Bio-Based Leather Market Size 2024-2028

The bio-based leather market size is forecast to increase by USD 227.7 million, at a CAGR of 6% between 2023 and 2028.

- The market is experiencing significant growth due to increasing consumer awareness of health risks and allergies related to traditional leather, as well as concerns over the use of specialty chemicals in its production. This trend is particularly evident in the accessories and furniture industries, where biotechnology and materials science are being leveraged to create innovative, eco-friendly alternatives. This market is driven by the environmental hazards associated with conventional leather production, including high energy and water consumption, greenhouse gas emissions, and waste generation. In response, there is a continuous push for research and development in the production of biodegradable bio-based leather. However, challenges remain, such as scalability issues and ensuring the desired properties, including breathability, scratch resistance, and durability, are maintained. Bio-based leather is not only finding applications in the production of garments and accessories but also in home decoration, making it a versatile and promising market.

What will the size of the market be during the forecast period?

- The market is gaining traction as a viable alternative to traditional leather in various industries, including fashion, footwear, furniture, and accessories. This market is driven by the increasing demand for eco-friendly materials that offer comparable quality, durability, and texture to their animal-derived counterparts. Bio-based leather is produced using renewable resources such as mushroom mycelium, pineapple leaves, cork, and leftover fruits. These materials offer several advantages over traditional leather, including reduced health risks associated with chemicals, lower energy and water consumption, and decreased greenhouse gas emissions. Mushroom leather, also known as mycelium leather, is a promising alternative to animal-derived leather. It is produced by growing the mycelium, or root structure, of mushrooms on a substrate, resulting in a material with a suede-like texture. Mycelium leather is breathable, scratch-resistant, and requires minimal water and energy to produce. Another bio-based leather alternative is pineapple leaf fiber, which is derived from the waste of pineapple harvesting. This material is used to create a leather-like fabric that can be used for clothing, bags, and wallets.

- Pineapple leaf fiber is also breathable, lightweight, and offers excellent tear strength. Cork leather is another sustainable option that is gaining popularity in the market. It is produced by removing the bark of cork oak trees, which regrow their bark after harvesting. Cork leather is known for its durability, water resistance, and elasticity. Furthermore, bio-based leather is not limited to the fashion industry. It is also used in furniture production, offering a sustainable alternative to animal-derived leather upholstery. These materials offer similar benefits, including reduced emissions, water consumption, and waste. In conclusion, the market is an emerging trend in the sustainable materials industry. These alternatives offer comparable quality, durability, and texture to traditional leather while reducing the environmental impact of production. As consumers become more conscious of their impact on the environment, the demand for bio-based leather is expected to continue growing in the fashion, footwear, furniture, and accessories industries.

How is this market segmented and which is the largest segment?

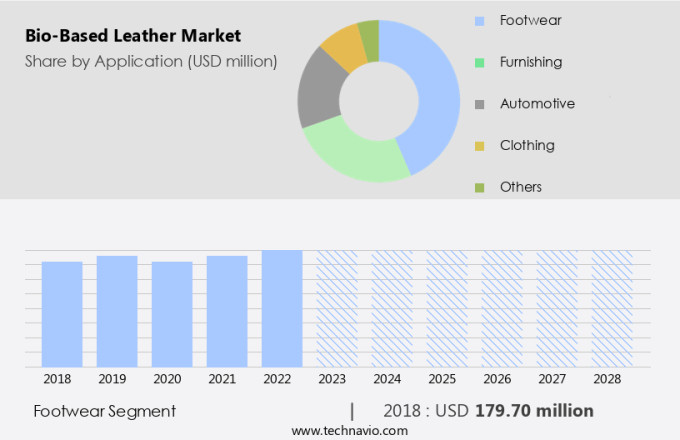

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Footwear

- Furnishing

- Automotive

- Clothing

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

- The footwear segment is estimated to witness significant growth during the forecast period.

The demand for premium leather footwear in the United States has led to an increased usage of tanning agents, resulting in environmental concerns due to improper disposal. To address this issue, there is a rising preference for bio-based leather derived from agricultural waste such as corn, leftover fruits, and pineapple leaves. Companies like Piñatex use non-woven mesh made from pineapple leaves to produce leather alternatives. Brands like Hugo Boss and Allbirds have adopted these eco-friendly materials in their product lines. The biodegradability of bio-based leather aligns with sustainability initiatives, making it a preferred choice. US regulatory bodies like the US Department of Agriculture and the National Organic Program ensure the ethical production of leather from animals raised on organic feeds and tanned in certified organic tanneries using plant-based smoke.

Get a glance at the market report of share of various segments Request Free Sample

The footwear segment was valued at USD 179.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is experiencing significant growth due to increasing consumer preference for eco-friendly fashion products and rising awareness about sustainable manufacturing processes. This trend is driven by the growing popularity of customized leather footwear and accessories, as well as the increasing use of online platforms for shopping. Despite economic uncertainties, the US market is expected to continue its growth trajectory, fueled by the surging demand for sustainable leather alternatives

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Bio-Based Leather Market?

Environmental hazards associated with the use of normal leather are the key driver of the market.

- The global leather industry is shifting towards eco-friendly and sustainable materials, with bio-based leather gaining significant traction. Bio-based leather, also known as vegetable-tanned or biodegradable leather, is an alternative to traditional animal-derived leather. This trend is driven by increasing consumer awareness and demand for sustainable fashion. The quality and durability of bio-based leather are comparable to that of animal leather, offering a texture that is similar yet unique. In the US, the fashion industry is embracing this eco-friendly alternative, with footwear and garment manufacturers showing a keen interest. The use of bio-based leather reduces the environmental impact of leather production, as it requires fewer chemicals and generates less waste.

- Manufacturers of leather products in the US are subject to various regulations related to leather production, waste disposal, and use of chemicals. This regulation significantly affected manufacturers and suppliers of leather goods, including apparel, home furnishings, handbags, shoes, and belts. In conclusion, the shift towards bio-based leather is a significant trend in the global leather industry, with the US market showing a growing interest. This eco-friendly alternative offers a sustainable solution for fashion brands, while also addressing regulatory requirements and consumer demand. The future of leather production lies in the adoption of sustainable and eco-friendly practices, making bio-based leather a promising alternative to traditional animal-derived leather.

What are the market trends shaping the Bio-Based Leather Market?

Continuous research and development and green entrepreneurship is the upcoming trends in the market.

- The market for bio-based leather, utilized in the production of eco-friendly garments and accessories, is experiencing significant growth due to increasing consumer awareness and preference for sustainable products. With the escalating issues related to energy consumption, water usage, and emissions from traditional manufacturing processes, there is a pressing need for more sustainable alternatives. Bio-based leather offers a solution by being biodegradable, breathable, and scratch-resistant.

- As the focus on sustainability continues to intensify, manufacturers are responding by adopting practices that minimize their environmental impact. This shift towards eco-friendly production methods is expected to remain a key trend in the market. The demand for bio-based leather in home decoration is also on the rise, further expanding its market potential.

What challenges does the Bio-Based Leather Market face during its growth?

Scalability issues associated with bio-based leather is a key challenge affecting the market growth.

- The market is experiencing growth due to increasing concerns regarding the environmental impact of traditional leather production methods. Conventional leather manufacturing processes utilize harmful chemicals, consume large amounts of water, and generate significant waste. These practices pose health risks for workers and contribute to environmental degradation. Bio-based leather, on the other hand, offers a sustainable alternative. This material is derived from natural sources, such as pineapple leaves and other plant-based materials, using biotechnology and materials science. While the production cost is currently higher than conventional leather, the eco-friendly and vegan-friendly nature of bio-based leather is gaining popularity among consumers.

- High research and development expenses, coupled with the price disparity between bio-based and conventional leather, hinder market expansion. Nevertheless, as awareness of the environmental and health risks associated with traditional leather production continues to rise, the demand for sustainable alternatives is expected to increase. Bio-based leather is finding applications in various industries, including accessories and furniture. As the market matures, it is anticipated that the use of bio-based leather in these sectors will expand, providing opportunities for growth. Despite the current challenges, the future of bio-based leather looks promising as it aligns with the global trend towards sustainability and eco-friendly products.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bolt Threads

- Desserto

- ECCO LEATHER

- Fleather

- Flosker

- Fruitleather Rotterdam

- FRUMAT

- MODERN MEADOWS

- MycoWorks

- NAT-2

- Natural Fiber Welding, Inc.

- TJEERD VEENHOVEN STUDIO

- Toray Industries Inc.

- ULTRAFABRICS

- Veerah

- Vegea SRL

- Veja Faire Trade SARL

- Zhejiang Meisheng New Material Co., Ltd.Ã

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Bio-based leather, a revolutionary eco-friendly alternative to traditional leather, is gaining significant traction in various industries such as fashion, footwear, garments, accessories, furniture, and home decoration. This sustainable material is derived from natural sources like pineapple leaves, mushroom mycelium, cork, corn, and leftover fruits, making it a more ethical and eco-conscientious choice. Compared to conventional leather, bio-based leather offers similar qualities such as durability, texture, and water-repellence. It is also breathable, scratch-resistant, and biodegradable, reducing the environmental impact of production. Moreover, it eliminates health risks associated with chemicals and allergens commonly found in animal-derived leather. The production of bio-based leather utilizes advanced biotechnology and materials science, resulting in high-quality, vegan-friendly products.

Further, brands across the globe, including Hugo Boss and Allbirds, are increasingly adopting this innovative material in their fashion products, demonstrating a growing trend towards sustainability and animal welfare awareness. Bio-based leather production consumes less energy, water, and generates minimal waste compared to traditional leather manufacturing processes. Additionally, it is suitable for various applications, from clothing and bags to furniture and electronics, making it a versatile and attractive option for both online and offline retailers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market Growth 2024-2028 |

USD 227.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.6 |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.