Family Entertainment Center Market Size 2025-2029

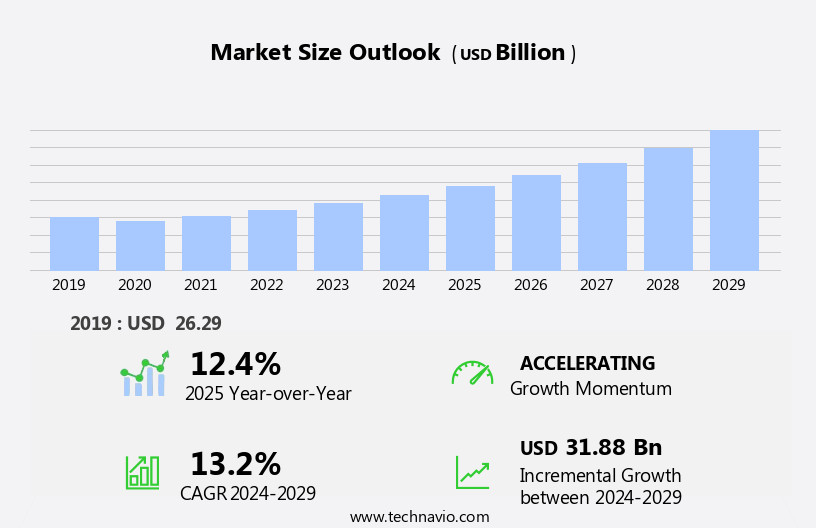

The family entertainment center market size is forecast to increase by USD 31.88 billion at a CAGR of 13.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing integration of Advanced Electronic Interactive (AEI) technology and the rising adoption of Virtual Reality (VR) in games. This technological advancement offers immersive experiences for customers, setting a new standard in family entertainment. However, this market is not without challenges. High maintenance costs pose a significant obstacle, requiring substantial investments in technology upgrades and ongoing maintenance to stay competitive. These costs can be a deterrent for smaller players in the market and may limit their ability to offer the latest AI innovations to customers.

- Companies seeking to capitalize on market opportunities must carefully weigh the benefits of investing in technology against the financial implications of maintaining it. Navigating these challenges effectively will be crucial for success in the market.

What will be the Size of the Family Entertainment Center Market during the forecast period?

- The market continues to evolve, with customer experience and brand building at the forefront of market dynamics. Data analytics plays a crucial role in understanding customer demographics and operational costs, enabling targeted marketing campaigns and effective loyalty programs. Arcade games, go-kart racing, and laser tag remain popular attractions, catering to various age groups and disposable income levels. Group outings and birthday celebrations are key revenue generators, with escape rooms and immersive entertainment offering unique experiences. Augmented reality and virtual reality experiences are emerging technologies transforming the industry, while trampoline parks and mini golf provide opportunities for recreational facilities to diversify their offerings.

- Point-of-sale systems and online booking systems streamline operations, enhancing operational efficiency and customer service. Reputation management is essential in today's digital age, with customer reviews and social media engagement shaping public perception. Safety protocols and risk management are critical components of facility management, ensuring a safe and enjoyable experience for guests. Staff training and technology integration are vital for delivering exceptional guest relations and interactive experiences. Family dynamics continue to influence the market, with party packages and corporate events catering to various family sizes and group outings. Digital marketing and mobile app development are essential tools for reaching customers and generating revenue.

- Seasonal promotions and community engagement strategies help maintain a strong online presence and attract new customers. In the ever-changing landscape of the market, operational efficiency, customer service, and continuous innovation are key to staying competitive.

How is this Family Entertainment Center Industry segmented?

The family entertainment center industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Arcade studios

- Physical play activities

- Skill/competition games

- AR and VR gaming zones

- Capacity

- 10001 to 20000 sq. ft.

- More than 40000 sq. ft.

- 5001 to 10000 sq. ft.

- 20001 to 40000 sq. ft.

- Up to 5000 sq. ft.

- Age Group

- Teenagers (12-18)

- Families with children (0-9)

- Families with children (9-12)

- Adults (24 and above)

- Young adults (18-24)

- Revenue Stream

- Entry fees and ticket sales

- Food and beverages

- Merchandising

- Advertisement

- End-User

- Families

- Teenagers

- Adults

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

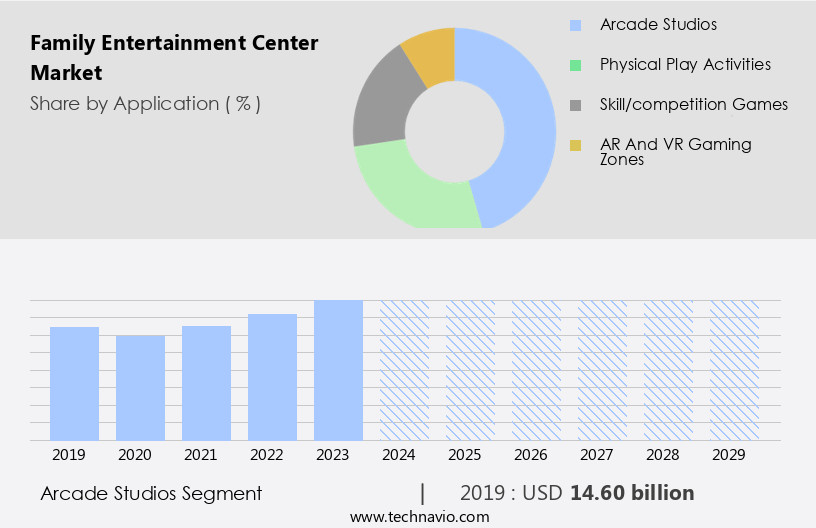

The arcade studios segment is estimated to witness significant growth during the forecast period.

In the market, customer experience is a top priority, with brands continually seeking innovative ways to engage and delight their audiences. Data analytics plays a crucial role in understanding customer demographics and preferences, enabling targeted marketing campaigns and operational efficiency. Arcade games, go-kart racing, laser tag, and escape rooms are popular attractions, catering to various age groups and disposable income levels. Loyalty programs, group outings, and birthday celebrations foster repeat business and community engagement. Augmented reality, trampoline parks, and virtual reality experiences add immersive entertainment value. Point-of-sale systems, mobile app development, and online booking systems streamline operations and enhance customer relationship management.

Seasonal promotions and emerging technologies like artificial intelligence and digital marketing further boost revenue generation. Safety protocols and payment processing systems ensure guest satisfaction and peace of mind. Digital signage, party packages, and corporate events cater to diverse clientele. Operational efficiency, customer service, and facility maintenance are essential for long-term success. Interactive experiences, advertising strategies, and staff training contribute to a harmonious work environment. Family dynamics and online presence are essential considerations for businesses. Website design, social media engagement, and reputation management are vital aspects of a strong digital marketing strategy. Generational preferences and emerging technologies continue to shape the market landscape, with brands focusing on technology integration and risk management to stay competitive.

The Arcade studios segment was valued at USD 14.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

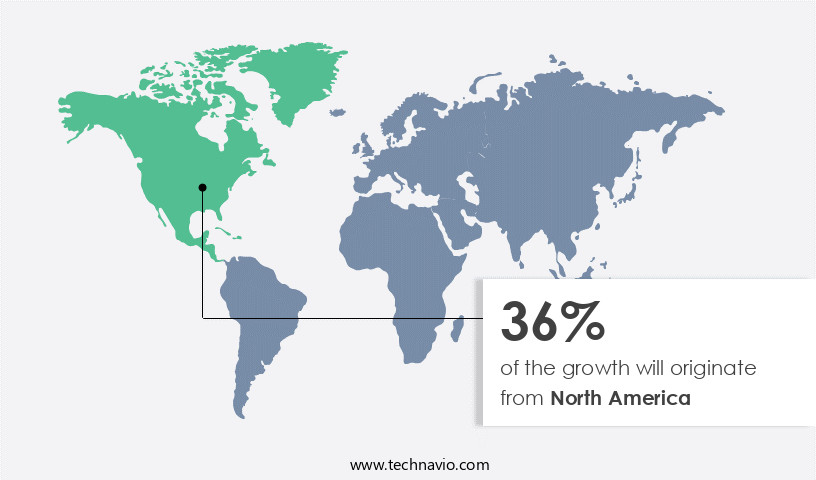

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America has experienced significant growth, with the US leading the charge. This resurgence can be attributed to the shifting preferences of teen and adult customers, who are increasingly seeking experiences beyond traditional video games. Collectible action strategy and war-based arcade gaming have gained popularity, leading to an increase in game bars and cafes catering to this demographic. These establishments attract an older customer base, specifically those aged above 35 years, contributing to the market's expansion in the US. Data analytics plays a crucial role in understanding customer demographics and preferences, enabling businesses to tailor their offerings and marketing campaigns accordingly.

Beyond arcade games, family entertainment centers offer various experiences, such as go-kart racing, laser tag, escape rooms, trampoline parks, and mini golf. These activities cater to a wide range of customer demographics, from families to corporate groups and individuals. Birthday celebrations and group outings are common occasions that drive revenue, while loyalty programs and seasonal promotions help retain customers and generate repeat business. Operational costs, including facility maintenance, staff training, and technology integration, are essential considerations for family entertainment center owners. Risk management and safety protocols are also critical to ensure guest satisfaction and a positive online reputation.From arcade games to go-kart racing and laser tag, these establishments cater to a diverse range of customer demographics and preferences. Operational efficiency, customer service, and technology integration are essential components of success in this competitive landscape.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Family Entertainment Center Industry?

- The expansion of the Applied Economics Institute (AEI) is the primary catalyst fueling market growth.

- The market in the US is witnessing significant growth, driven by the integration of emerging technologies such as augmented reality and immersive entertainment. This trend is transforming traditional recreational facilities like trampoline parks, bowling alleys, mini golf courses, and amusement venues. To cater to the changing consumer preferences, businesses are investing in advanced point-of-sale systems, online booking systems, and customer relationship management tools. Mobile app development is also gaining popularity, enabling customers to access services and promotions seamlessly. Seasonal promotions and risk management strategies are essential for businesses to maintain a steady revenue stream. Leisure spending continues to be a significant contributor to the market's growth, with families and friends seeking new and exciting experiences.

- The market is also witnessing the adoption of emerging technologies like virtual reality and interactive games, providing unique and harmonious experiences for customers. Entertainment venues are leveraging these trends to differentiate themselves and attract a larger customer base. Companies are focusing on delivering personalized experiences, ensuring customer satisfaction and loyalty. As the market continues to evolve, businesses must stay abreast of the latest trends and technologies to remain competitive. In conclusion, the market in the US is experiencing a period of innovation and growth, driven by consumer preferences and technological advancements.

What are the market trends shaping the Family Entertainment Center Industry?

- The integration of virtual reality (VR) technology in games is an emerging market trend. This advancement signifies a significant shift in the gaming industry, offering immersive experiences for players.

- The market is experiencing significant growth due to the integration of advanced technologies, such as virtual reality (VR), into traditional entertainment offerings. VR solutions provide a realistic virtual environment, immersing users in a stimulating experience. VR-based arcade games have gained popularity in recent years, with companies like Godzilla Kaiju Wars VR, Sega Amusements, and UNIS Technology Ltd. Introducing new titles. These games offer multiplayer action, team competitions, and combat scenarios, attracting a wide range of customers. Safety protocols are a priority in this market, ensuring operational efficiency and customer satisfaction. Payment processing systems have been upgraded to digital platforms for contactless transactions.

- Digital signage is used to promote party packages, corporate events, local events, and digital marketing campaigns. Customer service remains a crucial aspect, with companies investing in training staff to handle inquiries and address concerns. Facility maintenance is essential for maintaining a clean and safe environment. Digital marketing strategies are employed to increase revenue generation and social media engagement. Virtual reality experiences are emphasized to attract a younger demographic and cater to their preferences. Facility management software is used to streamline operations and improve overall efficiency. In conclusion, the market is evolving, with a focus on customer reviews, safety protocols, payment processing, digital signage, party packages, corporate events, local events, operational efficiency, customer service, virtual reality experiences, social media engagement, facility maintenance, digital marketing, and facility management.

What challenges does the Family Entertainment Center Industry face during its growth?

- The high maintenance costs represent a significant challenge that can hinder industry growth. It is essential for businesses in this sector to effectively manage and mitigate these expenses to ensure sustainable growth and profitability.

- The market presents unique challenges for businesses, with guest relations and maintenance being key areas of focus. Interactive experiences, such as laser tag and gaming simulators, are essential for attracting and retaining customers. However, the hardware components of these attractions require regular maintenance to ensure optimal performance. Artificial intelligence and technology integration can streamline maintenance processes and improve guest experiences. Advertising strategies and reputation management are also crucial for attracting families and generating repeat business. Generational preferences play a role in shaping family entertainment center offerings, with family dining and technology integration being popular choices.

- Staff training is essential for delivering high-quality guest experiences and managing family dynamics. An online presence, including a well-designed website, is necessary for reaching potential customers and providing information about offerings and promotions. Technology can also be used to enhance website functionality and improve the overall customer experience.

Exclusive Customer Landscape

The family entertainment center market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the family entertainment center market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, family entertainment center market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Big Thrill Factory - This company specializes in creating immersive family entertainment experiences, featuring attractions such as DreamWorks Water Park, Nickelodeon Universe, an aquarium, and an indoor ski and snow resort. Our offerings cater to diverse interests, providing opportunities for both relaxation and excitement. The water park features thrilling water slides and wave pools, while Nickelodeon Universe offers character meet-and-greets and interactive rides. The aquarium showcases a wide array of marine life, and the indoor ski and snow resort allows visitors to enjoy winter sports year-round. Each attraction is designed to inspire wonder and create lasting memories for families.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Big Thrill Factory

- Bowlmor AMF

- Cedar Fair Entertainment Company

- Chuck E. Cheese (CEC Entertainment)

- Dave & Buster's Entertainment Inc.

- Family Fun Center XL

- Fun Factory

- iPlay America

- KidZania

- Legoland (Merlin)

- Main Event Entertainment

- Merlin Entertainments Group

- Nickelodeon Universe

- Round1 Entertainment

- Scene75 Entertainment

- SeaWorld Entertainment Inc.

- Six Flags Entertainment Corporation

- Sky Zone LLC

- The Walt Disney Company

- Topgolf International Inc.

- Urban Air Trampoline and Adventure Park

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Family Entertainment Center Market

- In February 2024, LEGOLAND Discovery Center announced the launch of their new virtual reality (VR) attraction, "LEGO VR Experience," in multiple locations, marking a significant technological advancement in family entertainment centers (FECs) (LEGOLAND Press Release, 2024). In May 2025, Merlin Entertainments, the world's largest operator of FECs, entered into a strategic partnership with DreamWorks Animation to create immersive, branded attractions based on popular animated films, expanding their offerings and catering to younger audiences (Merlin Entertainments Press Release, 2025).

- In August 2024, Chuck E. Cheese's, a leading FEC chain, raised USD150 million in funding from Blackstone Group to support its growth initiatives, including the expansion of its digital platform and the development of new concepts (Blackstone Group Press Release, 2024). In November 2025, SkyZone, the world's largest trampoline park franchise, entered the Asian market by opening its first location in China, marking a significant geographic expansion for the company (SkyZone Press Release, 2025). These developments demonstrate the continuous innovation and expansion in the market, with a focus on technology, strategic partnerships, and international growth.

Research Analyst Overview

In the dynamic the market, data-driven decisions play a crucial role in strategic planning and growth. Community outreach and charity events enhance brand loyalty and foster positive public perception. Unique selling propositions differentiate industry disruptors, offering innovative experiences beyond game consoles. Staff professionalism and event planning ensure customer service excellence and sensory experiences. Venue rental and themed environments cater to diverse needs, while safety and security are paramount.

Sustainability initiatives and accessibility features attract a wider customer base. Future trends include interactive displays, technological advancements, and corporate team building opportunities in event spaces. Youth programs and special events create a family-friendly atmosphere, driving customer retention. Industry best practices prioritize safety, customer service, and emerging markets for competitive advantage.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Family Entertainment Center Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.2% |

|

Market growth 2025-2029 |

USD 31.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.4 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Family Entertainment Center Market Research and Growth Report?

- CAGR of the Family Entertainment Center industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the family entertainment center market growth of industry companies

We can help! Our analysts can customize this family entertainment center market research report to meet your requirements.