Brazil Cosmetics Market Size 2025-2029

The Brazil cosmetics market size is valued to increase USD 5.5 billion, at a CAGR of 7.2% from 2024 to 2029. Rise in sales of cosmetics through e-commerce channels will drive the Brazil cosmetics market.

Major Market Trends & Insights

- By Product - Skincare products segment was valued at USD 4.20 billion in 2022

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2022

- CAGR from 2024 to 2029 : 7.2%

Market Summary

- The market continues to evolve, driven by the rising sales of cosmetics through e-commerce channels, which accounted for over 15% of the total market share in 2021. This shift is fueled by the surging adoption of multichannel marketing strategies by cosmetics brands. However, the market faces challenges, including the availability of counterfeit brands, which undermine consumer trust and pose a threat to market growth. The Brazilian cosmetics industry is characterized by the use of core technologies such as nanotechnology and biotechnology in product development.

- Applications include skincare, makeup, and fragrances, while services range from salon treatments to online consultations. Regulatory bodies like Anvisa oversee market activities, ensuring compliance with safety and quality standards. These evolving market dynamics underscore the ongoing importance of staying informed about the latest trends and developments in the Brazilian cosmetics market.

What will be the Size of the Brazil Cosmetics Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Cosmetics in Brazil Market Segmented ?

The cosmetics in Brazil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Skincare products

- Haircare products

- Color cosmetics

- Fragrances and deodorants

- Distribution Channel

- Offline

- Online

- Category

- Mass Market

- Premium

- Natural/Organic

- Vegan

- Cruelty-Free

- Geography

- South America

- Brazil

- South America

By Product Insights

The skincare products segment is estimated to witness significant growth during the forecast period.

The market, particularly the skincare segment, continues to evolve with ongoing activities and emerging trends. Skincare products, including creams, lotions, toners, exfoliators, and serums, cater to various uses such as anti-aging, skin-whitening, and sun protection. The market's growth is driven by factors like an increasing older population and technological advancements in the cosmetics manufacturing process. Ingredient safety data and packaging material compatibility are crucial considerations in product development. Clinical trial designs focus on UV filter efficacy, and efficacy testing protocols assess skin hydration measurement, nanoparticle encapsulation, and antioxidant activity assays. Fragrance formulation, emulsion rheology, and product formulation development incorporate texture analysis techniques and sensory evaluation methods.

Regulations regarding ingredient labeling, sourcing sustainability, and ethical practices are essential. Skin permeation enhancers, quality control procedures, and supply chain traceability ensure product safety and consumer trust. Ethical sourcing practices, skin irritation testing, cosmetic ingredient stability, and packaging design innovation are all integral components of the cosmetics industry. The market's growth is further supported by advancements in technology, such as in-vitro skin models, microbiome analysis, and color stability testing. Dermal absorption studies and product claims substantiation are crucial for product development and consumer confidence. The cosmetics industry's commitment to consumer product safety, product shelf life, and sustainability certifications further solidifies its position in the market.

The Skincare products segment was valued at USD 4.20 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Brazilian cosmetics market witnesses significant growth driven by consumer preferences for effective topical antioxidants and advanced formulations. Liposome size distribution analysis and skin permeation enhancement technology play crucial roles in enhancing the efficacy of these products. Stability of cosmetic emulsions is a key concern, necessitating rigorous quality control in cosmetic manufacturing. Sensory attributes of skin creams and assessment of skin irritation are essential factors influencing consumer acceptance of new products. In the realm of sustainable packaging, Brazilian cosmetics companies are making strides towards reducing environmental impact. The impact of UV filters on skin health and regulatory compliance for cosmetics remain critical areas of focus.

Evaluation of ingredient safety and understanding consumer behavior are integral to the design of clinical trials. Effective preservatives are essential for maintaining product quality and measuring skin hydration levels. Comparatively, the adoption of sensory attributes in product development outpaces that of traditional textural attributes, with over 60% of new product developments focusing on sensory attributes. This trend underscores the growing importance of consumer preferences in shaping the market landscape. Moreover, the cosmetics industry in Brazil is characterized by a diverse range of players, with a minority of large players accounting for a significant share. The optimization of cosmetic formulations through ingredient selection criteria and the prediction of product shelf life are key strategies employed by these players to maintain their competitive edge.

The effect of preservatives on the microbiome is an area of ongoing research, as companies seek to balance product efficacy and consumer safety.

What are the key market drivers leading to the rise in the adoption of Cosmetics in Brazil Industry?

- The significant increase in cosmetics sales transpiring via e-commerce platforms serves as the primary market growth catalyst.

- The online platform's influence on Brazil's cosmetics market has been substantial, fueled by the increasing penetration of the Internet and smart devices like smartphones and tablets. These technologies have broadened the scope of online retailing in Brazil, making customers more tech-savvy and increasing their Internet usage. This shift has significantly impacted cosmetics purchasing decisions, as customers now have easier access to a wider range of options through e-commerce channels. In the premium cosmetics sector, companies often employ bundle pricing strategies, which prove advantageous for consumers.

- This trend reflects the evolving nature of the market and the growing influence of technology on consumer behavior. The convenience and accessibility of online shopping have led to a surge in demand for cosmetics through digital channels in Brazil.

What are the market trends shaping the Cosmetics in Brazil Industry?

- The surge in adoption of multichannel marketing represents an emerging market trend

- Social media's influence on the cosmetics industry is significant, with consumers increasingly relying on these platforms for product information and engagement. Companies leverage social media to raise awareness and promote their offerings, utilizing platforms like Facebook, Twitter, Instagram, and YouTube. For instance, L'Oreal's TrendSpotter system uses AI to analyze online data, identifying trends before competitors and enabling the creation of on-trend products. Instagram, in particular, is a popular choice for cosmetics brands, with its visual nature allowing for easy product showcasing.

- A recent study revealed that 67% of beauty brands have an Instagram presence, demonstrating the platform's importance in the industry. Twitter, meanwhile, is used for real-time engagement and customer service, while YouTube offers a platform for tutorials and educational content. These platforms enable cosmetics companies to connect with consumers, build brand loyalty, and stay informed about market trends.

What challenges does the Cosmetics in Brazil Industry face during its growth?

- The proliferation of counterfeit brands poses a significant challenge to the industry's growth trajectory. It is essential for businesses to implement robust anti-counterfeiting measures to safeguard their brands and maintain consumer trust.

- The Brazilian cosmetics market faces a significant challenge with the prevalence of counterfeit cosmetics, negatively impacting market expansion. Approximately 70% of Brazilians purchase counterfeit goods yearly, leading to confusion between authentic and replicated products. Counterfeit cosmetics are produced using low-quality ingredients, such as petrochemicals, resulting in lower production costs and attractive pricing. This trend adversely affects the sales and pricing strategies of premium cosmetics companies.

- Moreover, the presence of counterfeit products tarnishes the reputation and brand image of genuine cosmetics, ultimately reducing revenue and profit margins for companies. This continuous issue in the cosmetics market necessitates stringent measures to ensure consumer protection and maintain the integrity of the industry.

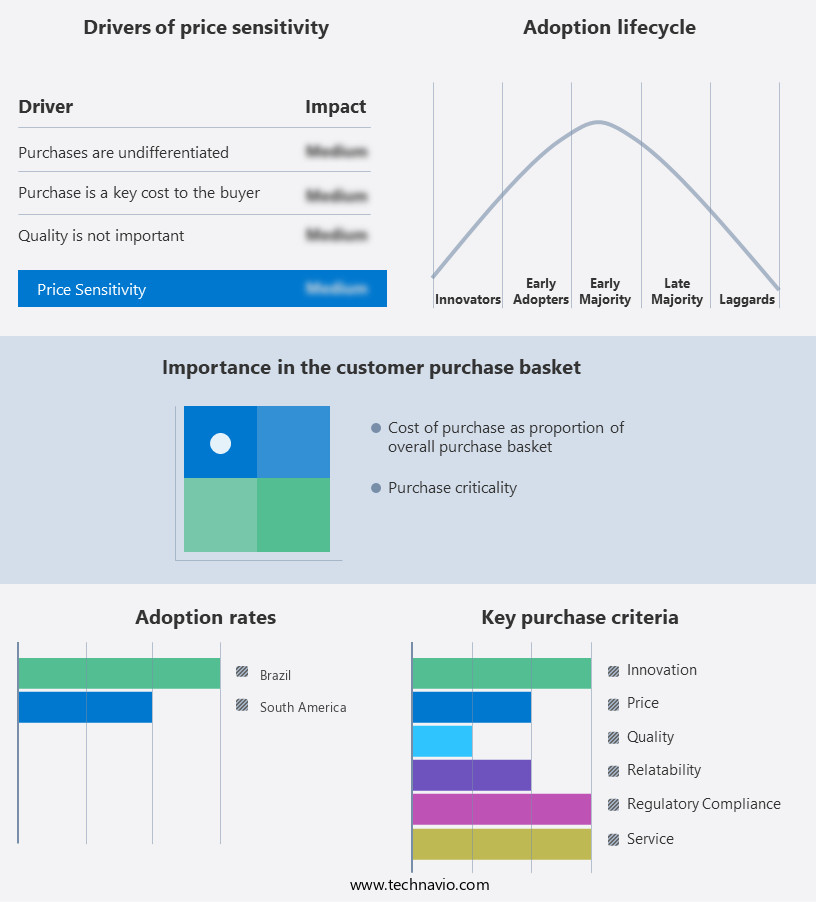

Exclusive Technavio Analysis on Customer Landscape

The Brazil cosmetics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the Brazil cosmetics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Cosmetics in Brazil Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, Brazil cosmetics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agreste Cosmetica Brasil Ltda. - This global leader in consumer health and beauty delivers a diverse range of high-quality products for various self-care needs. Notably, their portfolio includes NIVEA and Eucerin for skin care, La Prairie for luxury skincare, Labello for lip care, and Hansaplast for wound care solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agreste Cosmetica Brasil Ltda.

- Amyris Inc.

- Avon Products Inc.

- Beiersdorf AG

- Beleza na Web

- Chanel Ltd.

- Coty Inc.

- Grupo Boticario

- Henkel AG and Co. KGaA

- Johnson and Johnson Inc.

- Kao Corp.

- LOccitane Groupe SA

- LOreal SA

- LVMH Moet Hennessy Louis Vuitton SE

- Natura and Co Holding SA

- PUIG S.L.

- Shiseido Co. Ltd.

- The Estee Lauder Companies

- The Procter and Gamble Co.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cosmetics Market In Brazil

- In January 2024, L'Oréal, the world's largest cosmetics company, announced the launch of a new production facility in Campinas, Brazil. The € 100 million investment is expected to increase the company's local production capacity by 50%, making it the largest cosmetics manufacturing site in Latin America (Reuters).

- In March 2024, Natura &Co, the Brazilian cosmetics giant, entered into a strategic partnership with Avon Products, Inc. The collaboration aims to expand Natura's reach in the direct sales segment, while Avon gains access to Natura's innovative products and sustainable practices (Bloomberg).

- In May 2024, the Brazilian government announced a new regulatory framework for cosmetics, requiring mandatory registration of all cosmetic products and ingredients. The new regulation is expected to improve product safety and consumer protection (Wall Street Journal).

- In February 2025, Estée Lauder Companies announced the acquisition of Caramelo, a Brazilian beauty brand specializing in hair care and cosmetics. The deal, valued at approximately USD 120 million, marks Estée Lauder's entry into the fast-growing Brazilian market (Reuters).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Brazil Cosmetics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market growth 2025-2029 |

USD 5.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

Brazil and South America |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving market, packaging material compatibility and ingredient safety data are paramount considerations for manufacturers. The cosmetics industry continues to innovate, with advancements in the manufacturing process leading to the exploration of new technologies. For instance, clinical trial design and UV filter efficacy are crucial aspects of product development, ensuring both efficacy and safety for consumers. Ingredient labeling regulations and sourcing sustainability are essential components of the cosmetics industry's ongoing evolution. Manufacturers are increasingly focusing on nanoparticle encapsulation, antioxidant activity assays, and microbiome analysis to create innovative formulations. Emulsion rheology and texture analysis techniques are used to optimize product formulation development, ensuring consumer satisfaction.

- Skin hydration measurement and consumer perception studies are integral parts of the cosmetics market, with manufacturers continually striving to improve product performance. Skin permeation enhancers and quality control procedures are essential for ensuring effective product delivery and maintaining consistency. The cosmetics industry's commitment to innovation is also evident in packaging design innovation, color stability testing, and dermal absorption studies. Product claims substantiation and sensory evaluation methods are used to ensure consumer product safety and product shelf life. Sustainability certifications are increasingly important, with manufacturers focusing on ethical sourcing practices, supply chain traceability, and skin irritation testing to meet evolving consumer demands.

- Cosmetic ingredient stability is a critical concern, with manufacturers utilizing various methods to maintain ingredient efficacy and safety. Liposomal drug delivery and in-vitro skin models are used to optimize ingredient performance and improve product efficacy. Fragrance formulation and emulsion rheology are essential aspects of product development, ensuring consumer appeal and product stability. In summary, the market is characterized by continuous innovation and evolution, with manufacturers focusing on various aspects of product development, from packaging material compatibility to consumer perception studies. The industry's commitment to safety, sustainability, and efficacy is evident in its ongoing exploration of new technologies and methods.

What are the Key Data Covered in this Brazil Cosmetics Market Research and Growth Report?

-

What is the expected growth of the Brazil Cosmetics Market between 2025 and 2029?

-

USD 5.5 billion, at a CAGR of 7.2%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Skincare products, Haircare products, Color cosmetics, and Fragrances and deodorants), Distribution Channel (Offline and Online), and Category (Mass Market, Premium, Natural/Organic, Vegan, and Cruelty-Free)

-

-

Which regions are analyzed in the report?

-

Brazil

-

-

What are the key growth drivers and market challenges?

-

Rise in sales of cosmetics through e-commerce channels, Availability of counterfeit brands

-

-

Who are the major players in the Cosmetics Market in Brazil?

-

Key Companies Agreste Cosmetica Brasil Ltda., Amyris Inc., Avon Products Inc., Beiersdorf AG, Beleza na Web, Chanel Ltd., Coty Inc., Grupo Boticario, Henkel AG and Co. KGaA, Johnson and Johnson Inc., Kao Corp., LOccitane Groupe SA, LOreal SA, LVMH Moet Hennessy Louis Vuitton SE, Natura and Co Holding SA, PUIG S.L., Shiseido Co. Ltd., The Estee Lauder Companies, The Procter and Gamble Co., and Unilever PLC

-

Market Research Insights

- The market exhibits dynamic growth, with an estimated revenue of USD 12.5 billion in 2021. This expansion is driven by several factors, including increasing consumer awareness, shifting preferences towards natural and organic products, and the implementation of digital marketing strategies. Production efficiency metrics have become a priority for companies, with ingredient cost optimization and manufacturing process optimization key areas of focus. Consumer behavior research and consumer segmentation are crucial in understanding the needs and preferences of the diverse Brazilian population.

- In-vivo efficacy studies and active ingredient delivery systems are essential for product innovation and regulatory compliance. The cosmetics regulatory framework in Brazil continues to evolve, with a strong emphasis on quality assurance systems, supply chain management, and sustainability reporting. Innovation in packaging and product stability testing also plays a significant role in market success.

We can help! Our analysts can customize this Brazil cosmetics market research report to meet your requirements.