Aviation Battery Market Size 2024-2028

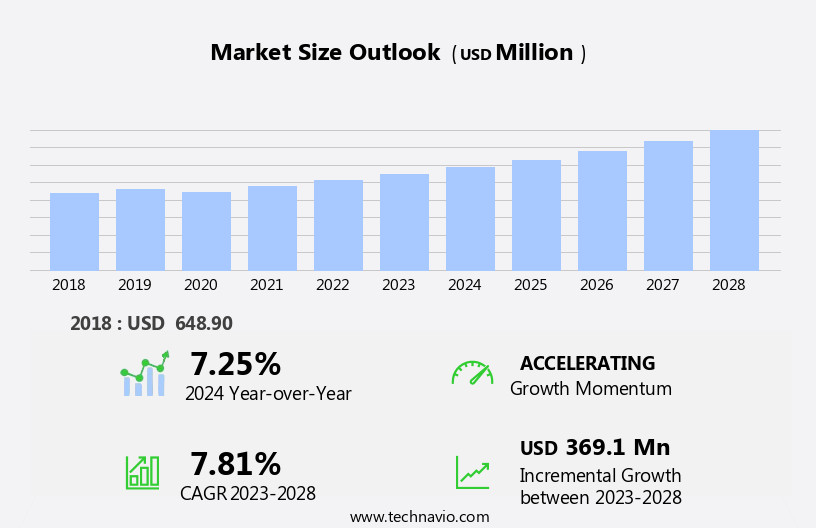

The aviation battery market size is forecast to increase by USD 369.1 million at a CAGR of 7.81% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand for air transport and the declining prices of Lithium-ion batteries. These batteries have become the preferred choice for powering aircraft due to their high energy density, lightweight, and long life cycle. However, the market is not without challenges. Competition from fuel cells, which offer similar benefits but with the added advantage of producing zero emissions, is intensifying. This competition is pushing battery manufacturers to innovate and improve their products to remain competitive. Additionally, safety concerns and stringent regulations surrounding the use of batteries in aviation applications continue to pose challenges.

- Companies seeking to capitalize on this market opportunity must focus on developing safe, efficient, and cost-effective batteries that meet regulatory requirements and address the evolving needs of the aviation industry. By staying abreast of market trends and addressing these challenges, players in the market can position themselves for long-term success.

What will be the Size of the Aviation Battery Market during the forecast period?

- The electrical energy shift in the aviation industry is driving significant growth in the use of electric engines and auxiliary power units (APUs). Sustainable operations are increasingly prioritized, with APUs providing electrical solutions for aircraft during preflight and on the ground. Safety remains a top concern, leading to the adoption of electronic controls and advanced battery technologies, such as high-energy-density battery options. Airplane noise is another area of focus, with efforts to reduce it through the implementation of electric engines and APUs. The aviation industry's efforts to minimize carbon emissions and contribute to a sustainable planet are also fueling the demand for electrical energy alternatives.

- Unmanned aircraft systems (UAS) are further expanding the market for aircraft batteries. Chemical energy, in the form of batteries, plays a crucial role in powering aircraft systems. Jet engines continue to dominate the aviation landscape, but the trend towards electrification is gaining momentum. The electrical system's importance in managing various aircraft functions, from hydraulic controls to electronic systems, is increasing. The market for aircraft batteries is expected to grow steadily, as the industry embraces electrical energy and seeks to minimize environmental impact. The integration of electrical energy into aircraft systems will bring about a more efficient, quieter, and greener aviation sector.

How is this Aviation Battery Industry segmented?

The aviation battery industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Battery Type

- Nickel-based batteries

- Lithium-based batteries

- Lead-based batteries

- Distribution Channel

- OEM

- Aftermarket

- Geography

- North America

- US

- Europe

- Russia

- Middle East and Africa

- APAC

- China

- Japan

- South America

- Rest of World (ROW)

- North America

By Battery Type Insights

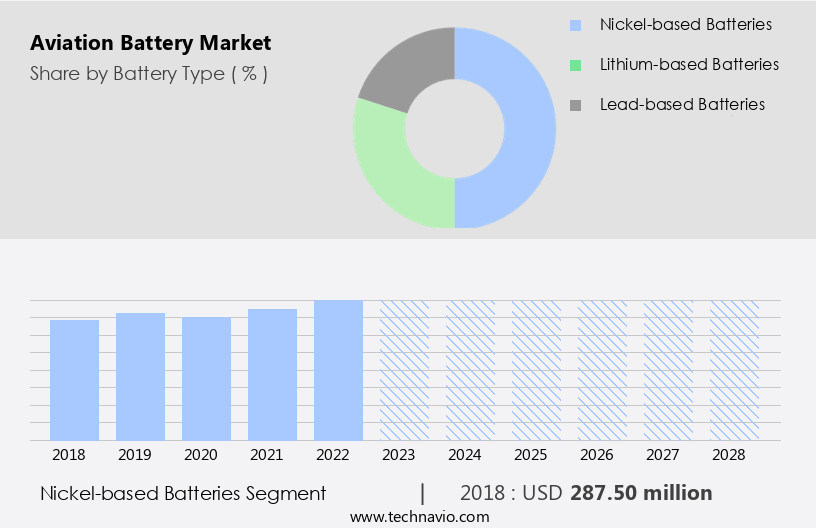

The nickel-based batteries segment is estimated to witness significant growth during the forecast period.

The Aircraft Battery Market encompasses various types of batteries, including Nickel-Cadmium (Ni-Cd) and Nickel Metal Hydride (NiMH) batteries. The Ni-Cd segment is projected to expand substantially during the forecast period. Ni-Cd batteries possess a lower self-discharge rate than NiMH batteries, making them more popular. They offer reliability, minimal maintenance requirements, and a wide temperature range, making them suitable for diverse aircraft applications. Saft Groupe SA (Saft) is a leading manufacturer of Ni-Cd batteries for the aviation industry. However, these batteries necessitate regular maintenance to ensure longevity. A Ni-Cd battery consists of a metallic casing housing multiple individual cells.

This battery type is known for its robustness and extensive use in the aviation sector. Despite their advantages, Ni-Cd batteries are being gradually replaced by high-energy-density battery options like Lithium-ion batteries due to their superior energy-to-weight ratio and longer service life. The aviation industry is actively exploring sustainable solutions to address climate change and reduce emissions. Electric aircraft, including eVTOLs and hybrid aircraft, are gaining popularity due to their potential to decrease carbon dioxide emissions and contribute to a pollution-free future. Lightweight battery systems, such as those made of Silver Aluminum, are essential components of these emerging aircraft types.

The Aircraft Battery Industry is evolving, with electric engines and electrical systems becoming increasingly integral to aircraft technologies. Electric planes, like those manufactured by Zunum Aero, are being developed to enhance operational efficiency and reduce fuel consumption. These advancements are paving the way for a more sustainable aviation sector. The global aircraft fleet is transitioning towards electric and hybrid aircraft, necessitating the development of advanced battery systems. The Aircraft Battery Market is expected to witness significant growth as a result of this trend. Electric aircraft manufacturers, such as Eagle Picher Technologies, are at the forefront of this innovation, providing high-energy-density battery systems to power these new aircraft.

In summary, the Aircraft Battery Market is experiencing dynamic growth as the aviation industry shifts towards more sustainable and electric aircraft. Ni-Cd batteries, while reliable and widely used, are being replaced by high-energy-density battery options like Lithium-ion batteries. The transition towards electric and hybrid aircraft is driving the demand for advanced battery systems, making the Aircraft Battery Industry a crucial player in the aviation sector's evolution.

Get a glance at the market report of share of various segments Request Free Sample

The Nickel-based batteries segment was valued at USD 287.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

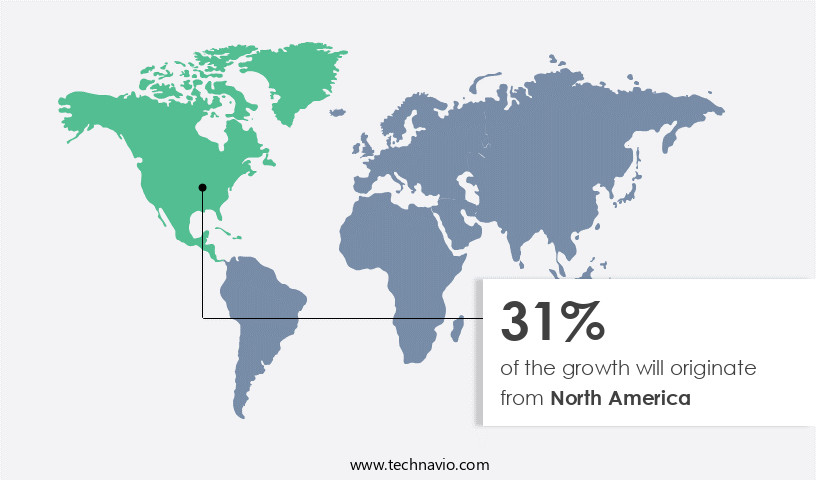

North America is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The aviation industry in the Americas is witnessing significant advancements in the field of aviation batteries, driven by the large aircraft fleet, particularly in the US, and the increasing global demand for new aircraft. This region is home to technologically advanced countries and mature markets, enabling the development of high-performance batteries for various applications. The aerospace sector in the Americas is highly competitive, with major OEMs like Boeing leading the way in the development and production of electric and hybrid aircraft. These innovations aim to address the challenges of reducing emissions, improving operational efficiency, and enhancing safety. In the commercial aviation sector, electric and hybrid aircraft are gaining traction as they offer several advantages, including lower fuel consumption, reduced noise levels, and improved sustainability.

Electric systems, such as electric engines and electronic controls, are being integrated into aircraft as integral components to support these advancements. Military aviation is also embracing the trend towards electrification, with the need for backup power supplies and lightweight, high-energy-density battery options becoming increasingly important. Lithium-ion batteries are popular choices due to their high energy-to-weight ratio and low resistance properties, while Silver Zinc batteries offer high energy density for specific applications. The emergence of eVTOLs (electric vertical takeoff and landing aircraft) and unmanned aerial vehicles (UAVs) is further fueling the demand for aviation batteries. These emerging aircraft types require electrical energy storage solutions to power their electrical systems and ensure optimal safety during flight operations.

The aviation industry's efforts to reduce emissions and contribute to a pollution-free future are also driving the growth of the aircraft battery market. Companies are investing in research and development to create lightweight battery systems with enhanced conductivity and longer service life to meet the evolving needs of the industry. In summary, the market in the Americas is experiencing substantial growth due to the increasing demand for electric and hybrid aircraft, the need for backup power supplies in military aviation, and the emergence of new aircraft types. The region's mature markets and technologically advanced countries are providing a fertile ground for innovation and growth in this sector.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Aviation Battery Industry?

- Increasing demand for air transport is the key driver of the market.

- The market has experienced notable growth in recent years due to the surge in air travel demand and the increasing reliance on air freight transportation. According to the latest research, air traffic grew by approximately 36.9% in 2023 compared to the previous year, fueling the need for more aircraft worldwide. Emerging economies, such as India and China, are leading this growth.

- Additionally, the trend of globalization has led to a substantial increase in air freight transportation, further driving the demand for aviation batteries. These batteries are essential for powering various aircraft systems, including auxiliary power units and starting systems. The market is anticipated to continue its upward trajectory during the forecast period, providing significant opportunities for companies.

What are the market trends shaping the Aviation Battery Industry?

- Declining prices of Li-ion batteries is the upcoming market trend.

- Li-ion batteries have gained significant traction in the global aviation industry due to their superior energy density and performance advantages. These rechargeable batteries are increasingly preferred over traditional Ni-Cd batteries in both commercial and military applications. The advantages of Li-ion batteries, including low maintenance, long life, lightweight, and high energy storage potential, make them an ideal choice for aviation battery needs. Despite their higher cost compared to lead-acid and NiMH batteries, the manufacturing cost of Li-ion batteries has been declining steadily due to increased production scale and manufacturing efficiency. This cost reduction trend is expected to continue, making Li-ion batteries increasingly affordable for aviation applications.

- Li-ion batteries offer several benefits over other battery technologies, making them a preferred choice for aviation battery requirements. Their high energy density, low self-discharge rate, and long cycle life contribute to their growing popularity. The market is expected to grow significantly due to the increasing adoption of Li-ion batteries in the industry.

What challenges does the Aviation Battery Industry face during its growth?

- Competition from fuel cells is a key challenge affecting the industry growth.

- Fuel cells serve as an efficient and non-polluting energy solution for converting stored chemical energy into electricity. This process, which involves electrochemical reactions rather than combustion, offers numerous advantages in civil aviation. Fuel cells, capable of supplying power to an aircraft's electrical system as an auxiliary power unit, have gained recognition as potential energy providers. Despite their high cost, companies are investing in research and development to create more affordable fuel cells.

- The electrochemical conversion process ensures a cleaner and more efficient energy source compared to traditional fuel combustion methods. By harnessing the power of fuel cells, the aviation industry can make significant strides towards reducing its carbon footprint and improving overall operational efficiency.

Exclusive Customer Landscape

The aviation battery market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aviation battery market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aviation battery market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aerolithium Aviation Batteries - The company specializes in advanced aviation battery solutions, including Aerolithium Lithium technology and experimental backup batteries, delivering superior performance and reliability for the aviation industry. Our offerings cater to the unique power requirements of aircraft, ensuring optimal efficiency and safety. With a commitment to innovation, we continuously explore emerging technologies to enhance our product portfolio and meet the evolving needs of our clients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aerolithium Aviation Batteries

- Amprius Technologies Inc.

- BAE Systems Plc

- Concorde Battery Corp.

- Customcells Itzehoe GmbH

- EaglePicher Technologies LLC

- EnerSys

- GS Yuasa International Ltd.

- HBL Power Systems Ltd.

- MarathonNorco Aerospace

- Marvel Aero International Inc.

- Meggitt Plc

- Mid Continent Instrument Co. Inc.

- Northrop Grumman Corp.

- Sichuan Changhong Electric Co. Ltd.

- Sion Power Corp.

- Teledyne Technologies Inc.

- Thales Group

- The Boeing Co.

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The aviation industry is witnessing a significant shift towards electrical solutions as a means to reduce carbon dioxide emissions and improve operational efficiency. One of the key components driving this trend is the advancement of Electric Vertical Takeoff and Landing (EVTOL) vehicles and emerging aircraft types, which require high-performance batteries with a high energy-to-weight ratio. The demand for lightweight battery systems with enhanced conductivity and longer service life is on the rise in the aircraft battery market. Traditional lead-acid batteries, while reliable, have limitations in terms of energy density and weight. As a result, alternative battery technologies such as lithium-ion, silver zinc, and nickel metal hydride are gaining popularity.

The importance of electrical energy in aircraft applications extends beyond propulsion systems. Electronic controls, auxiliary power units (APUs), and emergency backup supplies all rely on electrical energy. The need for longer service intervals and optimal safety is driving the development of vented batteries and high-energy-density battery options. The aviation industry's efforts towards sustainable air travel and reducing emissions have led to the electrification of aircraft, from UAVs to commercial and military aircraft. However, the integration of these electrical systems into existing aircraft designs presents challenges. For instance, the weight of batteries and their impact on fuel burned, as well as the need for frequent replacement requirements, are critical considerations.

Battery materials, such as cells and electrolytes, play a crucial role in the performance and safety of aircraft batteries. The extreme temperatures encountered in aviation applications, from extreme heat to extreme cold, pose unique challenges for battery manufacturers. The global aircraft fleet is evolving, with more electric aircraft, hybrids, and electric systems being developed. The aircraft battery industry is responding with innovative battery technology and design, including lithium oxyhalide, nickel cadmium, and mixtures of solvents. The importance of battery technology in aviation extends beyond traditional aircraft applications. For instance, the Orion crew module and Artemis I spacecraft rely on batteries for power.

The integration of electrical systems into aircraft design is also driving the development of portable battery systems for on-ground operations. The use of batteries in aviation applications is not without challenges. Safety concerns, such as the risk of shorts out and electrolyte leakage, must be addressed. Additionally, the impact of battery technology on aircraft noise levels and emissions is an area of ongoing research. The aviation industry's commitment to sustainable operations and a pollution-free future is driving the development of advanced battery systems. The challenge lies in balancing the need for high energy density, low maintenance cost, and optimal safety in a market where specifications are constantly evolving.

In conclusion, the market is a dynamic and evolving industry, driven by the need for high-performance batteries with a high energy-to-weight ratio. The integration of electrical systems into aircraft design is presenting new challenges and opportunities for battery manufacturers. The focus on sustainability, operational efficiency, and safety will continue to drive innovation in this field.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.81% |

|

Market growth 2024-2028 |

USD 369.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.25 |

|

Key countries |

US, China, Russia, Japan, and Israel |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Aviation Battery Market Research and Growth Report?

- CAGR of the Aviation Battery industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the aviation battery market growth of industry companies

We can help! Our analysts can customize this aviation battery market research report to meet your requirements.