Biomedical Refrigerator And Freezer Market Size 2024-2028

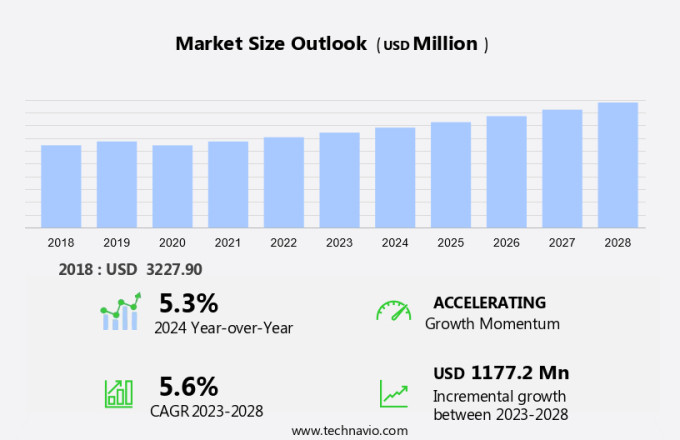

The biomedical refrigerator and freezer market size is forecast to increase by USD 1.17 billion at a CAGR of 5.6% between 2023 and 2028.

- The market exhibits significant growth due to several key drivers. One primary factor is the increasing demand for temperature-controlled storage solutions in clinical trials and laboratories. This need is driven by the importance of maintaining precise temperature conditions for various biological samples. Another trend in the market is the emphasis on energy-efficient cooling technologies, which reduce operational costs and minimize environmental impact. Thermal insulation plays a crucial role in maintaining the required temperature distribution. Additionally, regulatory compliance with medical guidelines is a critical consideration, particularly for blood bank refrigerators, lab refrigerators, lab freezers, ultralow temperature freezers, and shock freezers. Furthermore, the declining number of blood donors necessitates the need for advanced temperature monitoring systems to ensure the safety and efficacy of donated blood. Overall, the market is characterized by the availability of value-added software and hardware products that enhance temperature control and monitoring capabilities.

What will the size of the market be during the forecast period?

- The market holds a crucial position in the healthcare and research sectors, catering to the demand for temperature-controlled storage solutions for various biological samples and temperature-sensitive materials. These storage systems are essential in maintaining the integrity and efficacy of vital biological materials used in medication discovery, biopharmaceuticals, organ transplantation, and clinical trials. Biological samples, medications, and temperature-sensitive materials are integral components of healthcare and research facilities. Proper temperature control is essential to ensure their stability and efficacy.

- Furthermore, biomedical refrigerators and freezers provide the necessary cooling technologies to maintain optimal temperatures, ensuring the longevity and integrity of these materials. In the realm of healthcare, biomedical refrigerators and freezers play a pivotal role in storing temperature-sensitive medications and vaccines. These storage solutions enable healthcare providers to maintain the efficacy of these essential medicines, ensuring they remain potent and effective for extended periods. Moreover, they are instrumental in the storage of temperature-sensitive biological samples used in diagnostic procedures and organ transplants. Research facilities also heavily rely on biomedical refrigerators and freezers to store temperature-sensitive materials, such as DNA-based drugs, genome engineering samples, and cellular therapy specimens.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Blood banks

- Healthcare sector

- Pharmaceutical sector

- Research laboratories

- Others

- Product

- Blood bank and plasma freezers

- Lab refrigerators and freezers

- Ultra-low temperature freezers

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

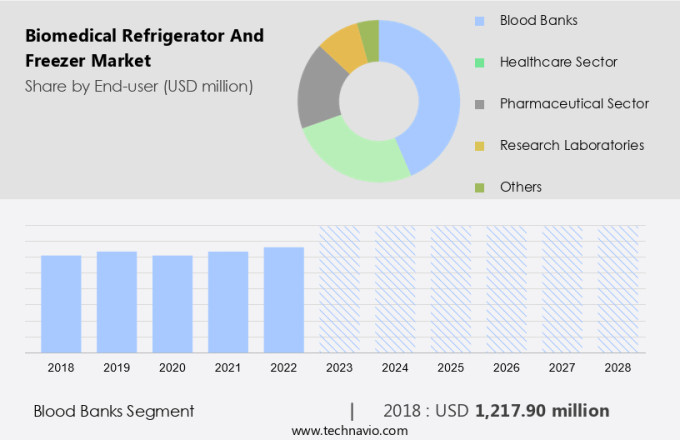

- The blood banks segment is estimated to witness significant growth during the forecast period.

Blood bank refrigerators play a vital role in the storage and preservation of blood and related biomedical samples in diagnostic centers and healthcare organizations. These refrigerators are essential for preventive healthcare and precision medicine, ensuring the integrity and quality of samples for disease diagnosis and treatment. The market for biomedical refrigerators and freezers is witnessing growth due to the increasing demand for advanced storage solutions for biomedical products. Blood bank refrigerators are constructed with safety and performance in mind, featuring user-friendly interfaces and precise temperature control.

Furthermore, they come in various configurations, including floor, countertop, and under-counter units, catering to different energy requirements and power supply conditions.

Get a glance at the market report of share of various segments Request Free Sample

The blood banks segment was valued at USD 1.22 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is experiencing consistent expansion due to substantial investments in healthcare infrastructure in the United States. The presence of strong distribution networks in countries like the US and Canada, along with the commitment of manufacturers to offer comprehensive refrigeration solutions for hospitals and diagnostic centers, is driving the market's growth in this region. Chronic diseases such as cardiovascular disease, diabetes, and cancer continue to pose significant health challenges in North America. According to the American Heart Association, cardiovascular diseases are the leading cause of death in the US. Biomedical refrigerators and freezers play a crucial role in the storage of temperature-sensitive biological samples, medication discovery, and biopharmaceuticals, contributing to advancements in organ transplantation and organ transplants.

Furthermore, these factors underscore the importance of the market in North America. In the US, road accidents are a leading cause of injuries, resulting in the need for surgeries and blood transfusions. The Centers for Disease Control and Prevention (CDC) reports that fatalities from road accident injuries are a major cause of death in the country. Effective thermal insulation in biomedical refrigerators and freezers ensures the preservation of these essential medical supplies, making them indispensable in healthcare facilities.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Biomedical Refrigerator And Freezer Market?

The presence of value-added software and hardware products is the key driver of the market.

- In the market, companies are working diligently to expand their market presence by providing supplementary software and hardware solutions to clients. For example, B Medical Systems provides a Data Monitoring Network (DMN), which is a software platform for collecting, archiving, and visualizing temperature data.

- This software offers an integrated event and activity history of all appliance components, as well as a graphical representation of all temperature curves. It enables simultaneous data monitoring and recording and provides the option for customized alarm notifications via email and SMS. The DMN offers cost savings compared to traditional circular chart recorders and their spare parts. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Biomedical Refrigerator And Freezer Market?

Emphasis on energy-efficient refrigerators is the upcoming trend in the market.

- Biomedical refrigerators and freezers play a crucial role in maintaining temperature control for various applications, including clinical trials, blood banks, laboratories, and ultralow temperature freezers. Energy efficiency and the use of eco-friendly cooling technologies are essential considerations for manufacturers to meet environmental regulations. These systems must employ refrigerants with zero ozone depletion potential, minimal global warming potential, and safety features against toxicity and flammability. Carbon dioxide is a potential alternative refrigerant, but its use was phased out in favor of hydrocarbons due to insulation and cooling property advancements during the 1950s. However, with the growing need for energy-efficient and eco-friendly cooling solutions, there is renewed interest in carbon dioxide as a refrigerant.

- Future developments in refrigerant technology will focus on creating safe, effective, and environmentally sustainable alternatives. Manufacturers must explore new refrigerant technologies while adhering to strict safety and performance standards. The use of carbon dioxide as a potential refrigerant is gaining attention due to its eco-friendly properties.

What challenges does the Biomedical Refrigerator And Freezer Market face during its growth?

Compliance with medical guidelines and the declining number of blood donors is a key challenge affecting the market growth.

- In the healthcare sector, the preservation of temperature-sensitive materials such as medications and biological samples is crucial for the effective treatment of various medical conditions. These materials, including blood and platelets for transfusions, are essential for patients undergoing treatments for disorders like thalassemia, sickle cell anemia, hemophilia, cancer, and those undergoing surgeries. However, the cold chain, which ensures the proper storage and transportation of these materials, faces challenges. Decreasing public awareness and lifestyle changes have led to a decrease in the number of blood donations, which is a vital component of the cold chain. Lack of interest, insufficient knowledge about the importance of blood donations and their locations and schedules, and time constraints related to work are some factors contributing to this issue.

- The healthcare industry, pharmaceutical companies, and research facilities rely heavily on the availability of these temperature-sensitive materials to provide optimal care and conduct groundbreaking research. The importance of maintaining the cold chain is not only limited to healthcare but also extends to the pharmaceutical industry, where temperature-sensitive medications are a significant investment. Medication spoilage due to improper storage can lead to significant financial losses and negatively impact patient care. Ensuring the cold chain's integrity is essential to prevent such occurrences and maintain the quality and efficacy of these materials.

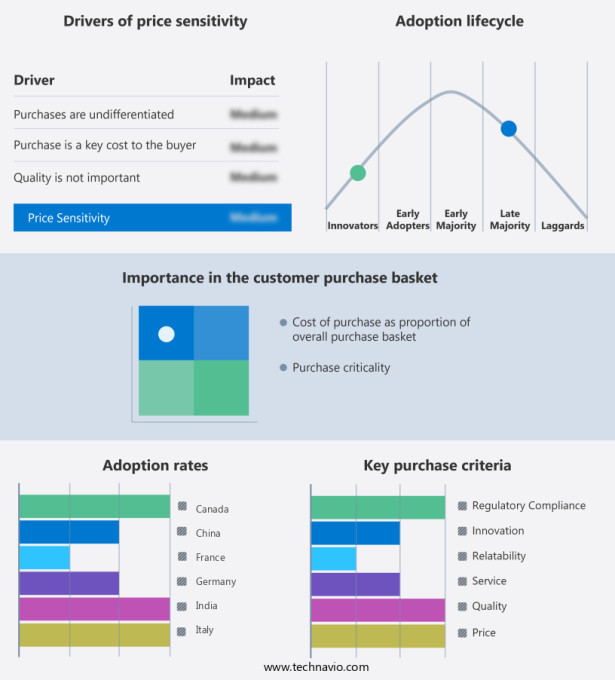

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aegis Scientific

- Angelantoni Industrie Srl

- ARCTIKO AS

- BINDER GmbH

- Biomedical Solutions Inc.

- Bionics Scientific Technologies Pvt. Ltd.

- Desmon SpA

- DSI DANTECH AS

- Eppendorf SE

- EVERmed Srl

- Fiocchetti

- Haier Biomedical

- Helmer Scientific Inc.

- Liebherr International AG

- Philipp Kirsch GmbH

- Porkka Finland Oy

- Standex International Corp.

- Terumo Corp.

- Thermo Fisher Scientific Inc.

- ZHONGKE MEILING CRYOGENICS CO. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market caters to the storage needs of temperature-sensitive biological materials and medications in various healthcare organizations. These include research facilities, pharmaceutical companies, diagnostic centers, blood banks, and educational institutes. The increasing prevalence of chronic diseases such as cardiovascular disease, diabetes, and cancer necessitates advanced healthcare infrastructure for medication discovery, biopharmaceuticals, and organ transplantation. Biological samples and medications require precise temperature control for optimal storage. Energy usage is a significant concern in the market, leading to the development of energy-efficient systems and cooling technologies. The market encompasses various types of refrigerators and freezers, including laboratory refrigerators, pharmacy refrigerators, blood bank refrigerators, lab freezers, ultralow temperature freezers, shock freezers, and chest refrigerator equipment.

Moreover, temperature monitoring and inventory management systems ensure the integrity of temperature-sensitive materials, preventing medication spoilage and maintaining the cold chain. The market also caters to the storage needs of blood components like plasma, cryoprecipitate, and platelet concentrates for hematological illnesses. Preventive healthcare, lifestyle changes, and the rise of precision medicine further fuel the demand for storage solutions. Freezer monitors and user-friendly interfaces facilitate easy management of these systems. In summary, the market plays a vital role in the healthcare sector by providing temperature-controlled storage solutions for temperature-sensitive materials, medications, and biological samples.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.6% |

|

Market Growth 2024-2028 |

USD 1.17 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.3 |

|

Key countries |

US, Canada, Germany, UK, China, France, Italy, Japan, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch