Mobile Gaming Market Size 2025-2029

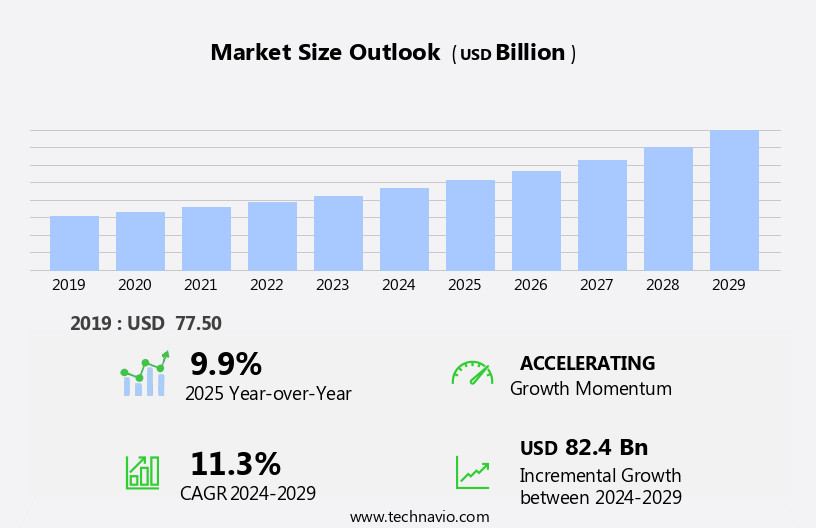

The mobile gaming market size is forecast to increase by USD 82.4 billion at a CAGR of 11.3% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the rising popularity of multiplayer mobile games and the increasing availability of free-to-play options. The popularity of multiplayer mobile games continues to rise, as players seek social interaction and competition in their gaming experiences. These trends have expanded the market's reach, attracting a larger and more diverse player base. However, the increasing cost of mobile gaming development poses a significant challenge for market players. With the demand for high-quality graphics and immersive gameplay experiences continuing to rise, the financial investment required to develop and launch successful mobile games is becoming increasingly steep. Companies seeking to capitalize on market opportunities must navigate this challenge effectively by implementing cost-effective development strategies, such as utilizing cloud-based gaming technologies or outsourcing development to lower-cost regions.

- Additionally, partnerships and collaborations with other industry players can help reduce development costs and share risks. Overall, the market's strategic landscape is characterized by intense competition and a rapidly evolving technological landscape, requiring companies to stay agile and adapt to changing consumer preferences and market trends.

What will be the Size of the Mobile Gaming Market during the forecast period?

- The market continues to evolve, with dynamic market activities shaping player behavior and gaming trends. In-game advertising and subscription services have emerged as key monetization strategies, offering new revenue streams for game developers. Accessibility features, such as closed captioning and adjustable difficulty levels, enhance user experience and broaden the reach of action games, simulation games, and mid-core titles. Social media marketing and influencer partnerships fuel user acquisition, while mobile esports and competitive gaming foster engagement and community building. Augmented Reality And Virtual Reality technologies bring immersive experiences to puzzle games and adventure titles. Game development, driven by user feedback and data analysis, adapts to player preferences, resulting in innovative game designs and monetization models.

- Cloud gaming and Game Streaming services expand access to games, enabling players to enjoy their favorite titles on various devices. Game analytics and engagement metrics provide valuable insights, informing game development and marketing strategies. The ongoing unfolding of these market activities underscores the continuous evolution of mobile gaming, with monthly active users and daily active users driving growth across various sectors. In-app purchases and user experience remain crucial factors in player retention, while app store optimization and game design continue to influence market success. The mobile gaming landscape remains vibrant and dynamic, with ongoing advancements in technology and player preferences shaping the future of this ever-evolving industry.

How is this Mobile Gaming Industry segmented?

The mobile gaming industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Platform

- Online

- Offline

- Type

- Casual gaming

- Professional gaming

- Game Genre

- Puzzle Games

- Battle Royale Games

- Idle Games

- Strategy Games

- Others

- Distribution Channel

- App Stores

- Online Platforms

- Pre-Installed Games

- Others

- End-User

- Casual Gamers

- Competitive Gamers

- Young Gamers

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

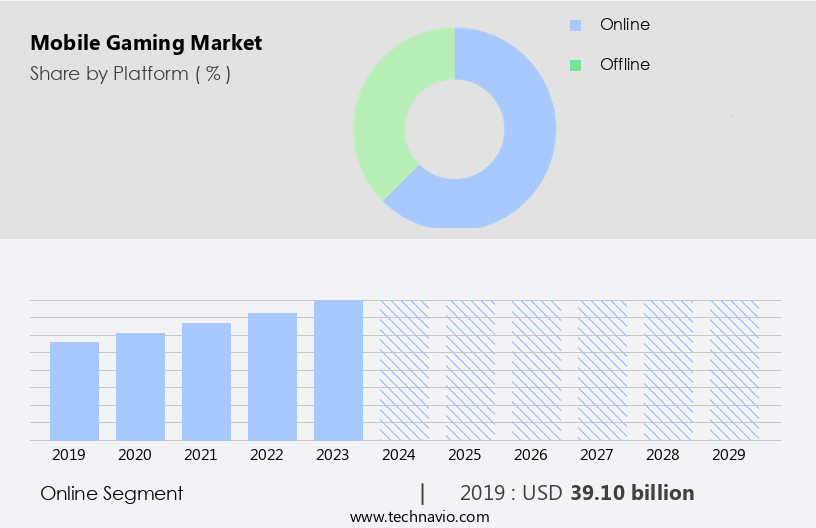

By Platform Insights

The online segment is estimated to witness significant growth during the forecast period.

Mobile gaming has experienced significant growth, with online segment adoption increasing due to the widespread use of mobile devices and internet penetration. Free games on app stores and the convenience of playing from anywhere, at any time, contribute to this trend. Social interaction is a key element in certain online games, fostering community building and enabling users to engage with friends or strangers during gameplay. In-game advertising, monetization strategies such as in-app purchases and subscription services, and user acquisition through social media marketing are essential components of the mobile gaming industry. Action games, simulation games, strategy games, adventure games, puzzle games, and casual games cater to diverse player preferences.

Emerging technologies like augmented reality, virtual reality, cloud gaming, and game streaming services are transforming the gaming landscape. Competitive gaming, including esports tournaments and battle royale, adds to the excitement. Game development, design, and engine advancements continue to enhance user experience. Data analysis and engagement metrics are crucial for player retention and improving game design.

The Online segment was valued at USD 39.10 billion in 2019 and showed a gradual increase during the forecast period.

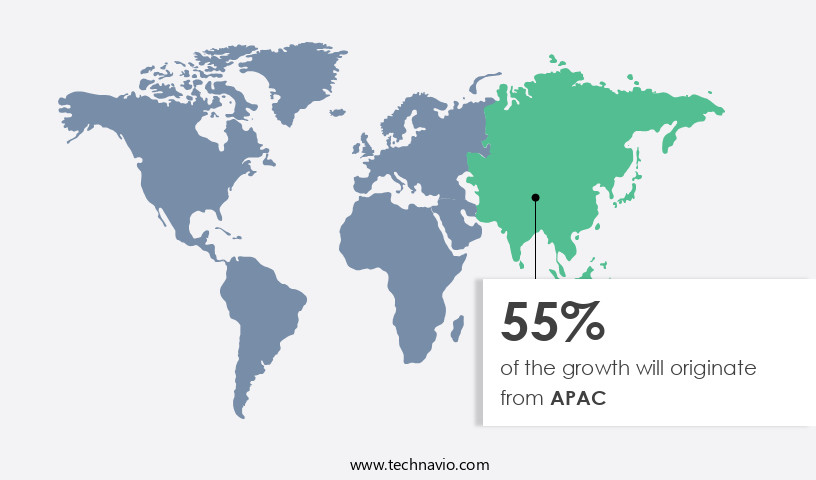

Regional Analysis

APAC is estimated to contribute 55% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Asia Pacific (APAC) region is a significant player in The market, with countries like China and Japan driving its growth. The popularity of mobile games in the region can be attributed to the continuous development of new titles, with Honor of Kings and PUBG, two of the biggest mobile games in China, remaining lucrative globally despite market challenges and China's suspension of new video game licenses. The presence of major original equipment manufacturers (OEMs), such as Huawei Technologies Co., further bolsters the growth of the market in APAC. Action games, simulation games, strategy games, adventure games, puzzle games, and casual games are popular genres in the region, catering to diverse player preferences.

Subscription services and in-app purchases are common monetization strategies, while user acquisition is facilitated through social media marketing, influencer marketing, and app store optimization. Augmented reality (AR) and Virtual Reality (VR) games are gaining traction, offering immersive gaming experiences. Mobile esports tournaments and live streaming services are also on the rise, fostering competitive gaming communities. Cloud gaming and game streaming services provide greater accessibility to games, enabling players to enjoy their favorite titles on various devices. Game development companies employ data analysis and engagement metrics to improve user experience and player retention. Game design and game engines, such as Unreal Engine, play a crucial role in creating high-quality mobile games.

The mobile app stores serve as the primary distribution channels for these games, providing a platform for gaming communities to connect and share their experiences. In conclusion, the market in APAC is experiencing a surge in growth, driven by the development of new games, the presence of major OEMs, and the increasing popularity of various gaming genres. The market dynamics are shaped by factors such as monetization strategies, user acquisition, accessibility, and community engagement.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Mobile Gaming Industry?

- The surge in popularity of multiplayer mobile games serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing popularity of massively multiplayer online (MMO) games. In MMO games, a large community of players, ranging from hundreds to thousands, engage in real-time gameplay on the same server. This feature ensures continuity, as the game remains active even when an individual player is absent. MMO games encompass various genres, including role-playing games (RPGs), first-person shooters (FPS), and real-time strategy (RTS) games. Developers are continually expanding the gaming landscape by introducing innovative genres. For instance, in 2023, Activision Blizzard released Crash Team Rumble, a 4v4 team online multiplayer game developed by Toys for Bob and featuring characters from the Crash Bandicoot universe.

- In addition to game development, other market trends include in-game advertising, game accessibility through subscription services, social media marketing, mobile esports, augmented reality, and simulation games. Cloud gaming is another emerging trend, offering players the flexibility to access games on various devices without the need for local storage.

What are the market trends shaping the Mobile Gaming Industry?

- The expansion of free-to-play mobile games is a notable market trend that is gaining momentum. This trend signifies a significant shift in the gaming industry, with an increasing number of developers offering complimentary mobile games to attract and retain users.

- The market is characterized by the prevalence of free-to-play games, which represent a significant portion of the freemium business model. These games allow users to download and play without any upfront cost from popular app stores. Monetization strategies in free-to-play mobile games primarily revolve around virtual currencies and microtransactions for virtual goods. Virtual currencies enable users to purchase various in-game items, such as clothing, models, and other enhancements. In some instances, users opt to spend real money on virtual products, including coins, magic wands, houses, guns, and swords.

- Notable examples of free-to-play mobile games include Clash of Clans, Pokemon GO, The Sims FreePlay, and Brawl Stars. Engagement metrics and game analytics are crucial in understanding user behavior and optimizing monetization strategies. Additionally, game streaming services and esports tournaments, such as battle royale, contribute to the growth and diversification of the market.

What challenges does the Mobile Gaming Industry face during its growth?

- The escalating costs of mobile gaming development represent a significant challenge to the industry's growth trajectory.

- The market experiences continuous growth due to increasing player retention through in-app purchases and Mobile Advertising. Game developers focus on enhancing user experience by investing in advanced game design, including intricate characters, objects, stages, and visual effects. These complexities drive up development costs, with art creation being a significant expense. To remain competitive, mobile gaming companies hire professional voice actors, often from the film industry, for virtual characters.

- User acquisition is another critical aspect, with data analysis playing a vital role in understanding player behavior and preferences. Live streaming and competitive gaming further engage players, expanding market opportunities. Despite rising costs, the mobile gaming industry continues to innovate, offering immersive experiences that captivate audiences.

Exclusive Customer Landscape

The mobile gaming market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mobile gaming market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mobile gaming market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Activision Blizzard - The company specializes in providing mobile gaming platforms featuring globally recognized titles such as Candy Crush, Call of Duty: Mobile, World of Warcraft: Classic, Overwatch, Hearthstone, and Diablo Immortal.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Activision Blizzard

- Bandai Namco

- Electronic Arts

- Epic Games

- Garena

- Glu Mobile

- King

- Konami

- Miniclip

- NetEase

- Nexon

- Niantic

- Playrix

- Rovio Entertainment

- Scopely

- Supercell

- Tencent

- Ubisoft

- Voodoo

- Zynga

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mobile Gaming Market

- In February 2024, Apple Arcade, a subscription-based mobile gaming service, was launched, offering users access to over 100 exclusive games without in-app purchases or ads (Apple Inc. Press release). This move represented a significant shift in the market, as major tech companies began to invest more heavily in subscription services to compete with traditional gaming platforms.

- In May 2024, Tencent, the world's largest gaming company, announced a strategic partnership with Microsoft to bring its popular mobile game, PUBG Mobile, to Xbox consoles (Microsoft press release). This collaboration marked a key milestone in the mobile gaming industry, as it bridged the gap between mobile and console gaming, expanding the reach of mobile titles and attracting console gamers to the mobile platform.

- In May 2025, Unity Technologies, a leading mobile game development platform, raised USD 650 million in a funding round, bringing its valuation to USD 9 billion (TechCrunch). This investment underscored the growing potential of the market and the demand for advanced game development tools and services.

- In June 2025, Google Play Games introduced cloud gaming capabilities, allowing users to stream games directly from the cloud to their mobile devices (Google press release). This technological advancement significantly reduced the need for high-end hardware, making mobile gaming more accessible to a broader audience and enhancing the overall user experience.

Research Analyst Overview

The market continues to evolve, integrating advanced technologies such as blockchain gaming, machine learning, and artificial intelligence. This technological shift enhances user experience, enabling real-time multiplayer, game performance optimization, and AI-powered gaming. Mobile device compatibility remains a crucial factor, with game localization and user interface design ensuring accessibility for a global audience. Quality assurance and game testing are essential for maintaining high standards, while in-app advertising and mobile payments facilitate monetization. Indie games and NFT games are gaining traction, fueled by player feedback and user research.

Cloud-based gaming and beta testing further enhance accessibility and innovation in the market. Mobile ad networks and user experience design are key components, optimizing the gaming experience and facilitating seamless monetization through in-app advertising and mobile wallets.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mobile Gaming Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.3% |

|

Market growth 2025-2029 |

USD 82.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.9 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mobile Gaming Market Research and Growth Report?

- CAGR of the Mobile Gaming industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mobile gaming market growth of industry companies

We can help! Our analysts can customize this mobile gaming market research report to meet your requirements.