Beer Glassware Market Size 2024-2028

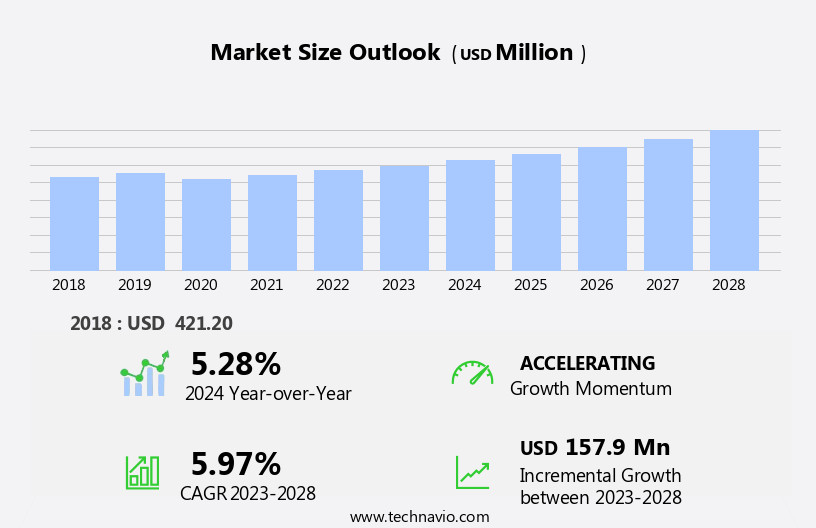

The beer glassware market size is forecast to increase by USD 157.9 million at a CAGR of 5.97% between 2023 and 2028.

What will be the Size of the Beer Glassware Market During the Forecast Period?

How is this Beer Glassware Industry segmented and which is the largest segment?

The beer glassware industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Commercial

- Household

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- Germany

- France

- North America

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

By End-user Insights

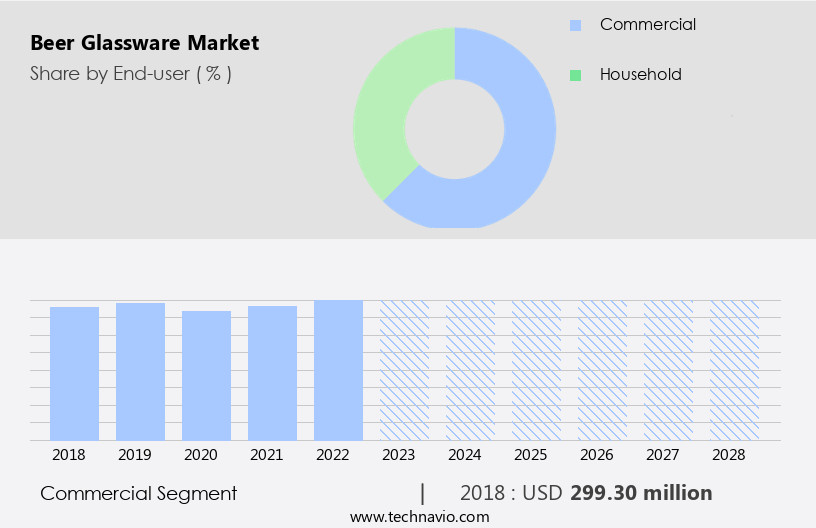

The commercial segment is estimated to witness significant growth during the forecast period. The market has witnessed notable expansion In the commercial sector, including bars, pubs, and restaurants, in 2023. This growth can be attributed to the increasing popularity of craft beer and beer tourism, leading to a heightened demand for distinctive, premium beer glassware. These establishments prioritize offering their patrons a unique drinking experience and a diverse selection of glassware designed to optimize beer appreciation. The hospitality industry acknowledges the significance of presentation in crafting memorable customer experiences, with beer glassware playing a pivotal role. It allows for the showcasing of beer's visual appeal, aroma, and taste, thereby enhancing overall enjoyment.

Get a glance at the market report of various segments Request Free Sample

The Commercial segment was valued at USD 299.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

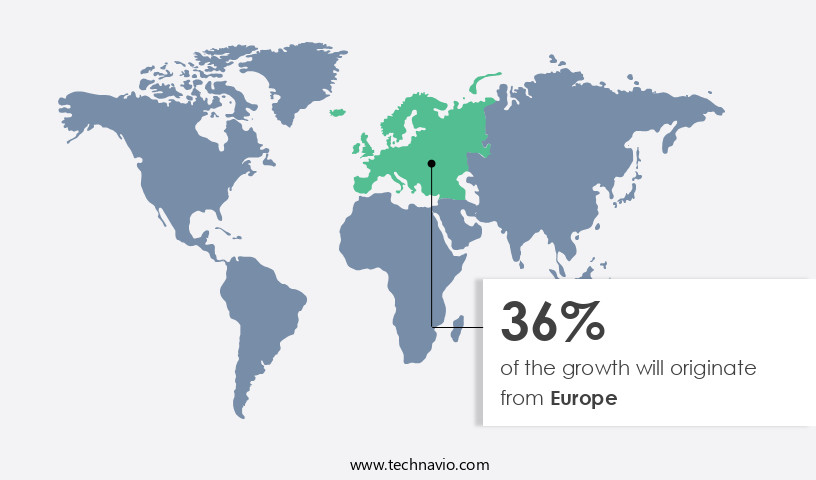

Europe is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The European the market has experienced notable growth due to the region's rich beer culture and the increasing popularity of craft beer. Unique beer glassware designs, specifically those that highlight the distinct color and characteristics of various beer types, have gained significant demand. European countries, including Germany, Belgium, and the Czech Republic, have a long-standing tradition of brewing and consuming beer, leading brewing companies to develop regionally specific glassware styles, such as the stout glass used in Germany. The appeal of beer glassware extends beyond aesthetics, as the materials, shape, and design can enhance the taste, fragrances, and effervescence of beer.

Beer glasses are essential drinking vessels in bars, restaurants, hotels, clubs, pubs, wine shops, and online retail platforms. The market offers various glass materials, including glass and plastics, catering to both household and commercial requirements. The cultural reflections and national traditions embodied in beer glass styles contribute to the cultural tapestry, making them an integral part of the beer-drinking experience. Sustainability is a growing concern In the beer glassware industry, with an increasing focus on recycled glass, waste minimization, and energy consumption. Multi-functional products and brewing activities further expand the market's potential, making beer glasses an essential component of home entertainment and cultural beer preferences.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Beer Glassware Industry?

- Increase in demand for craft beer is the key driver of the market.The market is experiencing significant growth due to the increasing popularity of craft beer. Craft beer, which is often produced using traditional methods and premium ingredients, offers a more complex and distinct taste profile compared to mass-produced beers. Consequently, craft beer aficionados seek specialized glassware to optimally appreciate the beer's aroma, flavor, and appearance. This trend is particularly prevalent in bars, restaurants, hotels, clubs, pubs, wine shops, and even online retailers. Various beer glass styles, such as mugs, pints, pilsner, weizen, snifters, taster glasses, and plastics, cater to diverse cultural reflections and regional traditions. The commercial breweries and brewing activities also leverage these vessels to enhance the overall beer drinking experience.

As sustainability becomes a priority, multi-functional products made from recycled glass or energy-efficient materials are gaining traction. The market is an integral part of the cultural tapestry, reflecting the appeal of beer and its rich history.

What are the market trends shaping the Beer Glassware market?

- Use of sustainable materials is the upcoming market trend.The market is witnessing a growing emphasis on sustainability, as consumers express a preference for eco-friendly products. In response, manufacturers are producing beer glassware from sustainable materials, such as recycled glass, and implementing production methods that minimize waste and promote the reuse or recycling of their products. Lean manufacturing practices, including the use of precision cutting tools and optimized production processes, are being adopted to reduce energy consumption and waste. Some manufacturers offer take-back programs, enabling customers to return used glassware for recycling or reuse. These initiatives cater to the increasing demand for environmentally conscious products In the beer industry.

What challenges does the Beer Glassware Industry face during its growth?

- Price sensitivity among consumers is a key challenge affecting the industry growth.The market encounters price sensitivity as a notable challenge. Consumers' reluctance to pay premium prices for specialized beer glasses, such as mugs, pints, pilsner, weizen, snifters, taster glasses, and plastics, exists due to the availability of affordable generic alternatives. This trend can hinder the growth of high-end or custom-designed beer glasses, particularly in price-sensitive markets or during economic downturns. Retailers and distributors also face apprehensions regarding the carrying and selling of high-priced beer glassware. Concerns over demand, inventory costs, and competition can deter them from stocking these products, thereby restricting the market potential for specialized beer glass manufacturers.

Moreover, the fragile nature of glass materials used in beer glassware production can lead to complications In the supply chain, affecting the overall market dynamics. Despite these challenges, the appeal of beer glassware in enhancing the taste, fragrances, and visual presentation of beer continues to drive demand, particularly in bars, restaurants, hotels, clubs, pubs, wine shops, and online retail platforms. Sustainability initiatives, such as recycled glass and waste minimization, are gaining traction In the market, offering opportunities for manufacturers to cater to evolving customer requirements and serving requirements. Multi-functional beer glassware and brewing activities at home further contribute to the cultural tapestry of beer preferences, making beer glasses an essential part of the cultural reflections and national traditions.

Exclusive Customer Landscape

The beer glassware market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the beer glassware market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, beer glassware market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Bormioli Luigi S.p.A. - The beverage industry's emphasis on enhancing the consumer experience extends to the glassware used for serving beer. One notable player in this market is the company, which provides a range of specialized beer glasses, including those designed for IPA beers, such as the Birrateque model. These glasses are engineered to optimize the beer drinking experience by accentuating aromas and enhancing flavor profiles. The company's commitment to innovation and quality makes it a preferred choice for establishments seeking to elevate their beer offerings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bormioli Luigi S.p.A.

- Borosil Ltd.

- Cello World Pvt. Ltd.

- Eagle Glass Deco Pvt. Ltd.

- Fiskars Group

- Guangdong Garbo Industrial Co. Ltd.

- Hamilton Housewares Pvt. Ltd.

- Libbey Inc.

- Lifetime Brands Inc.

- Ngwenya Glass Swaziland/Eswatini

- Ocean Glass Public Co. Ltd.

- Pinkoi Group

- SAHM GmbH and Co. KG

- Shotoku Glass Co. Ltd.

- The Beer Store

- Tiroler Glashutte GmbH

- Treasure Retail Pvt. Ltd.

- Villeroy and Boch AG

- Zenan Glass

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Beer glassware refers to the various types of drinking vessels designed specifically for serving and consuming beer. These vessels come in various shapes and sizes, each with unique features that enhance the beer drinking experience. The market encompasses a wide range of products, including mugs, pints, pilsner glasses, weizen glasses, snifters, taster glasses, and more. The appeal of beer glassware goes beyond mere functionality. The shape and design of these vessels can significantly impact the taste, fragrances, and overall enjoyment of beer. For instance, the narrow tapering shape of a pilsner glass allows for the appreciation of the beer's carbonation and aroma, while a weizen glass with a wide bowl and short stem is designed to showcase the beer's head and allow for swirling to release its complex flavors.

The materials used in beer glassware production vary, with glass being the most common choice due to its ability to preserve carbonation and showcase the beer's appearance. However, there is a growing trend towards sustainable and eco-friendly options, such as recycled glass and plastics. These materials offer advantages such as waste minimization, energy consumption reduction, and the production of multi-functional products. The market caters to both household and commercial consumers. Bars, restaurants, hotels, clubs, pubs, wine shops, and online retailers are some of the key channels through which these products reach consumers. The demand for beer glassware is driven by cultural reflections and national traditions, with each region having its unique beer glass styles.

Despite the numerous benefits of beer glassware, there are complications associated with their fragile nature. The need to handle them with care and the potential for breakage can be a concern for both consumers and businesses. However, the growing popularity of craft beer and the desire for a more authentic drinking experience have led to an increased demand for these vessels. The market is a vibrant and dynamic one, with new trends and innovations constantly emerging. The growing emphasis on sustainability and e-commerce has led to the rise of online retailers as a significant channel for sales. The market is expected to continue growing, driven by customer requirements and serving requirements in various sectors.

In conclusion, beer glassware plays a crucial role in enhancing the beer drinking experience, with its unique designs and materials contributing to the appreciation of beer's taste, aroma, and cultural significance. The market for beer glassware is diverse and dynamic, with various channels and trends shaping its growth. The use of sustainable materials and e-commerce platforms are expected to be key drivers of future growth in this market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

151 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.97% |

|

Market growth 2024-2028 |

USD 157.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.28 |

|

Key countries |

US, Germany, China, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Beer Glassware Market Research and Growth Report?

- CAGR of the Beer Glassware industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the beer glassware market growth of industry companies

We can help! Our analysts can customize this beer glassware market research report to meet your requirements.