare Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Audio And Video Editing Software Market

- In January 2024, Magix, a leading multimedia software company, launched a new version of its popular audio and video editing software, Magix Movie Edit Pro, featuring AI-assisted video editing and improved color correction tools (Magix Press Release).

- In March 2024, Adobe announced a strategic partnership with Wipro, an IT consulting and business process services company, to enhance Adobe's audio and video editing solutions for businesses (Adobe Press Release).

- In April 2024, iZotope, a leading audio technology company, raised USD50 million in a funding round led by Sorenson Capital to expand its product offerings and enhance its audio and video editing solutions (Crunchbase News).

- In May 2025, Avid, a digital media technology provider, entered the Indian market by launching its Pro Tools audio workstation software, targeting the growing demand for audio and video editing tools in the Indian media and entertainment industry (Avid Press Release). These developments underscore the market's continued growth and innovation, driven by technological advancements, strategic partnerships, and expanding market opportunities.

Research Analyst Overview

- The market is witnessing significant advancements, with various segments experiencing robust growth. Broadcast graphics and film editing solutions continue to dominate the professional video production landscape, while social media video and game development applications gain traction. File formats and software compatibility remain key considerations for media producers, as they navigate the complexities of post-production services and online video platforms. Bit depth, frame rate, color space, and aspect ratio are essential technical specifications for video editing, as they impact the final output's quality. Amateur video editors increasingly rely on mobile video editing apps and editing suites for content creation, while educational video editing and corporate video editing cater to specific niches.

- The emergence of streaming services and web video editing tools has democratized video production, enabling businesses to produce high-quality marketing videos and video conferencing content. Simultaneously, animation studios and audio production houses leverage advanced tools to create visually stunning and immersive experiences. Post-production services, video editing training, and video editing certification programs cater to the evolving needs of media professionals, ensuring they stay updated with the latest trends and technologies. Data storage and hardware requirements are crucial factors in the selection of video editing software, as the volume of content continues to grow. In the realm of multimedia editing, the line between video and audio editing is blurring, as businesses recognize the importance of synchronizing both elements to create engaging and effective content.

- The market for video editing software is diverse and dynamic, with constant innovation and adaptation to emerging technologies and consumer demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Audio And Video Editing Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 1803.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, Canada, UK, Germany, China, Italy, France, Spain, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Audio And Video Editing Software Market Research and Growth Report?

- CAGR of the Audio And Video Editing Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the audio and video editing software market growth of industry companies

We can help! Our analysts can customize this audio and video editing software market research report to meet your requirements.