Airless Tires Market Size 2024-2028

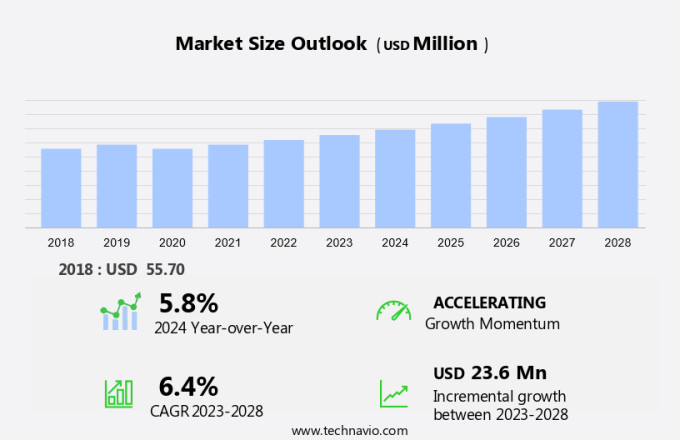

The airless tires market size is forecast to increase by USD 23.6 million at a CAGR of 6.4% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. One major factor is the increasing downtime caused by pneumatic tire pressure issues in heavy industrial applications. Airless tires offer superior pressure distribution, reducing the likelihood of downtime and increasing productivity. Additionally, the tires' extended longevity and durability make them an attractive option for industries such as agriculture, construction, and mining. Another trend in the market is the shift towards more sustainable tire materials and environmentally-friendly initiatives. As sustainability goals become increasingly important, companies are investing in research and development to create eco-friendly tires. This not only reduces the environmental impact of tire production and disposal but also positions companies as industry leaders. Moreover, soil compaction is a significant concern in heavy industrial applications, and airless tires offer a solution. Their unique design distributes weight evenly, reducing soil compaction and improving overall efficiency. Overall, the airless tire market is poised for growth, driven by these key trends and the benefits they offer to industries seeking to increase productivity, reduce downtime, and minimize their environmental footprint.

What will be the Size of the Market During the Forecast Period?

- Non-air tires, also known as airless tires, have gained significant attention in the agriculture industry due to their unique features and benefits. These tires offer a promising solution to the challenges posed by traditional pneumatic tires, particularly in agricultural settings. Efficiency is a crucial factor in modern farming, and non-air tires contribute to this goal by eliminating the need for constant tire pressure monitoring and maintenance. Traditional pneumatic tires require regular attention to maintain optimal pressure levels, which can lead to downtime and decreased productivity. In contrast, non-air tires do not require any maintenance, allowing farmers to focus on their core operations. Reliability is another essential aspect of agriculture, and non-air tires excel in this area. Punctures and leaks, common issues with pneumatic tires, are virtually eliminated with non-air tires. This results in reduced downtime and increased uptime, ensuring that farming operations remain uninterrupted. Drivetrain protection is vital for the longevity of agricultural machinery.

- Additionally, the production of non-air tires consumes fewer resources compared to traditional tires, making them a more environmentally-friendly choice. Soil compaction is a significant concern in agricultural settings, as it can negatively impact nutrient absorption and drainage. Non-air tires offer superior flotation, reducing the pressure exerted on the soil and minimizing compaction. This results in improved yields and healthier crops. Non-air tires are particularly beneficial in rugged terrain, where traditional pneumatic tires can struggle. These tires provide excellent traction and durability, enabling farming operations to continue even in challenging conditions. In conclusion, non-air tires offer numerous advantages in the agriculture industry, including improved efficiency, reliability, drivetrain protection, and environmental sustainability. These benefits make non-air tires an attractive alternative to traditional pneumatic tires, particularly in agricultural settings.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Automotive

- Non-automotive

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- APAC

- Middle East and Africa

- South America

- North America

By Application Insights

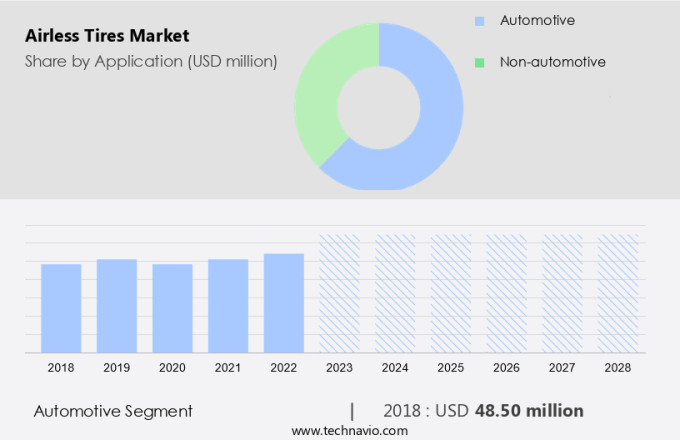

- The automotive segment is estimated to witness significant growth during the forecast period.

Airless tires, an alternative to traditional pneumatic tires, have yet to gain significant traction in the commercial market. Their primary application is in niche industries, such as golf carts and specific industrial vehicles. The reason for this limited adoption lies in their increased rolling resistance and heavier weight compared to standard tires. These characteristics make airless tires less desirable for mainstream passenger cars and commercial vehicles. The automotive sector encompasses off-road vehicles, construction equipment, agricultural machinery, golf carts, commercial vehicles, and others. These vehicles are engineered to endure heavy loads and operate in challenging terrain and weather conditions.

Consequently, their tires are strong and wider than those in conventional vehicles, adding to their overall weight. Furthermore, these vehicles often have extended run times, which further distinguishes them from passenger cars and light commercial vehicles. Airless tires' environmental impact and sustainability goals are essential considerations in today's business landscape. Manufacturers are increasingly focusing on environmentally-friendly initiatives, and airless tires offer several advantages. For instance, they eliminate the need for tire inflation, reducing downtime and maintenance costs. Additionally, their longevity is superior to that of pneumatic tires, as they are not susceptible to punctures or leaks. Tire materials used in airless tires are also being researched and developed to minimize their environmental footprint.

Get a glance at the market report of share of various segments Request Free Sample

The automotive segment was valued at USD 48.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

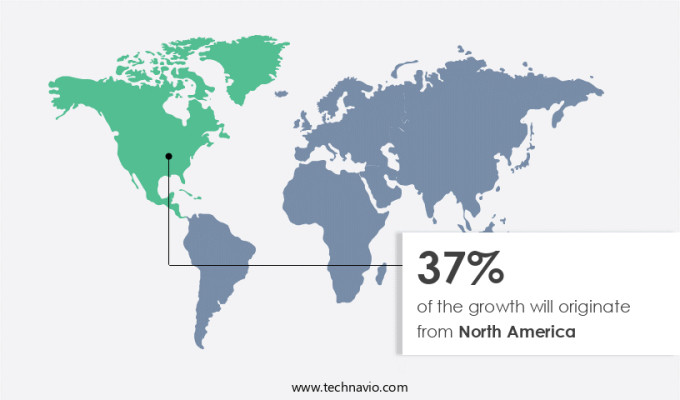

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the North American market, airless tires are gaining significant attention due to their benefits such as zero downtime and smooth ride. Engineers have been developing non-pneumatic tires as an alternative to traditional pneumatic tires for various applications. The US military and law enforcement agencies are major consumers of these tires due to their need for puncture-resistant and durable tires. For instance, Polaris, a leading manufacturer, offers airless tires for motorized golf carts and lawnmowers. Additionally, the company has developed airless tires for heavy equipment like backhoes, suitable for high-risk puncture areas. The extensive road infrastructure in North America makes it an ideal region for the adoption of airless tires in the automotive industry, ensuring efficient road logistics and reducing the need for frequent tire replacements.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Airless Tires Market?

The rising adoption of ATVs in agriculture sector is the key driver of the market.

-

The market is witnessing a shift towards airless mobility solutions, with cars and trucks being the primary focus. Airless mobility is an innovative technology that eliminates the need for air pressure in tires, addressing concerns related to debris and weight distribution. This solution is particularly beneficial for passenger vehicles, as it enhances safety and durability. However, the implementation of airless tires in autonomous vehicles poses certain hurdles, including the need for extensive research and development. The utility of airless tires extends beyond traditional vehicles, as they can also be employed in various industries, such as agriculture. In this context, all-terrorain vehicles (ATVs) are a popular choice for agricultural activities. These vehicles are essential for transporting people and light loads on rugged terrain, often inaccessible for pickup trucks. Consequently, the high utility of ATVs in agricultural locations, including orchards, forests, ranches, ornamental nurseries, and farms, underscores their significance in this sector. The agricultural industry's growth is fueled by factors such as the adoption of high-yielding crops, improved irrigation facilities, and support from local government organizations.

This, in turn, drives the demand for agricultural machinery, including vehicles. By addressing the challenges associated with traditional tires, airless tires offer a promising solution for enhancing the efficiency and productivity of agricultural operations. In conclusion, the global automotive sector, including passenger vehicles and industrial applications, stands to benefit significantly from the adoption of airless tires. The technology's potential to improve safety, durability, and efficiency, particularly in agriculture, positions it as a key trend to watch in the coming years. Despite the hurdles, the future of airless tires looks promising, with ongoing research and development efforts aimed at overcoming challenges and unlocking their full potential. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Airless Tires Market?

The development of eco-friendly tires is the upcoming trend in the market.

- The tire industry is facing growing concerns over the environmental impact of traditional pneumatic tires, which are commonly manufactured using high-aromatic oils derived from oil refineries. These oils contribute to environmental pollution during the tire manufacturing process. In response, there is a rising demand for non-air tires, also known as airless tires, which use pure rubber compounds and low-aromatic oils. The efficiency and reliability of airless tires make them an attractive alternative to traditional pneumatic tires, which are prone to punctures and leaks.

- In the agriculture sector, where heavy machinery operates in challenging terrains, airless tires offer a significant advantage due to their durability and maintenance-free design. As manufacturers continue to prioritize sustainability and reduce their carbon footprint, the market for non-air tires is expected to grow steadily. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does Airless Tires Market face during the growth?

High penetration of pneumatic tires is a key challenge affecting the market growth.

- Airless tires, an alternative to traditional pneumatic tires, are gaining attention from automobile manufacturers, with companies like Local Motors integrating them into their innovative vehicles, such as the Olli shuttle. However, the adoption of airless tires in the US market faces performance targets that must be met. These targets include load capacity, speed, and durability, which airless tires must match or exceed compared to pneumatic tires. Although pneumatic tires have been the industry standard for decades, their reliability and maintenance are significant advantages. Pneumatic tires are less prone to tire blowouts and offer a wide range of maintenance services, many of which can be performed by vehicle owners themselves.

- In contrast, airless tires require expert servicing, leading to higher maintenance costs. Despite these challenges, the shift towards airless tires may become a necessity due to their potential benefits, such as increased safety, reduced environmental impact, and longer lifespan. However, extensive research and development are required to address the technical challenges and meet the performance targets for airless tires to become a viable alternative to pneumatic tires in the US market. In conclusion, while the transition to airless tires may not occur overnight, the potential benefits and advancements in technology make them an intriguing prospect for the future of the automotive industry in the United States.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amerityre Corp

- Bridgestone Corp.

- Cheng Shin Rubber Ind. Co. Ltd.

- Continental AG

- Cooper Tire and Rubber Co.

- Evolution Wheel

- GRI Tires

- Hankook Tire and Technology Co. Ltd.

- Marathon Industries inc.

- McLaren Industries

- Michelin Group

- Pirelli and C S.p.A

- Resilient technologies Pvt. Ltd.

- Sumitomo Rubber Industries Ltd.

- Tannus America LLC

- The Goodyear Tire and Rubber Co.

- Toyo Tire Corp.

- Trelleborg AB

- Yokohama Rubber Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

In the realm of transportation, the shift towards efficiency and sustainability is gaining momentum, particularly in agriculture where non-air tires are making waves. Traditional pneumatic tires, with their reliance on air pressure for functionality, present challenges such as punctures and leaks, leading to unwarranted downtime. In contrast, non-air tires, also known as airless tires, offer reliability and longevity, making them an attractive alternative. Engineers have been exploring tire materials and designs to optimize pressure distribution and minimize soil compaction in agricultural settings. Initiatives like the Galileo wheel, Iricup, and the bidirectional structure of Olli Shuttle are spearheading this movement.

Furthermore, these airless tires promise zero downtime, smooth ride, and environmental benefits, aligning with sustainability goals. Consumers, particularly in the automotive industry, are increasingly interested in airless mobility solutions for cars and trucks. However, mainstream use of these tires faces hurdles, including performance targets related to load, speed, and durability. Debris and weight distribution are other factors under consideration. Autonomous vehicles, such as those by Local Motors and Rinspeed, are also exploring the potential of airless tires to enhance their capabilities. Overall, the market is poised for growth, driven by the need for reliable, efficient, and environmentally-friendly transportation solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market Growth 2024-2028 |

USD 23.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.8 |

|

Key countries |

US, Germany, France, Canada, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch