Bed And Bath Linen Market Size 2024-2028

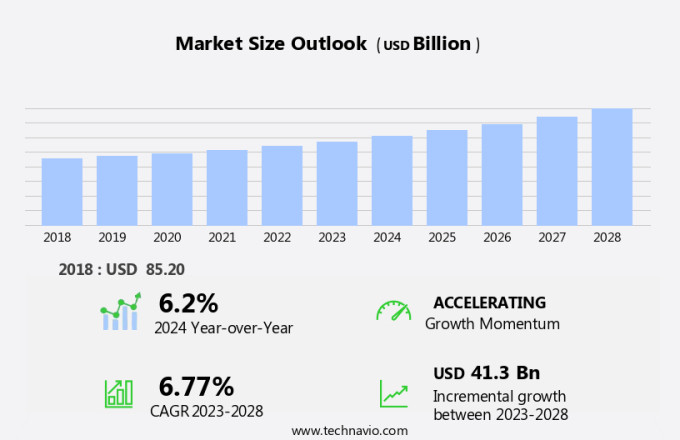

The bed and bath linen market size is forecast to increase by USD 41.3 billion at a CAGR of 6.77% between 2023 and 2028. The market is experiencing significant growth, driven by the expanding breadth of products and effective merchandising strategies. Small companies are making a mark by catering to the needs of various sectors, including housing and hospitality. According to Comscore, there is a notable increase in consumer interest in bed and bath linen, particularly in blankets, quilts, comforters, pillowcases and covers, curtains, and bed pads. The health-related benefits of these products are a major factor, as consumers seek organic and eco-friendly options. Additionally, stringent regulations in the textile industry are pushing companies to innovate and improve product quality. Influencer engagement stats indicate a growing trend of social media endorsements for bed and bath linen brands. Overall, the market is witnessing steady growth, with a focus on sustainability, quality, and consumer preferences.

What will be the Size of the Market During the Forecast Period?

The market is a significant segment of the home furnishings industry, catering to the needs of both residential and commercial sectors. This market is influenced by various factors, including consumer spending patterns, housing sector trends, and technology developments. Consumer spending on home furnishings, including bed and bath linens, has been on the rise in recent years. The increasing focus on creating comfortable and aesthetically pleasing living spaces has led to an uptick in demand for high-quality linens. The housing sector's growth, particularly in urban areas, has also contributed to the market's expansion.

Technology developments have significantly impacted the market. Innovations in fiber combinations, textures, and fabrics have led to the creation of advanced products that offer superior comfort and durability. For instance, the use of microfiber, bamboo, and organic cotton in bedding and bath linens has gained popularity due to their softness, breathability, and eco-friendliness. Designs, colors, and effective merchandising are essential factors that influence consumer preferences in the market. Small companies and established players alike are investing in research and development to create unique and trendy designs that cater to evolving consumer tastes. The availability of a wide range of colors and patterns allows consumers to express their personal style and preferences.

The hospitality sector is another significant market for bed and bath linens. Hotels and resorts prioritize providing their guests with high-quality linens to ensure a comfortable and memorable stay. The use of branded linens can also enhance a hotel's reputation and differentiate it from competitors. The market is vast and diverse, encompassing various product categories such as blankets, quilts, comforters, pillowcases and covers, curtains, and bed pads. Each product category caters to specific consumer needs and preferences.

This growth can be attributed to the increasing demand for high-quality linens, the proliferation of e-commerce platforms, and the availability of a wide range of products. Influencer engagement stats and digital archives are essential tools for market research in the bed and bath linen industry. Domain experts and industry analysts use these resources to gain insights into consumer preferences, trends, and market dynamics. Proprietary platforms that offer access to these resources can provide a competitive edge to businesses looking to stay ahead of the curve. Privacy and identity are critical concerns in the market, particularly in the context of data collection and usage.

Companies must ensure that they comply with relevant regulations and best practices to protect consumer data and maintain trust. In conclusion, the market is a dynamic and evolving industry that is influenced by various factors, including consumer spending patterns, housing sector trends, technology developments, and design preferences. Companies that can effectively navigate these factors and provide high-quality, innovative products are well-positioned to succeed in this market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Bed linen

- Bath linen

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Product Insights

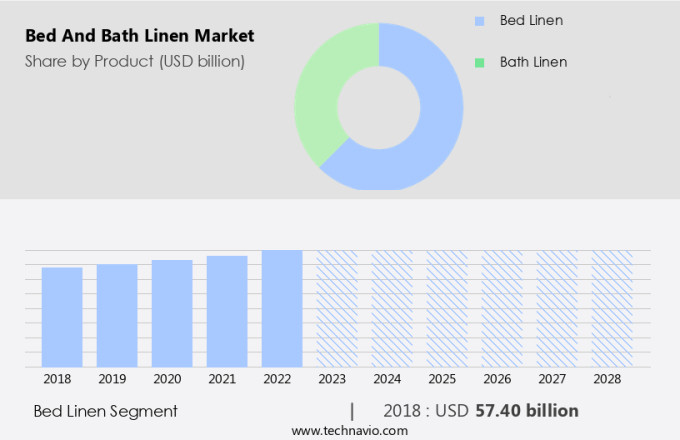

The bed linen segment is estimated to witness significant growth during the forecast period. The bed linen market encompasses a range of products, including bedsheets, pillowcases, duvet covers, quilts, and more. These textiles offer functional advantages, such as temperature regulation, and health benefits. Linen, specifically, is renowned for its thick fibers, which make it an effective insulator. Its heat conductivity is five times greater than that of cotton, wool, and other fabrics, enabling it to maintain optimal body temperature, approximately 39.2 degrees Fahrenheit cooler than cotton or silk. As a result, linen has gained popularity for use in bedding and related products. As digital archives continue to expand, domain experts have access to extensive statistics and market narratives.

Interactive questionnaires, competitor coverage, and various other resources provide valuable insights into market trends. YouTube video transcripts, influencer interviews, and podcasts offer unique perspectives and up-to-date information.

Get a glance at the market share of various segments Request Free Sample

The Bed linen segment accounted for USD 57.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

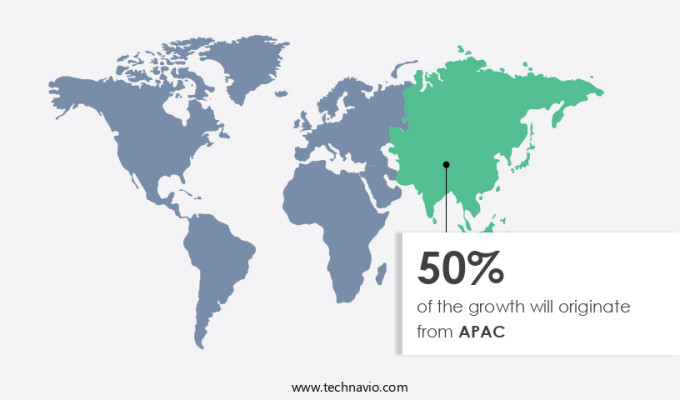

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the Asia Pacific (APAC) region, the housing market's growth has led to an increase in consumer spending on home furnishings. Bed and bath linen is a significant category within home textiles, with major consumers including China, India, and Australia. The market in APAC is primarily driven by the expansion of bed and bath linen production and the surge in imports and exports. China, India, Pakistan, and Bangladesh are prominent global producers and exporters of home textiles, including bed and bath linen. Major global companies dominate the market in APAC, particularly in India. These companies focus on inorganic growth strategies to maintain their market position.

The market is further fueled by advancements in technology developments, such as fiber combinations, textures, fabrics, designs, colors, and physical benefits. Consumers in APAC seek high-quality and affordable bed and bath linen products, leading to a growing demand for innovative and sustainable offerings. The market in APAC is expected to continue its growth trajectory due to the region's large and growing population, increasing disposable income, and rising awareness of the importance of comfortable and stylish home environments.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Health-related benefits of linen products is the key driver of the market. The market, a segment of the home textiles industry, experiences significant consumer spending due to the various physical and mental benefits associated with linen fabrics. Linen, derived from the flax plant, is a natural fiber known for its breathable properties and functional advantages. These include higher moisture-wicking capacity, anti-allergic properties, and the ability to suppress the growth of microbes. The availability of various fiber combinations, textures, and designs in bed linen fabrics caters to diverse consumer preferences. The housing market and hospitality sector are key contributors to the demand for bed linen products. Technology developments, such as privacy and identity-focused platforms, have influenced consumer behavior and retail networks.

Market dynamics, including labor costs, economic instability, monetary policy tightening, and higher interest rates, impact the market. Climate disasters, disinflation, elections, capital flows, and investment strategies also shape market trends. Small companies and industry experts leverage digital archives, interactive questionnaires, competitor coverage, and influencer engagement stats to stay informed and agile in this volatile environment. Bed coverings, bed throws, blankets, cushion covers, cushions, duvets, duvet covers, mattress covers, pillows, and mattress pads are essential bed linen items. The bed linen market includes products for the nuclear household and extends to the hospitality sector. The breadth of products and effective merchandising strategies contribute to the market's growth..

Market Trends

Growing interest of consumers in organic and eco-friendly bed and bath linen products is the upcoming trend in the market. The housing market's shift towards eco-consciousness has significantly impacted the market. Consumers are increasingly prioritizing organic and eco-friendly home furnishings, including bed linens. These products, free from genetically engineered substances and synthetic chemicals, offer both physical and mental benefits. They are not only better for consumers' health but also contribute to environmental sustainability. Technological developments have also influenced the bed linen segment, with fiber combinations, textures, and fabrics continually evolving. Allergy-free and moisture-wicking fabrics have gained popularity, leading to shorter replacement cycles. The bed linen market encompasses a broad range of products, including bed coverings, bed throws, blankets, cushion covers, cushions, duvets, duvet covers, mattress covers, pillows, and mattress pads.

The home textiles market is a significant contributor to the housing sector, with retail networks expanding to cater to the growing demand. However, labor costs and the availability of products remain critical factors affecting market dynamics. Small companies and industry experts leverage proprietary platforms, digital archives, and influencer engagement stats to stay competitive. Geopolitical factors, economic instability, monetary policy tightening, higher interest rates, climate disasters, disinflation, elections, capital flows, and investment strategies all influence the bed linen market narrative. Businesses must remain agile and demonstrate strategic foresight to navigate this volatile environment and make informed investment decisions.

Market Challenge

Stringent regulations in textile industry is a key challenge affecting the market growth. The market is a significant segment of the home textiles industry, which is subjected to various regulations and policies aimed at ensuring consumer safety and well-being. Compliance with these regulations poses challenges for market growth. For instance, the EU's Textile Regulation (EU) No 1007/2011 mandates fiber names and related labeling for textile products, including bed linen, across all member countries. Consumer spending on home furnishings, including bed and bath linens, is influenced by technology developments, availability of products with fiber combinations, textures, fabrics, designs, colors, and functional benefits. The housing market and hospitality sector are key consumers of bed linens, with retail networks playing a crucial role in distribution.

Labor costs, economic instability, monetary policy tightening, higher interest rates, climate disasters, disinflation, elections, capital flows, and investment strategies impact the market. Small companies and businesses must demonstrate agility and strategic foresight to navigate this volatile environment. Influencer engagement stats, digital archives, domain experts, proprietary platforms, privacy and identity, and interactive questionnaires are essential tools for understanding market dynamics. Competitor coverage, YouTube video transcripts, influencer interviews, podcasts, press statements, and event keynotes provide valuable insights. Geopolitics, economic instability, monetary policy tightening, higher interest rates, climate disasters, disinflation, elections, capital flows, and investment strategies influence market trends. Bed linen fabrics, such as allergy-free and moisture-wicking, have shorter replacement cycles due to their functional benefits.

The bed covering, bed throws, blankets, cushion covers, cushions, duvets, duvet covers, mattress, and mattress cover, pillows, and bed pads are essential bed linen products. In summary, the market is subjected to various regulations and policies aimed at ensuring consumer safety and well-being, which pose challenges for growth. Consumer spending is influenced by technology developments, availability of products, and functional benefits. The housing and hospitality sectors are key consumers, and retail networks play a crucial role in distribution. Market dynamics are influenced by economic, political, and technological factors.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Acton and Acton Ltd. - The company offers a selection of high-quality items such as fitted sheets, throwovers, and eiderdowns.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Textile Co.

- American Textile Systems

- Beaumont and Brown

- Bedding Acquisition LLC

- Beyond Inc.

- Crane and Canopy Inc.

- Frette North America Inc.

- Hunan Mendale Hometextile Co. Ltd.

- Penney OpCo LLC

- Ralph Lauren Corp.

- Serta Simmons Bedding LLC

- Shanghai Luolai Home Textile Co. Ltd.

- Shanghai Mercury Home Textiles Co. Ltd.

- Shenzhen Fuanna Household Products Co. Ltd.

- Springs Global Participacoes S.A.

- Tempur Sealy International Inc.

- Trident Ltd.

- Welspun Group

- Williams Sonoma Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

In the dynamic housing market, consumer spending on home furnishings, including bed and bath linens, continues to grow. Technology developments bring new fiber combinations, textures, and fabrics, enhancing the functional and aesthetic value of bed linen. Allergy-free and moisture-wicking fabrics offer physical benefits, while calming colors and designs contribute to mental well-being. The bed linen segment of the home textiles market thrives, with a wide range of products such as bed coverings, bed throws, blankets, cushion covers, cushions, duvets, duvet covers, mattress covers, pillows, and mattress pads. Nuclear households and retail networks drive demand, with labor costs and retail prices influencing market dynamics.

Small companies and large businesses alike invest in innovative designs and functional benefits, catering to various sectors, including housing and hospitality. Effective merchandising strategies and influencer engagement help capture market share in this volatile environment. Market statistics show a growing bed linen segment, with numbers reflecting increased consumer interest. Factors such as economic instability, monetary policy tightening, and higher interest rates can impact the market narrative. Stay informed with interactive questionnaires, industry reports, and insights from domain experts on proprietary platforms. Privacy and identity are essential considerations in today's digital archives. Agility and strategic foresight are crucial for businesses in this sector, as they navigate geopolitical risks, recession risks, volatile capital flows, and investment strategies.

Tech firms and businesses must adapt to the ever-changing market landscape to remain competitive.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.77% |

|

Market growth 2024-2028 |

USD 41.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.2 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 50% |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acton and Acton Ltd., American Textile Co., American Textile Systems, Beaumont and Brown, Bedding Acquisition LLC, Beyond Inc., Crane and Canopy Inc., Frette North America Inc., Hunan Mendale Hometextile Co. Ltd., Penney OpCo LLC, Ralph Lauren Corp., Serta Simmons Bedding LLC, Shanghai Luolai Home Textile Co. Ltd., Shanghai Mercury Home Textiles Co. Ltd., Shenzhen Fuanna Household Products Co. Ltd., Springs Global Participacoes S.A., Tempur Sealy International Inc., Trident Ltd., Welspun Group, and Williams Sonoma Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch