Automotive Airbag Market Size 2024-2028

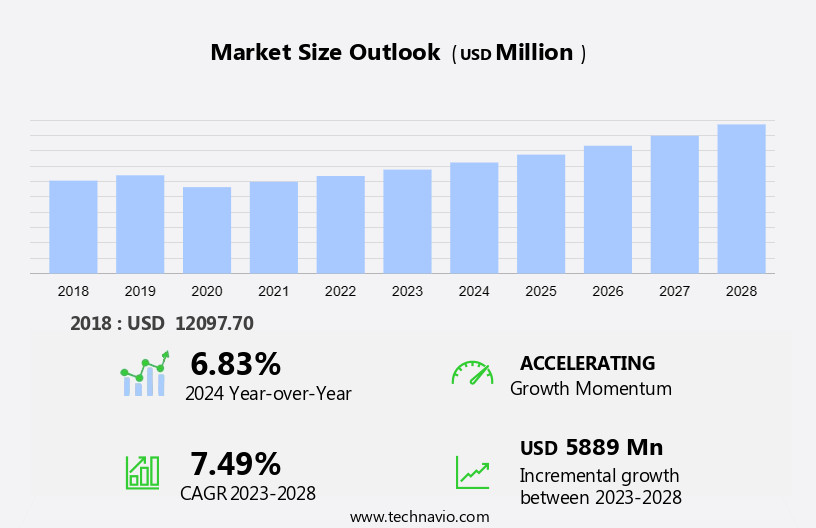

The automotive airbag market size is forecast to increase by USD 5.89 billion at a CAGR of 7.49% between 2023 and 2028.

- The market is witnessing significant growth due to the rise in global vehicle production and increasing advancements in airbag technologies. The increasing demand for safety features in vehicles is driving the market growth. Additionally, Automotive Seatbelts and pretensioners continue to be the primary safety providers, but the market is expanding to include side airbags, knee airbags, and multi-modal approaches for enhanced safety.

- Safety regulations, consumer awareness, and stringent laws emphasizing road safety continue to influence market dynamics. However, the rising raw material cost of airbags is a major challenge for market participants. The increasing use of alternative materials and the implementation of cost-effective manufacturing processes are some of the strategies being adopted to mitigate this challenge. Overall, the market is expected to experience steady growth In the coming years.

What will be the Size of the Automotive Airbag Market During the Forecast Period?

- The market is driven by the increasing prioritization of passenger safety in collision scenarios. Airbags, as essential safety devices, provide critical protection for vehicle occupants during collisions. The market utilizes high-strength materials to ensure effective performance, with a focus on both frontal and side & curtain airbags for head and neck protection. Market trends include the integration of airbags in low-end vehicles to meet safety regulations, as well as the development of customized curtain airbags for enhanced side impact protection. Supply chain disruptions due to raw material availability and component shortages pose challenges to market growth.

- The driving experience is further enhanced through the integration of airbags with seatbelts, steering wheels, and other mobility safety solutions. The market caters to various vehicle segments, including passenger cars, light commercial vehicles, and buses, ensuring comprehensive safety solutions for diverse transportation needs.

How is this Automotive Airbag Industry segmented and which is the largest segment?

The automotive airbag industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Front airbag

- Side airbag

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Type Insights

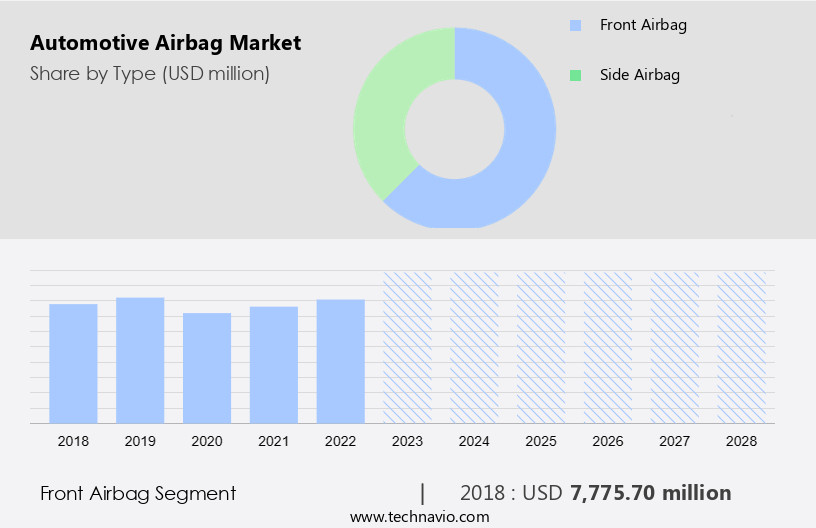

- The front airbag segment is estimated to witness significant growth during the forecast period.

Front airbags, also referred to as driver-side and passenger-side airbags, are essential safety features in automobiles that deploy from the steering wheel and dashboard during front collisions. They protect occupants from head, chest, and upper body injuries, making them a critical component in enhancing safety. Regulatory authorities and governments worldwide mandate their inclusion in new vehicles to ensure minimum safety standards are met. Advanced safety features like front airbags significantly influence consumer purchase decisions and contribute to higher safety ratings for vehicles. Airbag systems consist of components such as impact sensors, indicator lamps, and airbag inflators, which work in unison to deploy the airbags effectively.

Furthermore, the SUV segment, hatchback/sedan segment, light commercial vehicles, and heavy commercial vehicles all incorporate front airbags as standard safety features. The integration of smart airbag technology further enhances the driving experience by customizing the airbag deployment based on the severity and type of collision.

Get a glance at the Automotive Airbag Industry report of share of various segments Request Free Sample

The front airbag segment was valued at USD 7.78 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

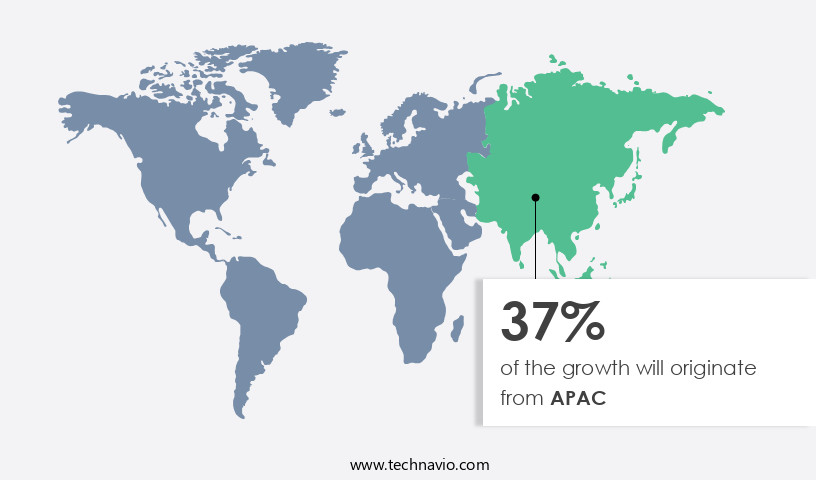

- APAC is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia-Pacific region is experiencing significant growth in its automotive markets, particularly in countries like China and India, due to economic expansion and increasing disposable income. This trend has resulted in a rise in vehicle sales and ownership. With safety becoming a top priority for consumers, the demand for automobiles equipped with airbags has increased. Airbags are essential safety components, and their adoption is being driven by heightened awareness of road safety issues. The automotive industry In the APAC region is undergoing rapid technological advancements, leading to the integration of safety solutions such as seatbelts with pre-tensioners, side airbags, pedestrian protection, connected safety services, and powered two-wheeler rider safety. These innovations aim to provide comprehensive mobility safety solutions for various types of vehicles.

Market Dynamics

Our automotive airbag market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Airbag Industry?

A rise in global vehicle production is the key driver of the market.

- With the growing number of vehicles on the roads, the demand for automotive airbags as safety devices has risen. In 2023, the International Organization of Motor Vehicle Manufacturers (OICA) reported a 9.11% increase in total vehicles produced, amounting to 93.54 million units. This figure includes 67.13 million passenger cars and 26.41 million commercial vehicles worldwide. As a result, the need for airbags to meet safety regulations and standards has intensified. As vehicle production expands, manufacturers are obliged to integrate airbags into their vehicles, thereby fueling the market's growth. High-strength materials, such as nylon, are used In the production of airbags to ensure energy absorption and head/neck protection during collisions.

- Airbag systems include various components, including indicator lamps, impact sensors, and airbag inflators. The SUV segment and hatchback/sedan segment are significant markets for airbags, with side & curtain airbags and head & neck protection being essential features. Light Commercial Vehicles (LCVs), buses, trucks, and even two-wheelers are also incorporating airbags to enhance safety. Improved lifestyles and increased safety awareness campaigns have led to a greater emphasis on automobile safety solutions, including airbags, seatbelts, and steering wheels. Technological advancements, such as smart airbags and multi-modal approaches, have further boosted the market's growth. Despite the challenges posed by supply chain disruptions and raw material availability, the airbag market continues to evolve, with innovative airbag technology and connected safety services catering to various industrial requirements.

What are the market trends shaping the Automotive Airbag Industry?

Increasing advancements in airbag technologies is the upcoming market trend.

- The market is driven by the increasing focus on passenger safety in collision situations. Traditional airbags made of high-strength materials have been a staple safety device in vehicles for decades. However, advancements in technology have led to the development of more sophisticated airbag systems. These systems, such as multi-stage airbags and adaptive airbag systems, offer improved protection for passengers by deploying with varying degrees of force based on the severity of the impact. Multi-stage airbags can reduce the risk of injuries caused by excessive deployment, while adaptive airbag systems tailor deployment strategies to suit the specific requirements of each occupant.

- Sensor technology plays a crucial role In these advancements. Impact sensors and indicator lamps are essential components of airbag systems, enabling the timely deployment of airbags during a collision. Side and curtain airbags, head and neck protection, and rollover crash airbags are some of the types of airbags that offer enhanced safety features. The market is not limited to passenger cars alone. It extends to light commercial vehicles, buses, trucks, and even two-wheelers like e-scooters. The market is influenced by various factors, including safety regulations, safety awareness campaigns, and consumer awareness. Improved lifestyles and increased purchasing power have led to an increased focus on automobile safety measures. Self-driving cars and autonomous vehicles are expected to further revolutionize the market by integrating airbags with advanced safety features and real-time crash test data.

What challenges does the Automotive Airbag Industry face during its growth?

The rising raw material cost of airbags is a key challenge affecting the industry growth.

- The market is driven by the increasing demand for safety devices in vehicles, particularly In the wake of collision incidents. Airbags, a crucial safety component, provide essential protection to passengers during accidents. Manufacturers utilize high-strength materials, such as nylon, for airbag production, ensuring energy absorption and head/neck protection. However, the rising costs of raw materials pose a challenge to the market. These costs, which include those for components like airbag inflators, impact sensors, and indicator lamps, can impact profitability and competitive pricing. Moreover, safety regulations and awareness campaigns continue to prioritize road safety, leading to a greater focus on airbag technology.

- This includes innovations like smart airbags, which offer customized curtain airbags, side airbags, and knee airbags for enhanced protection. The SUV segment, hatchback/sedan segment, light commercial vehicles, buses, trucks, and even two-wheelers are all incorporating advanced airbag systems. Despite these advancements, the market faces challenges, including supply chain disruptions and the need for weight reductions. Improved lifestyles and increased consumer awareness have led to a growing demand for mobility safety solutions, including airbags and seatbelts. Additionally, the integration of electronics and passive safety systems, such as pretensioners and side airbags, is becoming increasingly common. The market is diverse, encompassing various types of airbags, including side and curtain airbags, head and neck protection, and rollover crash protection.

Exclusive Customer Landscape

The automotive airbag market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive airbag market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive airbag market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Analog Devices Inc. - The company offers automotive airbags such as MAX15007 ultra-low quiescent current linear regulator for automotive air bags.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- ARC Automotive, Inc

- Ashimori Industry Co. Ltd.

- Autoliv Inc.

- Continental AG

- Daicel Corp.

- DENSO Corp.

- Dorman Products Inc.

- Hyundai Motor Group

- Infineon Technologies AG

- Joyson Safety Systems Aschaffenburg GmbH

- Kolon Industries Inc.

- Mitsubishi Electric Corp.

- Nihon Plast Co. Ltd.

- NXP Semiconductors NV

- Robert Bosch GmbH

- Stellantis NV

- TaiHangChangQing Automobile Safety System Co. Ltd.

- Toyoda Gosei Co. Ltd.

- Yanfeng International Automotive Technology Co. Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a vital segment of the transportation industry, focusing on safety devices designed to protect passengers during collision events. These safety devices, commonly known as airbags, have become an essential component in modern vehicles, providing essential head and neck protection for passengers in various impact situations. High-strength materials, such as nylon, play a significant role In the production of airbags. These materials are essential for energy absorption during a collision, ensuring the airbag cushion effectively shields passengers from harm. The supply chain for these materials and components can experience disruptions due to various reasons, including raw material availability and production capacity.

Moreover, airbag systems are not limited to passenger cars. They are also utilized in light commercial vehicles, SUVs, hatchbacks, sedans, buses, trucks, and even two-wheelers like e-scooters. The SUV segment and the hatchback/sedan segment have seen significant growth in airbag adoption due to increased safety regulations and consumer awareness. The market is influenced by various factors, including the technological advancements in airbag systems. Smart airbags, for instance, can adapt to different crash scenarios, providing customized protection for various impact situations. Side and curtain airbags, head and neck protection, and rollover crash protection are some of the advanced airbag types that have gained popularity in recent years.

Furthermore, the passenger car segment and the passive safety segment are significant contributors to the market. However, the electronics segment is also making strides in airbag innovation, with concepts like self-driving cars and connected safety services revolutionizing the industry. The driving experience is another critical factor influencing the market. Airbags are not just safety devices; they also contribute to the overall comfort and dependability of a vehicle. Factors like seatbelts, pre-tensioners, side airbags, and knee airbags are essential components of a comprehensive safety system, protecting in various sitting situations. The market is subject to stringent laws and regulations, ensuring that vehicles meet specific safety requirements.

|

Automotive Airbag Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.49% |

|

Market Growth 2024-2028 |

USD 5.89 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.83 |

|

Key countries |

US, China, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Airbag Market Research and Growth Report?

- CAGR of the Automotive Airbag industry during the forecast period

- Detailed information on factors that will drive the Automotive Airbag growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive airbag market growth of industry companies

We can help! Our analysts can customize this automotive airbag market research report to meet your requirements.