Body Worn Camera Market Size 2025-2029

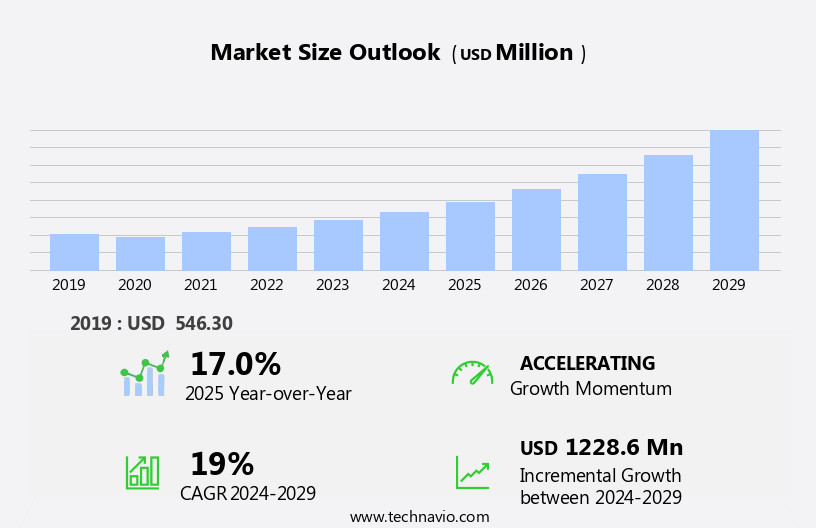

The body worn camera market size is forecast to increase by USD 1.23 billion, at a CAGR of 19% between 2024 and 2029.

- The market experiences significant growth, driven by the increasing popularity of adventure tourism and the subsequent demand for capturing high-definition footage of thrilling experiences. Simultaneously, advancements in technology have expanded the market's reach, making body worn cameras increasingly accessible to various industries, including law enforcement and security services. However, the market faces challenges as well. The proliferation of counterfeit body worn cameras poses a threat to market integrity, with substandard products potentially compromising the reliability and effectiveness of the technology.

- Companies must prioritize ensuring product authenticity and invest in robust quality control measures to maintain consumer trust and differentiate themselves from competitors offering inferior alternatives. By addressing these challenges and capitalizing on the market's growth drivers, businesses can effectively navigate the evolving landscape and capitalize on the opportunities presented by the expanding the market.

What will be the Size of the Body Worn Camera Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The body-worn camera market continues to evolve, with dynamic market activities unfolding across various sectors. Pre-event buffering, video resolution, field of view, frame rate, and data integrity are crucial factors shaping this market. Advanced body-worn cameras integrate seamlessly these features, ensuring high-definition video recording and remote monitoring. Data security is paramount, with data encryption and access control measures ensuring privacy regulations are met. Battery life, charging time, and body-worn camera accessories are essential considerations. Long-lasting batteries and quick charging times enable extended use, while accessories such as mounting brackets and docking stations offer versatility and convenience. Cloud-based video management and on-premises solutions offer different advantages, with cloud storage providing scalability and remote access.

Data analytics platforms enable efficient evidence management and real-time insights. Innovations in body-worn cameras include in-camera processing, image stabilization, and wireless connectivity. Shock resistance, water resistance, and dust resistance ensure durability in challenging environments. User interface and operating system enhance user experience, while software updates maintain system functionality. Legal considerations, regulatory compliance, and data retention policies are essential aspects of body-worn camera deployment. Role-based access control and third-party applications offer customization and flexibility. Motion detection, night vision, and low-light performance expand camera capabilities. The body-worn camera market is characterized by continuous innovation, with ongoing advancements in technology shaping its evolution.

How is this Body Worn Camera Industry segmented?

The body worn camera industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Recording and live streaming

- Recording

- Product Type

- HD

- Full HD

- 4K and above

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

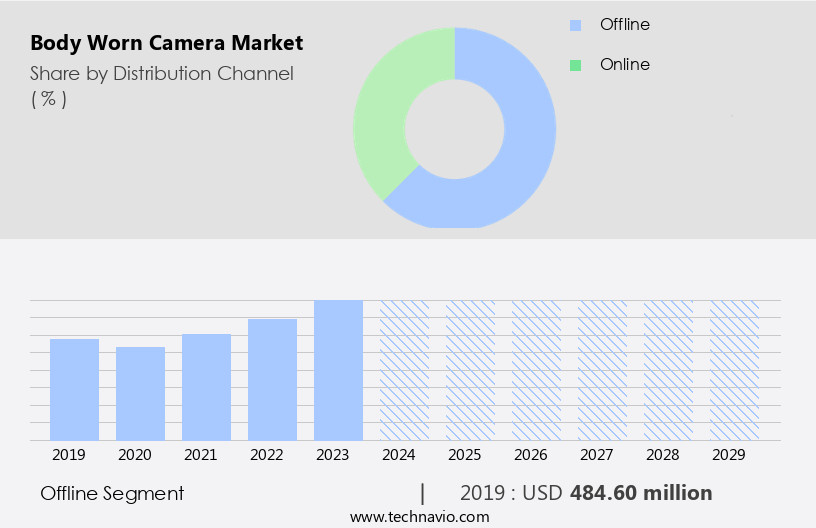

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

Body worn cameras have gained significant traction in various sectors, including law enforcement and security, due to their ability to provide visual evidence and enhance accountability. The market for these cameras is witnessing several trends and dynamics. On-premises video management and cloud-based video management solutions enable efficient storage and retrieval of footage. Evidence presentation software and video editing software facilitate the preparation of court-ready evidence. Shock resistance and in-camera processing ensure durability and reliability, while high storage capacity and docking stations enable seamless charging and data transfer. Night vision, audio recording, GPS tracking, and user interface enhance the functionality of body worn cameras.

Water resistance, remote playback, live streaming, motion detection, image stabilization, and mounting brackets cater to diverse user needs. System integration, legal considerations, and regulatory compliance are crucial factors influencing market growth. Battery type, HD video recording, wireless transmission, low-light performance, and wireless connectivity are essential features for professional users. Data retention policies, data encryption, and data analytics platforms ensure data security and integrity. Remote monitoring, privacy regulations, and battery life are ongoing concerns for organizations adopting body worn cameras. Body worn camera accessories, such as wide angle lenses, remote access control, and third-party applications, expand the functionality of these devices.

Cellular network and evidence management solutions streamline the process of collecting, storing, and managing footage. Overall, the market for body worn cameras is evolving rapidly, driven by technological advancements and growing demand for transparency and accountability.

The Offline segment was valued at USD 484.60 billion in 2019 and showed a gradual increase during the forecast period.

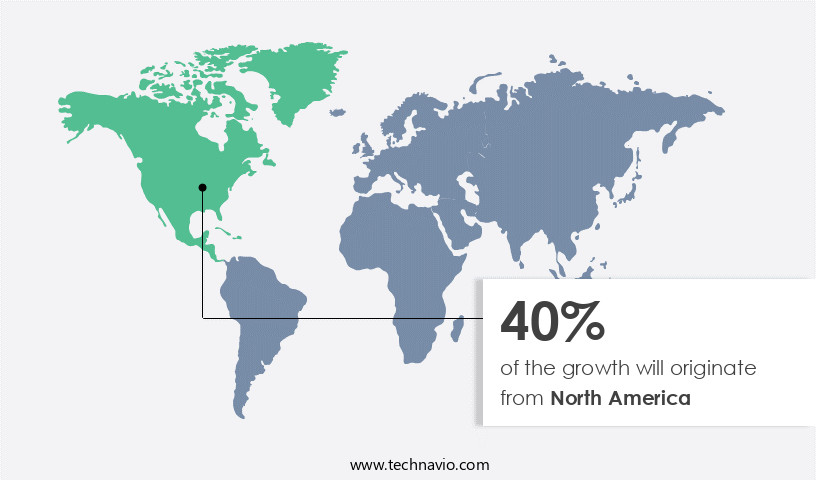

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in North America, where the region holds the largest market share. This can be attributed to the higher deployment rates of surveillance systems in countries like the US, Canada, and Mexico. In the US alone, over 85 million surveillance cameras were installed in 2024, covering various public spaces, businesses, and residential areas. This figure is projected to increase during the forecast period due to increased government spending on security systems and infrastructure projects. Government initiatives, including mandatory installation of surveillance cameras in public places, are driving market growth. Body worn cameras offer several advanced features such as on-premises and cloud-based video management, evidence presentation software, video editing software, shock resistance, in-camera processing, and storage capacity.

Other features include docking stations, night vision, microsd cards, audio recording, gps tracking, user interface, water resistance, remote playback, live streaming, motion detection, image sensor, internal memory, encryption algorithms, data analysis, cloud storage, dust resistance, image stabilization, mounting brackets, system integration, legal considerations, battery type, hd video recording, wireless transmission, low-light performance, wireless connectivity, operating system, data transfer speed, user authentication, regulatory compliance, data retention policies, wide angle lens, remote access control, third-party applications, role-based access control, software updates, pre-event buffering, video resolution, field of view, frame rate, data integrity, data security, remote monitoring, privacy regulations, battery life, data encryption, data analytics platform, charging time, and body-worn camera accessories.

The market is also witnessing the integration of cellular networks for live streaming and remote access control, enhancing the functionality of body worn cameras. Additionally, regulatory compliance, data retention policies, and privacy regulations are key considerations for market players. As technology advances, body worn cameras are expected to offer improved low-light performance, image stabilization, and longer battery life, further boosting market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market continues to gain momentum as law enforcement agencies and security personnel seek advanced solutions for recording evidence and enhancing accountability. These innovative devices offer real-time video recording, ensuring transparency and improving public trust. Body worn cameras feature high-definition video and audio capabilities, allowing for clear documentation of incidents. They are compact, lightweight, and durable, making them ideal for use in various environments. Integrated GPS and Wi-Fi enable seamless data transfer and remote monitoring. The market is driven by factors such as increasing crime rates, growing demand for transparency, and technological advancements. Additionally, regulatory compliance and the need for evidential quality footage further fuel market growth. Body worn cameras offer numerous benefits, including improved safety, enhanced evidence collection, and increased efficiency in investigations. The future of the market looks promising, with continuous innovation and integration of new technologies on the horizon.

What are the key market drivers leading to the rise in the adoption of Body Worn Camera Industry?

- The surge in demand for adventure tourism experiences is the primary market driver.

- The global market for body worn cameras has experienced significant growth due to the increasing popularity of outdoor and adventure sports, such as snorkeling, surfing, and scuba diving. These activities, which offer both adventure and health benefits, have gained favor among individuals seeking fitness and leisure opportunities in their busy urban lives. Body worn cameras are essential tools for capturing memorable moments during these sports, providing a means for monitoring and documenting experiences. Key features of body worn cameras include remote playback, live streaming, motion detection, and image stabilization. These cameras often incorporate advanced technologies such as image sensors, internal memory, encryption algorithms, and data analysis capabilities.

- Additionally, features like cloud storage, dust resistance, and system integration are increasingly important for users. Legal considerations, including battery type and mounting brackets, are also crucial factors in the market. Body worn cameras used for snorkeling, for instance, offer numerous health benefits, including improved aerobic fitness, muscle toning, and stress reduction. The global market for these cameras is expected to continue growing as the trend toward outdoor activities and health consciousness persists.

What are the market trends shaping the Body Worn Camera Industry?

- The market is experiencing significant developments, positioning it as the latest market trend in security and law enforcement technology. This growing sector reflects the increasing demand for transparency and accountability in various industries.

- The market is witnessing significant advancements, with key players introducing innovative features to cater to the growing demand for transparency and accountability in law enforcement. In May 2021, the Wilmington Police Department implemented a body worn camera program, emphasizing community engagement and accountability. Panasonic i-PRO Sensing Solutions introduced the Arbitrator body worn camera, offering seamless connectivity to its Video Insight Management Software for enhanced usability. In August 2020, the Los Angeles County Sheriff's Department entered into an agreement with Axon Enterprise Inc., integrating advanced body worn cameras into their operations. These developments underscore the importance of HD video recording, wireless transmission, and low-light performance in body worn cameras.

- Wireless connectivity and data transfer speed are crucial for efficient data management, while user authentication, regulatory compliance, and data retention policies ensure security and privacy. Wide angle lenses and remote access control provide added functionality, while third-party applications, role-based access control, software updates, and user-friendly operating systems enhance the user experience. These features are propelling the market forward, as the demand for advanced body worn camera solutions continues to surge.

What challenges does the Body Worn Camera Industry face during its growth?

- The expanding market for counterfeit goods poses a significant challenge to the industry's growth trajectory.

- The market faces a significant challenge from the proliferation of counterfeit wearable devices. These imitations, predominantly manufactured in Asia Pacific, are flooding the market due to the region's low labor costs and established counterfeit markets. Counterfeit smartwatches and smart bands are the most frequently duplicated products, as they hold greater appeal for local consumers compared to other wearable electronic devices. Consumers, knowingly or unknowingly, are drawn to these counterfeits due to their significantly lower prices. Maintaining market growth in this context requires addressing concerns related to data integrity and security. Pre-event buffering, video resolution, field of view, frame rate, battery life, data encryption, remote monitoring, and privacy regulations are essential features that differentiate genuine body worn cameras from counterfeit ones.

- A robust data analytics platform, charging time, and body-worn camera accessories, including cellular network capabilities, further enhance the value proposition of authentic products. By focusing on these aspects, market participants can assure customers of the reliability and trustworthiness of their offerings.

Exclusive Customer Landscape

The body worn camera market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the body worn camera market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, body worn camera market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arashi Vision Co. Ltd. - This company specializes in advanced body-worn technology, featuring the Insta360 X3 camera. Our innovative solution enhances transparency and accountability by recording high-definition footage. The Insta360 X3 boasts 5.3K resolution, ensuring crystal-clear images and videos. Its wide-angle lens captures every detail, while advanced image stabilization technology maintains clarity during motion. The device is equipped with intelligent features, including automatic recording activation and wireless data transfer. This cutting-edge technology empowers organizations to document events accurately and efficiently, fostering trust and improving operational effectiveness.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arashi Vision Co. Ltd.

- Axon Enterprise Inc.

- Diamante

- Getac Technology Corp.

- GoPro Inc.

- i PRO Co. Ltd.

- LensLock Inc.

- Mangal Security Products

- Motorola Solutions Inc.

- Pinnacle Response Ltd.

- Pro Vision Solutions LLC

- Safe Fleet Acquisition Corp.

- Safety Vision LLC

- Sentinel Camera Systems LLC

- Shenzhen QOHO Electronics Co. Ltd.

- StuntCams LLC

- Utility Inc.

- Veho

- VeriPic Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Body Worn Camera Market

- In January 2024, TASER International, a leading provider of body-worn cameras and axon Evidence.Com, announced the launch of their new Axon Body 3 camera, featuring advanced AI capabilities and improved video quality (TASER International Press Release). In March 2024, Motorola Solutions and Axon announced a strategic partnership to integrate Motorola's public safety technology with Axon's body-worn cameras and evidence management solutions (Motorola Solutions Press Release). In May 2024, Axon reported a significant increase in body-worn camera sales, with a 50% year-over-year growth rate, driven by the growing demand for police transparency and accountability (Axon Q1 2024 Earnings Report). In April 2025, the European Union passed a regulation mandating the use of body-worn cameras for law enforcement in all EU member states by 2028, creating a substantial growth opportunity for market players (European Parliament Press Release).

Research Analyst Overview

- The market is experiencing significant advancements, with technology innovations shaping its landscape. First responders and law enforcement agencies are increasingly adopting data visualization tools and artificial intelligence for video analytics to enhance investigation efficiency. Case management systems with analytics dashboards and integration APIs facilitate seamless data transfer and access. Retail stores are also embracing wearable technology for security purposes, integrating facial recognition, license plate recognition, and object detection for threat detection and data breach prevention. Healthcare professionals and security personnel are utilizing video redaction and digital evidence management for privacy and compliance. Machine learning and deep learning algorithms are driving improvements in video analytics, enabling real-time incident reporting, remote live view, and disaster recovery.

- Training simulations and video tagging are essential components of the market, ensuring effective use and reducing human error. Wearable technology integration with secure file transfer, incident reporting, and evidence retention solutions is crucial for ensuring data integrity and compliance with regulatory requirements. Construction sites benefit from video analytics for safety inspections and threat detection, while internal audit tools provide valuable insights for continuous improvement.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Body Worn Camera Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 19% |

|

Market growth 2025-2029 |

USD 1228.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.0 |

|

Key countries |

US, China, UK, Japan, Canada, Germany, France, Brazil, India, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Body Worn Camera Market Research and Growth Report?

- CAGR of the Body Worn Camera industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the body worn camera market growth of industry companies

We can help! Our analysts can customize this body worn camera market research report to meet your requirements.