Autonomous Delivery Robots Market Size 2024-2028

The autonomous delivery robots market size is forecast to increase by USD 29.22 billion at a CAGR of 22.2% between 2023 and 2028.

- Autonomous delivery robots have gained significant traction in various industries, driven by the increase in e-commerce sales and the increasing focus on reducing carbon footprints. The global market for autonomous delivery robots is expected to witness substantial growth, as organizations adopt these technologies to streamline their supply chain operations and enhance customer experience. The market is witnessing significant growth as businesses seek to optimize their logistics operations and enhance customer experience. However, challenges such as malfunctioning of robots due to technical glitches and navigational complexities persist, which need to be addressed to ensure the widespread adoption of these robots. Events like product launches, partnerships, and collaborations continue to shape the market dynamics, with key locations, including urban areas and campuses, witnessing high demand for these robots. Overall, the market is poised for strong growth, driven by these trends and challenges.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth as businesses seek to optimize their logistics operations and enhance customer experience. This market is driven by the integration of advanced technologies such as social networks, recommendation engines, graph databases, and visualization in the development of these robots. Social networks are playing a crucial role in the market by enabling real-time communication between logistics professionals and their customers. Recommendation engines are used to analyze customer data and suggest optimal delivery routes, ensuring timely and accurate deliveries. Graph databases are another key technology that is transforming the market.

- Furthermore, with the property graph model, these databases allow for efficient data modeling and management, enabling quick identification of vertices, edges, labels, and indexes. This is essential for long tasks such as route optimization and warehouse management. Data centers and cloud regions are also critical components of the market. Real-time analytics and stored procedures are used to process large volumes of data and provide insights into business processes. This information is crucial for optimizing delivery routes and managing inventory levels. Despite the numerous benefits, the market faces challenges due to the lack of standardization. Programming ease and the need for customization are major concerns for logistics professionals.

How is this market segmented and which is the largest segment?

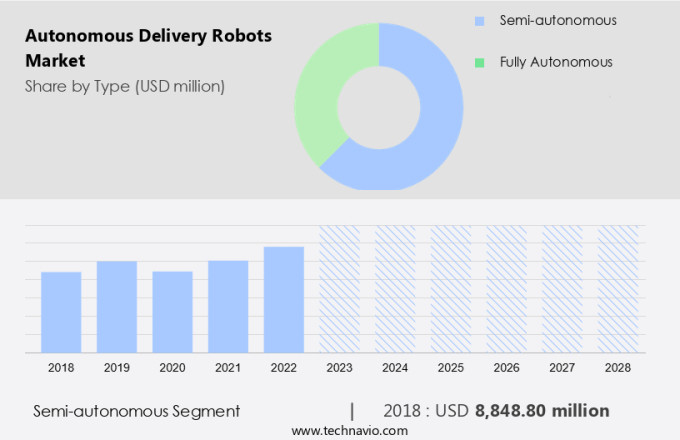

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Semi-autonomous

- Fully autonomous

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- APAC

- Middle East and Africa

- South America

- North America

By Type Insights

- The semi-autonomous segment is estimated to witness significant growth during the forecast period.

Semi-autonomous delivery robots are revolutionizing the logistics industry by offering a blend of automation and human intervention. These robots, which can be controlled remotely from a central command center, require minimal human input to complete tasks. Companies like Postmates and Marble are leading the charge in this space. The user-friendliness of these robots is a significant advantage, with touchscreens and additional functions such as a help button for customers. Human intervention ensures safety and reliability, making these robots a preferred choice over fully autonomous counterparts. Real-time location monitoring allows for remote path adjustments, ensuring efficient delivery. As the logistics sector continues to evolve, the adoption of semi-autonomous delivery robots is poised to increase, offering benefits in data management, medical information, and disease surveillance.

Get a glance at the market report of share of various segments Request Free Sample

The semi-autonomous segment was valued at USD 8.85 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

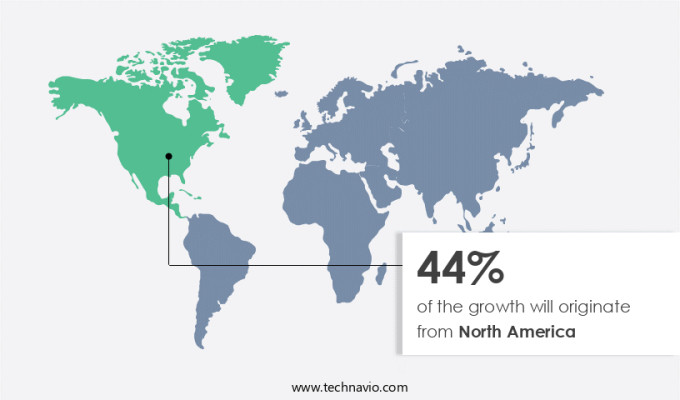

- North America is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the market, North America holds a significant portion due to escalating last-mile delivery expenses and the expanding utilization of delivery robots within the retail sector. Advanced robotics technology developments and the integration of advanced technologies like machine learning (ML) are propelling market growth in this region. Governmental bodies in North America are actively funding research and development initiatives, particularly in robotics, defense projects, and economic sectors, which is further fueling the market's expansion.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Autonomous Delivery Robots Market?

Growth in e-commerce industry is the key driver of the market.

- The market is experiencing significant growth due to the expansion of the e-commerce sector worldwide. The increasing Internet connectivity in emerging economies, such as India and China, has fueled the growth of e-commerce businesses, particularly during the COVID-19 pandemic. This trend has enabled manufacturers and retailers to directly reach consumers, leading to a increase in demand for on-time and high-quality product delivery.

- In response, e-commerce platforms are offering same-day delivery services and other quick shipping options to retain customers. Advanced data modeling and analytics tools are being employed by companies to optimize delivery routes and improve efficiency.

What are the market trends shaping the Autonomous Delivery Robots Market?

Growing focus on reducing carbon footprint is the upcoming trend in the market.

- The transportation sector, accounting for approximately 14% of global greenhouse gas emissions, is a significant contributor to the rise in carbon emissions since the late 1900s. According to the United States Environmental Protection Agency (EPA), over 95% of the world's transportation energy comes from petroleum-based fuels, primarily gasoline and diesel. Commercial vehicles (CVs), which generate a higher amount of nitrogen oxide than passenger vehicles, are a major source of these emissions. Many CVs use diesel engines, which emit a high level of particulate matter, a harmful pollutant. In response to these environmental concerns, the market for Autonomous Delivery Robots is gaining traction as a potential solution.

- Furthermore, these robots can reduce carbon emissions by optimizing delivery routes, reducing the number of vehicles on the road, and utilizing renewable energy sources for power. Events such as the increasing adoption of e-commerce and the need for contactless delivery during the pandemic have further accelerated the growth of this market.

What challenges does Autonomous Delivery Robots Market face during the growth?

Malfunctioning of robots is a key challenge affecting the market growth.

- Autonomous Delivery Robots (ADRs) have gained significant attention in recent years due to their potential to revolutionize the logistics industry. However, the use of these robots comes with certain concerns, particularly regarding safety and security. Malfunctions or intentional attacks on ADRs can pose risks to people and places in their vicinity.

- Moreover, external threats, such as theft and cyberattacks, are a major concern, as are internal vulnerabilities, such as unencrypted control communications, authentication issues, and insufficient authorization. These weaknesses can allow hackers to manipulate the firmware of ADRs, potentially leading to harmful consequences. The integration of technologies like GPS and cameras in ADRs further increases their susceptibility to attacks. It is crucial for manufacturers and stakeholders to address these security challenges and ensure the safe and reliable operation of ADRs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ANYbotics

- Boston Dynamics Inc.

- Caterpillar Inc.

- Effidence

- Elip Ort

- European Space Agency

- JD.com Inc.

- Kiwibot

- Locus Robotics Corp.

- Lowpad BV

- Nuro Inc.

- ON Semiconductor Corp.

- Piaggio and C. Spa

- Quantum Robotics

- Relay Robotics Inc.

- Segway Robotics

- Shanghai Gaussian Automation Tech. Dev. Co. Ltd.

- Starship Technologies Inc.

- Wonik Robotics Co. Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Autonomous delivery robots have gained significant attention in various industries, including logistics and finance, due to their ability to streamline operations and enhance efficiency. These robots utilize advanced data modeling and real-time analytics to optimize delivery routes, minimize bottlenecks, and improve shipment tracking. In the logistics industry, they have been implemented to manage warehouses and streamline the movement of goods between places and people. Think tanks and organizations have been leveraging big data and fraud detection tools to analyze the performance of these robots and ensure their smooth integration into existing systems. In the finance industry, they have been used to transport sensitive financial information between locations, enhancing security and reducing the risk of data breaches.

Moreover, autonomous delivery robots have found applications in the medical industry for transporting medical supplies and information, as well as in disease surveillance. Data management and warehouse management services have also been optimized with the help of these robots, enabling logistics professionals to make informed decisions in real-time. Component services play a crucial role in the maintenance and repair of these robots, ensuring their continued performance and reliability. Advanced analytics tools are used to monitor their performance and identify any potential issues, enabling proactive maintenance and reducing downtime.

The Autonomous Delivery Robots Market is experiencing significant growth due to technological advances in delivery technology. This market encompasses the use of drones, self-driving cars, and small-sized delivery vehicles for transporting food, groceries, medicines, trade goods, and other cargo. The evolving industry is revolutionizing food delivery, enabling the seamless transportation of beverages, retail items, documents, and last-mile deliveries. Human delivery operators are being replaced by autonomous robots, including drones and self-driving vehicles, which utilize satellite navigation systems, computer vision, radars, and ultrasonic sensors for precise location and delivery. The food sector is a major driver of this market, with trends in food, new flavors, and popular tastes being forecast using ML machine learning and workflows.

Independent delivery services, ridesharing services, and traditional players like the dabbawalas of Mumbai, who use tiffins for transporting food, are adopting autonomous delivery robots to streamline their operations and improve efficiency. The use of autonomous vehicles, such as self-driving cars, in cargo shipping is also gaining traction, offering cost savings and faster delivery times. In conclusion, the Autonomous Delivery Robots Market is an exciting and rapidly evolving industry that is transforming the way we transport goods, from food and groceries to trade goods and documents. With technological advances in delivery technology, including drones, self-driving cars, and smartphones, the future of delivery is autonomous and efficient.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 22.2% |

|

Market growth 2024-2028 |

USD 29.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.8 |

|

Key countries |

US, Germany, France, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch