Background Music Market Size 2025-2029

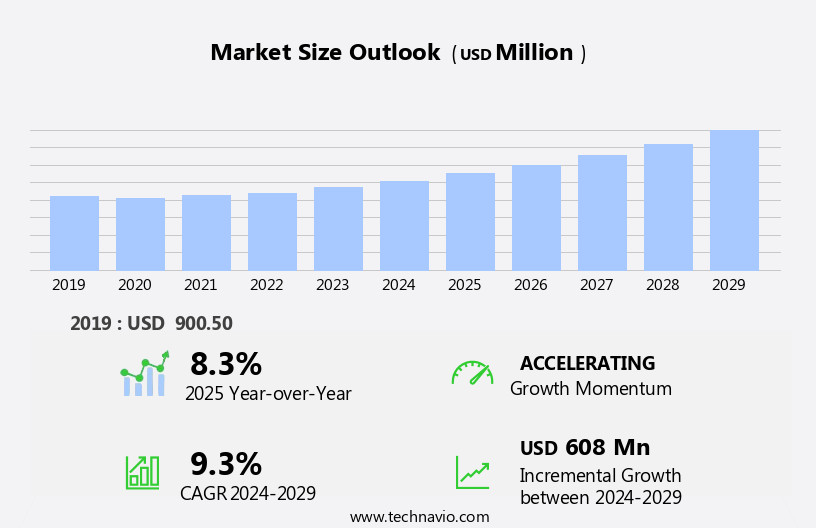

The background music market size is forecast to increase by USD 608 million at a CAGR of 9.3% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing demand for music in various sectors such as retail and hospitality. Digital content, including recorded music and podcasts, is increasingly being used for LED displays, visual content, and publishing. The proliferation of music subscription services, such as Apple Music and Spotify, is further fueling market growth. However, the market is characterized by low margins due to intense competition among labels and background music generators. E-commerce platforms are also leveraging background music to enhance user experience and boost sales. As the market continues to evolve, players in the background music industry must adapt to these trends and challenges to remain competitive.

What will be the Size of the Background Music Market During the Forecast Period?

- The market encompasses the production and distribution of audio content for various industries, including hospitality, healthcare, restaurants, entertainment venues, and the retail sector. This market is driven by the growing importance of ambience and customer engagement in modern business environments. Ambient music, soft tunes, and recorded sound have become essential components of the consumer shopping experience, enhancing productivity, and fostering positive consumer relationships. In the hospitality industry, background music sets the mood and contributes to a memorable guest experience. In healthcare settings, calming music improves patient comfort and reduces stress. In retail environments, music can influence consumer behavior and boost sales.

- The market offers value-added options, such as digital subscription-based music and digital broadcasts, providing businesses with flexibility and cost savings. These services cater to various industries, including recreation, commercials, films, marketing videos, and sleep quality applications. Modern infrastructures, such as TouchTunes and Beat Suite Music, enable businesses to easily access and manage their background music offerings. The market's growth is fueled by the increasing use of background music as a marketing aspect and the continuous evolution of technology to deliver more personalized and customizable music experiences.

How is this Background Music Industry segmented and which is the largest segment?

The background music industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Music streaming

- AV system

- End-user

- Hospitality

- Retail

- Commercial buildings

- Public infrastructure

- Others

- Genre

- Ambient music

- Upbeat and energetic

- Classical or instrumental

- Others

- Geography

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Europe

By Product Type Insights

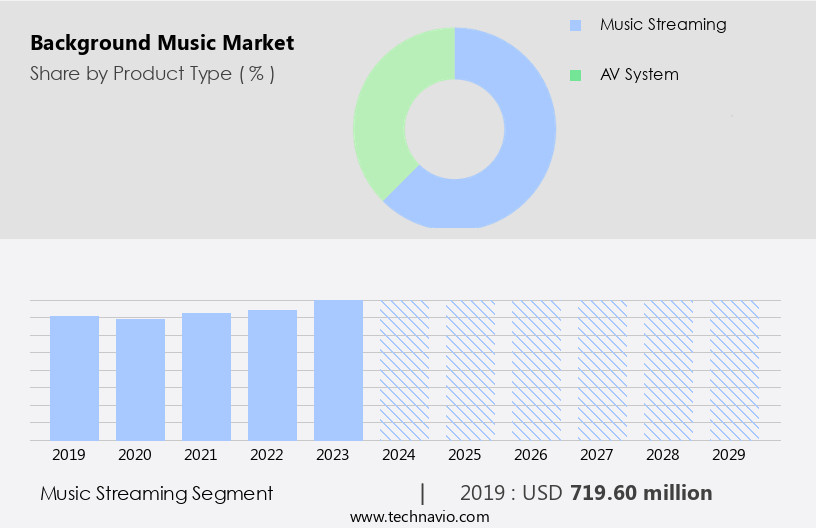

- The music streaming segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the increasing use of digital platforms and smart devices. Music streaming services, which offer features such as customizable playlists, song recommendations, and seamless connectivity, are becoming increasingly popular. Additionally, the expansion of podcast genres on these platforms is further fueling market growth. Another key trend is the adoption of 5G connections, which are in high demand due to their ability to support large data transfers and provide faster internet speeds. This growth is evident in various sectors including hospitality, healthcare, retail, corporate, recreation, and entertainment venues. Background music is used to enhance customer engagement, create a positive atmosphere, and improve business productivity.

Get a glance at the market report of share of various segments Request Free Sample

The music streaming segment was valued at USD 719.60 million in 2019 and showed a gradual increase during the forecast period.

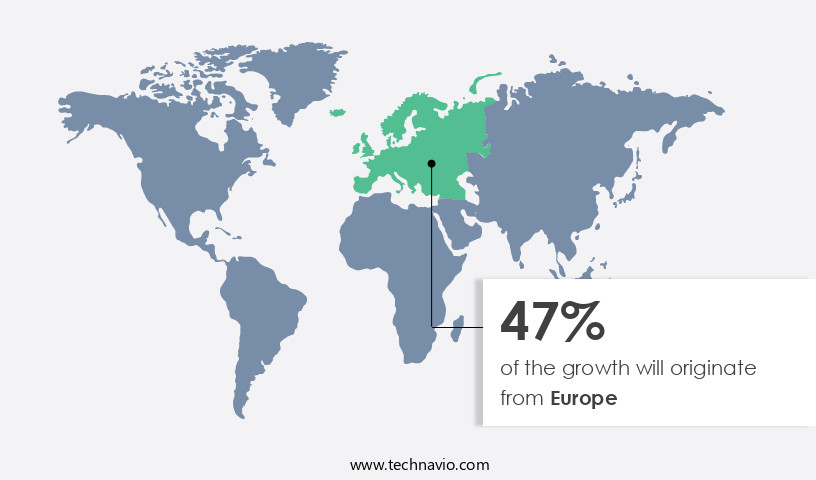

Regional Analysis

- Europe is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Europe, as one of the leading retail economies globally, witnesses significant investment from retailers in physical retail markets, particularly in countries like the UK, France, Germany, and Turkey. Background Music (BGM) plays a pivotal role in attracting customers in these spaces. In the omnichannel retail strategy, stationary retail spaces, such as shopping centers, have assumed a new function. The European market is projected to experience substantial revenue growth during the forecast period, with untapped opportunities in Eastern and Central European countries. Europe holds the highest per capita music consumption, with an average user consuming music for approximately four hours on media devices.

For more insights on the market size of various regions, Request Free Sample

BGM is a crucial component of the retail experience, enhancing customer engagement, ambience, and marketing efforts. It is used in various sectors, including hospitality, healthcare, restaurants, entertainment venues, and the corporate sector. BGM can be delivered through digital subscription-based music, digital broadcasts, or recorded sound, creating a soothing shopping environment, improving business productivity, and fostering consumer relationships. Modern infrastructures incorporate multiple speakers, ensuring a positive mood, concentration, and performance. BGM caters to younger demographics, alleviating stress, tension, nervousness, and anxiety, and complements visual content for a relaxing experience. It is used in commercials, films, marketing videos, and personalized traveling, among other applications. BGM is integral to creating a better atmosphere in fitness centers, physical activities, and housing buildings.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Background Music Industry?

- Demand for BGM in retail sector is the key driver of the market. Background Music (BGM) has emerged as a crucial element in modern infrastructures, significantly influencing various sectors such as Hospitality, Healthcare, Restaurants, Entertainment venues, Retail, and Corporate spaces. Soft and slow BGM is proven to create a positive ambience, increasing customer engagement and time spent in these environments. BGM offers several advantages for businesses. It provides a branded shopping experience and sets the pace for customer movement, offering stress relief and boosting employee morale and productivity. Furthermore, it increases product sales and revenue, improves customer re-visits, and promotes customer marketing.

- In the competitive retail landscape, BGM is a valuable investment for businesses aiming to differentiate themselves from generic stores. It creates a soothing shopping environment, complementing food offerings and enhancing the consumer shopping experience. BGM can be delivered through digital subscription-based music, digital broadcasts, or recorded sound, making it accessible and flexible for various applications. BGM is not limited to retail stores and cafes & restaurants. It is also utilized in leisure & hospitality establishments, public organizations, shopping malls, fitness centers, and physical activities such as aerobics and yoga. Personalized traveling experiences, tourism, and virtual spaces also benefit from the use of BGM.

What are the market trends shaping the Background Music Industry?

- Growth of music subscription services is the upcoming market trend. The market has experienced significant growth in recent years, driven primarily by the rise of digital subscription-based music services. These services offer unlimited access to a vast library of audio content for a monthly fee, making music consumption more affordable and convenient. Traditionally, consumers purchased music on a pay-per-track or album basis, but the high cost of music under this model discouraged many from making purchases and led to piracy. In response to this trend, the music industry has shifted towards digital broadcasts and streaming services. TouchTunes, Beatport, and other streaming platforms offer a range of options, including paid subscriptions, streaming radio, and ad-supported services.

- The affordability and ease of use of these services have led to a shift in consumer behavior, with more people opting for unlimited access to music. The use of background music is not limited to entertainment venues such as restaurants, cafes, and retail stores. It is also prevalent in the hospitality, healthcare, corporate, and recreation sectors. Background music helps create a positive ambience, enhance customer engagement, and improve business productivity. It can also help reduce stress, anxiety, and negative moods, making it an essential component of modern infrastructures. Value-added options such as personalized music, soothing shopping environments, and virtual spaces have become increasingly popular.

What challenges does the Background Music Industry face during its growth?

- Low margins for BGM companies is a key challenge affecting the industry growth. The market is a competitive industry, with numerous companies offering music streaming and audio system installation services. Despite the homogeneous offerings, profit margins are slim due to significant revenue sharing with artists, content creators, publishing companies, and music labels. This leaves little income for BGM providers, making market sustainability a challenge. The volume of subscribers and music sales are key revenue generators. However, with the emergence of technology music-streaming startups, attracting a substantial user base has become challenging. Furthermore, industry profitability and income are starting to plateau. BGM providers cater to various sectors, including hospitality, healthcare, restaurants, entertainment venues, retail, corporate, recreation, and public organizations.

- They offer value-added options such as ambient music, recorded sound, and digital subscription-based music for commercials, films, marketing videos, and virtual spaces. The market dynamics are influenced by factors like consumer engagement, ambience, business productivity, and consumer relationships. Soft tunes contribute to a relaxing shopping environment, while upbeat music boosts energy and motivation. Low volume music can reduce stress, tension, nervousness, and anxiety. Modern infrastructures like shopping malls, elevators, housing buildings, fitness centers, and physical activities like aerobics and yoga, use BGM to create a better atmosphere. Personalized traveling experiences, such as tourists' traveling songs, are also popular.

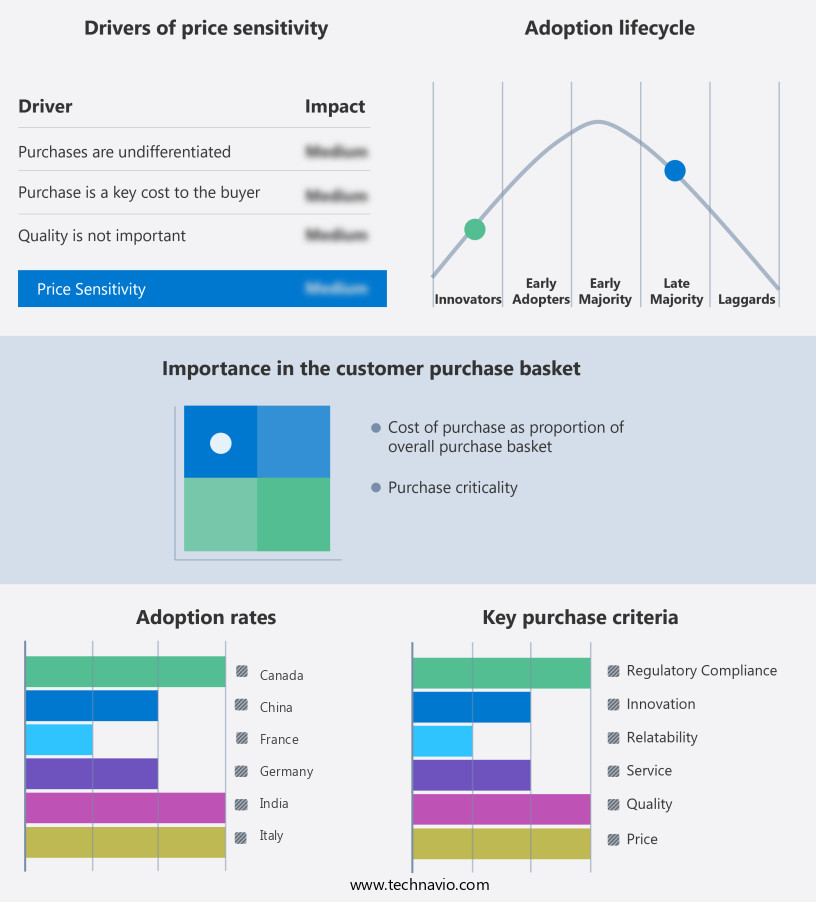

Exclusive Customer Landscape

The background music market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the background music market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, background music market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Almotech Media Solutions - The company offers background music for retail audio, multi zone player for petrol station and deli audio, fashion audio and family restaurants.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AMI Entertainment Network LLC

- Auracle Sound Ltd.

- Brandtrack Inc.

- CMRRA SODRAC Inc.

- Heartbeats International AB

- HIBOU MUSIC LIBRARY

- Imagesound Group

- Liberty Media Corp.

- Mood Media Corp.

- Open Ear Music Ltd.

- Qsic Pty Ltd.

- Rockbot Inc.

- SOUNDMACHINE

- Soundreef

- Soundtrack Your Brand Sweden AB

- Stingray Media Group.

- TouchTunes Music Corp.

- USEA Pte Ltd.

- Xenox Music and Media B.V.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a vast array of industries and applications, with audio content playing a pivotal role in various sectors such as hospitality, healthcare, and entertainment venues. In the recreational sphere, businesses increasingly recognize the importance of ambient music in enhancing customer engagement and creating a modern, value-added experience. Ambient music, a genre characterized by its subtle and unobtrusive nature, has become a staple in numerous business settings. In the hospitality industry, it contributes to the creation of a soothing shopping environment, complementing the consumer experience in retail stores, cafes, and restaurants. The leisure and hospitality sector, in particular, has embraced the use of background music to set the tone for a positive mood and improve overall ambience.

In addition, in the corporate sector, background music is often used to boost productivity and foster a motivating work environment. The use of soft tunes can help alleviate stress, tension, nervousness, and anxiety, leading to better focus and performance. Younger demographics, in particular, have shown a preference for low volume music, which can contribute to a more creative and cognitively stimulating workspace. Modern infrastructures, such as AV systems, have made it easier for businesses to access and stream digital subscription-based music and digital broadcasts. This has led to an increase in the use of background music in various settings, from commercials and films to marketing videos and virtual spaces.

Moreover, the use of multiple speakers and high-quality recordings ensures that the music experience is consistent and enriching, creating a more engaging atmosphere for consumers. In public organizations, background music can help set a positive mood, while in fitness centers, it can enhance the experience of physical activities such as aerobics and yoga. Background music also plays a crucial role in the housing industry, contributing to a better atmosphere in buildings and elevators. In the travel industry, personalized traveling experiences can be further enhanced through the use of recorded songs and IPods, providing a more enjoyable experience for tourists and travelers alike.

Therefore, the market is a dynamic and evolving industry that plays a significant role in various sectors, from hospitality and healthcare to the corporate world and entertainment venues. Its ability to influence consumer moods, enhance productivity, and create a more engaging atmosphere makes it an essential component of modern business infrastructure. The use of digital subscription-based music, digital broadcasts, and advanced AV systems has made it easier for businesses to access and utilize background music, leading to a more enriching and personalized consumer experience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.3% |

|

Market growth 2025-2029 |

USD 608 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.3 |

|

Key countries |

US, China, Canada, Germany, UK, France, Japan, Italy, India, and The Netherlands |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Background Music Market Research and Growth Report?

- CAGR of the Background Music industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the background music market growth of industry companies

We can help! Our analysts can customize this background music market research report to meet your requirements.