Singapore Automotive Market Size 2023-2027

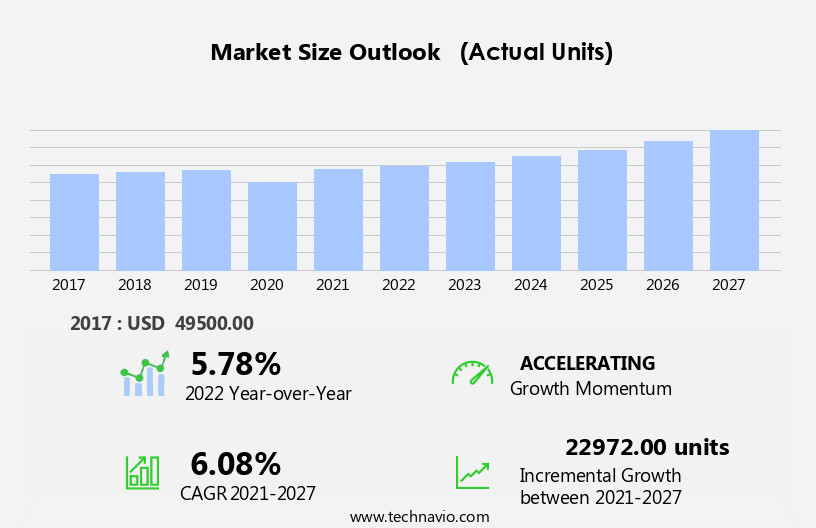

The singapore automotive market size is forecast to increase by 22972.00 units, at a CAGR of 6.08% between 2022 and 2027.

- The market is witnessing significant growth, driven by the increasing demand for fuel-efficient and low-emission vehicles. This trend aligns with the Singaporean government's commitment to reducing carbon emissions and promoting sustainable transportation. Moreover, technological advances in Electric Vehicles (EVs) are gaining traction, offering consumers a more eco-friendly and cost-effective alternative to traditional combustion engine vehicles. However, the market faces a notable challenge: the insufficient charging infrastructure. Despite the growing popularity of EVs, the limited availability of charging stations poses a significant barrier to widespread adoption. Companies seeking to capitalize on this market opportunity must address this challenge by investing in the development of robust charging infrastructure.

- Additionally, collaborating with the government and industry partners to expand charging station networks and promote EV adoption can help businesses navigate this obstacle and establish a strong market presence. Overall, the market presents a strategic landscape ripe with opportunities for companies that can effectively address the challenges and meet the evolving needs of consumers.

What will be the size of the Singapore Automotive Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2017-2021 and forecasts 2023-2027 - in the full report.

Request Free Sample

- In the dynamic Singapore automotive market, innovation drives growth as automakers integrate advanced technologies. Automotive paint hues transform with AI-driven color selection, while driver monitoring systems ensure road safety. Parking assist and climate control systems enhance user experience. Big data analytics optimizes engine performance through fuel injector and engine oil analysis. Emergency braking and lane keeping assist systems employ AI for proactive safety measures. Hydrogen fuel cells and alternative fuels, including fuel cell technology and electric motors, reduce carbon emissions. Adaptive cruise control and blind spot monitoring ensure seamless driving experiences. Vehicle-to-grid (V2G) technology and solid-state batteries power the future of sustainable transportation.

- 3D printing revolutionizes vehicle upholstery production, while lithium-ion batteries and battery cells fuel the rise of electric vehicles. Over-the-air (OTA) updates and power electronics enable real-time vehicle optimization. Traffic sign recognition and digital cockpits offer enhanced connectivity, while audio systems and navigation apps provide personalized in-car entertainment. Head-up displays (HUDs) and smartphone integration keep drivers informed and engaged. Manufacturing automation streamlines production processes, from catalytic converters to power inverters. The Singapore automotive market continues to evolve, embracing the future of transportation.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD units" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- Type

- Hatchback

- Sedan

- SUV

- MPV

- Geography

- APAC

- Singapore

- APAC

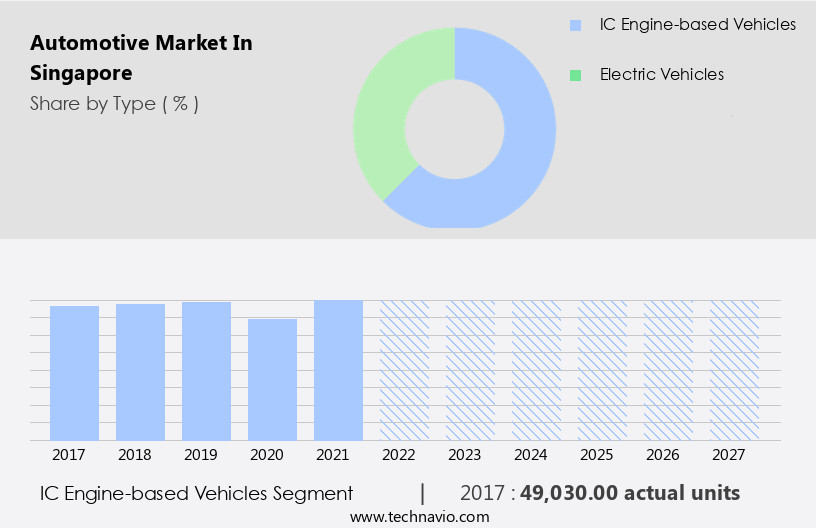

By Type Insights

The hatchback segment is estimated to witness significant growth during the forecast period.

In Singapore's automotive market, hatchbacks are a preferred choice due to their compact size, fuel efficiency, and practicality, making them ideal for city driving. The hatchback segment is highly competitive, with a blend of established global brands and local players vying for market share. Leading automakers offer a diverse range of hatchback models, prioritizing fuel efficiency, performance, and affordability. Environmental consciousness is shaping the hatchback segment in Singapore, with government regulations and consumer preferences driving the shift towards eco-friendly vehicles. As a response, automakers are introducing hybrid and electric hatchback models, offering reduced emissions and lower operating costs compared to traditional Internal Combustion Engine (ICE) vehicles.

Autonomous driving technology is also gaining traction in the market, with autonomous taxis and driverless cars becoming increasingly common. Transmission systems are evolving, with a focus on fuel efficiency and smooth operation for both ICE and electric vehicles (EVs). Navigation systems and infotainment systems are becoming more advanced, offering real-time traffic updates, voice commands, and connectivity features. The use of lightweight materials, such as aluminum alloys and carbon fiber, is on the rise in vehicle manufacturing, contributing to improved vehicle performance and reduced fuel consumption. The market is also witnessing the growth of shared mobility services, car sharing, and ride-hailing platforms, offering flexible and affordable transportation solutions.

The EV market in Singapore is expanding, with battery technology advancements and the availability of charging stations making electric vehicles a viable option for consumers. Renewable energy sources, such as solar and wind, are being integrated into the charging infrastructure, promoting sustainable mobility. Fleet management and supply chain management are becoming more sophisticated, with the adoption of telematics and IoT technologies enabling real-time vehicle monitoring and predictive maintenance. Repair services and aftermarket parts are essential for maintaining vehicle longevity and performance, with many players offering specialized services for different vehicle makes and models. The luxury vehicle segment in Singapore continues to thrive, with a focus on vehicle design, top speed, and advanced features, such as suspension systems, braking systems, and vehicle lighting.

Pick-up trucks and commercial vehicles cater to the logistics and transportation needs of businesses, offering robust performance and versatility. In conclusion, the Singapore automotive market is dynamic and evolving, with a focus on fuel efficiency, sustainability, and advanced technology. The market is witnessing the adoption of electric vehicles, autonomous driving, and shared mobility, while traditional ICE vehicles continue to offer competitive performance and affordability. The market is also witnessing advancements in vehicle design, safety, and maintenance services, ensuring that consumers have access to a diverse range of options to meet their transportation needs.

The Hatchback segment was valued at USD 49030.00 units in 2017 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the vibrant and dynamic the market, car enthusiasts and businesses thrive on the latest trends and innovations. From sleek sedans to powerful sports utility vehicles, the diverse range caters to various preferences and needs. Singapore's Carbon Tax and Certificate of Entitlement (COE) system influence consumer decisions, making fuel efficiency and low emissions a priority. Electric Vehicles (EVs) and Hybrid cars are gaining traction, with advanced charging infrastructure and incentives supporting their adoption. Car rental services, insurance providers, and maintenance centers form a robust ecosystem, ensuring seamless ownership experiences. The market's growth is further fueled by the increasing demand for ride-hailing and car-sharing services, as well as the emergence of autonomous vehicles and connected cars. Singapore's automotive landscape is a testament to its forward-thinking approach, embracing technology and sustainability in the transportation sector.

What are the Singapore Automotive Market drivers leading to the rise in adoption of the Industry?

- The increasing demand for fuel-efficient and low-emission vehicles serves as the primary market driver, as consumers prioritize eco-friendly and cost-effective transportation solutions.

- The market is experiencing significant shifts due to increasing concerns over emissions and fuel efficiency. With the harmful effects of fossil fuel-operated vehicles becoming a global concern, there is a growing demand for low-emission alternatives. This trend is further accentuated by the volatility of oil and gas prices, leading consumers to prioritize fuel-efficient vehicles. As a result, the adoption of electric vehicles (EVs) is on the rise. For instance, the price of gasoline in Singapore increased by approximately 15 cents per liter between July and October 2020. This surge in fuel prices, coupled with the demand for eco-friendly transportation, has compelled both consumers and automotive manufacturers to explore alternatives to gasoline and diesel-powered vehicles.

- Commercial vehicles, including delivery vans and buses, are also transitioning to EVs and alternative fuel sources. Additionally, the development of autonomous taxis and car-sharing services further underscores the market's shift towards sustainable transportation solutions. Transmission systems are evolving to accommodate EVs, with navigation systems becoming increasingly important for optimizing routes and reducing energy consumption. Compact cars are also gaining popularity due to their fuel efficiency and smaller carbon footprint. Automotive financing solutions are adapting to the changing market dynamics, offering flexible financing options for EV purchases. Overall, the market is undergoing a transformation, with a focus on reducing emissions, improving fuel economy, and enhancing the driving experience through advanced technologies.

What are the Singapore Automotive Market trends shaping the Industry?

- The trend in the automotive industry is shifting towards technological advances in Electric Vehicles (EVs). This development is a mandatory movement in the market, reflecting growing consumer interest and demand for more eco-friendly and efficient transportation solutions.

- The market is experiencing significant growth in the electric vehicle (EV) sector, driven by increasing consumer awareness and government incentives. This shift presents new opportunities for various stakeholders, including system integrators, vehicle manufacturers, engine manufacturers, and component providers. However, challenges persist, with high costs and limited range being major concerns. To address these issues, companies are investing heavily in research and development to produce more efficient and cost-effective EV models. Meanwhile, the demand for suspension systems, charging stations, and automotive electronics continues to rise, as consumers seek improved vehicle performance and enhanced infotainment systems. The emergence of shared mobility and micro vehicles further adds to the market dynamics.

- In addition, the aftermarket for EV parts is growing, as consumers look for affordable alternatives to maintain their vehicles. As the market evolves, companies must stay abreast of the latest trends and technologies, such as advanced charging systems and sports car innovations. The adoption of EVs is poised to transform the automotive landscape, and companies that can provide innovative solutions will be well-positioned for success.

How does Singapore Automotive Market faces challenges face during its growth?

- The insufficient development of charging infrastructure represents a significant obstacle to the expansion and growth of the industry.

- The market is experiencing significant growth, particularly in the adoption of advanced technologies such as hybrid vehicles and the use of lightweight materials in vehicle design. However, the lack of electric vehicle (EV) charging infrastructure poses a challenge for consumers, as the demand for EVs is anticipated to rise. The high cost of establishing charging stations is a major hurdle, with an AC level-1 residential charger unit and installation ranging from USD250 to USD1,500. To address this issue, governments and companies must collaborate to provide the necessary infrastructure. Furthermore, the increasing popularity of pick-up trucks and the emphasis on vehicle safety continue to drive market dynamics.

- In addition, the supply chain management of engine components, including the use of steel alloys, is a critical aspect of the industry. The integration of renewable energy sources into the automotive sector is also a growing trend, offering opportunities for innovation and sustainability. Repair services remain an essential part of the market, ensuring the longevity and functionality of vehicles.

Exclusive Singapore Automotive Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aston Martin Lagonda Ltd.

- Bayerische Motoren Werke AG

- Daimler AG

- Ferrari spa

- Honda Motor Co. Ltd.

- Isuzu Motors Ltd.

- Mazda Motor Corp.

- Mitsubishi Electric Corp.

- Porsche Automobil Holding SE

- Renault SAS

- SAIC Motor Corp. Ltd.

- Stellantis NV

- Suzuki Motor Corp.

- Tata Sons Pvt. Ltd.

- TC Changan Singapore Pte Ltd

- Tesla Inc.

- Toyota Motor Corp.

- AB Volvo

- General Motors Co.

- Hyundai Motor Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Market In Singapore

- In January 2024, Singapore's Land Transport Authority (LTA) announced a strategic collaboration with Volvo and Nanyang Technological University (NTU) to develop autonomous buses for the city-state's public transportation system (LTA press release). This partnership marked a significant step towards implementing autonomous vehicles in Singapore's public transport sector.

- In March 2024, Tesla, Inc. Officially launched its Supercharger network in Singapore, marking the electric vehicle (EV) manufacturer's expansion into the Southeast Asian market (Tesla press release). This move was a key development in promoting EV adoption in the country, as Tesla's Superchargers offer faster charging times compared to standard charging stations.

- In May 2024, Singaporean automotive parts manufacturer, Aptiv, and German automaker, BMW Group, announced a joint venture to develop and manufacture electric vehicle (EV) components in Singapore (Aptiv press release). This strategic partnership aimed to strengthen Singapore's position as a global hub for EV technology and production.

- In April 2025, the Singaporean government introduced the Green Plan 2030, which included initiatives to promote the adoption of electric vehicles and reduce the carbon footprint of the transportation sector (Government of Singapore press release). The plan included incentives for EV buyers, such as rebates and waivers, and a commitment to increasing the number of EV charging points in the country.

Research Analyst Overview

The market continues to evolve, with various sectors experiencing dynamic shifts. Commercial vehicles, a key segment, are embracing top speed and lightweight materials, such as aluminum alloys, to enhance fuel efficiency and meet emissions standards. Passenger vehicles exhibit similar trends, with a growing preference for hybrid vehicles and advanced transmission systems. Autonomous taxis and driverless cars are gaining traction, revolutionizing the transportation landscape. Navigation systems and infotainment systems are becoming increasingly sophisticated, while car sharing and ride-hailing services are transforming the way people commute. Pick-up trucks and micro vehicles cater to specific market needs, offering versatility and efficiency. Repair services and maintenance are crucial, with the aftermarket parts industry providing essential support.

Supply chain management and fleet management are optimized through advanced technology and sustainable mobility initiatives. Engine components, including steel alloys and carbon fiber, are essential for vehicle performance and safety. Renewable energy sources, such as charging stations for electric vehicles (EVs), are becoming more prevalent. The used car market remains a significant player, with a focus on vehicle safety and value retention. Innovations in battery technology and vehicle design continue to unfold, pushing the boundaries of EV range and performance. Sustainable mobility and smart city initiatives are shaping the future of the automotive industry in Singapore.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Market in Singapore insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.08% |

|

Market growth 2023-2027 |

22972.00 units |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

5.78 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Singapore

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch