Bowling Centers Market Size 2025-2029

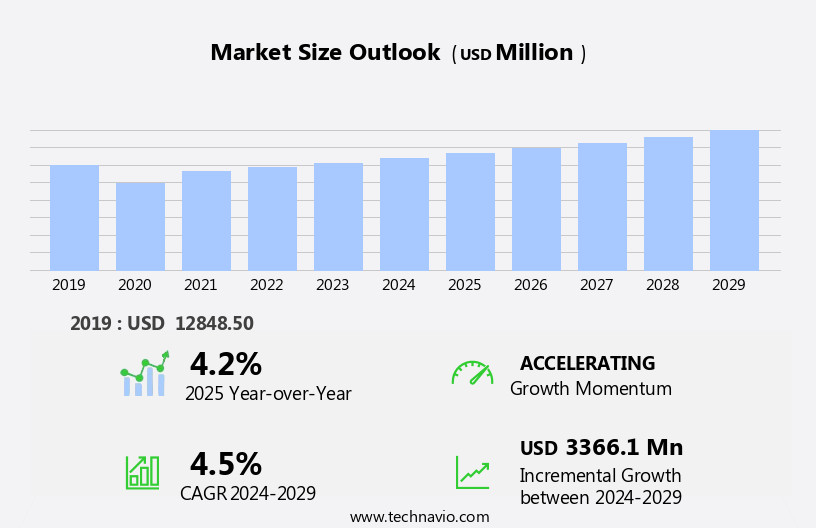

The bowling centers market size is forecast to increase by USD 3.37 billion, at a CAGR of 4.5% between 2024 and 2029.

- The market is experiencing significant shifts as traditional lanes transform into family entertainment hubs, catering to a growing demographic of recreational bowlers. This transition reflects the evolving consumer preference for immersive experiences that go beyond conventional sports. Simultaneously, the emergence of virtual reality technology poses a challenge to these centers, as it offers an alternative form of interactive entertainment. As consumers seek novel experiences, bowling centers must adapt by integrating technology and diversifying offerings to maintain competitiveness. To capitalize on this market evolution, strategic business decisions and operational planning should focus on enhancing customer experience, embracing technology, and addressing the threat from virtual reality.

- By doing so, bowling centers can effectively navigate these trends and continue to thrive in the dynamic entertainment landscape.

What will be the Size of the Bowling Centers Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Energy efficiency measures, such as LED lighting and automated heating systems, are increasingly prioritized to reduce operational costs and minimize environmental impact. Social media marketing and e-sports integration are revolutionizing customer engagement, attracting tech-savvy audiences. Bowling centers are leveraging advanced technology, including ball return systems and pinsetter technology, to streamline operations and enhance the customer experience. Bar operations and lane maintenance are optimized through data analytics and website development, enabling seamless online booking and real-time scoring. League management and tournament organization are facilitated through automated scoring systems, ensuring accuracy and efficiency.

Innovation in bowling, such as virtual bowling and mobile gaming, broadens the market appeal and caters to diverse customer preferences. Profitability analysis, acquisition strategies, and marketing strategies are essential components of the industry trends, with a focus on customer experience and public relations. Bowling centers prioritize safety regulations, community engagement, and waste management to maintain a positive reputation and foster long-term relationships with customers. Youth leagues and entertainment options, including arcade games and accessibility features, cater to families and diverse demographics. Staff training and insurance requirements ensure a high level of service and risk management. Sustainability initiatives, such as water conservation and bowling ball sales, contribute to the overall profitability and social responsibility of the market.

Franchise opportunities and bowling instruction offer growth potential for entrepreneurs and existing businesses, while sustainability initiatives and environmental regulations ensure a responsible and sustainable future for the market.

How is this Bowling Centers Industry segmented?

The bowling centers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Synthetic lane

- Wooden lane

- Guardian lane

- Service

- Bowling and amusement

- Food and beverages

- Type

- Shopping malls

- Theme parks

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

.

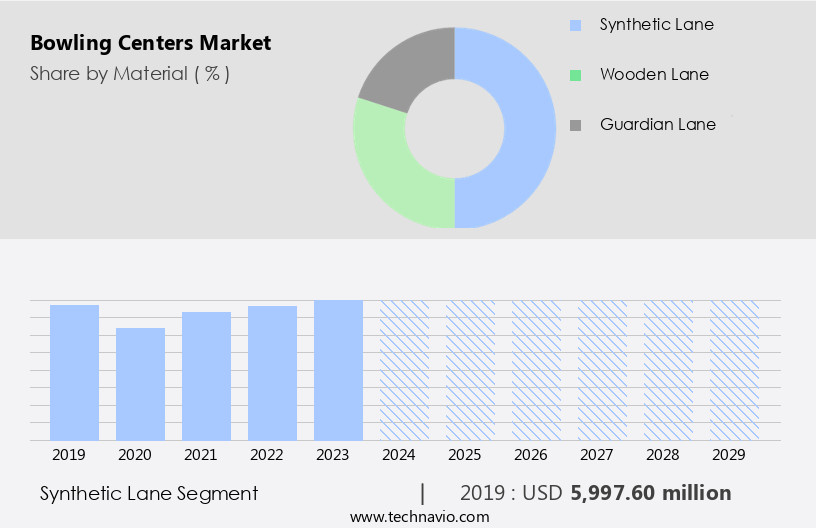

By Material Insights

The synthetic lane segment is estimated to witness significant growth during the forecast period.

In the dynamic world of bowling centers, innovation and technology continue to shape the industry. Synthetic lanes, a key trend, provide a consistent playing surface with advanced oil patterns and conditions. These lanes, an upgrade from traditional wood, offer versatility for various skill levels and events. Their durability ensures a stable and predictable experience, essential for professional and tournament bowling. Bowling centers are embracing digital transformation through social media marketing and e-sports integration. Automated scoring systems streamline operations and enhance the overall experience. League management tools facilitate organization and communication. Tournaments are efficiently managed with digital registration and online booking.

Innovation extends to pinsetter technology, ensuring accurate and efficient pin knockdowns. Ball return systems minimize wait times and improve customer flow. Bar operations leverage data analytics for inventory management and customer preferences. Lane maintenance is optimized with advanced tools and sensors. Customer experience is prioritized through personalized marketing strategies and loyalty programs. Accessibility features cater to diverse needs, including mobility and hearing impairments. Staff training programs ensure high-quality service and safety regulations are adhered to. Entertainment options expand beyond bowling, with mobile gaming, arcade games, and virtual bowling. Franchise opportunities and bowling instruction cater to entrepreneurs and enthusiasts.

Sustainability initiatives, such as water conservation and waste management, demonstrate social responsibility. Competition analysis and profitability analysis are crucial for business success. Corporate events and birthday parties cater to diverse clientele, contributing to revenue growth. Insurance requirements are addressed through comprehensive policies. Bowling centers continue to evolve, integrating technology and innovation to create immersive and harmonious experiences for bowlers and spectators alike.

The Synthetic lane segment was valued at USD 6 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, with North America leading the charge. Energy efficiency initiatives, such as the use of LED lighting and high-efficiency HVAC systems, are becoming increasingly important in bowling centers to reduce operational costs and enhance sustainability. Social media marketing and e-sports integration are also transforming the industry, attracting a younger demographic and creating new revenue streams. Innovation in bowling technology, including ball return systems, pinsetter technology, automated scoring, and tournament organization, is driving competition and improving the customer experience. Bowling centers are also expanding their offerings with bar operations, league management, and entertainment options like arcade games and virtual bowling.

Accessibility features, such as wheelchair ramps and hearing assistance systems, are essential for creating an inclusive environment. Staff training and customer loyalty programs are key strategies for bowling centers to differentiate themselves and retain customers. Franchise opportunities and bowling instruction are also growing areas of interest for entrepreneurs. Sustainability initiatives, including water conservation and waste management, are becoming increasingly important for bowling centers to meet environmental regulations and attract eco-conscious consumers. The US, with companies like Bowlero and Strikes and Spares, is the largest market for bowling centers in North America. The rise of adult and youth leagues, corporate events, and birthday parties is fueling demand for bowling centers.

Competition analysis and profitability analysis are essential tools for bowling center owners to optimize their operations and stay ahead of the competition. Safety regulations and insurance requirements are also critical considerations for bowling center owners to ensure a safe and enjoyable experience for their customers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Bowling Centers Industry?

- The transformation of bowling centers into full-fledged family entertainment centers, encompassing attractions like laser tag, arcade games, and dining options, is the primary market driver.

- The market is witnessing a significant transformation as companies focus on enhancing the customer experience beyond traditional bowling alleys. These centers are evolving into comprehensive family entertainment destinations, catering to diverse demographics. Attractions such as mini bowling, laser tag, go-karts, arcade games, bumper cars, and video games are becoming common features. Moreover, some centers offer child-friendly play areas and facilities for birthday parties, contributing substantially to the revenue of these companies. To boost footfall, major players like Bowlero and ROUND ONE are adopting acquisition strategies and marketing initiatives. They are revamping the bowling industry by integrating innovative entertainment options and accessibility features.

- Staff training is a key focus area to ensure a harmonious and immersive customer experience. Industry trends indicate a growing emphasis on online booking systems for convenience and public relations efforts to maintain a positive brand image. Youth leagues are also being encouraged to attract and retain a younger demographic. Overall, these strategies aim to position bowling centers as more than just a recreational activity but a family destination for fun and entertainment.

What are the market trends shaping the Bowling Centers Industry?

- The increasing prioritization of recreational bowling participators represents a significant market trend. This demographic is gaining prominence within the industry.

- The market is witnessing significant growth as companies shift their focus towards attracting recreational bowlers to maximize revenues. Recreational bowlers generate higher revenues compared to league or professional bowlers. Bowlero, for instance, offers incentives such as discounted shoe rentals, early bird offers, and food and beverage discounts to attract recreational bowlers. Additionally, a pay-as-you-go program allows these bowlers to pre-pay for a set number of games at a discounted price, which they can redeem throughout the year. Moreover, companies are incorporating technology to enhance the customer experience. Mobile gaming and virtual bowling are becoming popular offerings at bowling centers.

- Customer loyalty programs are also being implemented to retain customers and encourage repeat visits. Sustainability initiatives are another area of focus for bowling centers. Water conservation and eco-friendly practices are being adopted to reduce environmental impact. Bowling ball sales are a significant revenue stream, and companies are exploring opportunities to offer customized balls to cater to individual preferences. Franchise opportunities are also available for entrepreneurs looking to enter the market. Bowling instruction is another area where companies are investing to attract a wider customer base. Insurance requirements are essential considerations for bowling center owners, and it is crucial to ensure adequate coverage for potential risks.

- In conclusion, the market is dynamic, with companies focusing on enhancing the customer experience, implementing technology, adopting sustainability initiatives, and exploring franchise opportunities to stay competitive.

What challenges does the Bowling Centers Industry face during its growth?

- Virtual reality poses a significant threat that could hinder the growth of the industry. This challenge necessitates continuous innovation and adaptation to maintain competitiveness within the market.

- The market faces a challenge from the increasing popularity of virtual reality (VR) gaming and mobile applications. With VR technology advancing, consumers, particularly those aged 6-34, are increasingly drawn to immersive gaming experiences at home. This demographic group represents a significant portion of the overall customer base for bowling centers. To remain competitive, these businesses must adapt and leverage data analytics to better understand customer preferences and behaviors. Website development and optimization are essential for attracting and retaining customers. Bowling centers can offer online booking systems, digital membership programs, and interactive features to enhance the user experience.

- Additionally, community engagement initiatives, such as adult leagues and corporate events, can help differentiate the business from virtual alternatives. Safety regulations and waste management are crucial aspects of operating a bowling center. Compliance with these regulations not only ensures a safe environment for customers but also reduces operational costs through efficient waste management practices. Furthermore, arcade games and other amenities can provide additional revenue streams and contribute to overall profitability. Environmental regulations also play a role in the market. Bowling centers can adopt eco-friendly practices, such as energy-efficient equipment and recycling programs, to reduce their carbon footprint and appeal to environmentally-conscious consumers.

- By focusing on these areas, bowling centers can maintain their competitiveness and continue to serve their communities.

Exclusive Customer Landscape

The bowling centers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bowling centers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bowling centers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bowlero Corp. - The company operates bowling centers under the brands Bowlero, BowlMor Lanes, and AMF, featuring innovative facilities including backlight bowling areas and social clubs.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bowlero Corp.

- Hollywood Bowl Group plc

- Main Event Entertainment Inc.

- Pinstripes Holdings Inc.

- QubicaAMF Europe spa

- REVS Bowling and Entertainment

- Round1 Entertainment Inc.

- Smaaash Entertainment Pvt. Ltd.

- South Point Hotel and Casino

- Strikes and Spares Entertaiment

- Switch Bowling Dubai

- TEEG Australia Pty Ltd.

- Tenpin Entertainment Ltd.

- Thunderbowl lanes

- Tsogo Sun

- Twelve Strike

- Whitestone Lanes

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Bowling Centers Market

- In February 2024, Strike Holdings, a leading bowling center operator, announced the launch of their innovative Virtual Bowling League platform (VBL). This digital solution allows players to join and compete in leagues from the comfort of their homes, significantly expanding the market reach for bowling centers (Strike Holdings Press Release).

- In May 2024, AMF Bowling Worldwide, a major player in the bowling industry, entered into a strategic partnership with Fitbit, a leading wearable technology company. This collaboration aimed to integrate Fitbit's fitness tracking technology into AMF's bowling centers, offering customers an enhanced experience and promoting a healthier lifestyle (AMF Bowling Worldwide Press Release).

- In August 2024, Brunswick Corporation, a global leader in the bowling industry, completed the acquisition of Ebonite International, a significant bowling ball manufacturer. This move strengthened Brunswick's market position and expanded its product offerings, providing a more comprehensive solution for bowling center operators and consumers (Brunswick Corporation SEC Filing).

Research Analyst Overview

- In the dynamic market, brands strive to enhance their visibility through various strategies, including social media engagement and search engine optimization (SEO). Catering services and event planning have become essential offerings to attract diverse clientele, with compliance requirements and customer satisfaction surveys ensuring regulatory adherence and patron contentment. Technological advancements dominate the scene, with point-of-sale (POS) systems and mobile app development streamlining operations. Synthetic lane surfaces and advanced lane conditioning systems improve the overall bowling experience, while data analysis tools and business intelligence enable informed decision-making. Sound systems, lane lighting, and indoor air quality contribute to a pleasant atmosphere, while bowling ball accessories, grips, and weights cater to players' preferences.

- Compliance with accessibility standards and safety protocols, including emergency response procedures and CCTV surveillance, prioritize customer safety. Bar inventory management, staff scheduling, and payroll management tools optimize operational efficiency, while marketing campaigns and promotional offers attract new customers. Risk management and ball drilling services ensure minimal downtime and maintain customer loyalty. Brand awareness and customer relationship management remain key focus areas, with online reviews and website optimization shaping perceptions. Financial reporting and business intelligence enable effective financial planning and strategic growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bowling Centers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 3366.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, Canada, China, UK, Japan, Germany, India, Brazil, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bowling Centers Market Research and Growth Report?

- CAGR of the Bowling Centers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bowling centers market growth of industry companies

We can help! Our analysts can customize this bowling centers market research report to meet your requirements.