Brazil Nuts Market Size 2025-2029

The Brazil nuts market size is forecast to increase by USD 71.8 million, at a CAGR of 4.7% between 2024 and 2029.

- The Brazil nut market is driven by the numerous health benefits associated with the consumption of these nuts. Rich in selenium, thiamine, and various minerals, Brazil nuts have gained popularity as a superfood, fueling market growth. Additionally, product innovation and diversification are key trends in the Brazil nut market, with manufacturers exploring new applications and forms to cater to evolving consumer preferences. However, potential allergens in Brazil nuts pose a significant challenge, necessitating careful handling and labeling to mitigate risks and ensure consumer safety.

- Companies seeking to capitalize on market opportunities must prioritize product innovation, adhere to stringent quality standards, and effectively manage allergen risks to maintain a competitive edge.

What will be the Size of the Brazil Nuts Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market exhibits a dynamic and evolving nature, with ongoing activities shaping its landscape. Unshelled Brazil nuts continue to be the primary focus, with stringent quality control measures ensuring top-notch produce. The emergence of value-added products, such as Brazil nut butter and protein, caters to niche markets and premium pricing. Supply chain management plays a crucial role in the market, with nut drying, sorting, and transportation techniques optimized for efficiency and sustainability. Environmental impact, including carbon footprint and fair trade practices, is increasingly important to consumers and regulators. Innovation in product formulation, such as Brazil nut milk and oil, expands the market's reach into various sectors, including food manufacturing, gourmet food, and health food.

Ingredient sourcing and nut grading ensure consistent nutritional value and food safety. Brand marketing and e-commerce sales further broaden accessibility, with a focus on health benefits and healthy fats. Regulations, including import and export guidelines, continue to shape the market, ensuring compliance with evolving industry standards.

How is this Brazil Nuts Industry segmented?

The Brazil nuts industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Conventional Brazil nuts

- Organic Brazil nuts

- Distribution Channel

- Offline

- Online

- Type

- Whole nuts

- Pieces

- Powder

- End-user

- Food and beverage

- Cosmetic

- Neutraceutical

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- The Netherlands

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

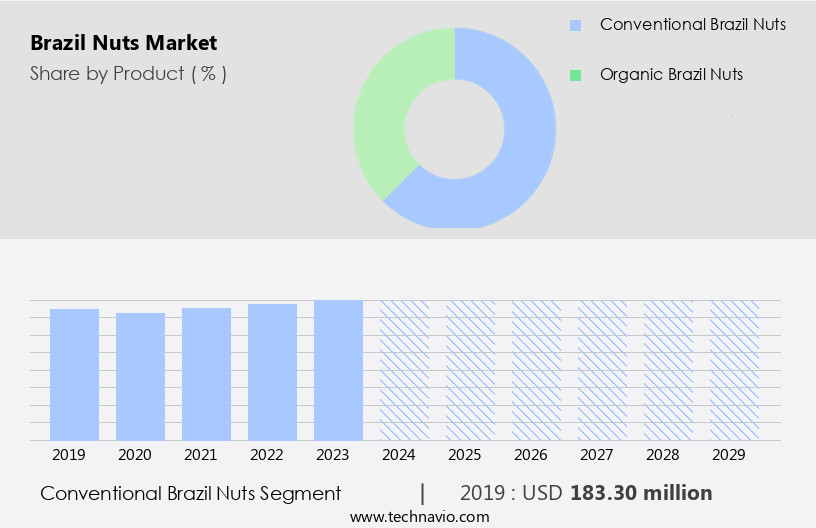

The conventional Brazil nuts segment is estimated to witness significant growth during the forecast period.

The Brazil nut market encompasses various product offerings, including paste, milk, butter, flour, oil, and roasted nuts. Carbon footprint is a growing concern in nut production, with some manufacturers focusing on organic farming and fair trade practices to reduce environmental impact. Wholesale distribution plays a crucial role in supplying these products to food manufacturers for use in snack foods and gourmet items. Product innovation is a key trend, with new forms such as Brazil nut milk and butter gaining popularity for their unique flavors and nutritional benefits. Premium pricing is common due to the nuts' limited availability and labor-intensive harvesting process.

Health-conscious consumers seek out Brazil nuts for their healthy fats, Vitamin E, and protein content. Nut processing involves cleaning, sorting, roasting, and cracking to ensure consistent quality. Nut grading, packaging, and storage are essential for maintaining freshness and shelf life. Import and export regulations are crucial for ensuring a stable supply chain. Brand marketing and recipe development are essential for reaching niche markets and expanding consumer reach. Direct-to-consumer sales through e-commerce platforms are also gaining traction. Despite the challenges of wild harvesting and nut drying, the market continues to grow due to the nuts' health benefits and unique taste.

Brazil nut farming practices can vary, with some relying on conventional methods using pesticides and fertilizers. However, the demand for organic and sustainably sourced nuts is increasing, driving innovation and investment in more eco-friendly farming practices. Quality control is a top priority for manufacturers, with strict adherence to food safety regulations ensuring the production of high-quality products. The Brazil nut market is expected to continue its growth trajectory, driven by increasing consumer awareness of the health benefits of nuts and the expanding range of product offerings.

The Conventional Brazil nuts segment was valued at USD 183.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Brazil nut market in Europe is experiencing continuous growth due to the increasing preference for healthier food options. Key European markets for Brazil nuts include the UK, Germany, Italy, and France. Central European countries such as Belgium, the Netherlands, and Poland are emerging markets, presenting opportunities for Brazil nut companies. The demand for Brazil nuts in Europe has been on the rise, with the third-highest import value growth rate in the past five years, following cashew nuts and chestnuts. Organic farming practices and fair trade are essential considerations in the Brazil nut market. Product innovation, including Brazil nut paste, milk, flour, extract, oil, and butter, is expanding the market's reach.

Wholesale distribution and retail channels ensure wide availability, while food manufacturing companies incorporate Brazil nuts into snack foods and gourmet dishes. Sustainable harvesting, nut cleaning, and packaging practices minimize the carbon footprint. Nut grading, roasting, and cracking ensure quality control, while food safety regulations maintain nutritional value. E-commerce sales and direct-to-consumer channels offer convenience, and supply chain management optimizes distribution. Import and export regulations ensure fair trade and market pricing. Brazil nuts are rich in healthy fats, vitamin E, and protein, making them a popular choice for health-conscious consumers. Ingredient sourcing from responsible suppliers and nut processing facilities is crucial for maintaining product quality and meeting consumer expectations.

Nut drying and sorting ensure consistent product quality, while shelf life and nut storage are essential for maintaining freshness.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant player in the global nuts and seeds industry, renowned for its unique and nutrient-dense product. Harvested primarily from the Amazon rainforest, Brazil nuts are rich in essential minerals, particularly selenium, making them a popular superfood. Brazil nut exports contribute substantially to the economies of countries like Peru and Bolivia. Sustainable farming practices are crucial in the market to ensure long-term availability. Traders and wholesalers source Brazil nuts directly from local cooperatives or through certified suppliers. The supply chain involves various stakeholders, including farmers, processors, exporters, and importers. Consumers worldwide appreciate Brazil nuts for their distinctive taste and health benefits. They are used in various applications, from raw snacking to baking and cooking. Brazil nuts are also popular in the functional food industry, where they are incorporated into energy bars, nut butters, and supplements. The market's growth is driven by increasing health consciousness, rising demand for plant-based protein sources, and the expanding functional food sector. Despite challenges such as weather volatility and supply chain complexities, the market continues to thrive, offering opportunities for stakeholders across the value chain.

What are the key market drivers leading to the rise in the adoption of Brazil Nuts Industry?

- The consumption of Brazil nuts is driven by the market due to the numerous health benefits they provide. These benefits, which include being rich in essential minerals and healthy fats, make Brazil nuts a popular choice for health-conscious consumers.

- Brazil nuts are a valuable nut with a rich nutritional profile, particularly high in selenium, healthy fats, protein, and fiber. Selenium is an essential mineral that plays a crucial role in various bodily functions, including thyroid hormone metabolism, DNA synthesis, reproduction, and a strong immune system. Approximately 13% of the global population is estimated to be deficient in selenium, a number that is expected to rise. Selenium deficiency can manifest through symptoms such as infertility, muscle weakness, fatigue, mental disorders, hair loss, and a weakened immune system. To address this deficiency, increasing the intake of selenium-rich foods is recommended.

- Brand marketing for shelled Brazil nuts has gained momentum due to their health benefits. As a gourmet and health food item, they are in demand for recipe development and health-conscious consumers. Fair trade and e-commerce sales have also contributed to their growing popularity. Nut storage is essential to maintain their nutritional value and freshness. Export regulations ensure the quality and safety of Brazil nuts for international markets. Brazil nut oil is another product derived from Brazil nuts, which is rich in selenium and healthy fats. It is used in various culinary applications and cosmetics.

- Food safety and nutritional value are crucial considerations for both the production and consumption of Brazil nuts. Consumers look for brands that prioritize these aspects, making transparency and certification essential for success in the market.

What are the market trends shaping the Brazil Nuts Industry?

- The trend in the market involves an upward trajectory for product innovation and diversification within the Brazil nut industry. This sector is witnessing significant growth through the development and introduction of new and enhanced Brazil nut products.

- The market is experiencing dynamic growth through product innovation and diversification. Unshelled Brazil nuts are being transformed into various forms to cater to diverse consumer preferences. Innovative flavor profiles, such as honey-roasted, spicy chili-lime, chocolate-covered, or infused with exotic spices, add unique taste experiences for consumers. Convenient snack packs, trail mixes, and mixed nut assortments are created for on-the-go consumers seeking healthier alternatives. Furthermore, the use of Brazil nuts is expanding in culinary applications, with the introduction of spreads like Brazil nut butter and nut butter blends, as well as their inclusion in baked goods such as granola, energy bars, and cookies.

- Quality control measures, including nut drying, sorting, and transportation, are essential in maintaining the shelf life and market pricing of these products. Import regulations ensure the ethical sourcing and sustainable production of Brazil nuts, further enhancing their appeal to niche markets.

What challenges does the Brazil Nuts Industry face during its growth?

- The presence of potential allergens poses a significant challenge to the expansion of the industry, requiring rigorous management and mitigation strategies to ensure consumer safety and regulatory compliance.

- Brazil nuts are a popular ingredient in various food products, including paste, milk, and snack foods. However, it is essential to note that Brazil nuts contain allergens, specifically the proteins Ber e 1 and Ber e 2, which can trigger severe allergic reactions in sensitive individuals. These proteins are responsible for allergic reactions ranging from mild symptoms such as itching and swelling to life-threatening conditions like anaphylaxis. Anaphylaxis can cause difficulty breathing, swelling of the throat, and a sudden drop in blood pressure, requiring immediate medical attention. In the food manufacturing industry, product formulation is a critical factor in addressing the presence of allergens.

- Organic farming practices and nut grading, nut roasting, and nut cracking processes can help minimize cross-contamination. Wholesale distribution of Brazil nut products must adhere to strict guidelines to ensure the safety of consumers. Premium pricing for Brazil nut products is a market trend, driven by their nutritional benefits and unique taste. Product innovation, such as Brazil nut paste and milk, caters to various consumer preferences. However, it is crucial to prioritize the safety and health of consumers, especially those with nut allergies, in the development and distribution of these products. Carbon footprint is also a consideration in the production and distribution of Brazil nut products, with companies implementing sustainable practices to reduce their environmental impact.

Exclusive Customer Landscape

The Brazil nuts market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the Brazil nuts market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, Brazil nuts market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Basse Nuts - The company specializes in providing raw Brazil nuts as a premium health product.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Basse Nuts

- Bata Food

- Nutty Gritties

- FLORENZANO NUTS

- Happilo International Pvt. Ltd.

- Urban Platter

- Food to Live

- NOW Foods

- Nut Cravings

- Nuts.com Inc.

- Nutshup

- Royal Nut Co.

- Select Harvests Ltd.

- Sincerely Nuts

- Sunbest Natural

- Sunfood

- Terrasoul Superfoods

- The Roasting Company

- We Got Nuts

- Wildly Organic

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Brazil Nuts Market

- In January 2024, in a strategic move to expand its product portfolio, The Brazil Nut Company announced the launch of roasted and salted Brazil nuts, targeting the growing demand for healthy snacks (Source: The Brazil Nut Company Press Release).

- In March 2024, Amazon Forest Partners, a leading player in the market, entered into a partnership with a local NGO to implement sustainable farming practices and increase production capacity by 30% (Source: Amazon Forest Partners Press Release).

- In August 2024, NutriBolivia, a Bolivian-based company, raised USD10 million in a Series A funding round to scale up its Brazil Nut processing facilities and expand its market reach (Source: VentureBeat).

- In May 2025, the Brazilian government announced the implementation of new regulations to protect the Brazil Nut harvesting industry from illegal logging and deforestation, ensuring the long-term sustainability of the market (Source: Brazilian Ministry of Environment Press Release).

Research Analyst Overview

- In the dynamic market, various factors influence sales channels and market trends. Water management is crucial for optimal crop growth, while price elasticity affects consumer purchasing decisions. The cosmetics industry utilizes nut oils processing for high-value applications, and processing technology advances drive innovation. Pest management and logistics optimization ensure supply chain resilience, while research and development and quality assurance enhance product positioning. Sustainability initiatives, social responsibility, and agricultural practices prioritize worker safety and community development. Nut-based desserts and snacks cater to evolving consumer preferences, and food preservation and labeling adhere to regulatory compliance.

- Disease control and regulatory compliance are essential for risk management, and innovation strategy drives competitive advantage. Nut butter blends and packaging materials contribute to economic impact, and soil health and environmental certifications promote sustainability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Brazil Nuts Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 71.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, UK, Germany, Italy, France, The Netherlands, Spain, Canada, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Brazil Nuts Market Research and Growth Report?

- CAGR of the Brazil Nuts industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the Brazil nuts market growth of industry companies

We can help! Our analysts can customize this Brazil nuts market research report to meet your requirements.