BLDC Fan Market Size 2025-2029

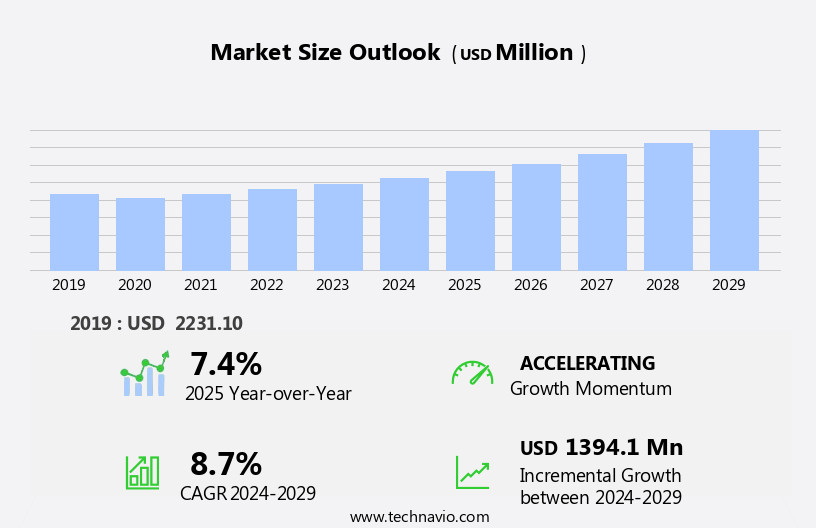

The bldc fan market size is forecast to increase by USD 1.39 billion, at a CAGR of 8.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand for energy-efficient electrical fans. This trend is fueled by consumer awareness and concern for the environment, as well as the rising disposable income of individuals, enabling them to invest in more advanced home appliances. The market is primarily driven by the commercial segment due to its extensive application in various industries, including cooling systems, computer peripherals, robotics, and medical equipment. However, the high-end product cost poses a challenge for market penetration among price-sensitive consumers. Manufacturers must strike a balance between affordability and innovation to cater to both segments effectively. To capitalize on this market potential, companies should focus on developing energy-efficient, cost-effective BLDC fan solutions while maintaining a competitive edge through technological innovation and strategic partnerships.

- By addressing the affordability challenge and continuing to meet the evolving demands of energy-conscious consumers, the market is poised for continued growth and success.

What will be the Size of the BLDC Fan Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Applications span various sectors, from residential and commercial buildings to industrial processes and renewable energy systems. Key market dynamics include the integration of customer reviews and feedback, power cord designs, speed control settings, and pricing strategies. Intellectual property, such as design patents and utility patents, play a crucial role in product differentiation and competitive advantage. Manufacturing processes and motor drivers are continually refined to improve product lifespan and motor shaft efficiency. Blade design innovations focus on quiet operation, aerodynamics, and aesthetic appeal. Compliance certifications ensure safety regulations are met, while installation instructions simplify the setup process.

Permanent magnet technology and hall sensors enable efficient speed control and PWM (pulse-width modulation) regulation. Energy efficiency, thermal management, and lightweight design are essential considerations for the evolving market. Online sales channels and IoT connectivity expand distribution possibilities, while smart home integration offers new opportunities for customer convenience and control. Component sourcing and supply chain optimization are essential for maintaining quality control and data analytics. The market's continuous dynamism is reflected in its ongoing evolution, with advancements in electronics engineering and material science shaping the future of this versatile technology.

How is this BLDC Fan Industry segmented?

The bldc fan industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Commercial

- Residential

- Speed

- More than 400 RPM

- Below 300 RPM

- 300-400 RPM

- Type

- Ceiling fans

- Exhaust fans

- Table fans

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

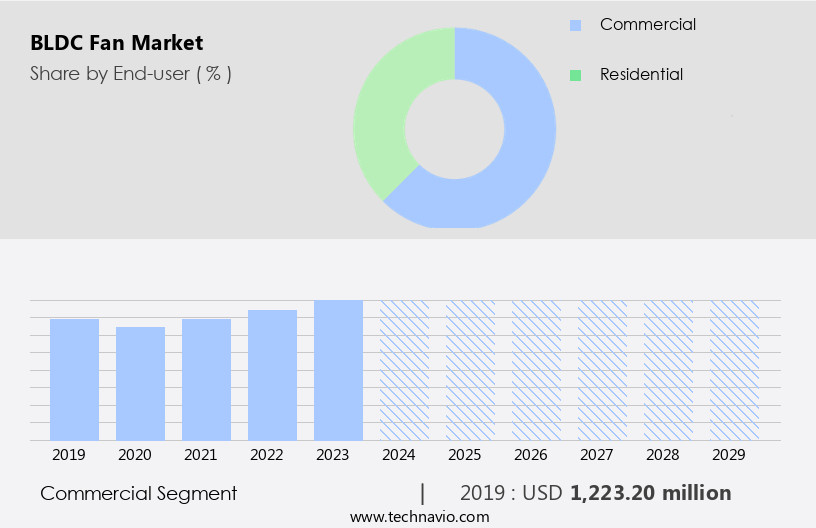

By End-user Insights

The commercial segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth due to the commercial segment's dominance, driven by the increasing use of BLDC fans in various applications, including cooling systems, computer peripherals, robotics, and medical equipment. The demand for compact DC fans in electrical equipment across industries fuels this segment's expansion. Moreover, the global market's growth is influenced by the rising need for cooling systems in diverse applications, the growing preference for technologically advanced, energy-efficient products, and the increasing international trade in fans. Intellectually protected innovations, such as design patents and utility patents, contribute to the market's competitiveness. Quiet operation, speed control, and remote control are essential features that cater to customers' demands.

Housing materials, sensor integration, and IoT connectivity are essential trends. The market's supply chain is strengthened by distribution channels and customer service, ensuring product differentiation and compliance with safety regulations. Energy efficiency, thermal management, and lightweight design are crucial factors in BLDC motor manufacturing processes. The market's longevity is ensured by product lifespan, motor shaft, blade design, and compliance certifications. The competitive advantage lies in manufacturing processes, motor drivers, and PWM control. BLDC fan blades' aesthetics and noise level are essential considerations for customers. Data analytics and component sourcing enable continuous improvement and cost savings. The market's growth is further boosted by renewable energy integration and smart home integration.

The Commercial segment was valued at USD 1.22 billion in 2019 and showed a gradual increase during the forecast period.

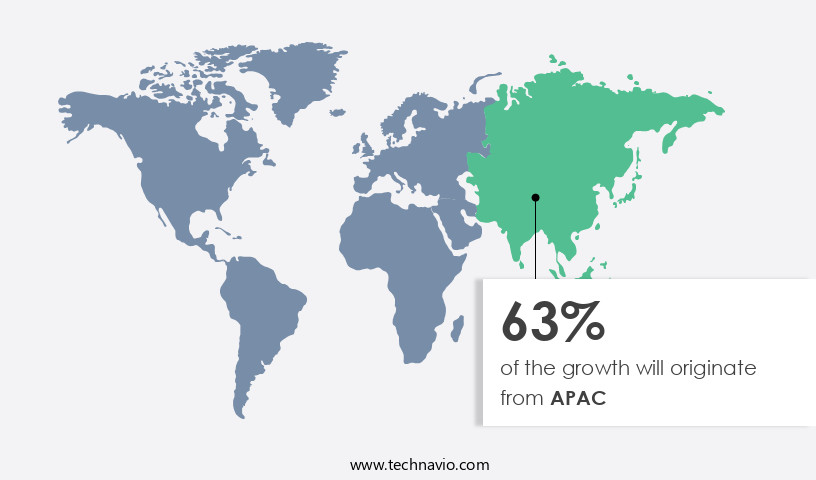

Regional Analysis

APAC is estimated to contribute 63% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC holds a significant share due to the region's industrial growth and temperate climate. In countries like China, Japan, Vietnam, and India, the manufacturing sector's expansion drives the demand for industrial cooling solutions, making BLDC fans a preferred choice. Meanwhile, the residential sector in several APAC countries, including those with summer temperatures reaching up to 55 degrees C, necessitates cooling solutions, further fueling market growth. Brand reputation and design patents are essential factors in the market. Quiet operation and speed control are desirable features, ensuring customer satisfaction. Housing materials, online sales, and power consumption are other critical considerations.

Remote control, compact size, and hall sensors are essential features for modern fans. Customer service, mounting options, sensor integration, distribution channels, intellectual property, IoT connectivity, and renewable energy are emerging trends. Product differentiation, safety regulations, user manuals, timer functions, and compliance certifications are essential elements of the market. Bldc motors, testing standards, quality control, data analytics, component sourcing, customer reviews, power cords, speed settings, pricing strategies, integrated circuits, utility patents, manufacturing processes, motor drivers, product lifespan, motor shafts, blade designs, and thermal management are integral aspects of the market. Competitive advantage, PWM control, and fan blades are essential for manufacturers to stay ahead.

The market's evolution is shaped by these entities, reflecting its dynamic nature.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of BLDC Fan Industry?

- The increasing demand for energy-efficient electrical fans is the primary market driver, as consumers seek to reduce energy consumption and save costs while maintaining comfort.

- BLDC fans, which utilize Brushless Direct Current motors, have gained significant traction in various industries due to their energy efficiency and compact size. These fans are increasingly used in a multitude of end-user applications, from home appliances like ceiling fans to complex industrial equipment requiring dynamic airflow control for cooling purposes. The demand for smart cooling systems, driven by the need for modern technology that is both energy-efficient and small, has further fueled the adoption of BLDC fans. BLDC fans offer increased airflow with reduced energy consumption, making them more efficient than traditional fans. Their compact size enables easy integration into sophisticated equipment where cooling is essential, such as high-end personal computers, communication server devices, and medical equipment.

- The supply chain for BLDC fans involves intellectual property considerations, component sourcing, testing standards, and quality control. IoT connectivity and timer functions are essential features in modern BLDC fans. Safety regulations and user manuals are crucial components of the distribution channels for these fans. Data analytics and testing standards play a significant role in ensuring product differentiation and maintaining a competitive edge. The market for BLDC fans is expected to grow as the demand for energy-efficient and compact cooling solutions continues to rise, particularly in industries with complex cooling requirements.

What are the market trends shaping the BLDC Fan Industry?

- The current market trend underscores the significance of rising disposable income among individuals. This trend is expected to shape consumer behavior and business strategies in the near future.

- The market is experiencing notable growth due to the increasing disposable income of consumers. This trend is observable in various regions, including the US, where disposable personal income has risen by over USD190 billion (0.9%) in January 2025. Factors such as the rise in dual household income, per capita income, and rapid employment growth have contributed to this increase. With more disposable income, consumers have greater purchasing power, leading to increased demand for modern ceiling fans. These fans offer energy savings and a touch of luxury, making them an attractive addition to homes. Key features of BLDC fans include customer-reviewed speed settings, power cords, and motor drivers.

- The fans' motor shafts and blade designs are engineered for optimal performance, while integrated circuits and compliance certifications ensure safety and reliability. Manufacturing processes are continually refined to improve product lifespan and efficiency. Motor drivers and integrated circuits are protected by utility patents, ensuring innovation and intellectual property protection. Installation instructions are provided to ensure a seamless user experience. Pricing strategies vary, catering to different consumer segments and market demands.

What challenges does the BLDC Fan Industry face during its growth?

- The high-end product cost poses a significant challenge to the industry's growth trajectory. In order to maintain competitiveness and attract a broader customer base, companies must carefully manage expenses and explore cost-effective production methods or pricing strategies.

- BLDC fans, known for their energy efficiency and quiet operation, hold a significant market presence in various applications, particularly in developed countries. However, their high cost due to advanced technology and import dependence on components such as magnets and motor controls from countries like China may hinder sales growth in underdeveloped and developing markets. For instance, cost-sensitive consumers in India have shown limited preference for BLDC fans. To mitigate this challenge, domestic firms are increasingly manufacturing these components in-house, thereby reducing dependence on imports and potentially lowering production costs. This trend could lead to increased competitiveness and market expansion.

- Energy efficiency, thermal management, and smart home integration are key market drivers, with electronics engineering and material science playing crucial roles in innovation and development. BLDC fans' lightweight design and PWM control contribute to their aesthetic appeal and improved performance. Overall, the market dynamics involve a balance between cost, technology, and consumer preferences.

Exclusive Customer Landscape

The bldc fan market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bldc fan market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bldc fan market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Atomberg Technologies Pvt. Ltd. - The company specializes in producing advanced BLDC Fans, including the Renesa Smart and Studio Plus Series, showcasing innovation and energy efficiency in cooling solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atomberg Technologies Pvt. Ltd.

- BHARAT BRUSHLESS MOTORS

- Brilltech Vayu

- Crompton Greaves Consumer Electricals Ltd.

- Fanimation

- Fantasia Ceiling Fans

- Havells India Ltd.

- Hunter Fan Co.

- Kichler Lighting LLC

- Luminance Brands LLC

- MinebeaMitsumi Inc.

- Minka Lighting Inc.

- Nidec Corp.

- OCECO ENERGY PVT LTD

- Orient Electric Ltd.

- Panasonic Holdings Corp.

- Superfan

- Usha International Ltd.

- Westinghouse Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in BLDC Fan Market

- In January 2024, Panasonic Corporation announced the launch of its new line of energy-efficient BLDC fans, the "Nanqueen Series," which incorporates IoT technology for remote control and real-time energy consumption monitoring (Panasonic Press Release, 2024).

- In March 2024, Danfoss and Haier signed a strategic partnership to develop and manufacture BLDC fans with advanced energy recovery technology, aiming to reduce energy consumption by up to 30% (Danfoss Press Release, 2024).

- In May 2024, LG Electronics secured a significant investment of USD100 million from Samsung Ventures to expand its BLDC fan production capacity and strengthen its market position (LG Electronics Press Release, 2024).

- In April 2025, the European Union passed the new Energy Efficiency Directive, mandating a minimum energy performance standard for fans, significantly boosting demand for BLDC fans due to their energy efficiency (European Commission Press Release, 2025).

Research Analyst Overview

- In the market, Finite Element Analysis and Computational Fluid Dynamics play crucial roles in product design and performance testing, ensuring efficient Magnetic Flux and minimizing Vibration Analysis. Safety features, such as PID Controllers and Feedback Control, are integral to customer loyalty and Product Liability. Alternating Current Motors and Direct Current Motors, including Brushless DC Motors, are subject to rigorous Thermal Simulation and Power Electronics to meet industrial standards. Circular Economy principles guide Material Selection and Sheet Metal Fabrication, while Distribution Network optimization and Inventory Management are essential for retail partnerships and E-commerce platforms. Warranty Claims are minimized through Quality Assurance and Digital Signal Processing.

- Brand Building hinges on Digital Marketing, Content Marketing, Social Media Marketing, and effective PID Controller implementation. Acoustic Modeling and Surface Treatment contribute to product design and customer satisfaction. Life Cycle Assessment and Return Rates are essential for continuous improvement and market competitiveness. Electronic Speed Controllers and Industrial Design collaborate to optimize blade pitch and motor efficiency. Embedded Systems and Product Design work together to enhance performance and reduce energy consumption. Online Marketing and Customer Loyalty programs foster long-term relationships and repeat business.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled BLDC Fan Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.7% |

|

Market growth 2025-2029 |

USD 1394.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.4 |

|

Key countries |

US, China, Japan, Canada, India, South Korea, Germany, UK, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this BLDC Fan Market Research and Growth Report?

- CAGR of the BLDC Fan industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bldc fan market growth of industry companies

We can help! Our analysts can customize this bldc fan market research report to meet your requirements.