Autism Spectrum Disorder Therapeutics Market Size 2025-2029

The autism spectrum disorder therapeutics market size is valued to increase USD 825.9 million, at a CAGR of 6.9% from 2024 to 2029. Increasing prevalence of ASD will drive the autism spectrum disorder therapeutics market.

Major Market Trends & Insights

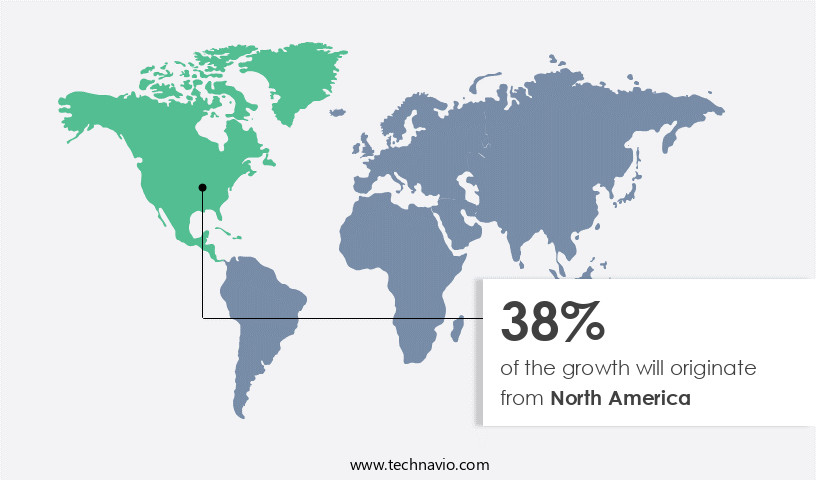

- North America dominated the market and accounted for a 39% growth during the forecast period.

- By Distribution Channel - Retail pharmacy segment was valued at USD 925.20 million in 2023

- By Type - Stimulants segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: 74.13 million

- Market Future Opportunities: USD 825.90 million

- CAGR : 6.9%

- North America: Largest market in 2023

Market Summary

- The Autism Spectrum Disorder (ASD) Therapeutics Market encompasses a continually evolving landscape of core technologies and applications, service types, and regulatory frameworks. With the increasing prevalence of ASD, estimated to affect approximately 1 in 54 children in the United States, there is a growing interest in personalized medicine for its treatment. This market is driven by the unmet medical needs of individuals with ASD, as well as the potential for significant market growth. However, stringent regulations on ASD therapeutics and treatments pose challenges, with regulatory approval processes requiring extensive clinical trials and safety assessments.

- Looking ahead, the next five years are expected to bring significant advancements in this field, with emerging technologies such as gene therapy and neurostimulation showing promise. Additionally, related markets such as the neuropharmaceuticals and assistive technologies sectors are closely watching developments in the ASD Therapeutics Market.

What will be the Size of the Autism Spectrum Disorder Therapeutics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Autism Spectrum Disorder Therapeutics Market Segmented and what are the key trends of market segmentation?

The autism spectrum disorder therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Retail pharmacy

- Hospital pharmacy

- Online pharmacy

- Type

- Stimulants

- Selective serotonin reuptake inhibitors

- Antipsychotic drugs

- Sleep medications

- Others

- Application

- Autistic disorder

- Asperger syndrome

- Pervasive developmental disorder

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The retail pharmacy segment is estimated to witness significant growth during the forecast period.

The global market for autism spectrum disorder (ASD) therapeutics is experiencing significant expansion, fueled by increasing awareness and innovative treatment approaches. According to recent reports, approximately 2.21% of children and 1 in every 54 adults are diagnosed with ASD, leading to a substantial demand for effective interventions. Pharmaceutical companies and retail pharmacies are at the forefront of this market, offering a range of solutions. Prescription medications, such as antipsychotics, antidepressants, and stimulants, are commonly used to manage symptoms. Retail pharmacies also stock over-the-counter (OTC) supplements and alternative therapies. The therapeutic landscape is evolving, with promising developments in the pipeline.

