Automotive Exhaust Manifold Market Size 2025-2029

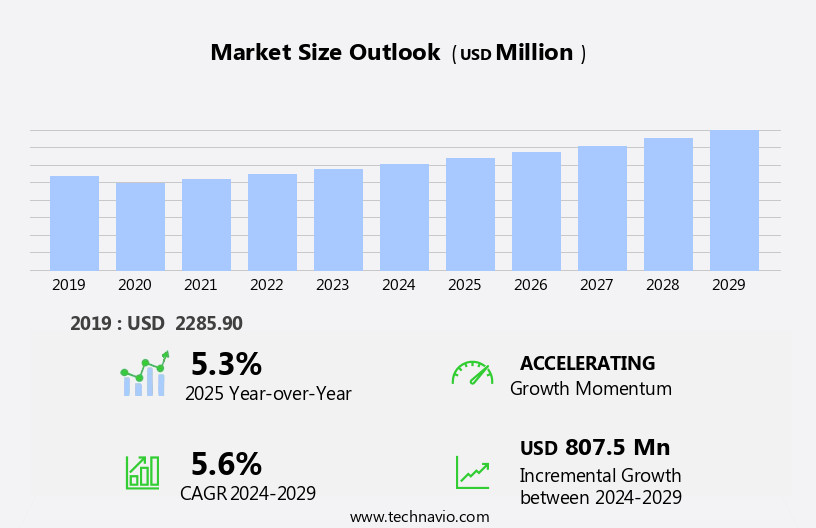

The automotive exhaust manifold market size is forecast to increase by USD 807.5 million at a CAGR of 5.6% between 2024 and 2029.

- The market is driven by the increasing production volume of passenger vehicles, which in turn boosts the demand for exhaust manifolds. Moreover, advancements in exhaust manifold designs for turbocharged diesel engines are creating new opportunities for market growth. However, the market faces challenges, including the development of cracks or leaks in automotive exhaust manifolds, which can negatively impact vehicle performance and safety. These challenges necessitate continuous research and development efforts to ensure the production of robust and reliable exhaust manifolds.

- Companies in the market can capitalize on the growing demand for fuel-efficient and environmentally friendly exhaust systems by investing in innovative technologies and improving the durability of their products. Additionally, strategic collaborations and partnerships can help companies overcome the challenges associated with manufacturing high-quality exhaust manifolds while maintaining competitive pricing.

What will be the Size of the Automotive Exhaust Manifold Market during the forecast period?

- The market continues to evolve, driven by advancements in engine technologies and emissions control regulations. Exhaust manifolds, an integral component of a car's exhaust system, play a crucial role in directing exhaust gases from engine cylinders to the exhaust ports. These manifolds are typically made of metal, such as cast iron or stainless steel, and are designed to withstand the high temperatures and pressures generated during the combustion process. Manufacturing processes for exhaust manifolds have also evolved, with a focus on improving product durability and reducing weight. Lightweight materials, such as aluminum and titanium, are increasingly being used to create more fuel-efficient automobiles.

- The integration of emissions control technologies, including catalytic converters and particulate filters, has become essential to meet stringent emission standards. High-performance vehicles, such as turbocharged engines, require specialized exhaust manifolds to optimize engine output and reduce back pressure. Simulation tools and advanced material science advancements are being employed to improve thermal conductivity and cooling, ensuring reliable exhaust system performance. The automotive industry's ongoing electrification trend is also influencing the exhaust manifold market. While electric vehicles (EVs) do not require traditional exhaust manifolds, the integration of exhaust gases into the overall energy recovery system is a growing area of research. The evolving market dynamics continue to unfold, with a focus on improving vehicle performance, fuel economy, and reducing environmental impact.

How is this Automotive Exhaust Manifold Industry segmented?

The automotive exhaust manifold industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Passenger car

- Commercial vehicle

- Fuel Type

- Gasoline

- Diesel

- Material

- Cast iron

- Stainless steel

- Others

- Distribution Channel

- OEM

- Aftermarket

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

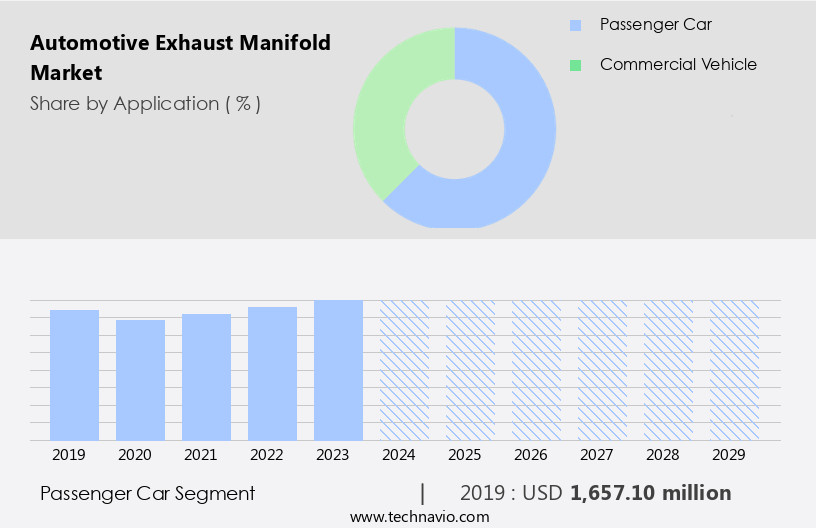

By Application Insights

The passenger car segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing production of fuel-efficient passenger cars in emerging economies. This trend is driven by improving socio-economic conditions, rising income levels, and increasing employment opportunities. In India, for instance, passenger car sales reached approximately 288,000 units in November 2023, a 4.3% increase from the same month the previous year. The demand for SUVs and crossovers continues to be strong, further fueling market growth. Manufacturers are focusing on advancements in material science, such as the use of stainless steel and lightweight materials, to improve exhaust system reliability and product durability.

Additionally, emissions control technologies, including catalytic converters and particulate filters, are becoming increasingly important as stricter pollution laws are enacted. The automotive industry is also witnessing the electrification trend, with electric vehicles (EVs) gaining popularity for their environmental benefits and fuel efficiency. Turbocharged engines and hybrid vehicles are also becoming more common, leading to advancements in manufacturing processes and the development of simulation tools to optimize engine performance and fuel economy. Engine cylinders and exhaust ports are being redesigned to reduce back pressure and improve thermal conductivity, leading to increased engine output and improved vehicle performance. Noise reduction is another key focus area, with manufacturers employing various techniques to minimize exhaust system noise.

In the context of high-performance vehicles, material science advancements are enabling the development of header manifolds and exhaust pipes that provide better cooling and improved exhaust gas flow. These advancements are contributing to the overall growth of the market.

The Passenger car segment was valued at USD 1657.10 million in 2019 and showed a gradual increase during the forecast period.

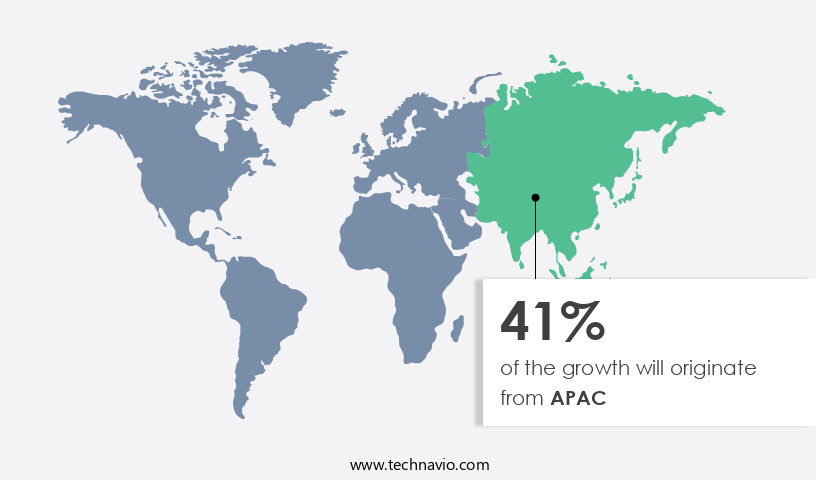

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth due to the increasing demand for fuel-efficient automobiles and stringent emission standards in major automobile markets. In regions such as Asia Pacific, countries like China, Japan, South Korea, India, Malaysia, Indonesia, and Thailand are the major contributors to the market's growth. These countries have the largest share of the global automobile sales, and the implementation of stringent vehicular emission norms in countries like Japan, South Korea, China, and Australia is driving the revenue generation of the market. The demand for passenger vehicles in APAC is on the rise due to improving socio-economic conditions, increasing purchase power parity, and rising disposable income.

This, in turn, is leading to advancements in exhaust system design and components, including the exhaust manifold. The automotive industry is focusing on the development of emissions control technologies, such as catalytic converters and particulate filters, to meet the emission standards. Manufacturing processes for exhaust manifolds are evolving, with a shift towards lightweight materials, such as stainless steel and aluminum, to improve fuel economy and reduce engine weight. Material science advancements are also leading to the development of high-performance exhaust manifolds for high-performance vehicles and turbocharged engines. The focus on noise reduction and back pressure optimization is also driving innovation in the market.

The electrification trend in the automotive industry is also influencing the market. While electric vehicles (EVs) do not require traditional exhaust manifolds, the development of hybrid vehicles is leading to the integration of exhaust manifolds in their powertrains. The market is also witnessing the adoption of simulation tools to optimize exhaust manifold design and improve engine performance. The reliability and product durability of exhaust manifolds are crucial factors in the market. The cooling of exhaust gases and thermal conductivity of exhaust manifold materials are essential to ensure engine economy and prevent damage to the exhaust system. The market is also focusing on the development of header manifolds to improve engine output and performance.

The market is expected to continue its growth trajectory due to the increasing demand for fuel-efficient vehicles, stringent emission standards, and advancements in manufacturing processes and materials. The market is also witnessing the adoption of emissions control technologies and the development of hybrid and electric vehicles, which is expected to create new opportunities for market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Exhaust Manifold Industry?

- The significant expansion in the production volume of passenger vehicles serves as the primary catalyst for market growth.

- The market is significantly influenced by the automobile industry, specifically the production of passenger cars. Exhaust manifolds are essential components in vehicles, facilitating the efficient transfer of exhaust gases from the engine to the exhaust system. In the US, the automotive industry reached a value of over USD83 billion in 2024, with over 16 million new light trucks and passenger cars sold. This market growth is primarily driven by the increasing demand for vehicles, particularly those with turbocharged engines and higher engine output. Moreover, the focus on reducing vehicle emissions, improving fuel economy, and noise reduction has led to advancements in material science and the adoption of header manifolds and simulation tools in the manufacturing process.

- The combustion process in the RPM ranges of these engines generates exhaust gases, necessitating the use of exhaust manifolds. As the auto industry continues to address environmental issues and enhance vehicle performance, the demand for advanced exhaust manifolds is expected to grow.

What are the market trends shaping the Automotive Exhaust Manifold Industry?

- Turbocharged diesel engines are experiencing advancements in exhaust manifold designs, which represents a significant market trend. This innovation aims to enhance engine performance and efficiency.

- The market is experiencing significant trends that are shaping its growth trajectory. One notable trend is the development of advanced exhaust manifold designs for diesel vehicles with turbochargers. These designs enhance engine performance and efficiency by optimizing the flow of exhaust gases. In turbocharged engines, the exhaust manifold plays a crucial role in the overall system's effectiveness. By employing sophisticated design analysis and simulation techniques, market participants are able to create exhaust manifolds that improve engine economy and emission control.

- Additionally, the integration of particulate filters and stainless steel components in exhaust systems is gaining popularity due to stricter pollution laws and consumer demand for cleaner vehicles. The shift towards fuel efficiency and the emergence of electric vehicles (EVs) may also influence the market dynamics in the future. Despite these advancements, reliability and thermal conductivity remain key considerations for manufacturers to ensure the longevity and efficiency of exhaust manifolds.

What challenges does the Automotive Exhaust Manifold Industry face during its growth?

- The development of cracks or leaks in automotive exhaust manifolds poses a significant challenge to the industry's growth, necessitating continuous research and innovation to enhance their durability and efficiency.

- The market faces challenges due to concerns over product durability. Extreme temperatures and continuous stress result in the development of cracks and leakages in the exhaust manifold. When the engine is operational, exhaust fumes can reach temperatures up to 1100 degrees F-1200 degrees F. The component undergoes contraction and expansion with temperature changes, increasing the likelihood of cracks or leaks. These issues have led to recalls, posing a significant market barrier. Lightweight materials, such as aluminum and stainless steel, are being increasingly used to address durability concerns and enhance performance.

- Additionally, emissions control technologies are integrated into exhaust systems to minimize harmful emissions, benefiting both the environment and the automotive industry. Internal combustion engines, including those in automobiles and high-performance vehicles, rely on robust exhaust manifolds to optimize engine efficiency and reduce emissions.

Exclusive Customer Landscape

The automotive exhaust manifold market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive exhaust manifold market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive exhaust manifold market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Benteler International AG - This company specializes in the production of advanced exhaust manifolds, including dual wall designs. These manifolds are available with either air gap or fiber mat insulation, providing superior thermal efficiency compared to traditional cast iron construction. The insulation reduces thermal losses, resulting in improved engine start-up behavior and overall efficiency. Our exhaust manifolds cater to the automotive industry, enhancing vehicle performance and emissions reduction.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Benteler International AG

- BG Products Inc.

- BorgWarner Inc.

- DuPont de Nemours Inc.

- Eberspacher Gruppe GmbH and Co. KG

- EDELBROCK LLC

- ElringKlinger AG

- Friedrich Boysen GmbH and Co. KG

- Futaba Industrial Co. Ltd.

- MAHLE GmbH

- Marelli Holdings Co. Ltd.

- Sango Co. Ltd.

- Sejong Industrial Co. Ltd.

- SHARDA MOTOR INDUSTRIES LTD.

- SPM Autocomp Systems Pvt Ltd.

- Tenneco Inc.

- Yutaka Giken Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Exhaust Manifold Market

- In February 2023, Magna International, a leading automotive supplier, announced the launch of its advanced Exhaust Gas Recirculation (EGR) exhaust manifold for heavy-duty vehicles. This innovative product reduces nitrogen oxide emissions by recirculating exhaust gases back into the engine, thereby improving fuel efficiency and reducing carbon footprint (Magna International Press Release).

- In October 2024, Cummins Inc., a global power leader, and Faurecia, a leading automotive technology company, announced a strategic collaboration to develop and manufacture advanced exhaust aftertreatment systems. This partnership aims to integrate Cummins' aftertreatment technologies with Faurecia's exhaust manifold systems, enhancing overall system performance and reducing emissions (Cummins Inc. Press Release).

- In January 2025, Tenneco Inc., a leading global supplier of automotive technology, completed the acquisition of Federal-Mogul Powertrain, a leading supplier of powertrain components. This acquisition expanded Tenneco's product portfolio, including exhaust manifold systems, and strengthened its position in the global automotive market (Tenneco Inc. Press Release).

- In March 2025, the European Union passed the new Regulation (EU) 2025/2021, which sets stricter emission standards for heavy-duty vehicles. This regulation is expected to drive demand for advanced exhaust manifold systems capable of reducing emissions and improving fuel efficiency (European Parliament Press Release).

Research Analyst Overview

The market is experiencing significant activity as automobile manufacturers prioritize fuel efficiency and emission control in response to stricter pollution laws and growing environmental concerns. The car's exhaust system, including the exhaust manifold, plays a crucial role in optimizing engine economy by efficiently managing exhaust gases and reducing back pressure. Fuel efficient automobiles and high performance vehicles alike are adopting advanced exhaust manifolds, such as header manifolds, to enhance engine output and improve vehicle performance. RPM ranges and cylinder configurations vary among engines, necessitating manifold designs tailored to specific applications. Metal exhaust manifolds, which offer superior heat conductivity and durability, are increasingly popular due to their ability to improve combustion process efficiency and reduce emissions.

Turbocharged engines, which require precise exhaust gas management, are a key growth area for the market. Exhaust ports and emissions control technologies, such as particulate filters, are essential components of modern exhaust systems, ensuring compliance with stringent regulations while minimizing environmental impact. The exhaust pipe and exhaust system as a whole are undergoing continuous innovation to maximize engine performance and minimize emissions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Exhaust Manifold Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

229 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market growth 2025-2029 |

USD 807.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, China, Japan, Canada, India, South Korea, UK, Germany, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Exhaust Manifold Market Research and Growth Report?

- CAGR of the Automotive Exhaust Manifold industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive exhaust manifold market growth of industry companies

We can help! Our analysts can customize this automotive exhaust manifold market research report to meet your requirements.