Middle East Aviation Market Size 2025-2029

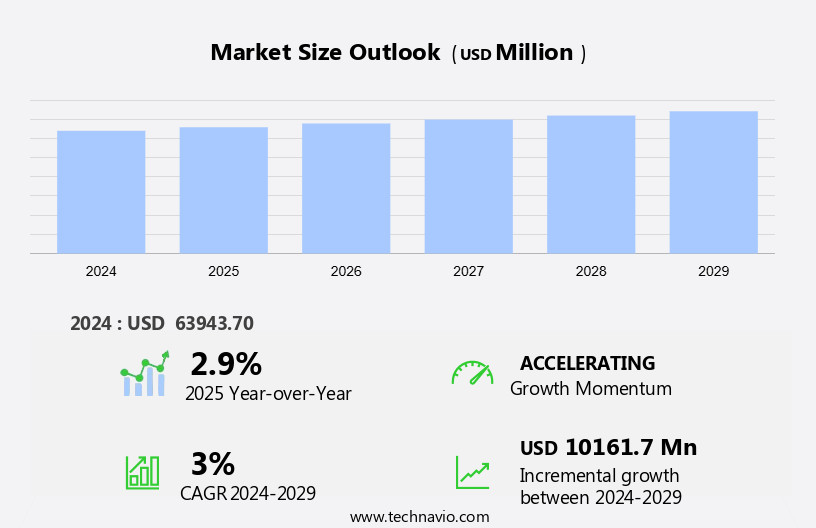

The Middle East aviation market size is forecast to increase by USD 10.16 billion at a CAGR of 3% between 2024 and 2029.

- The aviation market in the Middle East is witnessing significant growth, driven by the construction of new airports and terminals, expanding the capacity for commercial airlines. Business travel remains a key driver, with the region's economic growth and increasing connectivity fueling demand. The fluctuating prices of oil and gas, a major source of aviation fuel, add complexity to the market landscape.

- Additionally, there is a growing focus on sustainability, with alternative fuels such as biofuels and greenhouse gas reduction initiatives gaining traction. Cargo operations are also a significant contributor to the aviation sector, with the region's strategic location facilitating global trade.

- Furthermore, the luxury travel segment is experiencing growth, with the rise of airport spas and other amenities catering to the needs of high-end travelers.

What will be the Size of the Middle East Aviation Market During the Forecast Period?

- The Middle East aviation market is a significant contributor to the global air transport sector, experiencing robust growth driven by increasing economic development and expanding connectivity. With a thriving business environment and a large population, the region's air travel demand continues to escalate, driving the demand for LCCs. However, this growth comes with environmental implications, particularly concerning greenhouse gas emissions. The Middle East is home to several high-emitters In the aviation industry, contributing to the emission gap and carbon inequality. Frequent fliers and private aircraft emissions are significant contributors to the sector's overall energy intensity. The Paris Agreement and climate change implications have brought emission responsibilities to the forefront of the aviation industry's agenda.

- International and domestic air travel statistics indicate that the Middle East market is a substantial contributor to global air travel. National surveys suggest that emission reductions and the adoption of sustainable practices are essential to mitigate the environmental impact. Non-CO2 emissions and fuel use are also critical areas of focus in the aviation industry's efforts to reduce its carbon footprint. The Middle East aviation market's growth trajectory is influenced by economic growth and the region's strategic location as a global hub for trade and commerce. As the industry navigates the challenges of climate change and emission equity, it is essential to adopt sustainable practices and collaborate with stakeholders to minimize the environmental impact while maintaining competitiveness.

How is this Middle East Aviation Industry segmented and which is the largest segment?

The Middle East aviation industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Commercial aircraft

- Military aircraft

- General aircraft

- Application

- Airline

- Air cargo

- Geography

- Middle East

By Type Insights

The commercial aircraft segment is estimated to witness significant growth during the forecast period. The Middle East aviation market's commercial aircraft segment is projected to experience substantial growth in revenue during the forecast period. Commercial aircraft, consisting of general aviation and scheduled airline services, serve various transportation needs, including tourism, passenger travel, business travel, and freight transportation. Factors such as the expanding middle-class population's disposable income and the emergence of low-cost airlines have positively influenced air passenger numbers, consequently boosting demand for commercial aircraft In the region. Climate change implications, including emission equity, emission gaps, and the Paris Agreement, necessitate emission reductions from high emitters like the aviation industry. Commercial aviation, including major, national, and regional airlines, business aviation, and air cargo, contributes significantly to greenhouse gas emissions.

Non-CO2 emissions, fuel use, and economic growth are also essential considerations for sustainable aviation growth. Regulation authorities oversee safety, security, risk management, and certifications for commercial aviation, while aviation maintenance, air traffic control, and partnerships ensure resilience and efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Aviation in Middle East Industry?

- Increase in number of airports and terminals being constructed is the key driver of the market.

- The Middle East aviation market is experiencing significant growth due to rising air travel demand, driven by both tourism and business sectors. This growth is reflected In the construction of new airports and terminal expansions, such as Abha International Airport in Saudi Arabia, which aims to accommodate 8 million passengers by 2030, and Musandam Airport, which is building facilities to handle up to Boeing 737 and Airbus 320 aircraft. Climate change implications, including greenhouse gas emissions and carbon inequality, are becoming increasingly important In the aviation industry. The Paris Agreement emphasizes emission reductions for international aviation, while national surveys focus on domestic air travel.

- Emission distributions vary among high emitters, such as frequent fliers and private aircraft users. Non-CO2 emissions, fuel use, economic growth, and environmental impact are also key considerations for aviation-related businesses, including major airlines, regional carriers, business aviation, cargo transportation, and aerospace companies. Regulation authorities oversee commercial aviation, general aviation, military aviation, and aviation maintenance, ensuring safety, security, risk management, and certifications. The airline industry and its partners prioritize sustainable growth and resilience In the face of climate policy and emission equity concerns.

What are the market trends shaping the Aviation in Middle East Industry?

- Growing demand for business jets is the upcoming market trend.

- The Middle East aviation market is characterized by robust economic growth and increasing air transport demand, driven by the presence of a large number of high net worth individuals (HNWI) and their affinity for luxury business aircraft. This region is home to several countries, such as the UAE, Saudi Arabia, and Qatar, which have experienced significant economic prosperity due to factors like oil wealth, diversified economies, and strategic investments. The expansion of HNWIs and businesses In these countries has fueled the demand for large-cabin and long-range business jets, given their superior comfort and luxury features. The climate change implications of the aviation sector, including greenhouse gas emissions, have gained increasing attention.

- The Paris Agreement and the issue of emission equity and the emission gap are key considerations for the aviation industry. Emission distributions reveal that high emitters, such as frequent fliers and private aircraft, contribute significantly to the sector's carbon footprint. Non-CO2 emissions, fuel use, and energy intensity are also essential aspects of the environmental impact of aviation. The market dynamics of international and domestic air travel involve various stakeholders, including major airlines, national and regional carriers, business aviation, cargo transportation, aviation maintenance, air traffic control, and certification authorities. Aviation-related businesses, such as aircraft manufacturers and aerospace companies, also play a significant role.

- Regulation authorities oversee commercial aviation, general aviation, military aviation, and emergency medical evacuations, humanitarian aid, aerial combat, reconnaissance missions, aviation safety, and aviation security. Effective risk management, regulation, and oversight are crucial for sustainable growth In the aviation sector.

What challenges does the Aviation in Middle East Industry face during its growth?

- Fluctuations in oil and gas prices is a key challenge affecting the industry growth.

- The Middle East aviation market is a significant contributor to the global air transport sector, with growing demand driven by economic growth and increasing connectivity. However, the industry faces climate change implications as air transport is a major source of greenhouse gas emissions, particularly from high emitters such as frequent fliers and private aircraft. The Paris Agreement, an international accord to limit global warming, highlights the need for emission reductions In the aviation sector. Emission equity and the emission gap are key concerns, with carbon inequality a significant issue. Non-CO2 emissions from aviation, including nitrogen oxides and water vapor, also contribute to the environmental impact.

- The sector's energy intensity and emission distributions vary significantly between commercial aviation, general aviation, military aviation, cargo transportation, and aviation maintenance. The aviation industry, including major airlines, national carriers, regional airlines, business aviation, and aerospace companies, is working towards sustainable growth. Regulation authorities are implementing certifications, regulations, and oversight to ensure aviation safety, security, risk management, and emission responsibilities. Partners in this endeavor include air traffic control, fuel use, and emission reduction initiatives. The aviation sector's economic growth is influenced by various factors, including fuel use, freight, freight tonne kilometers, and aviation maintenance. The sector's environmental impact and emission responsibilities continue to be a focus for stakeholders, with the need for collaboration and innovation to reduce emissions and promote sustainable growth.

Exclusive Customer Landscape

The Middle East aviation market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the Middle East aviation market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, aviation market in Middle East forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Air Arabia PJSC - The Middle East aviation market encompasses a broad range of offerings, including aircraft sales and comprehensive airport services for airline operators and their clientele. These services extend to passenger, ramp, and cargo handling, ensuring seamless airport experiences. This sector caters to the unique demands of the aviation industry, providing essential support for the efficient operation of aircraft and the comfort of travelers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air Arabia PJSC

- Airbus SE

- Arkia

- Bombardier Inc.

- El Al

- Embraer SA

- General Dynamics Corp.

- Gulf Air

- Iran Air

- Kuwait Airways

- Leonardo Spa

- Lockheed Martin Corp.

- Mahan Air

- Oman Air

- Qatar Airways Group Q.C.S.C.

- Royal Air Maroc

- Textron Inc.

- Thales Group

- The Boeing Co.

- The Emirates Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The Middle East aviation market is a significant contributor to the global air transport sector, experiencing robust growth in recent years. This expansion is driven by various factors, including increasing economic development, cultural exchange, and the growing tourism industry. However, the aviation sector's environmental impact, particularly in terms of greenhouse gas emissions, has become a pressing concern. The Middle East's aviation industry's carbon footprint is substantial due to the high volume of air travel and the energy intensity of aircraft. The region's aviation-related businesses, including major airlines, regional carriers, and aerospace companies, are among the high emitters of carbon dioxide (CO2) and other non-CO2 emissions.

The Paris Agreement, a global climate accord signed in 2015, aims to limit global warming to well below 2 degrees Celsius above pre-industrial levels. The agreement recognizes the importance of reducing emissions from the aviation sector, which accounts for around 2% of global CO2 emissions. The aviation industry's emission gap, the difference between current emissions and the emissions required to meet the Paris Agreement's goals, is significant. Climate change implications for the aviation sector are multifaceted. Extreme weather events, such as hurricanes and sandstorms, can disrupt air traffic and cause significant economic losses. Rising temperatures can also impact aircraft performance and safety, leading to increased fuel use and emissions.

Carbon inequality is another concern, with frequent fliers contributing disproportionately to aviation's carbon emissions. Private aircraft emissions are also a significant contributor to the sector's overall carbon footprint. Efforts to reduce aviation's carbon emissions include the implementation of more fuel-efficient aircraft, the use of alternative fuels, and the development of sustainable aviation fuel. Regulation authorities are also exploring carbon pricing and other market-based mechanisms to incentivize emission reductions. The Middle East aviation market's economic growth is closely linked to the sector's expansion. However, the industry's environmental impact cannot be ignored. Aviation stakeholders, including governments, airlines, and aerospace companies, must work together to promote sustainable growth and reduce the sector's carbon footprint.

Partnerships between various stakeholders, such as airlines, air traffic control, and aircraft manufacturers, can help improve resilience and reduce emissions. Innovations in aviation maintenance, certifications, and air traffic control can also contribute to more efficient and sustainable air transport services. The Middle East aviation market's diversity encompasses commercial aviation, general aviation, military aviation, cargo transportation, and emergency medical evacuations. Each segment presents unique challenges and opportunities for reducing emissions and promoting sustainable growth. Regulation and oversight are crucial in ensuring the aviation sector's environmental sustainability. Regulatory frameworks must balance economic growth with environmental concerns and promote innovation and collaboration among stakeholders. In conclusion, the Middle East aviation market's growth presents both opportunities and challenges. The sector's significant environmental impact necessitates a concerted effort from all stakeholders to promote sustainable growth and reduce carbon emissions. Collaboration, innovation, and regulation will be key in achieving a more sustainable future for the aviation industry In the Middle East and beyond.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market growth 2025-2029 |

USD 10.16 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.9 |

|

Key countries |

UAE, Saudi Arabia, and Rest of Middle East |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Middle East Aviation Market Research and Growth Report?

- CAGR of the Middle East Aviation industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Middle East

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the Middle East aviation market growth of industry companies

We can help! Our analysts can customize this Middle East aviation market East research report to meet your requirements.