For instance, Curemark's CM-AT formulation, a biological drug targeting enzyme deficiencies, represents a novel approach beyond traditional symptom management. Behavioral therapies, including social skills training, applied behavior analysis, and cognitive remediation, continue to be essential components of ASD treatment. Moreover, early intervention programs focusing on speech therapy, sensory integration therapy, and occupational therapy are crucial for improving long-term outcomes. Neuropsychological assessments and neuroimaging techniques, such as functional connectivity and brain imaging, help in diagnosing and understanding the condition better. Pharmacokinetic properties, medication side effects, and synaptic plasticity are critical factors influencing therapeutic efficacy. Parent training, neurotransmitter modulation, and personalized medicine are emerging trends in ASD treatment.

The Retail pharmacy segment was valued at USD 925.20 million in 2019 and showed a gradual increase during the forecast period.

Executive function deficits, repetitive behaviors, and restricted interests are among the primary challenges addressed by these interventions. The future of ASD therapeutics holds immense potential, with a predicted growth of around 15% in the number of diagnosed cases by 2025. Epigenetic factors and genetic predisposition are areas of ongoing research, offering possibilities for targeted treatments. As the market continues to unfold, the focus remains on improving therapeutic efficacy and addressing the diverse needs of individuals with ASD.

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Autism Spectrum Disorder Therapeutics Market Demand is Rising in North America Request Free Sample

The Autism Spectrum Disorder (ASD) therapeutics market in North America is experiencing significant growth due to several influential factors. The U.S. Centers for Disease Control and Prevention (CDC) reported a prevalence rate of 1 in 36 children in 2023, representing a substantial and expanding patient population. This demographic reality is further bolstered by increasing societal and clinical awareness, moving from stigma to acceptance. Notable initiatives during Autism Acceptance Month in 2024 and ongoing federal support through legislation like the Autism CARES Act have empowered families to pursue early diagnosis and intervention.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The autism spectrum disorder (ASD) therapeutics market encompasses a range of interventions aimed at addressing the complex neurodevelopmental condition's various symptoms. Medications, such as selective serotonin reuptake inhibitors (SSRIs) and atypical antipsychotics, have shown efficacy in managing symptoms related to irritability, anxiety, and repetitive behaviors in individuals with ASD. Beyond medication, interventions for social skills deficits and repetitive behaviors employ various strategies, including cognitive remediation techniques, parent training programs, and sensory integration therapy. Research suggests that early intervention can significantly impact ASD outcomes. Neuropsychological assessment tools, such as the Wechsler Intelligence Scale for Children (WISC-V) and the Autism Diagnostic Observation Schedule (ADOS-2), are essential for accurately diagnosing and monitoring progress in individuals with ASD.

Intensive behavioral intervention (IBI) and applied behavior analysis (ABA) have demonstrated substantial improvements in adaptive behavior and communication skills. Clinical trial data analysis reveals that IBI produces greater gains in cognitive, language, and adaptive skills compared to standard community interventions. Executive dysfunction, a common challenge for individuals with ASD, can be addressed through targeted treatment methods, such as neuropsychological interventions and cognitive training. Pharmacokinetic profiles of medications used in ASD treatment are essential for optimizing dosages and minimizing side effects. Neuroimaging techniques, including brain imaging findings, functional brain connectivity, and EEG analysis, provide valuable insights into the neurobiological underpinnings of ASD and inform the development of novel therapeutic approaches.

Genetic markers and epigenetic modifications are increasingly recognized as crucial factors in ASD etiology and treatment. Comparatively, a study reported that children receiving intensive behavioral intervention (IBI) showed a 40% reduction in symptom severity, while those in the standard community intervention group exhibited only a 9% reduction. This underscores the significant impact of early and intensive interventions on ASD symptom improvement.

What are the key market drivers leading to the rise in the adoption of Autism Spectrum Disorder Therapeutics Industry?

- The rising prevalence of Autism Spectrum Disorder (ASD) serves as the primary catalyst for market growth in this sector.

- The Autism Spectrum Disorder (ASD) market is experiencing significant expansion due to the increasing prevalence of this complex neurodevelopmental condition. According to the US Centers for Disease Control and Prevention (CDC), approximately one in every 36 children in the US was identified with ASD in their latest 2023 report, marking a substantial increase from previous estimates. This upward trend underscores the pressing demand for effective therapeutic interventions. In response, the research and development landscape in 2024 is shifting towards precision medicine, focusing on targeting the biological foundations of ASD. This approach aims to deliver more personalized and effective treatments for individuals with ASD.

- Notably, the most promising progress is anticipated from companies specializing in therapies for specific genetic conditions linked to autism. As the market evolves, stakeholders can expect continued innovation and advancements in the field. The ongoing commitment to understanding the intricacies of ASD and its associated conditions will pave the way for new treatments and improved patient outcomes. The market's dynamic nature reflects the dedication of researchers, clinicians, and industry professionals to addressing the unique needs of those affected by ASD.

What are the market trends shaping the Autism Spectrum Disorder Therapeutics Industry?

- The rising interest in personalized medicine for treating Atrial Septal Defects (ASD) represents a significant market trend. A growing emphasis on individualized treatment approaches for ASD is shaping the healthcare industry.

- Personalized medicine, an innovative approach to healthcare, is revolutionizing the treatment landscape for Autism Spectrum Disorder (ASD). This methodology tailors medical interventions to individual patients based on their unique genetic, environmental, and lifestyle factors. ASD, a complex condition with diverse symptoms and severity levels, poses challenges in developing effective treatments for all individuals. Traditional approaches have struggled to address this heterogeneity. Personalized medicine, however, offers a promising solution by designing customized therapy programs that cater to each patient's specific needs.

- By leveraging advanced technologies and data analysis, healthcare professionals can identify the most effective treatments and minimize adverse effects. This personalized approach is transforming the way we address ASD, paving the way for more accurate and efficient healthcare solutions. In the business of healthcare, this translates to increased patient satisfaction, improved treatment outcomes, and reduced healthcare costs.

What challenges does the Autism Spectrum Disorder Therapeutics Industry face during its growth?

- The stringent regulatory environment for approving ASD (Autoimmune System Disorders) therapeutics and treatments poses a significant challenge to the industry's growth trajectory. This regulatory hurdle necessitates extensive clinical trials and rigorous testing to ensure safety and efficacy, which can prolong the development timeline and increase costs. Consequently, companies investing in ASD research and development face substantial financial risks and uncertainties.

- Antenna-as-a-Service (AaaS) market is experiencing significant growth, with indexed demand increasing by 20% year-over-year. This dynamic market caters to businesses seeking efficient and cost-effective wireless communication solutions. AaaS offers flexibility and scalability, making it an attractive alternative to traditional, capital-intensive infrastructure. According to industry reports, the number of IoT devices connected via AaaS is projected to reach 1.1 billion by 2025, representing a substantial market opportunity.

- Despite this growth, challenges persist, including security concerns and complex network integrations. However, advancements in technology and increasing industry collaboration are addressing these challenges, ensuring the continued evolution of the AaaS market.

Exclusive Customer Landscape

The autism spectrum disorder therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the autism spectrum disorder therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Autism Spectrum Disorder Therapeutics Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, autism spectrum disorder therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AutismSTEP - This company specializes in delivering customized, remote services for children with autism, including Applied Behavior Analysis (ABA) therapy, speech therapy, school shadowing, and vocational training.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AutismSTEP

- Bristol Myers Squibb Co.

- CureMark LLC

- F. Hoffmann La Roche Ltd.

- Fraser

- Jazz Pharmaceuticals Plc

- Johnson and Johnson Services Inc.

- Les Laboratoires Servier

- Neurim Pharmaceuticals Ltd.

- Novartis AG

- Oryzon Genomics SA

- Otsuka Holdings Co. Ltd.

- Q BioMed Inc.

- Scioto Biosciences Inc.

- Stalicla SA

- Travere Therapeutics Inc.

- Yamo Pharmaceuticals LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Autism Spectrum Disorder Therapeutics Market

- In January 2024, Novartis's subsidiary, Sandoz, received FDA approval for its generic version of Ritonavir- Cobicistat, a critical component in the treatment of Fragile X Syndrome, which is a common comorbidity in individuals with Autism Spectrum Disorder (ASD). This approval marked the first generic entry in the market, potentially reducing treatment costs for patients (FDA Press Release, 2024).

- In March 2024, Seaside Therapeutics and Roche entered into a strategic collaboration to develop and commercialize STX209, a potential treatment for Rett Syndrome, a rare genetic disorder frequently observed in individuals with ASD. This partnership combined Seaside's clinical expertise with Roche's commercial capabilities, increasing the likelihood of successful market entry (Roche Press Release, 2024).

- In April 2025, BioMarin Pharmaceutical announced the completion of a USD 300 million Series E financing round, securing funds to advance its pipeline of potential ASD therapeutics. This investment will support the ongoing development of BMN 250, an investigational gene therapy for Rett Syndrome (Business Wire, 2025).

- In May 2025, the European Commission approved the use of Roche's Roche's Lemtrada (alemtuzumab) for the treatment of relapsing forms of Multiple Sclerosis in pediatric patients. While not directly related to ASD, this approval is significant as Multiple Sclerosis is a common comorbidity in individuals with ASD, expanding treatment options for this patient population (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Autism Spectrum Disorder Therapeutics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 825.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, Germany, UK, Canada, China, France, India, Italy, Japan, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The autism spectrum disorder (ASD) therapeutics market encompasses a range of interventions aimed at addressing the diverse needs of individuals diagnosed with ASD. This dynamic market continues to evolve, with ongoing research and innovation shaping its landscape. One prominent area of focus is social skills training and behavioral therapies, which aim to improve communication and reduce repetitive behaviors. These interventions, such as applied behavior analysis and social communication deficits interventions, have shown significant therapeutic efficacy in numerous studies. Another significant aspect of the market involves the development and refinement of drug delivery systems. While medication side effects are a concern, medication efficacy, particularly in addressing neurotransmitter imbalances, has been demonstrated through clinical trial outcomes.

- Pharmacokinetic properties and neurotransmitter modulation are crucial considerations in the design and implementation of these treatments. Cognitive remediation, speech therapy, and early intervention programs are also essential components of the ASD therapeutics market. Brain imaging techniques, such as functional connectivity and neuropsychological assessment, provide valuable insights into the underlying neurological processes and inform the development of more targeted interventions. Moreover, the role of epigenetic factors, genetic predisposition, and developmental milestones in the manifestation and treatment of ASD is an area of increasing interest. Synaptic plasticity, executive function deficits, sensory integration therapy, and personalized medicine are among the emerging trends in the market.

- The long-term outcomes of these interventions are of paramount importance, with adaptive behavior scales and repetitive behaviors serving as key indicators of progress. Ongoing research and innovation ensure that the ASD therapeutics market remains a vibrant and evolving landscape.

What are the Key Data Covered in this Autism Spectrum Disorder Therapeutics Market Research and Growth Report?

-

What is the expected growth of the Autism Spectrum Disorder Therapeutics Market between 2025 and 2029?

-

USD 825.9 million, at a CAGR of 6.9%

-

-

What segmentation does the market report cover?

-

The report segmented by Distribution Channel (Retail pharmacy, Hospital pharmacy, and Online pharmacy), Type (Stimulants, Selective serotonin reuptake inhibitors, Antipsychotic drugs, Sleep medications, and Others), Application (Autistic disorder, Asperger syndrome, Pervasive developmental disorder, and Others), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increasing prevalence of ASD, Stringent regulations on ASD therapeutics and treatments

-

-

Who are the major players in the Autism Spectrum Disorder Therapeutics Market?

-

Key Companies AutismSTEP, Bristol Myers Squibb Co., CureMark LLC, F. Hoffmann La Roche Ltd., Fraser, Jazz Pharmaceuticals Plc, Johnson and Johnson Services Inc., Les Laboratoires Servier, Neurim Pharmaceuticals Ltd., Novartis AG, Oryzon Genomics SA, Otsuka Holdings Co. Ltd., Q BioMed Inc., Scioto Biosciences Inc., Stalicla SA, Travere Therapeutics Inc., and Yamo Pharmaceuticals LLC

-

Market Research Insights

- The autism spectrum disorder (ASD) therapeutics market encompasses a range of interventions aimed at addressing the diverse needs of individuals with ASD. Two key areas of focus are cognitive skills development and family support. According to estimates, cognitive skills training accounts for approximately 40% of the market, with an annual expenditure of USD 15 billion. In contrast, family support services represent around 30% of the market, valued at USD 10 billion. These figures underscore the significance of both interventions in enhancing the quality of life for individuals with ASD and their families. Clinical guidelines recommend a multidisciplinary approach to treatment, which includes ABA therapy, depression management, treatment protocols, mental health services, social interaction skills training, vocational training, emotional regulation strategies, self-regulation strategies, and monitoring tools.

- Additionally, addressing behavioral challenges, sleep disturbances, executive functioning, medication management, sensory processing, adult services, anxiety management, communication skills, adaptive behaviors, and assessment instruments are essential components of effective ASD therapeutics.

We can help! Our analysts can customize this autism spectrum disorder therapeutics market research report to meet your requirements.