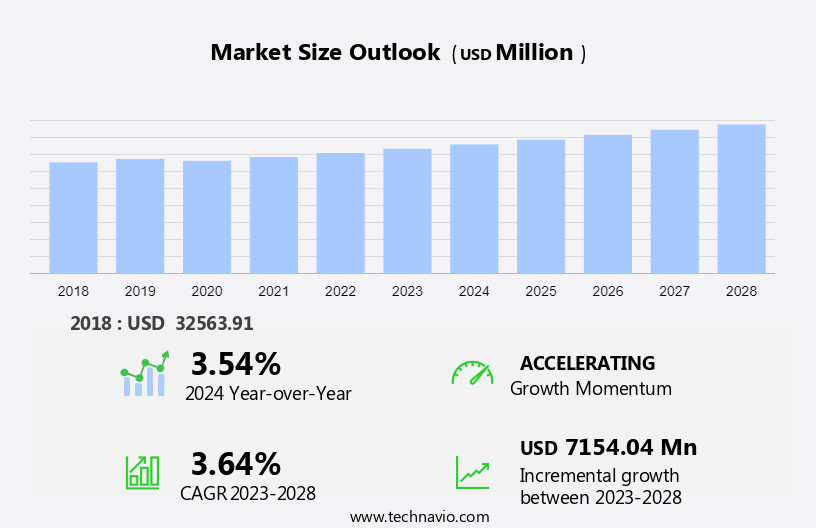

Europe Beverage Packaging Market Size 2024-2028

The Europe beverage packaging market size is forecast to increase by USD 7.15 billion at a CAGR of 3.64% between 2023 and 2028.

- Increasing demand for packaging tailored to functional beverages.

- Growing emphasis on sustainable practices in beverage packaging, driven by environmental concerns and regulatory frameworks.

- Expansion of the e-commerce sector in Europe, leading to a higher demand for specialized packaging solutions for online sales and distribution.

- The rise in demand for packaging designed specifically for functional beverages reflects changing consumer preferences and innovation in the beverage industry.

- The push for sustainability is driving the adoption of eco-friendly packaging materials and practices in response to broader environmental concerns.

- The expansion of e-commerce is increasing the need for packaging optimized for logistics, influencing the development of new packaging solutions that can withstand shipping and handling requirements.

What will be the size of the market during the forecast period?

To learn more about the market report, Request Free Sample

- The European beverage packaging market encompasses various types of packaging for different beverages, including fresh milk, shelf-stable milk, and non-alcoholic and alcoholic beverages.

- Population growth and increasing per capita income have fueled the demand for these packaging solutions. Lifestyle trends have led to an increase in off-premise consumption, driving the need for e-commerce-friendly packaging, such as pouches and recyclable plastics like PET.

- Production and transportation costs, including handling, have influenced the choice of packaging materials. Traditional fossil-fuel-based plastics, such as PET bottles and containers, have been widely used but are facing growing opposition due to environmental concerns. Sustainable alternatives, such as virgin plastics and recyclable cups, are gaining popularity.

- Additionally, the European Commission has set regulations for beverage containers, including the use of recyclable plastics, to reduce waste and promote sustainability.

- Companies are investing in innovative packaging solutionthatich uses renewable resources for its production. The market for beverage packaging in Europe is expected to continue its growth trajectory, driven by these trends and regulatory initiatives.

Market Segmentation

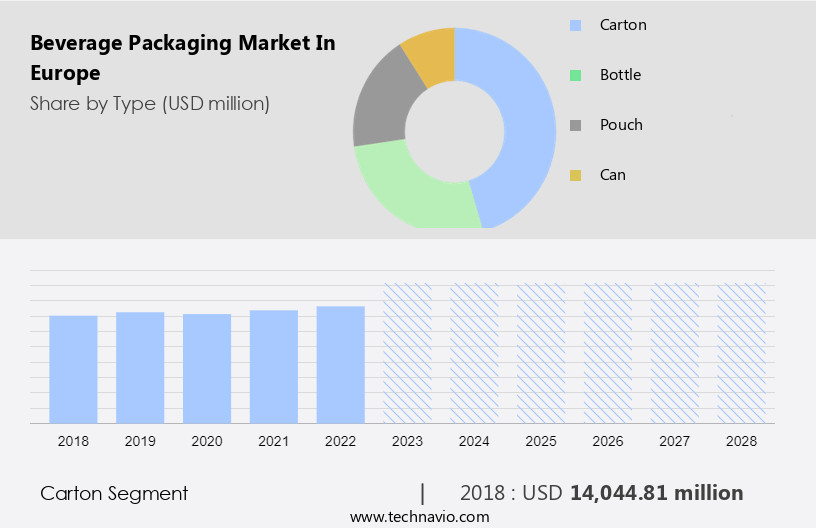

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Carton

- Bottle

- Pouch

- Can

- Material

- Paper and paper board

- Plastic

- Metal

- Glass

- Geography

- Europe

- Europe

By Type Insights

The Carton segment is estimated to witness significant growth during the forecast period. The European beverage packaging market experiences significant growth, particularly in the carton packaging category. This trend is influenced by several factors, including Europe's population growth and increasing per capita income, leading to shifting consumer lifestyles and preferences. Fresh milk and shelf-stable milk are popular beverages packaged in cartons, utilizing lightweight, sustainable materials such as virgin plastics and PETRA. Aseptic cartons, gable-top cartons, and tetra packs are common formats for these containers, offering convenience, sustainability, and product protection. The production, transportation, and handling costs associated with beverage containers are crucial considerations in the market. E-commerce sales have grown, necessitating the use of recyclable plastics and sustainable beverage ecosystems to minimize hazardous waste.

Additionally, consumption patterns related to alcoholic beverages have also influenced the market, with lockdown restrictions driving increased off-premise consumption and on-premise establishments adapting to new regulations. PET recycling companies, such as those mentioned, play a vital role in the circular economy of the beverage packaging industry.

Get a glance at the market share of various segments Request Free Sample

The Carton segment was valued at USD 14.04 billion in 2018 and showed a gradual increase during the forecast period.

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rise in demand for packaging of functional beverages is the key driver of the market.

- In Europe, the beverage packaging market caters to a population with increasing per capita income and evolving lifestyles. Functional beverages, including enhanced fruit drinks, RTD teas, sports drinks, energy drinks, enhanced water, and soy drinks, are gaining popularity.

- The demand for these beverages is driven by factors such as brain function promotion and healthy eyesight. The pandemic has intensified the need for beverages that help combat stress, anxiety, and sleeping problems.

- The packaging market in Europe is witnessing a shift towards lightweight materials like pouches, as opposed to traditional bottle and container packaging.

- Additionally, E-commerce sales have accelerated, necessitating packaging solutions that ensure product safety and sustainability during transit. Alcohol consumption patterns have also influenced the beverage packaging market.

- Lockdown restrictions have led to a rise in off-premise consumption, necessitating packaging for gin, cognac, and other spirits. Recyclable plastics are increasingly being adopted to minimize packaging waste.

- The European Commission is promoting a sustainable beverage ecosystem by encouraging the use of recycled materials in beverage containers and cups. Companies are leading the way in PET recycling, reducing hazardous waste and contributing to a circular economy.

- In conclusion, the logistics aspect of beverage packaging is also being addressed through innovative solutions, which specialize in glass bottles. Glass bottle manufacturers are focusing on recycled materials to reduce their carbon footprint.

- The use of fossil-fuel-based plastics is being phased out in favor of more sustainable alternatives. The market is expected to continue evolving, driven by consumer preferences, regulatory initiatives, and technological advancements.

Market Trends

The technological advancement in packaging is the upcoming trend in the market.

- In Europe, the beverage packaging market is experiencing significant growth, driven by various factors. The European population's increasing per capita income and evolving lifestyles have led to a higher demand for fresh milk and shelf-stable milk products.

- In response, beverage packaging manufacturers are focusing on using lightweight packaging materials, such as pouches, to reduce production, transportation, and handling costs.

- Moreover, the rise of e-commerce and changing consumer preferences have necessitated the adoption of smart packaging technologies, including QR codes, NFC, and RFID chips. These technologies offer valuable product information and interactive experiences to consumers, ensuring product authenticity and maintaining high quality.

- Additionally, the alcohol consumption sector, particularly affected by lockdown restrictions, has seen a shift towards off-premise consumption. As a result, beverage packaging companies are focusing on producing bottles and containers made from recyclable plastics, like PET, to reduce waste and promote a sustainable beverage ecosystem.

- The European Commission has set regulations for beverage containers and cups, encouraging the use of recyclable plastics and reducing hazardous waste. PET recycling companies and other waste management providers play a crucial role in the logistics aspect of recycling. Glass bottles, a traditional packaging material, are being challenged by innovative solutions like Nakpack's lightweight glass bottles.

Market Challenge

The high cost of recycled plastic products is a key challenge affecting the market growth.

- In Europe, the beverage packaging market is significantly influenced by population demographics and per capita income, shaping consumer preferences towards various beverage types and packaging materials.

- Fresh milk and shelf-stable milk are popular choices, leading to a high demand for lightweight packaging materials like PET bottles and containers. However, the production, transportation, and handling costs associated with these materials can be substantial.

- The European population's evolving lifestyles, driven by e-commerce growth and changing consumption patterns, have led to an increase in off-premise consumption. Alcoholic beverages, such as gin and cognac, are major contributors to the beverage packaging market.

- Lockdown restrictions have further boosted on-premise consumption, leading to a growth in demand for glass bottles from manufacturers like Bruni Glass France and Nakpack.

- However, despite these trends, recycling remains a crucial aspect of the European beverage packaging market. The European Commission has set ambitious targets for recycling beverage containers, including cups and bottles made from recyclable plastics like PET.

- Companies are at the forefront of PET recycling, transforming hazardous waste into valuable resources. However, the logistical and economic complexities of recycling plastic, particularly in separating and processing various types and compositions, add to the high costs.

- The use of virgin plastics and fossil-fuel-based plastics continues to pose sustainability challenges. The beverage industry is working towards creating a sustainable ecosystem by using recycled materials in packaging.

- In conclusion, the European beverage packaging market is shaped by population demographics, consumer preferences, and sustainability initiatives.

- The use of lightweight materials, recycling efforts, and the logistical challenges associated with recycling add to the production costs. Companies are focusing on using recycled materials and improving recycling processes to create a more sustainable beverage ecosystem.

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amcor plc: The company offers beverage packaging such as innovative PET bottles, lightweighted cans, and flexible pouches, providing sustainable and convenient options for diverse beverages.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AptarGroup Inc.

- Ardagh Group SA

- Ball Corp.

- Beatson Clark

- CANPACK SA

- Crown Holdings Inc.

- Gerresheimer AG

- Graphic Packaging Holding Co.

- Huhtamaki Oyj

- Mondi Plc

- O I Glass Inc.

- Plastipak Holdings Inc.

- Silgan Holdings Inc.

- Sonoco Products Co.

- Tetra Laval SA

- Stora Enso Oyj

- Verallia SA

- Vidrala SA

- Multi Plastics Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The European Beverage Packaging Market is a significant sector, encompassing various types of beverages and packaging materials. The market witnesses continuous progression, driven by consumer preferences for convenience, sustainability, and innovative designs. Plastics, glass, and metal are the primary packaging materials utilized in this industry. PET and PVC are popular choices for bottled beverages, while aluminum and steel are preferred for canned beverages. The market is segmented based on beverage types, which include carbonated soft drinks, juices, water, and others. The increasing trend towards eco-friendly and biodegradable packaging solutions is a key factor influencing the market's growth. Additionally, the growing popularity of functional and fortified beverages is expected to create new opportunities for beverage packaging manufacturers in Europe.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.64% |

|

Market growth 2024-2028 |

USD 7.15 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.54 |

|

Key companies profiled |

Amcor plc, AptarGroup Inc., Ardagh Group SA, Ball Corp., Beatson Clark, CANPACK SA, Crown Holdings Inc., Gerresheimer AG, Graphic Packaging Holding Co., Huhtamaki Oyj, Mondi Plc, O I Glass Inc., Plastipak Holdings Inc., Silgan Holdings Inc., Sonoco Products Co., Tetra Laval SA, Stora Enso Oyj, Verallia SA, Vidrala SA, and Multi Plastics Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles,market forecast , fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch