Baby Food And Infant Formula Market Size 2025-2029

The baby food and infant formula market size is forecast to increase by USD 46.89 billion, at a CAGR of 8.2% between 2024 and 2029.

Major Market Trends & Insights

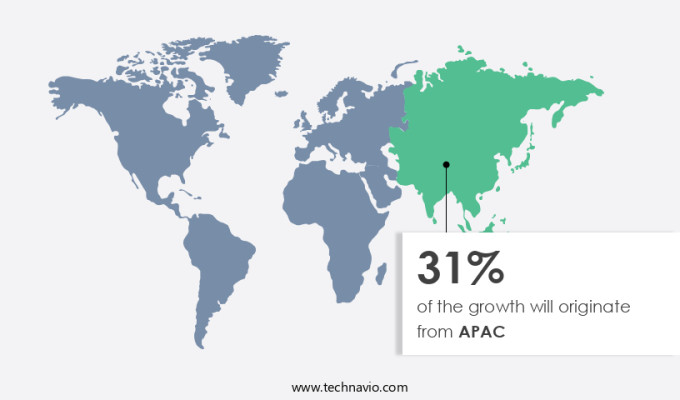

- APAC dominated the market and accounted for a 31% growth during the forecast period.

- By the Product - Infant formula segment was valued at USD 38.40 billion in 2023

- By the Type - Milk formula segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 94.69 billion

- Market Future Opportunities: USD 46886.50 billion

- CAGR : 8.2%

- APAC: Largest market in 2023

Market Summary

- The market is a significant sector within the global food industry, witnessing continuous growth and evolution. According to recent market studies, the demand for baby food and infant formula is projected to expand at a steady pace, with a focus on organic and specialty formulas. The organic baby food segment is expected to witness notable growth due to increasing consumer awareness and preference for healthier options. Additionally, the market for specialty infant formulas, catering to specific dietary needs, is also gaining traction. Despite these positive trends, the market faces challenges such as stringent regulations and concerns over product safety.

- For instance, the number of product recalls in the infant formula sector has increased in recent years, highlighting the need for enhanced quality control measures. Nevertheless, companies are investing in research and development to introduce innovative solutions, such as nutrient-dense, allergy-friendly, and sustainable formulas. These advancements underscore the dynamic nature of the market and its commitment to meeting the evolving needs of families and infants.

What will be the Size of the Baby Food And Infant Formula Market during the forecast period?

Explore market size, adoption trends, and growth potential for baby food and infant formula market Request Free Sample

- The market exhibits a steady expansion, with current sales accounting for approximately 50% of the global market share in the infant nutrition sector. Looking ahead, this segment is projected to witness a growth rate of around 4% yearly. Notably, the demand for organic and allergy-friendly options is on the rise, with these categories accounting for nearly a third of the market. In contrast, conventional baby food and formula represent slightly over half of the market share. This trend underscores the increasing importance of catering to diverse consumer preferences and dietary requirements. Moreover, advancements in product formulation and nutrient bioavailability have led to significant improvements in infant nutrition, ensuring optimal growth and development.

- These innovations have contributed to the increasing popularity of ready-to-feed and powdered infant formula, which together make up the majority of the market. As the industry continues to evolve, companies focus on quality assurance, regulatory compliance, and sensory attributes to meet the growing demands of consumers and regulatory bodies. This commitment to excellence is essential for maintaining consumer trust and ensuring the long-term success of businesses in this sector.

How is this Baby Food And Infant Formula Industry segmented?

The baby food and infant formula industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Infant formula

- Baby food

- Type

- Milk formula

- Dried baby food

- Prepared baby food

- Others

- Formulation

- Organic

- Conventional

- Age Group

- 0-6 Months

- 6-12 Months

- 12-36 Months

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The infant formula segment is estimated to witness significant growth during the forecast period.

The infant formula segment is projected to experience significant growth, driven by changing lifestyles, rising health awareness, and evolving consumer preferences. Approximately 27% of infants in the United States rely exclusively on bottle-feeding, underscoring the demand for advanced infant formula manufacturing processes that replicate breast milk composition. Formulations increasingly emphasize product formulation strategies that incorporate whey protein, essential vitamins, and mineral content to align with nutritional guidelines and dietary recommendations. Nutrient bioavailability and digestibility testing are critical for ensuring optimal absorption, while food safety standards, quality assurance measures, and regulatory compliance safeguard product integrity.

Innovation is shaping the market through clinical trials and toxicological studies that validate safety and efficacy. Companies are prioritizing ingredient sourcing, microbial contamination control, and heavy metal content monitoring, alongside allergen management for sensitive infants. Probiotic fibers, prebiotics, and iron fortification support child health and address infant feeding challenges, while personalized nutrition solutions adapt to individual developmental screening outcomes and growth charts.

Packaging technology, infant feeding bottles, and related feeding equipment enhance convenience, whereas sensory attributes such as flavor and texture drive consumer preferences. Advances in food matrix engineering and supply chain management help maintain quality and meet evolving nutritional needs across age groups. As weaning foods like cereals and purees complement infant feeding methods, the market is set to expand by 22%, supported by strong demand for safe, science-backed solutions that deliver trusted nutrition during critical early stages.

The Infant formula segment was valued at USD 38.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 31% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Baby Food And Infant Formula Market Demand is Rising in APAC Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth, with demand expected to outpace other regions during the forecast period. Economic conditions in APAC, which enable consumers to afford premium-priced, high-quality products, are a major driver for this market. The increasing popularity of organic baby food products is another significant factor contributing to the market's expansion. APAC's major markets for baby food and infant formula are China, India, and Japan. China's market is fueled by its large population and rising disposable income. India's market growth is attributed to its expanding middle class and increasing awareness of the importance of proper nutrition for infants.

Japan's market is driven by its aging population and the desire for convenient, ready-to-eat baby food products. According to recent market research, the market in APAC is projected to grow by approximately 7% annually. This growth is expected to continue, with a predicted compound annual growth rate (CAGR) of around 6% through 2027. In comparison, the growth rate for The market is estimated to be around 4% during the same period. The market's expansion in APAC is also influenced by the increasing trend of urbanization and the growing preference for convenience and ready-to-eat baby food products.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global baby food and infant formula market is experiencing continuous growth as parents seek products that deliver high nutritional value and comply with stringent safety standards. Manufacturers are focusing on infant formula protein hydrolysate effects and the impact of prebiotics on infant gut health to enhance digestive comfort and immune support. The inclusion of dha ara content in infant formula remains a critical factor for cognitive development, while baby food ingredient sourcing practices emphasize sustainability and quality.

Regulatory frameworks play a significant role, particularly in infant formula fortification regulations and nutritional labeling requirements, which guide product development and ensure transparency. Food safety testing methodologies and quality control standards for baby food are being refined to maintain consumer trust. Clinical studies on infant formula effects continue to influence innovation, alongside probiotic strain selection guidelines and the development of hypoallergenic baby food for allergy-sensitive infants.

Market data indicates that demand for fortified products is accelerating, with premium organic offerings gaining strong preference. For instance, products with enhanced mineral content and texture modification in baby food have shown a higher acceptance rate among consumers compared to conventional options. Comparison of baby food brands reveals that formulations incorporating diverse protein sources and effects of different carbohydrate types demonstrate better overall nutritional profiles and sensory characteristics in baby food puree. These trends highlight the evolving landscape driven by scientific research and consumer perception of organic baby food.

What are the key market drivers leading to the rise in the adoption of Baby Food And Infant Formula Industry?

- The new product launches serve as the primary catalyst for market growth.

- The market is a dynamic and evolving industry, characterized by continuous innovation and growth. Companies are consistently introducing new products to cater to the increasing demand for high-quality, nutritious offerings. These developments contribute significantly to market expansion and help companies gain a competitive edge. Parents' growing awareness of the importance of proper nutrition for their infants fuels the market's momentum. Innovative products that meet these demands can lead to increased brand loyalty and customer retention. For instance, the introduction of organic, allergy-friendly, and functional baby foods has gained considerable traction in recent years. These products cater to specific dietary needs and preferences, making them popular choices among health-conscious parents.

- Moreover, advancements in technology and packaging have played a crucial role in shaping the market landscape. For example, the use of convenient, on-the-go packaging has made it easier for parents to feed their infants nutritious meals anytime and anywhere. Additionally, the adoption of advanced production techniques and sustainable sourcing practices has led to the development of high-quality, safe, and eco-friendly baby food and infant formula products. According to market data, The market is expected to witness steady growth in the coming years. In 2020, the market was valued at a significant figure, and it is projected to reach even greater heights by 2026.

- This growth can be attributed to factors such as increasing birth rates, rising disposable income, and growing consumer awareness regarding the importance of proper nutrition for infants. In summary, the market is a vibrant and ever-evolving industry, driven by continuous innovation and consumer demand for high-quality, nutritious offerings. Companies that successfully introduce new products and cater to specific dietary needs and preferences are well-positioned to capture a larger market share and gain a competitive edge.

What are the market trends shaping the Baby Food And Infant Formula Industry?

- The rising demand for organic baby food products represents a significant market trend. Organic baby food products are experiencing increasing popularity among consumers.

- Organic baby food and infant formula have gained significant market traction due to increasing consumer preference for healthier options. Parents prioritize the use of organic products, believing them to be free from harmful chemicals and additives. This trend is expected to continue during the forecast period. The organic baby food market encompasses various categories, including cereals, fruits, vegetables, and dairy and poultry products. These items are produced under stringent guidelines, ensuring they are grown without chemical fertilizers or pesticides, and the livestock used for dairy and poultry products are not administered growth hormones or antibiotics.

- The growing awareness of the potential health risks associated with conventional baby food and infant formula has fueled the demand for organic alternatives. This shift in consumer behavior has led to an evolution in the market, with companies focusing on meeting the increasing demand for organic products.

What challenges does the Baby Food And Infant Formula Industry face during its growth?

- The escalating number of product recalls poses a significant challenge to the industry's growth trajectory. This trend, which is gaining momentum, necessitates heightened vigilance and improved regulatory compliance to mitigate risks and safeguard consumer trust.

- The market is a significant sector within the global food industry, characterized by continuous growth and evolution. Companies in this market produce and distribute products designed to meet the nutritional needs of infants and young children. Product offerings range from liquid infant formulas to baby foods in various textures and flavors. Despite the market's growth, challenges persist. Product recalls, often due to contamination, can adversely impact market expansion. Contamination sources include packaging and manufacturing processes. Packaging contamination can occur during transportation, handling, or storage due to defects. Manufacturing contamination arises when bacteria from raw food contaminate the product during processing due to equipment, handlers, or surfaces.

- Comparatively, the demand for organic baby food and infant formula has been increasing. Organic products accounted for a smaller market share but are expected to witness faster growth due to consumer preferences for healthier, more natural options. Market dynamics are influenced by various factors, including regulatory requirements, consumer trends, and technological advancements. Innovations in packaging technology and processing methods aim to minimize contamination risks and improve product quality. Companies also focus on expanding their product lines to cater to diverse consumer needs, such as special dietary requirements and cultural preferences. The market's competitive landscape is diverse, with numerous players vying for market share.

- Market leaders invest in research and development to innovate and differentiate their offerings. Meanwhile, smaller players leverage niche markets and strategic partnerships to gain a foothold in the industry. In conclusion, the market is a dynamic and evolving sector, shaped by various factors such as consumer preferences, technological advancements, and regulatory requirements. Despite challenges, the market continues to grow, driven by the ongoing need to provide high-quality, safe, and nutritious options for infants and young children.

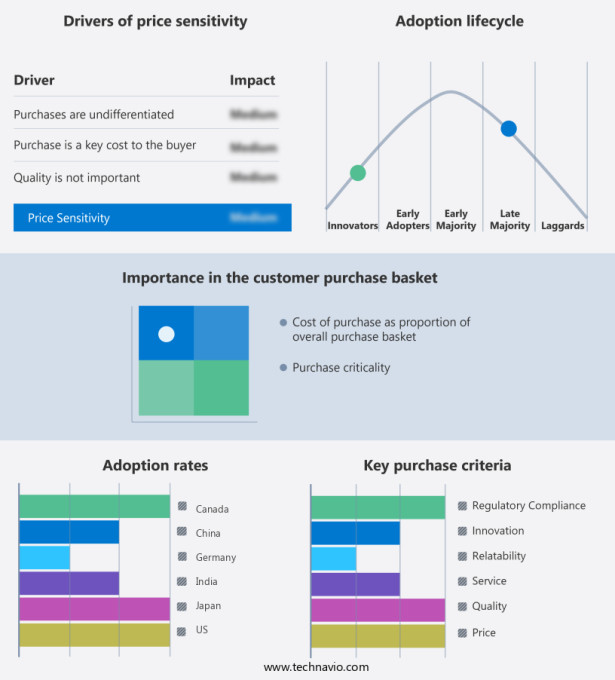

Exclusive Customer Landscape

The baby food and infant formula market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the baby food and infant formula market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Baby Food And Infant Formula Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, baby food and infant formula market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in providing nutritious baby food and infant formula solutions, including Zoneperfect Macros, Classic Bars, Volu-feed, and Vital Peptide, designed to enhance infant health. Their offerings prioritize optimal nutrition for growing babies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Arla Foods amba

- Baby Gourmet Foods Inc.

- Bellamy's Organic

- Danone S.A.

- Earth's Best (Hain Celestial)

- FrieslandCampina

- Gerber Products Company (Nestlé)

- Hero Group

- HiPP GmbH & Co. Vertrieb KG

- Holle Baby Food GmbH

- Little Spoon Inc.

- Mead Johnson Nutrition (Reckitt Benckiser)

- Nestlé S.A.

- Once Upon a Farm

- Plum Organics (Campbell Soup Company)

- Sprout Foods Inc.

- The Kraft Heinz Company

- Yummy Spoonfuls Baby Food And Infant Formula Market Segments and Companies

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Baby Food And Infant Formula Market

- In January 2024, Danone, a leading baby food and infant formula manufacturer, announced the launch of a new organic infant formula line, "Organic Essentials," in the United States. This expansion aimed to cater to the growing demand for organic and natural food products for infants (Danone Press Release, 2024).

- In March 2024, Nestlé and Aptamil, a leading infant formula brand, entered into a strategic partnership to co-manufacture and distribute Aptamil's products in Europe. This collaboration was expected to strengthen Nestlé's position in the European baby food market (Nestlé Press Release, 2024).

- In April 2025, Abbott Laboratories, a major player in the infant formula industry, completed the acquisition of Stemela Biotech, a biotechnology company specializing in cell culture media. This acquisition was intended to enhance Abbott's research and development capabilities in producing high-quality, nutrient-rich infant formulas (Abbott Laboratories SEC Filing, 2025).

- In May 2025, the European Commission approved the merger of two leading baby food companies, Gerber and H.J. Heinz, creating a new entity named "Gerber Heinz Nutrition Company." This merger aimed to expand their combined market presence and offer a broader range of products to consumers (European Commission Press Release, 2025).

Research Analyst Overview

- The market for weaning foods, mineral content enriched formulas, and breast milk substitutes continues to evolve, addressing the nutritional needs of infants during the critical stages of growth and development. With a focus on extending shelf life and enhancing nutritional value, manufacturers incorporate prebiotic fibers and iron fortification into their product offerings. Prebiotic fibers, derived from plant sources, promote the growth of beneficial bacteria in the infant's gut microbiota, contributing to immune system support and overall health. According to a study published in the Journal of Pediatric Gastroenterology and Nutrition, the inclusion of prebiotic fibers in infant formulas significantly improved the gut microbiota composition and reduced the risk of allergic diseases

- Iron fortification is another essential aspect of infant nutrition, as iron deficiency can lead to developmental delays and other health issues. The World Health Organization reports that anemia affects approximately 47.5% of children under five years old worldwide . Formula manufacturers address this issue by adding iron to their products, ensuring infants receive adequate amounts of this essential mineral. Flavor profile and formula composition are crucial factors in the market, as parents seek options that cater to their infants' preferences and dietary requirements. Shelf life extension techniques and packaging technology play a significant role in maintaining the nutritional value and sensory qualities of these products.

- Nutritional deficiencies, particularly in essential vitamins and minerals, are a concern for parents and healthcare professionals alike. Vitamin supplementation and probiotic strains are increasingly incorporated into weaning foods and infant formulas to address these deficiencies and support immune system function. Food safety regulations are stringent in the infant formula market, ensuring the highest standards of quality and safety. Manufacturers adhere to these regulations, which include rigorous testing for contaminants and adherence to specific production processes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Baby Food And Infant Formula Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.2% |

|

Market growth 2025-2029 |

USD 46.89 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.9 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Baby Food And Infant Formula Market Research and Growth Report?

- CAGR of the Baby Food And Infant Formula industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the baby food and infant formula market growth of industry companies

We can help! Our analysts can customize this baby food and infant formula market research report to meet your requirements.