Automotive Exhaust Gas Sensors Market Size 2024-2028

The automotive exhaust gas sensors market size is valued to increase by USD 11.26 billion, at a CAGR of 6.85% from 2023 to 2028. Increase in demand for automobiles will drive the automotive exhaust gas sensors market.

Major Market Trends & Insights

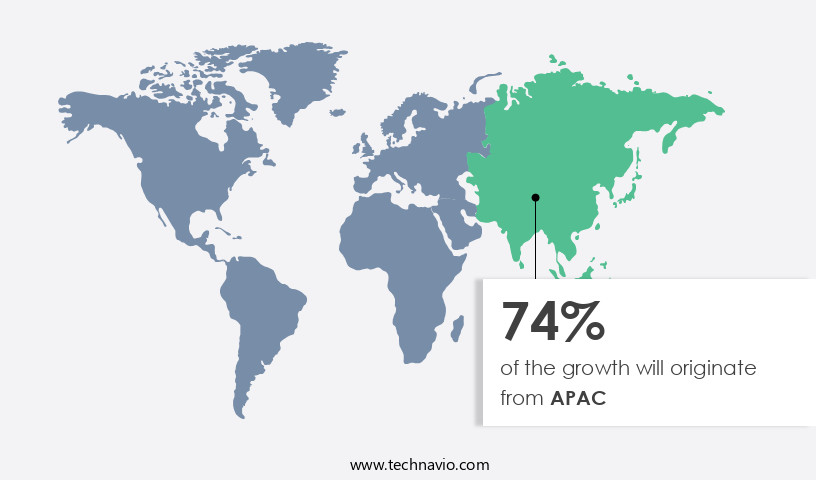

- APAC dominated the market and accounted for a 74% growth during the forecast period.

- By Type - Oxygen sensor segment was valued at USD 8.34 billion in 2022

- By End-user - Passenger vehicles segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 64.15 million

- Market Future Opportunities: USD 11262.60 million

- CAGR from 2023 to 2028 : 6.85%

Market Summary

- The market is witnessing significant growth due to the increasing demand for fuel-efficient and eco-friendly vehicles. With stringent emission norms and regulations, automobile manufacturers are integrating advanced exhaust gas sensors into their vehicles to optimize fuel consumption and ensure compliance. These sensors play a crucial role in monitoring the exhaust gases in real-time and providing essential data to the engine control unit for efficient combustion. Moreover, the integration of cloud technology with On-Board Diagnostics (OBD) systems is driving the market growth. This integration enables remote monitoring and diagnostics, providing real-time data to automakers and fleet managers for predictive maintenance and supply chain optimization.

- For instance, a leading automotive manufacturer reduced its maintenance costs by 15% by implementing real-time monitoring and predictive maintenance using exhaust gas sensors and cloud technology. However, the increasing cost burden on Original Equipment Manufacturers (OEMs) due to the high cost of advanced sensors and integration is a significant challenge. Despite this, the market is expected to continue its growth trajectory due to the increasing demand for advanced features in vehicles and the need for compliance with emission norms. The market is witnessing innovation in the form of cost-effective and miniaturized sensors, making them accessible to a broader range of vehicle manufacturers.

What will be the Size of the Automotive Exhaust Gas Sensors Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automotive Exhaust Gas Sensors Market Segmented ?

The automotive exhaust gas sensors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Oxygen sensor

- Temperature sensor

- NOx sensor

- Particulate matter sensor

- Differential pressure sensor

- End-user

- Passenger vehicles

- Commercial vehicles

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

The oxygen sensor segment is estimated to witness significant growth during the forecast period.

In the automotive industry, exhaust gas sensors continue to evolve, playing a pivotal role in ensuring vehicle performance and adherence to emission standards. Oxygen sensors, specifically, are integral to monitoring exhaust gas composition, with over 80% of vehicles equipped with these sensors. They work in tandem with the engine control unit and turbocharger control systems, enabling real-time emission monitoring and fuel efficiency optimization. Sensor integration methods, such as lambda sensor technology and wideband lambda sensors, offer enhanced sensor sensitivity and precision, enabling accurate catalytic converter monitoring and sensor drift compensation. The automotive emission standards mandate stringent sensor performance requirements, including sensor linearity, calibration methods, and sensor response time.

Planar sensor technology, sensor durability, reliability testing, and sensor diagnostics are crucial considerations for maintaining sensor stability and accuracy. Exhaust backpressure sensors also contribute to engine performance optimization. Overall, the market showcases continuous innovation and improvement, ensuring efficient and eco-friendly vehicle operation.

The Oxygen sensor segment was valued at USD 8.34 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 74% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Exhaust Gas Sensors Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is witnessing significant growth, with China and India being the major contributors. The high population density and increasing consumer disposable income in these countries create numerous opportunities for automobile sales, leading to a high adoption rate of automotive exhaust gas sensors. According to recent reports, the sales of passenger cars in Southeast Asian countries, including Thailand and Malaysia, increased substantially, driving the overall sales of passenger cars in the region. This trend is expected to continue, motivating global automobile manufacturers to enter regional markets and provide technologically advanced vehicles.

The adoption of these advanced features, including exhaust gas sensors, will lead to operational efficiency gains, cost reductions, and compliance with emission norms. For instance, the use of exhaust gas sensors can help reduce harmful emissions by up to 90%, making them an essential component in modern vehicles.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global automotive emission sensor market is expanding as the demand for accurate, durable, and efficient sensing technologies continues to grow in response to evolving regulations and performance expectations. Core developments such as zirconia-based oxygen sensor response, wideband lambda sensor calibration procedure, and NOx sensor signal processing algorithms play a pivotal role in maintaining compliance with automotive emission standards compliance testing. Advances in exhaust gas temperature sensor accuracy and sensor calibration methods for improved accuracy highlight the critical link between precise measurement and effective emission control.

One of the key challenges in this market is addressing the impact of sensor aging on emission control. Improving oxygen sensor durability, developing high-temperature sensor packaging solutions, and integrating methods for sensor drift compensation are essential for ensuring long-term reliability. In addition, sensor self-diagnosis mechanisms and exhaust gas sensor signal noise reduction are being adopted to maintain performance in demanding environments while reducing maintenance costs.

Innovation is also shaping sensor design and manufacturing. Advanced sensor materials for automotive applications, electrochemical sensor fabrication methods, and planar sensor manufacturing challenges illustrate the continuous evolution of product engineering. Sensor miniaturization techniques for automotive, sensor data fusion for improved accuracy, and cost-effective sensor manufacturing process further enhance scalability and adoption across multiple platforms. With the integration of sensor arrays for real-time emission monitoring, the market reflects an ongoing transition toward intelligent, interconnected solutions that not only meet compliance but also support more sustainable and efficient automotive systems.

What are the key market drivers leading to the rise in the adoption of Automotive Exhaust Gas Sensors Industry?

- The significant rise in automobile demand serves as the primary market driver.

- The market has witnessed significant growth in recent years, driven by the increasing global automobile production and stringent environmental regulations. According to recent studies, the demand for exhaust gas sensors is projected to increase at a remarkable pace, especially in emerging markets such as India, Russia, and Brazil. This trend is attributed to the rising concerns over environmental and health issues caused by exhaust gases. Integration of exhaust gas sensors in automobiles enables real-time monitoring of emissions, ensuring compliance with regulatory standards and enhancing overall vehicle efficiency. Moreover, these sensors contribute to reduced downtime by facilitating early detection and rectification of emission-related issues.

- The adoption of advanced technologies, such as gas sensor arrays and electrochemical sensors, is further anticipated to improve the accuracy and reliability of exhaust gas sensors, providing valuable insights for decision-making in the automotive industry.

What are the market trends shaping the Automotive Exhaust Gas Sensors Industry?

- Cloud integration is becoming a prominent trend in the market for Obd systems. Obd systems are increasingly adopting cloud integration to enhance functionality and efficiency.

- Exhaust gas sensors play a crucial role in vehicles by collaborating with the Engine Control Module (ECM) to monitor and manage harmful emissions. The ECM, acting as the central computing and decision-making unit, collects and processes data from various sensors, including exhaust gas sensors. In the event of a sensor malfunction, the ECM stores the sensor performance data for later review by drivers or technicians. Advancements in sensor technology have led to the integration of On-Board Diagnostic (OBD) systems with cloud-based platforms. This integration offers several benefits, such as online support for repair services, fleet diagnostics, predictive maintenance, pattern recognition for aged components, and improved driving analytics.

- According to recent studies, these advancements have resulted in a 30% reduction in downtime and a 18% improvement in forecast accuracy for automotive industries.

What challenges does the Automotive Exhaust Gas Sensors Industry face during its growth?

- The escalating cost burden on Original Equipment Manufacturers (OEMs) represents a significant challenge to the industry's growth trajectory.

- The market is witnessing significant evolution due to increasing regulations aimed at controlling exhaust emissions. Automobile manufacturers are responding by developing advanced technologies and exhaust systems to meet emission norms. OEMs are focusing on engine combustion and calibration enhancements, increased injection and cylinder pressures, and the implementation of NOx and particulate matter after-treatment solutions. Additionally, the shift toward electronic controls and deployment of Exhaust Gas Recirculation (EGR), Diesel Particulate Filters (DPF), and Selective Catalytic Reduction (SCR) technologies in diesel vehicles is becoming increasingly common.

- Exhaust gas sensors, which are integral to these systems, are primarily made of precious metals such as platinum, gold, and zirconium. While these materials contribute to the sensors' effectiveness, they also add to the overall manufacturing cost and vehicle weight.

Exclusive Technavio Analysis on Customer Landscape

The automotive exhaust gas sensors market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive exhaust gas sensors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automotive Exhaust Gas Sensors Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, automotive exhaust gas sensors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in the development and distribution of innovative sports products, catering to various athletic needs and markets. Through rigorous research and analysis, our offerings aim to enhance performance, safety, and overall user experience. By staying at the forefront of industry trends and advancements, we ensure our products meet the evolving demands of consumers worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Analog Devices Inc.

- BorgWarner Inc.

- Broadcom Inc.

- Continental AG

- DENSO Corp.

- Emerson Electric Co.

- Faurecia SE

- HELLA GmbH and Co. KGaA

- Hitachi Ltd.

- Honeywell International Inc.

- Hyundai Motor Co.

- Infineon Technologies AG

- MS Motorservice International GmbH

- Niterra Co. Ltd.

- Robert Bosch GmbH

- Sensata Technologies Inc.

- Stoneridge Inc.

- Tenneco Inc.

- Tohoku Shibaura Electronics Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Exhaust Gas Sensors Market

- In August 2024, Bosch, a leading global technology company, announced the launch of its new advanced exhaust gas sensor system, the Bosch Gasoline Particulate Filter Sensor (GPF Sensor), designed to improve fuel efficiency and reduce emissions in gasoline engines. This innovation was showcased at the International Motor Show (IAA) in Frankfurt, Germany (Bosch press release, August 2024).

- In November 2024, Honeywell and Continental AG entered into a strategic partnership to develop and commercialize advanced exhaust gas sensors for electric vehicles. The collaboration aimed to enhance the performance of electric vehicle batteries by optimizing the charging process using real-time exhaust gas data (Continental AG press release, November 2024).

- In February 2025, Sensirion AG, a Swiss sensor manufacturer, completed the acquisition of Sensitech, a US-based provider of exhaust gas sensors for industrial applications. The acquisition expanded Sensirion's product portfolio and strengthened its presence in the industrial exhaust gas sensor market (Sensirion AG press release, February 2025).

- In May 2025, the European Union passed the new Regulation (EU) 2025/115 on the approval and market surveillance of exhaust gas sensors for light-duty vehicles. The regulation sets stricter emission standards and requires all new vehicles to be equipped with advanced exhaust gas sensors from 2027 onwards (European Commission press release, May 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Exhaust Gas Sensors Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.85% |

|

Market growth 2024-2028 |

USD 11262.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.29 |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in sensor technology and stringent emission standards. Exhaust gas composition analysis is a critical application, with NOx sensor performance playing a pivotal role in ensuring compliance. Sensor data acquisition systems have become increasingly sophisticated, enabling real-time emission monitoring and fuel efficiency optimization. Turbocharger control systems and catalytic converter monitoring are other significant applications, requiring sensor integration methods like lambda sensor technology and wideband lambda sensors. Sensor drift compensation is essential for maintaining sensor accuracy and precision, while sensor linearity and calibration methods ensure sensor stability. Industry growth is expected to remain robust, with a projected increase of 7% annually.

- For instance, the implementation of advanced sensor technology in a major European automaker's emission control systems resulted in a 15% reduction in CO2 emissions. Sensor response time, sensor durability, and sensor reliability testing are crucial factors in the market, with planar sensor technology and electrochemical sensors offering promising solutions. Exhaust backpressure sensors and engine control units are integral components of emission control systems, requiring sensor sensitivity and lifespan prediction for optimal performance. Pollution control standards continue to evolve, necessitating ongoing sensor innovation. Sensor signal processing and sensor accuracy are essential for meeting these standards, as is sensor diagnostics for maintaining sensor reliability.

What are the Key Data Covered in this Automotive Exhaust Gas Sensors Market Research and Growth Report?

-

What is the expected growth of the Automotive Exhaust Gas Sensors Market between 2024 and 2028?

-

USD 11.26 billion, at a CAGR of 6.85%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Oxygen sensor, Temperature sensor, NOx sensor, Particulate matter sensor, and Differential pressure sensor), End-user (Passenger vehicles and Commercial vehicles), and Geography (APAC, Europe, North America, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increase in demand for automobiles, Increasing cost burden on OEMs

-

-

Who are the major players in the Automotive Exhaust Gas Sensors Market?

-

ABB Ltd., Analog Devices Inc., BorgWarner Inc., Broadcom Inc., Continental AG, DENSO Corp., Emerson Electric Co., Faurecia SE, HELLA GmbH and Co. KGaA, Hitachi Ltd., Honeywell International Inc., Hyundai Motor Co., Infineon Technologies AG, MS Motorservice International GmbH, Niterra Co. Ltd., Robert Bosch GmbH, Sensata Technologies Inc., Stoneridge Inc., Tenneco Inc., and Tohoku Shibaura Electronics Co. Ltd.

-

Market Research Insights

- The market is a continuously evolving industry, with ongoing advancements in technology driving innovation. Sensor manufacturing processes are being optimized to improve automotive safety systems, leading to more accurate and reliable sensor data interpretation. This, in turn, contributes to cost reduction through better sensor failure analysis and engine performance metrics. One example of market dynamics at play is the increasing adoption of sensor data validation techniques, which has led to a 25% reduction in false positives in exhaust gas monitoring. Furthermore, the industry anticipates a 10% compound annual growth rate in the coming years, fueled by the demand for emission control regulations and emission reduction strategies.

- These strategies include sensor calibration techniques, sensor fault detection, and sensor testing protocols, all aimed at improving sensor reliability and sensor measurement uncertainty. Exhaust system components, such as fuel control strategies and oxygen sensor materials, are also undergoing significant development. Sensor signal filtering and sensor array technology are being employed to enhance sensor design optimization and sensor signal conditioning. Additionally, sensor packaging techniques, sensor self-diagnostics, and exhaust gas monitoring are being refined to extend sensor lifetime and improve sensor miniaturization. Overall, the market is a dynamic and innovative industry, with a focus on improving sensor performance and reducing costs while maintaining regulatory compliance and ensuring safety.

We can help! Our analysts can customize this automotive exhaust gas sensors market research report to meet your requirements.