Binoculars Market Size 2024-2028

The binoculars market size is forecast to increase by USD 172.55 million at a CAGR of 4.01% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends. The increasing popularity of outdoor recreational activities, particularly in North America, is driving market growth. Moreover, the demand for multifunctional binoculars that offer additional features such as image stabilization and night vision is on the rise.

- However, the market faces challenges from substitute products like monoculars and smartphones with advanced camera features. These factors, along with regional trends and competitive landscape, are analyzed in detail in the market trends and analysis report. The report provides insights into market size, share, growth, and forecasts to help businesses make informed decisions.

What will be the Binoculars Market Size During the Forecast Period?

- The market encompasses a diverse range of products catering to various consumer needs and preferences. Among the popular segments are binoculars designed for travel, which offer compactness and portability without compromising on image quality. Another significant segment is waterproof binoculars, essential for outdoor activities in wet environments. Binoculars for astronomy and high magnification binoculars are in high demand for stargazing and observing distant objects. Fishing, concerts, wildlife viewing, hiking, opera, sports, and photography are other areas where binoculars play a crucial role. Sailing and birdwatching are specific use cases that require binoculars with specific features such as fog proof and waterproof capabilities.

- Moreover, affordable binoculars with image stabilization and low light performance are gaining popularity among consumers. The lens diameter is an essential factor in determining the brightness and clarity of the image. Binoculars with magnification and high-powered options are ideal for specific applications such as hunting and long-range observation. Manufacturers continue to innovate, introducing features such as zoom, fog proof, and waterproof capabilities to cater to the diverse needs of consumers. The market dynamics are influenced by factors such as consumer preferences, technological advancements, and competition. The demand for compact, high-performance, and affordable binoculars is expected to drive the market's growth.

How is this market segmented and which is the largest segment?

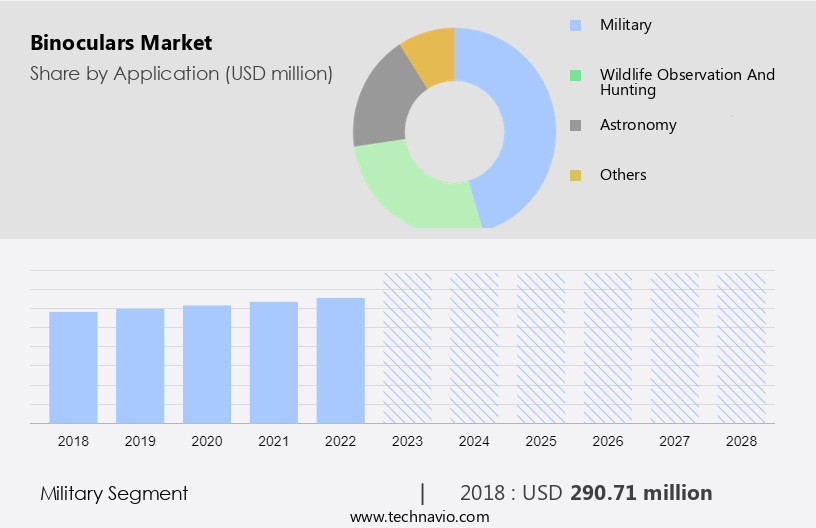

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Military

- Wildlife observation and hunting

- Astronomy

- Others

- Type

- Roof prism binoculars

- Porro prism binoculars

- Galilean binoculars

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- Germany

- Italy

- South America

- Middle East and Africa

- North America

By Application Insights

- The military segment is estimated to witness significant growth during the forecast period.

The market is driven by the military sector, with these devices serving as essential equipment for troops to locate and observe distant objects. Image stabilization technology enables clear vision through adverse weather conditions, enhancing their effectiveness. Defense spending is a significant growth factor, with countries such as China, Saudi Arabia, Russia, France, and Canada investing heavily in their militaries. The market's expansion is further fueled by the demand for advanced binoculars with higher magnification for outdoor enthusiasts, training, recreational activities, music festivals, wildlife observation, and star fields. Binoculars consist of lenses, prisms, and telescopes, with continuous advancements in their components ensuring improved image quality and durability. The market is expected to grow steadily during the forecast period, driven by these factors.

Get a glance at the market report of share of various segments Request Free Sample

The military segment was valued at USD 290.71 million in 2018 and showed a gradual increase during the forecast period.

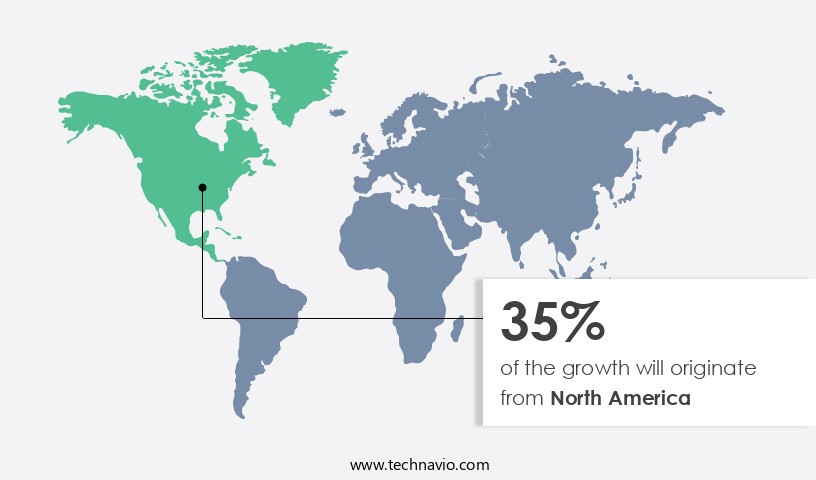

Regional Analysis

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America held the largest share in 2023, driven by significant investments in defense sectors in countries like the United States. With the US being the largest military spender globally since 2000, the demand for binoculars for military applications is high. However, the market is projected to experience stagnant growth due to the withdrawal of US military forces from Iraq and decreasing military spending. In FY 2022, the US allocated USD766 billion for national defense, representing 12% of total federal spending. Beyond military applications, binoculars are popular among birdwatchers, enthusiasts, and for surveillance and stargazing. Advanced features such as digital functions, optical coatings, and night vision enhance their functionality and optical performance. The market is expected to grow moderately due to increasing demand for these advanced binoculars and the expanding application areas.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Binoculars Market?

The rise in the popularity of outdoor recreational activities is the key driver of the market.

- The market has experienced significant growth due to the increasing popularity of outdoor recreational activities and adventure tourism. With hectic lifestyles leading to stress and the need for relaxation, people are turning to nature and the great outdoors for leisure pursuits. Binoculars are an essential tool for various outdoor activities such as bird watching, stargazing, hunting, and wildlife observation. The demand for high-performance binoculars with advanced features such as digital functions, optical coatings, image stabilization, and magnification power is on the rise. These features enhance the optical performance, range, and clarity of the binoculars, making them indispensable for enthusiasts of outdoor pursuits.

- Moreover, the growing interest in surveillance, night vision, and target acquisition has led to the development of specialized binoculars for military operations, security, and combat. These high-end binoculars often come with advanced lenses, fog-proof and waterproof features, and lightweight designs. Binoculars are also used in various other industries such as sea navigation, cargo management systems, and infrastructure development. They are essential for activities like cycling trips, sporting events, and wildlife conservation. The increasing customization options, compactness, and water resistance of binoculars make them a versatile tool for various leisure activities, including music festivals and theater performances. The market for binoculars is expected to continue growing due to the increasing popularity of outdoor recreational activities and the technological advancements in the field.

What are the market trends shaping the Binoculars Market?

Increased demand for multifunctional binoculars is the upcoming trend in the market.

- The market is witnessing significant growth as companies introduce innovative technologies to cater to the evolving needs of customers. Over the past five years, ergonomic designs have gained popularity, offering both aesthetic appeal and reliable performance. The market is responding to this trend, with a focus on multifunctional products that provide increased convenience and enhanced results. Optical coatings, digital functions, and image stabilization technology are key features driving demand for high-performance binoculars. Bird watching enthusiasts, surveillance operators, and stargazers alike benefit from these advanced features. Night vision capabilities and porro prism designs are also popular among outdoor enthusiasts, particularly those engaged in hunting, military operations, and infrastructure development.

- Moreover, durability is a crucial factor in the market, with companies focusing on fog-proof and waterproof features to ensure their products perform optimally in various environments. Lightweight designs are also essential for outdoor recreational activities such as cycling trips, sea navigation, and sporting events. Compactness and clarity are important considerations for travelers and theatergoers, while lens diameter and magnification power are critical factors for wildlife observation and star fields exploration. Lens components, prisms, and telescopes are essential components of binoculars, with companies investing in advanced lenses and customization options to differentiate their offerings. The market for binoculars is expected to grow further as companies continue to innovate, introducing features such as autofocus, laser rangefinders, and data management systems. Cost remains a significant factor, with companies offering a range of options to cater to various budgets. Overall, the market is an exciting space, with companies continually pushing the boundaries of technology to meet the diverse needs of their customers.

What challenges does Binoculars Market face during the growth?

The rise in the use of substitute products is a key challenge affecting the market growth.

- The market caters to the demands of various outdoor enthusiasts and recreational activities, offering durable and high-performance solutions for bird watching, wildlife observation, stargazing, and surveillance. These devices come with advanced features such as digital functions, optical coatings, image stabilization, and lens diameters that enhance optical performance and magnification power. The market includes porro prism and roof prism designs, fog-proof and waterproof features, and lightweight designs suitable for outdoor pursuits like hunting, sea navigation, and cycling trips. Night vision binoculars offer clear images in low-light conditions, making them essential for military operations, security, and combat situations.

- However, the market also caters to the needs of travelers, theatergoers, and individuals engaging in leisure activities, providing compact and user-friendly options with advanced lenses and customization features. Cost-effective solutions are also available for those with budget constraints, while high-end options offer laser rangefinders and autofocus capabilities. The market is continually evolving, incorporating the latest image stabilization technology, positioning systems, and data management systems to enhance user experience and functionality.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Technologies Network Corp.

- Barska Optics

- BERETTA HOLDING SA

- Canon Inc.

- Carl Zeiss AG

- Celestron Acquisition LLC

- Eschenbach Optik GmbH

- FUJIFILM Corp.

- Guangzhou Bosma Corp.

- Jaxy Optical Instrument Co. ltd.

- Leupold and Stevens Inc.

- Nikon Corp.

- Olympus Europa SE and Co. KG

- Sony Group Corp.

- Vista Outdoor Inc.

- Vortex Optics

- Meade Instruments

- Opticron

- Ricoh Imaging Co. Ltd.

- Shengzhen China Visionking Optical Technology Co. Ltd.

- Yukon Advanced Optics Worldwide

- Fabbrica dArmi Pietro Beretta S.p.A.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of products, catering to various applications and user preferences. This dynamic industry is driven by several factors, including advancements in technology, increasing demand from outdoor enthusiasts, and the growing popularity of outdoor recreational activities. One significant trend in the market is the focus on durability and ruggedness. With an expanding user base that includes bird watchers, hunters, and surveillance personnel, manufacturers are prioritizing the development of high-performance binoculars capable of withstanding harsh environmental conditions. These binoculars often feature advanced coatings, fog-proof designs, and waterproof features to ensure optimal performance in diverse environments. Another key trend is the integration of digital functions, such as image stabilization technology and autofocus, into binoculars. These features enhance the overall user experience, making binoculars more accessible to a broader audience, including those with visual impairments or those seeking enhanced precision in their observations. Optical performance is another critical factor in the market.

Furthermore, factors such as magnification power, field of view, and clarity play a significant role in determining the effectiveness of binoculars for various applications. For instance, high-magnification binoculars are preferred for stargazing and wildlife observation, while lower magnification binoculars are more suitable for surveillance and target acquisition. The market also caters to specialized applications, such as night vision and military operations. These binoculars often feature advanced components, such as Porro prisms and roof prisms, to optimize optical performance in low-light conditions. Additionally, the integration of sensors and data management systems in digital binoculars enables real-time data analysis and enhanced situational awareness for users in these fields. Compactness and lightweight designs are essential considerations for travelers, cyclists, and outdoor enthusiasts seeking portable binoculars for leisure activities. These binoculars often prioritize ease of use and user-friendliness, making them ideal for a wide range of applications, from music festivals to wildlife conservation efforts.

In conclusion, the market is a diverse and dynamic industry, driven by advancements in technology, increasing demand from various user groups, and the growing popularity of outdoor recreational activities. With a focus on durability, digital functions, and optical performance, manufacturers are continually pushing the boundaries of what binoculars can offer, ensuring that they remain an essential tool for a wide range of applications.

|

Binoculars Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

176 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.01% |

|

Market growth 2024-2028 |

USD 172.55 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.5 |

|

Key countries |

US, China, India, Germany, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch