Pillows Market Size 2025-2029

The pillows market size is forecast to increase by USD 11.39 billion, at a CAGR of 5.3% between 2024 and 2029.

- The pillow market is witnessing significant growth due to several key factors. The expanding hotel industry is one of the major drivers, as the hospitality sector continues to prioritize guest comfort and satisfaction. Additionally, the trend toward mergers and acquisitions in the bedding industry is leading to increased competition and innovation. Furthermore, health concerns related to the use of low-quality pillows are raising awareness among consumers, creating a demand for high-quality, supportive pillows. These factors, among others, are expected to shape the market dynamics and influence growth in the coming years.

What will be the Size of the Market During the Forecast Period?

- The market is a significant segment of the consumer goods industry, encompassing a wide range of products designed to provide comfort and support for various sleep needs. Hotels and residential complexes are among the key consumers of pillows, with a focus on high-quality offerings that ensure guest satisfaction and resident comfort. Toss pillows, made from various materials such as down, feather, and microbeads, continue to be popular choices due to their ability to conform to the shape of the head and neck, providing optimal support. Fabric selection is crucial in the production of pillows, with natural fibers like silk-cotton tree and synthetic materials like polyester used to cater to diverse consumer preferences. Memory foam and feather sleeping pillows are other prominent categories in the market, with memory foam offering superior pressure point relief and feather pillows providing a plush, luxurious feel.

- The senior population represents a significant consumer base for pillows, as sleep-related problems become more prevalent with age. Innovations in technology have led to the emergence of smart pillows, which incorporate features like wireless speakers and sleep trackers to enhance the overall sleep experience. Hospitals and rehabilitation centers also utilize specialized pillows to cater to patients with unique sleep requirements. E-commerce platforms have made it easier for consumers to purchase pillows online, enabling them to browse and compare various bedding ensembles, including king size, queen size, and standard size options, from the comfort of their homes. The tourism industry also plays a role in driving demand for pillows, as travelers seek comfortable accommodations during their stays. The consumer goods market for pillows is expected to witness steady growth, driven by increasing awareness of the importance of quality sleep and the availability of a diverse range of products catering to various consumer preferences and needs.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Memory foam pillows

- Cotton pillows

- Microbead pillows

- Down and feather pillows

- Geography

- North America

- Canada

- Mexico

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

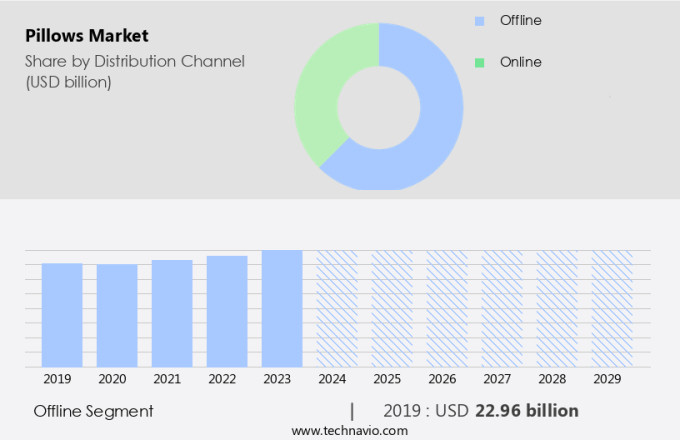

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

The offline distribution channel plays a substantial role in The market, accounting for a significant market share. This segment includes physical retail stores such as department stores, specialty stores, and home furnishing stores, which provide consumers with the opportunity to examine and purchase pillows in person. Shopping in these stores allows consumers to receive expert advice from sales representatives and make informed decisions based on their preferences. The offline distribution channel encompasses various retail formats, including hypermarkets, supermarkets, and convenience stores. Hypermarkets and supermarkets, in particular, offer a wide selection of pillows at competitive prices and are popular among consumers seeking convenience and affordability.

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 22.96 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

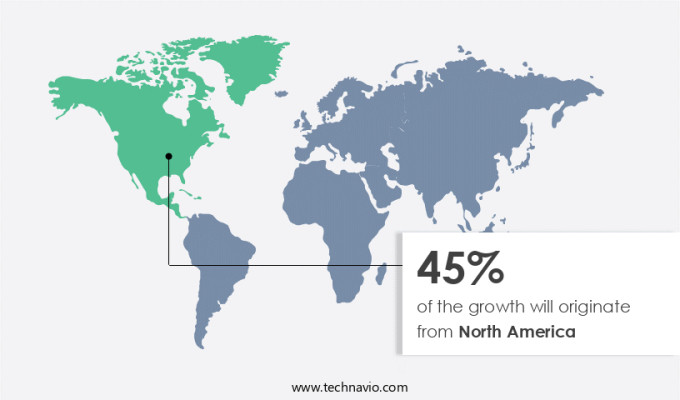

- North America is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is projected to expand substantially over the forecast period due to the influx of companies and their diverse product offerings. Consumers are increasingly drawn to innovative pillows such as memory foam and cervical pillows, which provide superior comfort and health benefits. Memory foam pillows, in particular, have gained popularity due to their ability to maintain proper spinal alignment and act as a barrier against allergens. These pillows inhibit the growth of harmful bacteria and viruses, making them a preferred choice for health-conscious consumers. E-commerce platforms have facilitated the easy availability of these pillows, enabling wider market reach and increased sales. Marketing tactics focusing on consumer education and product differentiation are key strategies adopted by companies to gain a competitive edge in this market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Pillows Market?

Growing hotel industry is the key driver of the market.

- The market is experiencing growth due to the expansion of the hotel industry and the increase in disposable income. With the construction of new hotels and the growth of the tourism sector, the demand for high-quality pillows is on the rise. In the US, for instance, the hotel industry is projected to grow, leading to an increase in the number of hotel rooms and the subsequent demand for pillows. The senior population, who often experience sleep-related problems, also contributes to the market growth. Consumers are increasingly seeking out advanced pillow technologies such as memory foam, down, feather, microbead, and smart pillows. These pillows cater to various needs, including muscle tension relief, injury prevention, and sleep tracking.

- Additionally, the rise of e-commerce platforms and marketing tactics, such as branding and lifetime guarantees from companies have made it easier for consumers to access and purchase these products. The market also includes various sizes, including king size, queen size, and standard size, and a range of consumer goods, from pillow protectors and covers to body pillows and couple pillows. Inflation pressures and economic expansion are also contributing factors to the market's growth. Hospitals, rehabilitation centers, and other institutions also use pillows for patient care, further expanding the market's scope.

What are the market trends shaping the Pillows Market?

Increasing mergers and acquisitions activities is the upcoming trend in the market.

- The Sleeping Pillow Market encompasses a diverse range of companies, including those specializing in Toss pillows, Down Sleeping Pillows, Feather Sleeping Pillows, Microbead Sleeping Pillows, and Memory foam pillows. These companies are expanding their reach through strategic acquisitions, enabling them to penetrate both local and global markets. This growth strategy not only increases their customer base and market share but also allows for product diversification. For example, in May 2023, Tempur Sealy International announced its acquisition of Mattress Firm Group for approximately USD 4 billion. This inorganic growth will benefit consumers, as they will have access to an expanded selection of pillows, including those made from Fabric sourced from the Silk-cotton tree, or advanced technologies such as Smart Pillows with Sleep Trackers and Wireless Speakers.

- Additionally, this trend is not limited to residential consumers, as hotels, hospitals, rehabilitation centers, and senior living complexes are also investing in high-quality pillows to address Sleep-related Problems and provide comfort to their guests and patients. Consumer goods companies, such as BEDGEAR, Performance Mattresses, and The Company Store, are also offering pillow protectors, pillow covers, and pillow ensembles, including Body pillows and Couple pillows, to cater to various consumer preferences. Inflation pressures and economic expansion have led to increased demand for these consumer products, making the market a significant and growing sector within the bedding industry.

What challenges does the Pillows Market face during the growth?

Health issues related to low-quality pillows is a key challenge affecting the market growth.

- The market encompasses a wide range of pillows, including Toss pillows, Down Sleeping Pillows, Feather Sleeping Pillows, Microbead Sleeping Pillows, and Memory foam pillows. These consumer goods are essential for providing comfort and support during sleep. However, the market's fragmented structure poses a challenge, with many substandard pillows available. These low-quality pillows can lead to health issues, such as sleep-related problems, muscle tension, and injury rates, particularly among the senior population. Hotels, Residential Complexes, and Hospitals are significant end-users of pillows. The tourism industry's growth and economic expansion have led to an increased demand for pillows in the hotel sector. In contrast, the residential market relies on various pillow types, including Memory foam, Polyester, and Silk-cotton tree pillows.

- Innovations in the market include Smart Pillows with wireless speakers and sleep trackers, as well as CBD Pillows with CBD-infused fabric. E-commerce platforms have made it easier for consumers to purchase pillows online, with marketing tactics such as branding and lifetime guarantees driving sales. Despite these advancements, the market faces challenges, including inflation pressures and competition from non-store-based retailers. The demand for pillows is influenced by factors such as population growth and increasing awareness of the importance of quality bedding for overall health. Consumer products like Body pillows, Couple pillows, and Pillow covers cater to various consumer preferences and needs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Advanced Sleep Technologies - The company offers pillows such as Beyosa pillow, designed to maintain the natural curve of the cervical spine while providing support and relieving pressure on the head, neck, and shoulders.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Sleep Technologies

- American Textile Co.

- Avocado Mattress LLC

- Bedding Acquisition LLC

- Brooklyn Bedding

- Casper Sleep Inc.

- ComfyDown

- Coop Home Goods

- Downlite

- Gio Clavis Co. Ltd.

- Leesa Sleep LLC

- Malouf Companies

- Mediflow Inc.

- My Pillow Inc.

- Purple Innovation Inc.

- Resident Home LLC

- Serta Simmons Bedding LLC

- Sleep Number Corp.

- SnugglePedic

- Tempur Sealy International Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of products designed to provide comfort and support during sleep. This market caters to various consumer segments, including residential and commercial consumers, such as hotels and hospitals. The market's growth is driven by several factors, including consumer preferences, technological advancements, and demographic trends. One significant trend in the pillow market is the increasing demand for high-quality, comfortable pillows. Consumers are willing to invest in pillows that offer superior comfort and support, leading to the growth of various pillow types, such as memory foam, down, feather, microbead, and silk-cotton tree pillows. These pillows cater to different consumer preferences, with memory foam providing excellent contouring and pressure relief, down and feather pillows offering a plush and luxurious feel, and microbead pillows providing adjustable support. Another trend in the pillow market is the increasing popularity of smart pillows. These pillows incorporate advanced technologies, such as wireless speakers, sleep trackers, and injury rate sensors, to enhance the user experience.

Smart pillows cater to consumers who seek personalized comfort and sleep optimization, making them an attractive option for tech-savvy consumers. The senior population represents a significant consumer segment in the pillow market. As the global population ages, there is a growing demand for pillows that cater to the unique sleep needs of older adults. Pillows designed to address sleep-related problems, such as muscle tension and back pain, are particularly popular among this demographic. The market is also influenced by economic expansion and inflation pressures. Consumer goods companies employ various marketing tactics, such as branding, pricing strategies, and distribution channels, to cater to different consumer segments and market conditions. E-commerce platforms have emerged as a popular distribution channel for pillow sales, offering consumers the convenience of shopping from the comfort of their homes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market Growth 2025-2029 |

USD 11.39 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, Canada, China, Germany, India, France, UK, Japan, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.