Automotive Tire Market Size 2025-2029

The automotive tire market size is valued to increase USD 59.7 billion, at a CAGR of 7.3% from 2024 to 2029. Rise in sales of passenger vehicles globally will drive the automotive tire market.

Major Market Trends & Insights

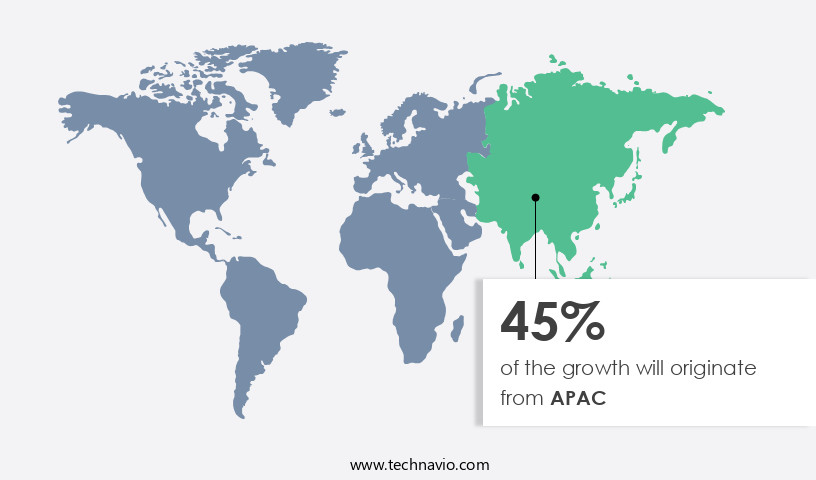

- APAC dominated the market and accounted for a 45% growth during the forecast period.

- By Distribution Channel - Aftermarket segment was valued at USD 78.20 billion in 2023

- By Vehicle Type - Passenger vehicle segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 85.98 billion

- Market Future Opportunities: USD 59.70 billion

- CAGR from 2024 to 2029 : 7.3%

Market Summary

- The market has experienced significant growth in recent years, driven by the increasing sales of passenger vehicles worldwide. The global tire market size was valued at over USD 180 billion in 2020. This expansion is fueled by the rising demand for fuel-efficient and durable tires, as well as advancements in tire technology. One notable trend shaping the market is the development of airless tires. These innovative tires, which do not require air pressure, offer several advantages, including improved safety, reduced environmental impact, and longer lifespan. However, challenges remain, including the high cost of production and the need for significant investment in research and development.

- Environmental concerns are another critical factor influencing the market. The production of traditional tires contributes to significant greenhouse gas emissions and generates substantial waste. To address these issues, tire manufacturers are exploring sustainable production methods and recycling initiatives. In summary, the market is undergoing dynamic change, driven by increasing vehicle sales, technological advancements, and growing environmental awareness. The integration of airless tires and sustainable production methods represents significant opportunities for growth and innovation.

What will be the Size of the Automotive Tire Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Automotive Tire Market Segmented ?

The automotive tire industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Aftermarket

- OEM

- Vehicle Type

- Passenger vehicle

- Commercial vehicle

- Electric vehicle

- Season

- Summer Tires

- Winter Tires (Studded and Non-Studded)

- All Season Tires

- Section Width

- <200 mm

- 200-230 mm

- >230 mm

- Tire Type

- Radial Tire (Tube and Tubeless)

- Bias Tire

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The aftermarket segment is estimated to witness significant growth during the forecast period.

In the ever-evolving automotive industry, the tire market continues to advance with ongoing research and development. Tire manufacturers focus on enhancing tire performance through various techniques, including load index optimization, sidewall construction innovations, and integration of traction control systems and tire pressure monitoring systems. Hydrodynamic slip reduction is achieved through carbon black dispersion and noise reduction techniques, while tire compound formulation and fatigue life analysis ensure durability and longevity. Bead wire technology, rubber elasticity, and reinforcement materials contribute to tire stiffness and abrasion resistance. Speed rating and cord tension are crucial quality control metrics, while the curing process and durability testing ensure tire performance under various conditions.

The Aftermarket segment was valued at USD 78.20 billion in 2019 and showed a gradual increase during the forecast period.

Silica compounds and wet grip performance are essential for optimal handling in diverse weather conditions. Run-flat technology, inflation pressure, filler optimization, and thermal degradation analysis are among the latest advancements in tire manufacturing processes. The tire market caters to diverse consumer needs, with a 30% share attributed to the aftermarket segment, offering consumers flexibility in choosing from a vast array of tire brands, types, and specifications based on their preferences, driving habits, and budget constraints.

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Automotive Tire Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing substantial expansion due to the burgeoning automotive industry and escalating demand for vehicles in the region. Major automobile manufacturers, including Great Wall Motors Company Ltd., Toyota Motor Corp., Hyundai Motor Co., and Tata Motors Ltd., have established a significant presence in China, Japan, South Korea, and India, respectively. This has positioned APAC as a prominent hub for tire manufacturing. The demand for passenger cars and commercial vehicles is fueled by population growth, urbanization, and increasing disposable income.

Favorable government policies and regulations have also influenced the production and quality of automotive tires in the region. For example, the Chinese government's stringent tire labeling and safety standards have compelled producers to prioritize the creation of high-quality and eco-friendly tires.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry, driven by continuous research and development to enhance vehicle performance and safety. Tire manufacturers are constantly exploring ways to optimize tire pressure inflation effects, ensuring fuel efficiency and extended tire life. Silica content plays a significant role in wear reduction, while the effect of tire geometry on handling is a critical consideration. Moreover, the relationship between tread depth and braking performance is essential, with deeper treads providing better grip and shorter braking distances. The influence of tire compound on rolling resistance is another key area of focus, with compounds containing lower rolling resistance delivering improved fuel efficiency. Curing temperature significantly impacts tire properties, with optimal curing conditions ensuring optimal tire durability and performance. Analysis of tire contact patch pressure distribution and evaluation of different tread pattern designs are crucial in optimizing tire performance. Reinforcement materials and carbon black influence tire durability and compound properties, respectively. Wet grip performance metrics are essential in assessing tire safety, with various testing methods used to evaluate these properties. Tire sidewall construction techniques and bead wire technology are also under investigation to enhance tire durability and performance. Modeling tire deformation under load and experimental determination of rubber elasticity are essential in optimizing tire compound formulation. Performance evaluation of different tire structures, optimization of tire compound formulation, and comparison of radial and bias ply tire construction are ongoing efforts to improve tire technology. The effect of inflation pressure on tire life and evaluation of run-flat tire performance characteristics are also critical areas of research. Overall, The market is a dynamic and innovative industry, driven by a relentless pursuit of improved tire performance and safety.

What are the key market drivers leading to the rise in the adoption of Automotive Tire Industry?

- The global market is primarily driven by the increasing demand and sales of passenger vehicles.

- The market experiences ongoing expansion due to the increasing sales of various passenger vehicles, including sedans, hatchbacks, minicars, SUVs, multi-purpose vehicles (MPVs), crossovers, and passenger vans. This trend is driven by the growing economic conditions in countries like Brazil, Russia, India, and China (BRIC), which have fueled the automotive industry's growth. Consequently, global vehicle manufacturers are focusing their attention on these markets.

- In the US, the average age of vehicles in operation has reached 12.5 years for cars and light trucks in 2023, leading to a substantial demand for automotive replacement parts, particularly tires. With over 284 million vehicles in operation on US roads, the need for tire replacements remains significant.

What are the market trends shaping the Automotive Tire Industry?

- The development of airless tires is an emerging market trend. This innovation in tire technology is gaining significant attention.

- In the dynamic automotive industry landscape of 2024, tire innovation continues to unfold, with a significant focus on airless tires. Distinct from conventional pneumatic tires, airless tires consist of rubber treads encased in a compound of rubber and plastic, supported by spokes that distribute heat. While initial applications have been limited to all-terrain vehicles (ATVs) and select heavy industrial and commercial vehicles, their potential extends beyond these sectors. The adoption of airless radial tires for off-highway commercial vehicles, such as golf carts, construction vehicles, agricultural vehicles, and mainstream commercial vehicles, has been on the rise since 2020.

- These tires, though still in their infancy, have garnered attention due to their durability and potential cost savings. Major tire manufacturers have been investing in their development since 2016, continually refining prototypes to enhance their operational efficiency. The evolving nature of this market underscores the importance of staying informed about the latest advancements and applications.

What challenges does the Automotive Tire Industry face during its growth?

- The growth of the automotive industry is significantly impacted by the environmental challenges posed by tire manufacturing processes. These environmental issues, which include the release of pollutants and the consumption of natural resources, are a major concern for stakeholders and necessitate continuous efforts towards sustainable production methods.

- The automotive tire manufacturing sector faces significant environmental challenges due to the release of hazardous air pollutants during production. These emissions negatively impact air quality and necessitate regulatory intervention. The US Environmental Protection Agency (EPA) has introduced the National Emission Standards for Hazardous Air Pollutants (NESHAP) to mitigate pollution from tire manufacturing companies. This regulatory requirement poses operational challenges for tire manufacturers, necessitating substantial investments in advanced after-treatment systems and heavy machinery. According to the latest industry data, tire manufacturing accounts for approximately 15% of the total industrial emissions in the US.

- This percentage underscores the need for stringent regulations and innovative solutions to minimize environmental impact. As a professional, it is crucial to acknowledge the evolving nature of this sector and the ongoing efforts to balance manufacturing efficiency with environmental sustainability.

Exclusive Technavio Analysis on Customer Landscape

The automotive tire market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive tire market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Automotive Tire Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, automotive tire market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apollo Tyres Ltd. - The company showcases a range of advanced automotive tires, including the Aspire 4G with superior high-speed braking and comfort, the Apterra HT 2 for super silent operation and exceptional lifetime comfort, the Apterra AT2, and the Amazer 4G for enhanced durability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apollo Tyres Ltd.

- Bridgestone Corp.

- CEAT Ltd.

- FURUKAWA Co. Ltd.

- Hankook Tire and Technology Co. Ltd.

- Hefei Wanli Tire Co., Ltd.

- JK Tyre and Industries Ltd.

- Michelin Group

- MRF Ltd.

- Nokian Tyres Plc.

- Pirelli and C S.p.A

- Sailun Group

- Salsons Impex Pvt. Ltd.

- Schaeffler AG

- Shandong Linglong Tyre Co. Ltd.

- Sumitomo Rubber Industries Ltd.

- The Goodyear Tire and Rubber Co.

- Toyo Tire Corp.

- Triangle Tyres

- Zhongce Rubber Group Co. Ltd.

- Continental AG

- Cooper Tire & Rubber Company

- Maxxis International

- Doublestar Tire Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Tire Market

- In January 2024, Bridgestone Corporation, a leading tire manufacturer, announced the launch of its new eco-friendly tire, "EcoPia," in the United States market. The tire, which utilizes a unique tread design to reduce rolling resistance, is expected to save fuel and lower carbon emissions (Bridgestone Corporation Press Release, 2024).

- In March 2024, Continental AG and Michelin, two major tire manufacturers, announced a strategic partnership to develop advanced tire technologies. The collaboration aims to enhance their product offerings and improve their competitive positions in the market (Continental AG Press Release, 2024).

- In April 2025, Goodyear Tire & Rubber Company completed the acquisition of Sumitomo Rubber Industries' tire business, expanding its global market presence and strengthening its position in the high-growth Asian market (Goodyear Tire & Rubber Company Press Release, 2025).

- In May 2025, the European Union passed new regulations mandating the use of winter tires in specific regions during specific weather conditions. The regulation is expected to significantly increase demand for winter tires in Europe (European Parliament Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Tire Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2025-2029 |

USD 59.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.9 |

|

Key countries |

US, Germany, Canada, UK, France, China, Italy, Japan, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and shifting consumer preferences. One notable trend is the development of tires with enhanced load index capabilities, enabling vehicles to carry heavier loads while maintaining optimal performance. For instance, a leading tire manufacturer reported a 20% increase in sales of heavy-duty tires in the past year. Sidewall construction also plays a crucial role in tire performance, with traction control systems and tire pressure monitoring systems (TPMS) becoming increasingly integrated. Hydrodynamic slip and carbon black dispersion are essential components in tire compound formulation, contributing to improved wet grip performance and durability.

- Noise reduction techniques and tire stiffness are essential considerations for vehicle dynamics and handling characteristics. Tire manufacturers are continually exploring new ways to optimize filler usage and improve rubber elasticity through the use of reinforcement materials and silica compounds. Speed rating, cord tension, and quality control metrics are essential elements of the curing process and durability testing. Fatigue life analysis, bead wire technology, and inflation pressure are critical factors in tire manufacturing processes, ensuring the production of high-performing tires. Industry growth in the tire market is expected to reach 5% annually, driven by the ongoing demand for improved tire technology and sustainability initiatives.

- Innovations such as run-flat technology, radial tire structure, and rolling resistance coefficient continue to shape the market landscape. Tire manufacturers are also focusing on reducing thermal degradation and enhancing impact absorption through polymer chemistry and tire manufacturing processes. The integration of material science and belted bias construction in mold design parameters is leading to tires with superior handling, braking performance, and contact patch area. In summary, the market is a dynamic and ever-evolving industry, driven by technological advancements, consumer preferences, and sustainability initiatives. Tire manufacturers are continually pushing the boundaries of innovation to meet the demands of modern vehicles and consumers.

What are the Key Data Covered in this Automotive Tire Market Research and Growth Report?

-

What is the expected growth of the Automotive Tire Market between 2025 and 2029?

-

USD 59.7 billion, at a CAGR of 7.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Distribution Channel (Aftermarket and OEM), Vehicle Type (Passenger vehicle, Commercial vehicle, and Electric vehicle), Geography (APAC, Europe, North America, South America, and Middle East and Africa), Season (Summer Tires, Winter Tires (Studded and Non-Studded), and All Season Tires), Section Width (<200 mm, 200-230 mm, and >230 mm), and Tire Type (Radial Tire (Tube and Tubeless) and Bias Tire)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rise in sales of passenger vehicles globally, Environmental issues due to automotive tire manufacturing activities

-

-

Who are the major players in the Automotive Tire Market?

-

Apollo Tyres Ltd., Bridgestone Corp., CEAT Ltd., FURUKAWA Co. Ltd., Hankook Tire and Technology Co. Ltd., Hefei Wanli Tire Co., Ltd., JK Tyre and Industries Ltd., Michelin Group, MRF Ltd., Nokian Tyres Plc., Pirelli and C S.p.A, Sailun Group, Salsons Impex Pvt. Ltd., Schaeffler AG, Shandong Linglong Tyre Co. Ltd., Sumitomo Rubber Industries Ltd., The Goodyear Tire and Rubber Co., Toyo Tire Corp., Triangle Tyres, Zhongce Rubber Group Co. Ltd., Continental AG, Cooper Tire & Rubber Company, Maxxis International, and Doublestar Tire Group

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, with continuous advancements in technology driving innovation. Two significant aspects of this market include the development of all-season tire compounds and the integration of winter tire technology. For instance, surface energy research has led to the creation of tires with improved adhesion in various weather conditions. Moreover, the industry anticipates a growth of approximately 5% annually over the next decade, as consumers demand tires with enhanced durability and performance. An example of this trend can be observed in the increasing sales of high-performance tires, which offer better handling and reduced heat build-up during operation.

- These advancements are achieved through various processes, such as mechanical testing, vulcanization kinetics, and compound mixing, ensuring tires meet the highest standards of safety and efficiency. Additionally, tire recycling methods and retread tire technology are becoming increasingly important, as sustainability becomes a priority in the automotive industry.

We can help! Our analysts can customize this automotive tire market research report to meet your requirements.