Breakfast Food Market Size 2025-2029

The breakfast food market size is valued to increase USD 108.7 billion, at a CAGR of 4.3% from 2024 to 2029. Frequent breakfast product launches will drive the breakfast food market.

Major Market Trends & Insights

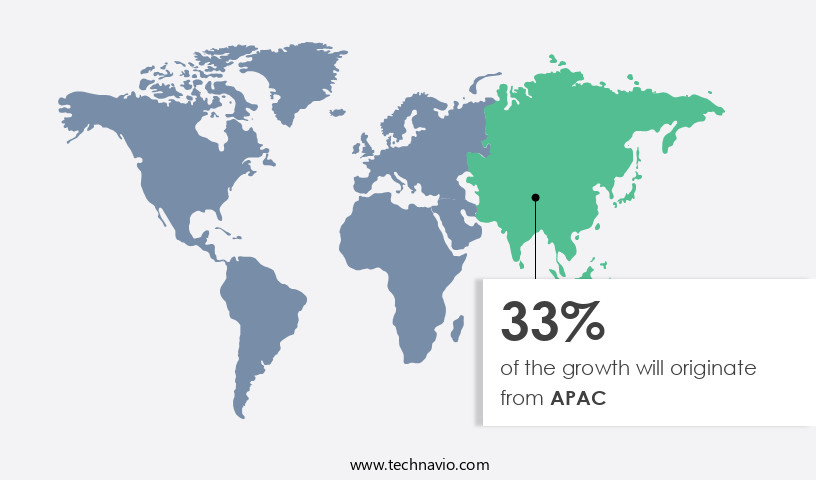

- APAC dominated the market and accounted for a 33% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 301.60 billion in 2023

- By Type - Bakery products segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 43.94 billion

- Market Future Opportunities: USD 108.70 billion

- CAGR from 2024 to 2029: 4.3%

Market Summary

- The market, a significant sector within the global food industry, experienced steady growth in recent years. Fueled by increasing consumer demand for convenience and healthier options, this market shows no signs of slowing down. Key drivers include the rise of plant-based foods, with alternatives to traditional animal-derived products gaining traction among health-conscious consumers. Additionally, frequent product launches catering to various dietary preferences and lifestyles contribute to the market's expansion. Despite these opportunities, the market faces challenges, such as fluctuations in food prices and the need for innovation to meet evolving consumer expectations.

- Producers must adapt to these trends while maintaining quality and affordability to remain competitive. The future direction of the market lies in continued innovation and catering to diverse consumer preferences. As consumers become more health-conscious and environmentally aware, plant-based and sustainable options are expected to dominate the landscape. On one hand, it caters to the increasing demand for healthier and more sustainable food choices. On the other hand, it requires companies to invest in research and development to create innovative, appealing, and competitive plant-based breakfast products. In conclusion, the market demonstrates robust growth, driven by consumer preferences for convenience, healthier options, and innovation. Companies must navigate challenges such as price fluctuations and evolving consumer expectations to remain competitive in this dynamic sector.

What will be the Size of the Breakfast Food Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Breakfast Food Market Segmented?

The breakfast food industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Bakery products

- Ready meals

- Cereals

- Snack bars

- Others

- Product

- RTE

- RTC

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with offline sales channels generating significant revenue in 2024. Supermarkets, convenience stores, and local grocery stores account for a substantial portion of the market, offering consumers the convenience of physical inspection and a trusted purchasing experience. Retailers and manufacturers collaborate to increase product presence, often utilizing promotions and discounts to attract customers. Sustainable packaging materials and ingredient cost optimization are key strategies for companies in this sector, with a focus on distribution channel management and supply chain efficiency. Market segmentation strategies and consumer preference data guide marketing communications, while product lifecycle management and waste reduction strategies ensure long-term success.

The Offline segment was valued at USD 301.60 billion in 2019 and showed a gradual increase during the forecast period.

Product formulation design, texture analysis methods, and flavor compound analysis are essential for innovation and differentiation. Food safety regulations and brand positioning are critical components of quality control metrics, ensuring consumer trust and loyalty. The market's focus on energy consumption reduction and ingredient traceability systems aligns with evolving consumer expectations. Sales channel optimization, cereal grain milling, nutrient fortification methods, and automated production lines contribute to production efficiency gains.

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Breakfast Food Market Demand is Rising in APAC Request Free Sample

The North American market exhibits substantial size and continuous expansion, fueled by shifting consumer preferences, hectic lifestyles, and the increasing appeal of convenient breakfast solutions. Traditional fare, including cereals, milk, eggs, bacon, sausages, and bread, continues to dominate the regional landscape. However, health and wellness trends have significantly influenced the market, with consumers gravitating towards options that feature reduced sugar, whole grains, high protein, and natural ingredients.

Greek yogurt, oatmeal, granola, and smoothies have emerged as popular alternatives. This dynamic market landscape underscores the importance of staying informed about evolving consumer preferences and trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant sector within the global food industry, encompassing a wide range of products from cereals and pastries to eggs and meat. The quality of ingredients used in the production of these foods plays a crucial role in determining product shelf life and consumer satisfaction. Optimization of cereal grain milling processes is essential to ensure consistent texture and flavor, while maintaining ingredient freshness. Consumer perception of breakfast food texture is another critical factor, with companies continually striving to improve product formulations to meet evolving preferences. Effective packaging is vital for food safety and preservation, with advances in materials and technologies enabling longer shelf life and reduced waste. Breakfast food production efficiency is a key focus for manufacturers, with strategies including the optimization of supply chains, reduction of waste, and improvement of energy efficiency. Analysis of consumer preferences for breakfast cereals and assessment of the nutritional content of various offerings are essential for product development. Sensory attributes of breakfast pastries are also evaluated to ensure optimal taste and texture, while sustainability considerations are increasingly important in the selection of packaging materials. Implementation of food safety management systems and effective marketing strategies are crucial for maintaining consumer trust and driving sales. Sales data analysis and assessment of the competitive landscape are essential tools for breakfast food companies, with effective pricing strategies and management of retail shelf space also playing significant roles in market success. The breakfast food industry is dynamic and competitive, with ongoing innovation and improvement essential to remain competitive.

In the competitive Breakfast Food Market, ensuring product quality, sustainability, and operational efficiency is essential to meet both consumer expectations and regulatory standards. One key determinant of product longevity is the impact of ingredient quality on product shelf life. High-quality raw materials not only enhance flavor and texture but also contribute to improved microbial stability and reduced spoilage over time. Equally important is the effect of packaging on food safety and preservation. Packaging solutions must provide effective barriers against moisture, oxygen, and light, while also supporting tamper resistance and extending freshness. Innovations in this area are closely tied to the evaluation of the sustainability of breakfast food packaging, as manufacturers seek eco-friendly materials that meet performance and environmental goals.

From an operational standpoint, strategies for improving breakfast food production efficiency are critical. This includes adopting automation, lean manufacturing techniques, and real-time monitoring to minimize downtime and increase throughput. These strategies also align with the improvement of energy efficiency in breakfast food production, where reducing energy consumption through optimized baking, freezing, or extrusion processes leads to lower operational costs and a reduced carbon footprint. Nutritional quality remains a top priority, prompting the ongoing assessment of the nutritional content of breakfast foods. This involves not only compliance with labeling regulations but also formulation efforts to enhance fiber, protein, and micronutrient content while reducing added sugars and saturated fats.

Consumer satisfaction depends heavily on the measurement of sensory attributes of breakfast pastries and other items. Sensory testing evaluates taste, aroma, texture, and appearance to ensure that products consistently meet consumer expectations and stand out in a crowded market. The logistics side of the business is also under scrutiny, with the optimization of the supply chain for breakfast food products becoming increasingly data-driven. Real-time tracking, demand forecasting, and inventory management help reduce delays and lower costs while maintaining product freshness.

Sustainability is further addressed through the reduction of waste in breakfast food manufacturing processes. This includes repurposing food scraps, improving yield ratios, and implementing circular systems for byproducts. Collectively, these efforts contribute to a more responsible and profitable production model. By integrating these areas—ranging from quality control and nutritional assessment to sustainability and operational optimization—the breakfast food market is evolving to meet the demands of modern consumers while addressing economic and environmental challenges.

What are the key market drivers leading to the rise in the adoption of Breakfast Food Industry?

- The consistent introduction of new breakfast products serves as the primary growth catalyst for the market.

- The market exhibits a fragmented landscape, with numerous international and domestic players introducing a diverse range of breakfast products to cater to evolving consumer preferences. In January 2024, General Mills Inc. entered the market with a new innovation, a cup of fruit and veggies per serving, which combines spinach, carrot, and sweet potato with whole grain oats. Similarly, Kellogg Co. Plans to launch a new cereal brand, Eat Your Mouth Off, in 2024, featuring zero sugar and high protein content.

- These strategic product launches underscore the competitive nature of the market and the industry's commitment to meeting the evolving nutritional demands of consumers. The market's growth is anticipated to be driven by the increasing number of product innovations during the forecast period.

What are the market trends shaping the Breakfast Food Industry?

- Plant-based foods are becoming increasingly popular in the market trend. This emerging trend reflects a growing preference for food derived from plants.

- Plant-based breakfast foods have witnessed a noteworthy surge in consumer preference in recent years. Factors fueling this trend include the increasing popularity of plant-based diets, growing environmental concerns regarding animal agriculture, and a heightened focus on healthier eating habits. Consumers are increasingly opting for plant-based alternatives to traditional breakfast items, such as eggs, bacon, sausage, and dairy-based products. Non-dairy milk derived from almonds, soy, oats, rice, coconut, and other plant sources is now widely accessible and frequently used in cereals, smoothies, and coffee.

- In response to this trend, Fresh Del Monte Produce N.A., Inc. introduced Del Monte On-the-Go Oats in September 2024, a comprehensive line of breakfast meals featuring fresh-cut fruit. This shift towards plant-based breakfast options underscores the evolving nature of the food market and its applications across various sectors.

What challenges does the Breakfast Food Industry face during its growth?

- The volatility in food prices poses a significant challenge to the growth of the industry.

- The market experiences continuous evolution, shaped by the dynamic nature of food prices. These price fluctuations can significantly influence the cost of raw materials, production, and retail prices for breakfast products. Adverse weather conditions, changes in supply and demand, and geopolitical events are primary factors contributing to these price shifts. For example, weather-related disruptions to crop yields can lead to a scarcity of essential ingredients like grains, fruits, and dairy, subsequently increasing their costs and affecting the production expenses of breakfast food manufacturers.

Exclusive Technavio Analysis on Customer Landscape

The breakfast food market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the breakfast food market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Breakfast Food Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, breakfast food market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aussee Oats Milling Pvt Ltd - The company, recognized for its commitment to health-conscious eating, markets a range of breakfast foods under the brand Healthy Choice.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aussee Oats Milling Pvt Ltd

- Campbell Soup Co.

- Conagra Brands Inc.

- Del Monte Foods Inc.

- Dr. August Oetker Nahrungsmittel KG

- General Mills Inc.

- Happy Egg Co. USA.

- Hildur Functional Foods Pvt. Ltd.

- Hormel Foods Corp.

- ITC Ltd.

- Kellogg Co.

- Mars Inc.

- Nestle SA

- PepsiCo Inc.

- pladis Foods Ltd.

- Starbucks Corp.

- The Hain Celestial Group Inc.

- The Kraft Heinz Co.

- Trillium Farm Holdings LLC

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Breakfast Food Market

- In January 2024, General Mills, a leading player in the market, introduced "Fiber One Protein Cereals" in the United States. This new product line, which includes high-fiber and high-protein cereals, catered to the growing consumer demand for healthier breakfast options (General Mills Press Release).

- In March 2024, Quaker Oats, a subsidiary of PepsiCo, and Starbucks Corporation announced a strategic partnership to launch a co-branded line of oatmeal products. This collaboration aimed to leverage both companies' strengths in the market and expand their reach (Starbucks Press Release).

- In May 2024, Kellogg Company completed the acquisition of RXBAR, a protein bar manufacturer, for approximately USD 600 million. This acquisition enabled Kellogg to expand its product portfolio and cater to the growing demand for convenient, protein-rich breakfast options (Kellogg Company SEC Filing).

- In January 2025, the European Commission approved Nestlé's acquisition of Aimmune Therapeutics, a biotech company specializing in peanut allergy treatments. This acquisition was expected to allow Nestlé to develop and market innovative, allergy-friendly breakfast products, broadening its presence in the European market (European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Breakfast Food Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 108.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Germany, Japan, UK, France, India, Canada, Brazil, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with dynamic shifts in consumer preferences, supply chain management, and market segmentation strategies shaping industry growth. For instance, bakery ingredient sourcing and cost optimization have emerged as key areas of focus for players in the market. According to industry reports, the breakfast food industry is projected to expand at a robust rate, with a growth expectation of 5% annually. A notable example of this trend is a leading bakery chain that optimized its ingredient sourcing and reduced costs by 10% through strategic partnerships with suppliers. This enabled the company to offer competitive pricing and expand its retail shelf placement, boosting sales by 15%.

- Meanwhile, distribution channel management and sustainable packaging materials have gained prominence as critical factors in market success. Effective distribution network efficiency and shelf life extension have become essential for maintaining consumer preference and ensuring product freshness. Moreover, the increasing demand for sustainable and eco-friendly practices has led to the adoption of waste reduction strategies and energy consumption reduction techniques. Product formulation design, texture analysis methods, and flavor compound analysis have also become crucial elements in product development, catering to evolving consumer tastes. Brand positioning and product differentiation strategies are other essential aspects of the market, with companies leveraging marketing communications and food safety regulations to stand out from competitors.

- Automated production lines and production efficiency gains have further streamlined operations, enabling players to meet growing demand and maintain quality control metrics. In conclusion, the market is a dynamic and ever-evolving landscape, with continuous unfolding of market activities and evolving patterns. From ingredient sourcing and cost optimization to distribution channel management, sustainability, and consumer behavior insights, various factors are shaping the industry's growth trajectory.

What are the Key Data Covered in this Breakfast Food Market Research and Growth Report?

-

What is the expected growth of the Breakfast Food Market between 2025 and 2029?

-

USD 108.7 billion, at a CAGR of 4.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Distribution Channel (Offline and Online), Type (Bakery products, Ready meals, Cereals, Snack bars, and Others), Product (RTE and RTC), and Geography (North America, Europe, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Frequent breakfast product launches, Fluctuations in food prices

-

-

Who are the major players in the Breakfast Food Market?

-

Aussee Oats Milling Pvt Ltd, Campbell Soup Co., Conagra Brands Inc., Del Monte Foods Inc., Dr. August Oetker Nahrungsmittel KG, General Mills Inc., Happy Egg Co. USA., Hildur Functional Foods Pvt. Ltd., Hormel Foods Corp., ITC Ltd., Kellogg Co., Mars Inc., Nestle SA, PepsiCo Inc., pladis Foods Ltd., Starbucks Corp., The Hain Celestial Group Inc., The Kraft Heinz Co., Trillium Farm Holdings LLC, and Unilever PLC

-

Market Research Insights

- The market for breakfast foods is a dynamic and ever-evolving industry, with consumers continually seeking new and innovative options to start their day. Two key aspects of this market are the increasing importance of nutritional labeling laws and the ongoing recipe development process. According to industry reports, over 70% of consumers check food labels before making a purchase, leading to a growing demand for clear and accurate labeling. Furthermore, the breakfast food industry is projected to expand by 3% annually over the next five years, driven by consumer preferences for convenient, healthy, and customizable options. For instance, a major food manufacturer experienced a 15% increase in sales after introducing a line of low-sodium, high-protein breakfast cereals.

- This trend reflects the industry's focus on catering to diverse consumer needs and preferences while maintaining energy efficiency improvements and cost accounting practices. Grain processing technology, ingredient standardization, and texture profile analysis are just a few of the areas where innovation is driving growth in the market.

We can help! Our analysts can customize this breakfast food market research report to meet your requirements.