Wool Market Size 2025-2029

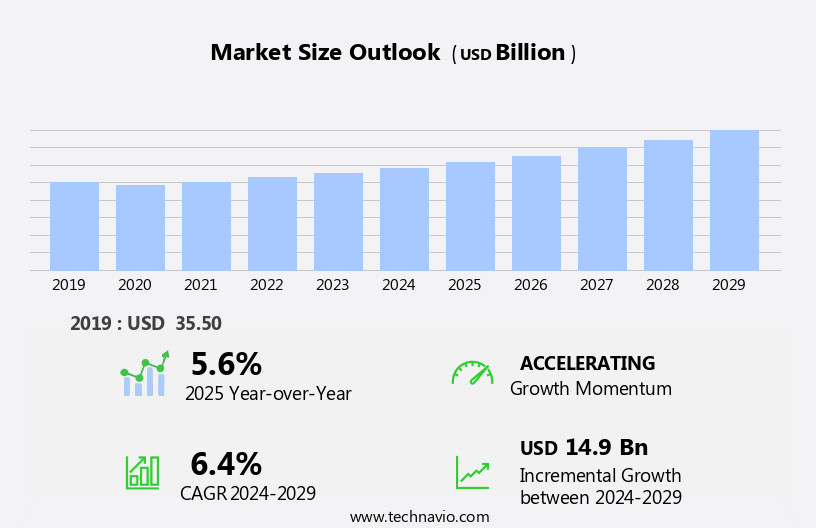

The wool market size is forecast to increase by USD 14.9 billion at a CAGR of 6.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by increasing exports from emerging economies, particularly China and India. These countries have become major players in the production and export of wool, contributing to the market's expansion. However, this trend also presents challenges, as limited access to raw materials in some regions may lead to price volatility and supply chain disruptions. Wool producers are focusing on improving sheep rearing practices and exploring new applications for wool, such as keratin fibers, to remain competitive. Consumers, particularly millennials, are increasingly drawn to the natural, biodegradable properties of wool, which offer superior insulation and durability.

- This trend is particularly strong in the apparel industry, where wool is increasingly being used in the production of high-performance clothing for outdoor activities and everyday wear. Despite these opportunities, companies operating in the market face significant challenges. Limited access to raw materials, particularly in some regions, can make it difficult to maintain consistent supply and meet demand. Additionally, the market is highly competitive, with a large number of players vying for market share. To succeed in this environment, companies must focus on innovation, sustainability, and operational efficiency, while also building strong relationships with suppliers and customers. By staying agile and responsive to changing market dynamics, they can capitalize on emerging opportunities and navigate challenges effectively.

What will be the Size of the Wool Market during the forecast period?

- The market encompasses a diverse range of natural fibers, including Merino, crossbred, specialty wools from Teeswater, Shetland, Peruvian, and Cashmere breeds, among others. This market exhibits significant activity, driven by the cultural significance of wool as a sustainable fiber and its versatility in various applications. Woolen yarns and clothes, as well as accessories, continue to be popular choices for consumers, particularly millennials drawn to fiber's quality and natural origins. Wool's unique properties, such as its biodegradability, insulation capabilities, and resistance to wrinkles, make it a sought-after alternative to synthetic fibers. Wool farming practices, which include rearing sheep and processing keratin fibers, have evolved to meet modern sustainability standards.

- Wool is also used extensively in industries like upholstery, insulation, and carpets, and holds a rich history in literature, art, and fashion. Certifications, spinning tools, and wool types catering to various industries and consumer preferences further fuel the market's growth. Wool's versatility and appeal are reflected in its use in clothing sales, advertising, and television, as well as in crafts and woolen accessories. With ongoing advancements in wool production and processing technologies, this market is expected to remain a dynamic and essential sector in the textile industry.

How is this Wool Industry segmented?

The wool industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Apparels

- Interior textiles

- Source

- Merino wool

- Teeswater wool

- Cashmere wool

- Others

- Type

- Fine wool

- Medium wool

- Coarse wool

- Form Factor

- Scoured wool

- Raw wool

- Washed wool

- Carbonized wool

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- North America

- US

- Canada

- South America

- Brazil

- Middle East and Africa

- APAC

By Application Insights

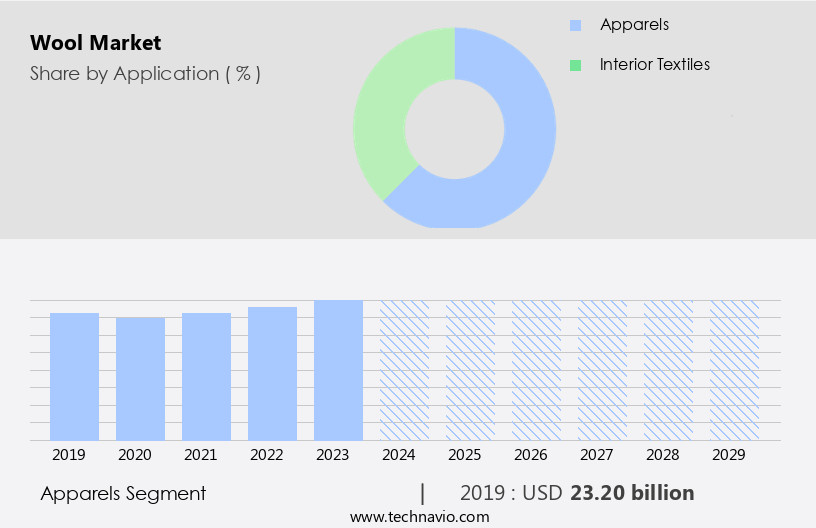

The apparels segment is estimated to witness significant growth during the forecast period. The market holds a prominent role in the textile industry, serving various sectors including fashion, home furnishings, and sports apparel. Wool, derived from the Ovis genus, is a highly valued natural fiber due to its inherent properties of durability, breathability, and thermal insulation. Merino wool, a fine and soft variety, is popular for its superior comfort and flexibility. Crossbred wool, a blend of Merino and other breeds, offers enhanced strength and resistance to pilling. Synthetic alternatives have emerged, but wool's sustainable, biodegradable, and compostable qualities continue to attract consumers. Wool producers in Australia, New Zealand, and Peru are significant contributors to the global supply.

Worsted processing enhances the wool's texture and appearance, while weaving tools like the Proxima Smartconer improve production efficiency. Wool's benefits extend beyond textiles, as it is used in various industries, including automotive and aerospace.

Get a glance at the market report of share of various segments Request Free Sample

The Apparels segment was valued at USD 23.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

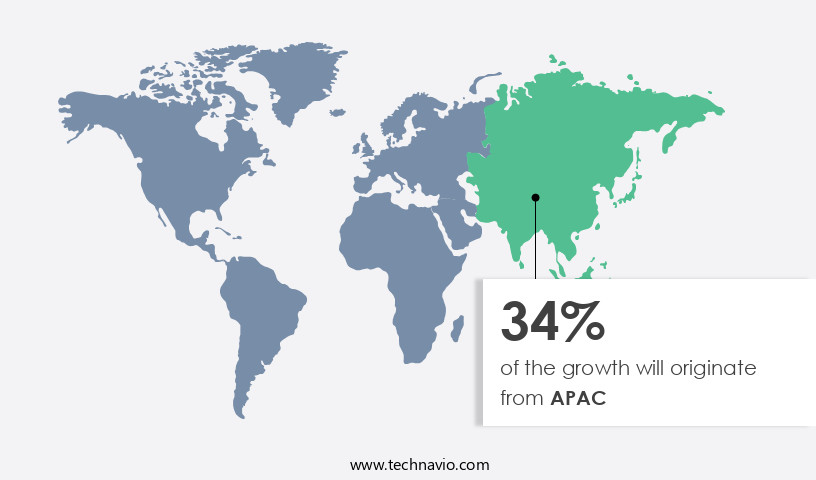

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Wool is a natural fiber derived from the Ovis genus, primarily from Merino sheep and various crossbreds. It is known for its thermal insulation properties and is a sustainable fiber with biodegradable and compostable qualities. Wool production involves sheep rearing and farming, with significant contributions from countries like China, India, and Japan due to their large consumer bases and increasing demand for high-quality clothing. In 2023, China imported 5% more Australian wool than in 2024, making it the world's largest consumer. Woolen yarns and clothes, including baby garments, are popular, with innovations in processing techniques, such as worsted and weaving tools like Proxima Smartconer, enhancing product quality. Millennial consumers prioritize wool's natural, biodegradable, and luxury qualities, making it a preferred choice for clothing retail.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Wool Industry?

- Growing woolen exports from emerging economies are the key driver of the market. The market is experiencing notable expansion due to the increasing wool production and export capacity of emerging economies, including China, India, and South Africa. China, with its expanding wool processing capabilities and status as a significant exporter of woolen textiles and garments, holds a prominent position in the market. South Africa, renowned for its fine Merino wool, has witnessed a rise in exports to premium markets in Europe and North America. India, with its rich heritage in woolen craftsmanship and growing demand for high-quality woolen products in international markets, is also contributing to the market's growth.

- These countries benefit from their favorable climates and cost-effective labor, making wool production an attractive industry. The market is poised for substantial growth as a result of these economic shifts. Genetic breeding and on-farm inspections ensure high wool quality. Woolen yarns and fabrics, including knitted and worsted processing, are used to create a wide range of products, from baby clothes and socks to suits and coats. Millennial consumers prioritize wool's natural origin and eco-friendly attributes. Brands like Allbirds Inc. and highlight the carbon footprint reduction and organic carbon benefits of wool. Wool's versatility is showcased in its use in luxury wool, interior textiles, and apparel wool. Wool insulation and sustainable textiles are gaining popularity in the construction industry. Wool's biodegradable and compostable qualities align with the growing demand for eco-friendly products.

What are the market trends shaping the Wool Industry?

- Increasing preference for innovative wool blends is the upcoming market trend. Wool, a natural fiber renowned for its insulation, breathability, and moisture-wicking properties, is revolutionizing the textile industry through innovative blends. By merging wool with other fibers, manufacturers enhance the performance, comfort, and functionality of textiles. For example, merino wool combined with polyester produces a fabric that is both lightweight and quick-drying, making it suitable for outdoor and athletic apparel. Wool blended with silk results in a luxurious fabric, offering the softness and sheen of silk alongside the warmth and resilience of wool, ideal for high-end fashion. Wool-nylon blends are frequently utilized in socks and outerwear, providing enhanced elasticity and abrasion resistance.

- Wool-nylon blends are popular in socks and outerwear due to their increased elasticity and abrasion resistance. These blends expand the application scope of wool, catering to diverse market segments and consumer preferences. Moreover, the carbon footprint of wool production is relatively low compared to synthetic alternatives, making it an attractive choice for those conscious of their environmental impact. The market is not limited to clothing and apparel; it also extends to interior textiles, insulation, and accessories. Woolen yarns and fabrics, including knitted and woven, are used extensively in the production of baby clothes, blankets, and other textile products.

What challenges does the Wool Industry face during its growth?

- Limited access to raw materials is a key challenge affecting the industry's growth. The market faces significant challenges due to the limited access to raw materials. The declining number of sheep worldwide is a major concern for businesses in this industry, as they heavily rely on a consistent supply of high-quality wool to meet customer demands. Urbanization, changing consumer preferences, and the availability of alternative fibers are contributing factors to the decrease in the global sheep population. The market is diverse, with various types of wool, including Merino, Peruvian, Teeswater, Shetland, and Cashmere, catering to different market segments. Each type of wool has unique properties and applications, making it essential to understand the specific requirements of the target market. The wool industry's future lies in product innovation, sustainability, and meeting the evolving demands of consumers. As the world moves towards more eco-friendly and sustainable textiles, wool's natural properties and production methods make it an attractive choice. The industry is also exploring new applications, such as biodegradable and compostable wool, to further expand its reach.

- This scarcity of raw materials poses a significant challenge for market companies, potentially impacting their ability to maintain production levels and meet market demands. Crossbred wool, derived from the mating of different breeds, is another trend gaining popularity for its superior characteristics. The cultural significance of wool as a sustainable fiber is increasingly resonating with millennial consumers. Wool's natural origin and biodegradable quality align with the growing trend towards eco-friendly and sustainable textiles.

Exclusive Customer Landscape

The wool market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wool market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wool market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amtex Yarn Manufacturing - The company offers wool such as Amtex wool.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amtex Yarn Manufacturing

- BKB Group

- Blue Sky Alpacas LLC

- Brown Sheep Co. Inc.

- Carolina Mills Inc.

- Europa Wools Ltd.

- G.Modiano Ltd.

- Indorama Ventures Public Co. Ltd.

- JiangSu Unitex Co. Ltd.

- Kentwool

- Laxtons Ltd.

- Merinotex

- National Spinning Co. Inc.

- Nundle Woollen Mill

- Otago Knitwear Ltd.

- Sudwolle Group GmbH

- Sunshine Yarns

- Waverley Mills Pty Ltd.

- Xinao textiles inc.

- Zhangjiagang Shepherd Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing a significant shift in dynamics, driven by various factors influencing the production and consumption of this natural fiber. Wool, derived from the Ovis genus, has been a staple in textile industries for centuries due to its unique properties, including thermal insulation and biodegradable quality. Wool producers are continually innovating to meet the evolving demands of consumers and the textile industry. Genetic breeding has played a crucial role in enhancing the quality and sustainability of wool production. Merino sheep, known for their fine wool, have been the focus of extensive breeding programs to improve fiber diameter, length, and crimp.

Wool's natural insulation properties make it an ideal choice for clothing and textiles designed for colder climates. The wool supply chain is undergoing significant changes, with a focus on transparency, sustainability, and ethical production practices. Regulatory authorities are implementing stricter regulations to ensure on-farm inspections and certification of wool production. Australian wool, known for its high quality, is subject to rigorous certification processes to ensure ethical and sustainable production. The wool industry is also embracing automation and technology to improve efficiency and productivity. Wool scouring, a critical process in wool production, is being automated using advanced tools like Proxima Smartconer, which optimizes the scouring process and reduces water usage.

Specialty wool, including high-quality options like Peruvian wool and Shetland wool, is highly valued in various industries, from woolen clothes to wool for insulation. These fibers, sourced from distinct sheep breeds like Ovis aries aries and Blue-Faced Leicester, offer unique wool fiber properties that make them ideal for products ranging from biodegradable wool clothing to wool for upholstery and carpets. The wool market, especially the worsted yarn market, is influenced by wool price fluctuations and sustainable wool production practices. As consumers increasingly seek eco-friendly and durable options, wool's benefits are highlighted in fashion, art, and even advertising. Sustainable wool production aligns with rural development goals and the growing demand for wool in industries such as knitted fabrics, woolen processing, and wool for crafts. Wool certifications and regulations ensure quality, while wool in marketing campaigns and wool for gifts remain popular in industries ranging from holidays to weddings and furniture. Automated wool processing is also revolutionizing the industry, enhancing efficiency in production and widening the scope for wool-based innovations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 14.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, China, Japan, India, South Korea, Canada, Brazil, UK, Germany, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wool Market Research and Growth Report?

- CAGR of the Wool industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wool market growth and forecasting

We can help! Our analysts can customize this wool market research report to meet your requirements.