What is the Beauty Salon Market Size?

The beauty salon market size is estimated to grow by USD 65.88 billion at a CAGR of 6.4% between 2024 and 2029. The market is experiencing significant growth, driven by several key factors. Rising disposable income among consumers is leading to increased spending on beauty and personal care services. New product launches by vendors continue to cater to evolving consumer preferences, further fueling market growth. Competition in the market is fierce, with salon chains and franchise stores offering a wide range of services, from haircuts and hair treatments to facials and body waxing. However, challenges persist, including a labor shortage and staff retention issues. Beauty salons are responding by offering competitive wages, benefits, and training programs to attract and retain skilled employees. As the market continues to evolve, staying abreast of these trends and challenges is essential for success.

What will be the size of Market during the forecast period?

Request Free Beauty Salon Market Sample

Market Segmentation

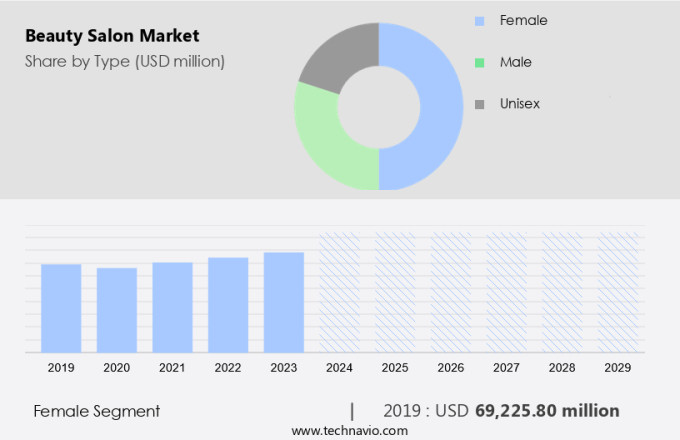

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019 - 2023 for the following segments.

- Type

- Female

- Male

- Unisex

- Service Type

- Hair care services

- Skin care services

- Nail care services

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- Middle East and Africa

- South America

- North America

Which is the largest segment driving market growth?

The female segment is estimated to witness significant growth during the forecast period. In the realm of self-care services, the beauty salon industry continues to thrive, with a notable segment being dedicated to female clients. These establishments prioritize personalized services tailored to the unique beauty and wellness requirements of women. One of the key offerings at female beauty salons is the provision of expert haircuts and styling.

Get a glance at the market share of various regions. Download the PDF Sample

The female segment was valued at USD 69.22 billion in 2019. Skilled professionals are on hand to create a diverse range of hairstyles that cater to individual preferences and current trends. From classic cuts to trendy styles or special occasion updos, these salons ensure clients leave feeling confident and beautiful. Additionally, an increasing number of female beauty salons are embracing organic beauty practices, providing a healthier work environment for both clients and staff. Check-in systems have also become commonplace, streamlining the client experience and enhancing overall efficiency. The market for these services continues to grow, reflecting the enduring importance of self-care and personal appearance in contemporary society.

Which region is leading the market?

For more insights on the market share of various regions, Request Free Sample

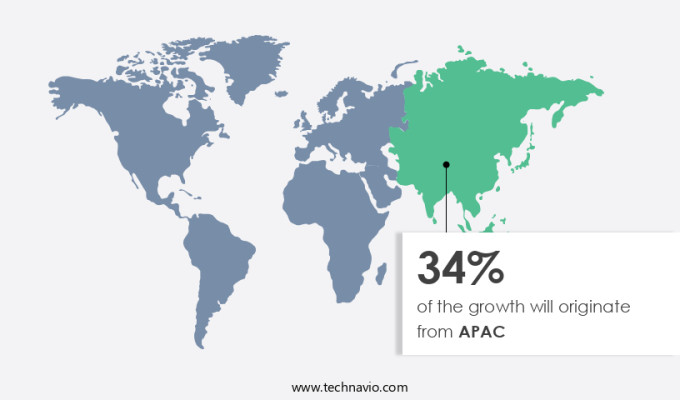

APAC is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional market trends and drivers that shape the market during the forecast period. Another region offering significant growth opportunities to vendors is North America. In North America, the beauty salon industry continues to thrive due to several key factors. The region's population boasts a high disposable income, enabling consumers to prioritize self-care and invest in beauty treatments. This income growth empowers consumers to allocate more funds towards beauty care, fueling the demand for salon services. Moreover, the proliferation of beauty salons in North America is another significant market growth catalyst. Both chain salons and independent establishments are expanding their footprint to meet the increasing consumer demand. Salon equipment, such as massage chairs and vegan treatment tables, are in high demand to cater to diverse consumer preferences. By prioritizing exceptional customer service and offering a wide range of neck and shoulder treatments, beauty salons differentiate themselves and attract a loyal customer base.

How do company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Aveda Corp. - This company offers beauty salon services that include haircuts, coloring, botanical repair treatments, and stress-relieving rituals.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- bluemercury

- Bumble and bumble

- Cost Cutters

- Fantastic Sams

- Floyds Barbershop

- Great Clips

- Hair Cuttery

- Lakme Lever Pvt Ltd.

- LOreal SA

- Regis Corp.

- Shiseido Co. Ltd.

- Snip its

- Sola Salon Studios

- Supercuts

- Sweet and Sassy

- Ulta Beauty Inc.

Explore our company rankings and market positioning. Request Free Sample

How can Technavio assist you in making critical decisions?

What is the market structure and year-over-year growth of the Beauty Salon Market?

|

Market structure |

Fragmented |

|

YoY growth 2024-2025 |

6.3 |

Market Dynamics

The beauty salon industry is a dynamic and ever-evolving market, encompassing a wide range of services and offerings. From hair styling and coloring to nail extensions and spa treatments, beauty salons cater to the diverse needs of consumers seeking to enhance their appearance and well-being. In this article, we delve into the intricacies of the market, exploring various market dynamics and trends. Customer Loyalty Programs and Salon Hygiene Standards Customer loyalty is a critical factor in the success of beauty salons. To retain customers and foster repeat business, many salons implement loyalty programs, offering incentives such as discounts, free services, and exclusive promotions. Salon hygiene standards also play a significant role in customer satisfaction and loyalty. Maintaining a clean and sanitary environment is essential for ensuring the health and safety of clients and staff alike. Salon Hygiene Standards and Salon Software Salon software solutions have emerged as valuable tools for managing various aspects of salon operations, including appointment scheduling, inventory management, and client records.

Salon equipment suppliers offer a wide range of products, from chairs and tables to styling tools and shampoo bowls. Salon Regulations and Safety Regulations governing the beauty industry vary by region, with a focus on ensuring the safety and well-being of clients and staff. Compliance with these regulations is essential for maintaining a reputable business and avoiding potential legal issues. Salon safety measures include proper ventilation, emergency procedures, and adherence to OSHA guidelines. Salon Website Design and Social Media Marketing In today's digital age, having a strong online presence is crucial for attracting and retaining clients. A well-designed website can showcase a salon's offerings, services, and client testimonials, while social media platforms provide opportunities for engagement and interaction. Our researchers analyzed the data with 2024 as the base year and the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the primary factors driving the market growth?

Rising disposable income is the key driver of the market. The market is experiencing steady growth due to the increasing disposable income of consumers in various regions. With more financial resources, individuals are investing in professional beauty and grooming services to enhance their appearance and well-being. This trend is particularly noticeable in emerging economies, such as China. This income growth has enabled more consumers to afford beauty treatments, leading to a rise in demand for services like neck and shoulder treatments, massages, manicures, and facials.

The beauty salon industry caters to diverse customer preferences, offering a range of services including vegan and eco-friendly options, hair care, nail care, and body waxing. Salons equip their facilities with high-quality chairs, cutting equipment, and massage tables to provide a comfortable and relaxing experience for clients. Salon chains and franchise stores have also entered the market, offering standardized services and efficient check-in systems. In the competitive market, customer service and experience are key differentiators. Service providers focus on providing personalized services, catering to male clientele and offering services like haircuts, hair treatments, and hair coloring. Organic beauty and eco-friendly practices are also gaining popularity, as consumers become more conscious of their personal care choices. Thus, such factors are driving the growth of the market during the forecast period.

What are the significant trends being witnessed in the market?

New launches by companies is the upcoming trend in the market. The market is experiencing significant growth due to increasing consumer awareness and preference for personal care services. Neck and shoulder treatments, massage, and nail care continue to be popular services offered at salons, with an emphasis on eco-friendly and vegan options. Salon equipment, including massage chairs and cutting tools, are being upgraded to provide a more comfortable and efficient customer experience. companies are responding with new product launches which addresses the specific need for hair loss solutions.

Furthermore, this collection, with its 94% plus naturally derived, vegan formula, has been shown to reduce hair loss and increase thickness. Hygiene remains a top priority in the industry, with a focus on maintaining a healthy work environment for both service providers and clients. Personal grooming services, including manicures, pedicures, and nail art, are also popular offerings. Hair care, including hair shampoo and hair coloring, is a significant segment of the market, with consumers seeking out organic and eco-friendly options. Barber shops and traditional barber services continue to coexist with beauty salons, catering to male clientele and offering specialized cutting equipment.

What are the major market challenges?

Labor shortage and staff retention is a key challenge affecting market growth. The market is transforming due to various factors. One of the significant challenges faced by the industry is the labor shortage and staff retention, particularly in sectors like neck and shoulder treatment, massage, and hair salons. This prolonged recruitment period is attributed to perceptions of low pay and a growing preference for college courses over traditional on-the-job training. However, the trend is not limited to hair salons alone.

Furthermore, the beauty care industry, including nail care, skin care, and barber shops, is also facing similar challenges. To remain competitive, salon owners are focusing on enhancing customer service, offering eco-friendly and vegan treatments, and implementing check-in systems. They are also investing in high-quality salon equipment, such as cutting equipment, hair shampoo, and hair straighteners, to provide better services and improve the overall customer experience. Moreover, there is a growing trend towards personalized services, including personal grooming, hair coloring, styling, and hair treatments, catering to diverse customer preferences. This shift towards self-care services is driving the demand for a healthy work environment, attracting a wider range of male clientele and offering services like perms, haircuts, and silk press.

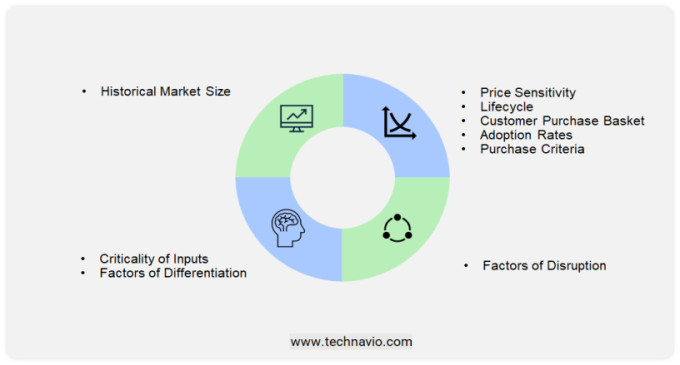

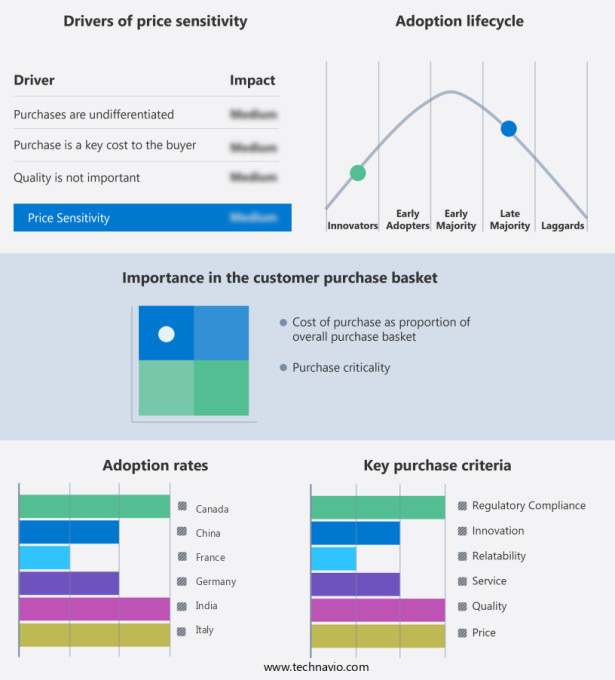

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

The market is a thriving industry that caters to the growing demand for personal care and self-indulgence. With an increasing focus on wellness and self-care, services such as neck and shoulder treatments and massages have gained significant popularity. Neck and shoulder treatments are an essential part of any beauty salon offering. These treatments help alleviate stress, tension, and pain in the neck and shoulder area, providing customers with a relaxing and rejuvenating experience. Effective hair salon management is essential for staying ahead of salon design trends and catering to the growing demand for male grooming services, while salon branding and offering top-quality personal care products can elevate the customer experience. Many salon franchise are now focusing on beauty salon trends, making it easier to find the best hair salons that align with these innovative changes.

Furthermore, eco-friendly and vegan massage oils and lotions are becoming increasingly popular, aligning with the growing consumer awareness towards sustainable and ethical personal care practices. Salon equipment plays a vital role in the successful operation of a beauty salon. A well-structured hair salon business plan, supported by the right hair salon software and hair salon financing options, can help a beauty school graduate successfully open and run their own salon, while adhering to hair salon regulations and ensuring safety standards. Hair oil and other personal care products sourced from a reliable beauty supply store can elevate salon offerings, while attending beauty industry events and winning hair salon awards can enhance brand visibility and credibility. Providing exceptional service, from the initial booking to the final consultation and treatment, is essential in retaining customers and attracting new ones. Personalized attention, clear communication, and a friendly demeanor are key components of excellent customer service.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019 - 2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market Growth 2025-2029 |

USD 65.88 billion |

|

Regional analysis |

North America, APAC, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 34% |

|

Key countries |

US, China, Canada, UK, Germany, France, Japan, South Korea, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aveda Corp., bluemercury, Bumble and bumble, Cost Cutters, Fantastic Sams, Floyds Barbershop, Great Clips, Hair Cuttery, Lakme Lever Pvt Ltd., LOreal SA, Regis Corp., Shiseido Co. Ltd., Snip its, Sola Salon Studios, Supercuts, Sweet and Sassy, and Ulta Beauty Inc. |

|

Market Segmentation |

Type (Female, Male, and Unisex), Service Type (Hair care services, Skin care services, Nail care services, and Others), and Geography (North America, APAC, Europe, Middle East and Africa, and South America) |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the market forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies