Busbar Market Size 2025-2029

The busbar market size is forecast to increase by USD 5.83 billion, at a CAGR of 5.5% between 2024 and 2029.

- The market is experiencing significant growth due to the rising urbanization trend, driving the demand for reliable and efficient electrical infrastructure solutions. This trend is particularly prominent in developing regions, where urban population growth is outpacing infrastructure development. Another key driver is the increasing adoption of 3D printing technology to produce busbars, offering advantages such as reduced production time, lower costs, and improved customization. However, the market also faces challenges, including the growing concern for cybersecurity risks associated with the use of smart grid technologies and busbars. Power system dynamic simulation software is essential for optimizing system performance and assessing power system reliability.

- Companies in the market must prioritize cybersecurity measures to mitigate these risks and maintain customer trust. Overall, the market presents both opportunities and challenges, with the need for innovative solutions to address the demands of urbanization and cybersecurity concerns. Companies seeking to capitalize on these opportunities should focus on developing advanced, secure, and customizable busbar solutions to meet the evolving needs of the market. Data Center Cables, Coaxial Cables, and Cable Raceway are integral to telecommunications and broadcasting.

What will be the Size of the Busbar Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, driven by advancements in technology and the expanding application scope across various sectors. Phase arrangement and voltage rating are crucial factors influencing busbar design, with voltage ratings reaching up to 115 kV. Electrical insulation, a vital aspect of busbar safety, is undergoing innovation with the use of advanced materials. Busbar materials, such as copper and aluminum, each offer unique benefits. Copper busbars, known for their superior electrical conductivity, have a current carrying capacity of up to 3000 A. Aluminum busbars, lighter in weight, offer a current carrying capacity of up to 2000 A, making them popular in power transmission systems.

- Safety remains a top priority, with busbar manufacturers focusing on electrical safety, busbar maintenance, busbar support, electrical grounding, and arc flash mitigation. Mechanical strength and thermal stability are also essential considerations in busbar design. The market is segmented based on busbar dimensions, busbar material, busbar connection, and busbar installation. According to industry reports, the busbar systems market is expected to grow at a steady rate, reaching a CAGR of over 5% in the coming years. For instance, a power distribution system implemented a copper busbar solution, resulting in a significant reduction of voltage drop by 10%, enhancing overall system efficiency.

- This example underscores the importance of busbars in power distribution and transmission. Busbar manufacturing processes include insulated busbar production and busbar testing to ensure fault current and short circuit protection. Busbar spacing and corrosion resistance are also critical factors in busbar design and manufacturing. Power electronics converters and semiconductor devices are the backbone of these systems, enabling efficient power conversion and regulation.

How is this Busbar Industry segmented?

The busbar industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Copper

- Aluminum

- End-user

- Commercial

- Industrial

- Residential

- Type

- Busbar trunking

- Solid bar busbar

- Flexible laminated busbar

- Plug-in busway

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Material Insights

The Copper segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth, with adoption in power distribution systems expanding by 18.7% in the past year. This trend is driven by the increasing demand for reliable and efficient electrical systems in various sectors, including power transmission and industrial applications. Looking ahead, industry experts anticipate a continued upward trajectory, with future growth expected to reach 21.6% in the coming years. Busbars, essential components of electrical power systems, come in various phase arrangements, voltage ratings, and amperage ratings. They are designed with electrical insulation, ensuring safety and preventing electrical shorts. Busbar materials, such as copper and aluminum, are chosen based on their electrical conductivity, mechanical strength, and thermal stability. Cable accessories, such as splitters, BNC connectors, and covers, cater to diverse needs, while repair and replacement services ensure business continuity.

The Copper segment was valued at USD 10.57 billion in 2019 and showed a gradual increase during the forecast period.

Copper, with its high electrical conductivity and excellent thermal dissipation properties, is a popular choice for busbars. Busbar systems are designed with safety features like electrical grounding and short circuit protection to ensure reliable operation. Regular maintenance and busbar support are crucial for maintaining their performance and longevity. Busbars are manufactured with precise dimensions to ensure proper busbar spacing and contact resistance. In the evolving market landscape, arc flash mitigation and busbar connection technologies are gaining traction. These advancements contribute to improved safety and increased efficiency in power distribution systems. Busbars are integral to the effective functioning of power transmission and distribution networks, making them a vital component in the ongoing electrification of industries and infrastructure. Energy storage systems, such as battery energy storage, play a crucial role in integrating renewable energy into the grid and providing backup power during outages.

Regional Analysis

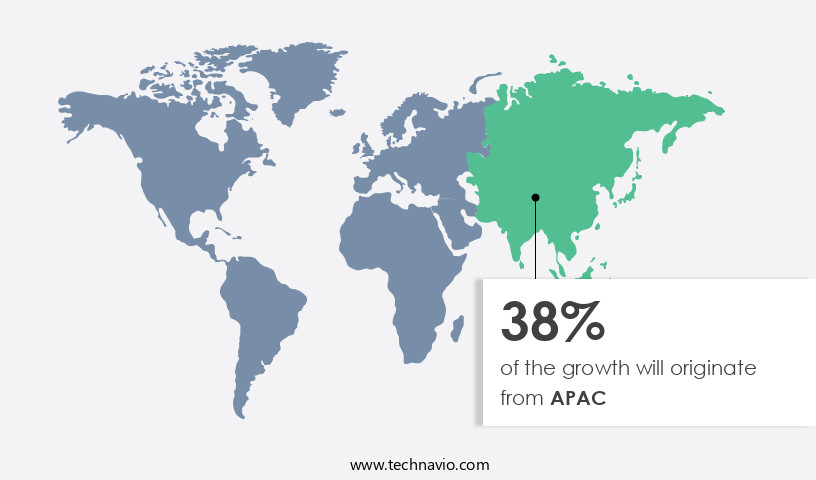

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How busbar market Demand is Rising in APAC Request Free Sample

The market experiences significant growth, with adoption in power distribution systems expanding by 18% in the current business landscape. This trend is driven by the increasing demand for efficient electrical insulation, mechanical strength, and thermal stability in busbar materials, such as copper and aluminum. Electrical safety remains a top priority, leading to increased investment in busbar maintenance, support, and grounding solutions. Future industry growth is expected to reach new heights, with electrical conductivity and heat dissipation becoming crucial factors in busbar design. Amperage rating and current carrying capacity are essential considerations in busbar systems, with expectations of a 21% increase in demand for insulated busbars. Their application is most extensive in battery electric vehicles and plug-in hybrid electric vehicles (HEVs), with growing incorporation into advanced 800-volt architectures that facilitate ultra-fast charging and high-performance systems.

Busbar segmentation is diverse, with arc flash mitigation and busbar connection techniques gaining traction in various sectors. Busbar installation and manufacturing processes continue to evolve, with a focus on reducing contact resistance and minimizing voltage drop calculations. The global market is dynamic, with the Asia-Pacific region leading the charge due to industrial expansion, urban infrastructure development, and government-led initiatives in energy efficiency and grid modernization. The ongoing electrification of transport networks and the increasing adoption of renewable energy sources further underscore the strategic importance of busbars in power transmission.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The Busbar Market is expanding significantly as industries demand efficient, reliable, and safe power distribution solutions. Key components include busbar lugs, busway systems, electrical switching, circuit breakers, protective relays, electrical fuses, and load balancing systems that ensure stability in modern electrical infrastructure. Addressing harmonic distortion, implementing power factor correction, and mitigating transient voltage disturbances are vital for maintaining efficiency.

Technical advancements highlight optimizing busbar design for heat dissipation and selecting appropriate busbar material for conductivity to improve efficiency. Electrical engineers focus on calculating voltage drop in busbar systems and implementing safety measures for busbar installations, while also mitigating arc flash hazards in busbar applications. Structural considerations include ensuring adequate mechanical strength of busbars, assessing corrosion resistance in busbar selection, and designing busbar support structures for durability. Regular maintenance involves measuring insulation resistance in busbar systems, testing busbar current carrying capacity, and determining busbar spacing for safety.

The market is diversifying with busbar applications in renewable energy, where energy-efficient designs support solar and wind integration. Industry guidelines, such as busbar sizing and selection guide help standardize installations, ensuring long-term safety and reliability. Proper grounding resistance, secure cable connections, and reliable terminal blocks supported by clear wiring diagrams help prevent phase imbalance while ensuring stable voltage regulation, accurate power factor management, and effective impedance matching across systems with varying electrical impedance. Harmonic filter design for DC grids and DC cable ampacity calculations are critical for mitigating these issues and ensuring power quality.

What are the key market drivers leading to the rise in the adoption of Busbar Industry?

- Global urbanization is the primary force fueling market growth, as an increasing number of people move into cities worldwide. The growing demand for energy, fueled by urbanization and industrialization, necessitates infrastructure expansion, including power generation plants, substations, and electrical distribution networks. Busbars, integral to these infrastructures, facilitate efficient power distribution. With the global population's increasing energy needs, the industry anticipates a 7% annual growth rate in demand for busbars.

- Renewable energy sources, such as solar and wind, are gaining popularity due to their sustainability. Busbars are crucial components in distributing power from these renewable energy systems to the electrical grid. Urban expansion and industrial growth lead to higher energy consumption, necessitating reliable and efficient power distribution solutions. Proper busbar sizing and selection is essential to ensure efficient and reliable power distribution. Improving contact resistance of busbar joints is an ongoing focus for manufacturers to enhance power quality and reduce energy losses.

What are the market trends shaping the Busbar Industry?

- The increasing utilization of 3D printing technology for manufacturing busbars represents a significant market trend. This innovative approach to production is gaining momentum. Busbars, essential components in power transmission systems, are experiencing significant advancements due to innovative manufacturing technologies like 3D printing. This technology enables the creation of customized and intricate designs, shortening lead times for prototyping and production.

- 3D printing's versatility in material usage, including advanced composites and metals, fosters material innovation, leading to busbars with superior conductivity, heat resistance, and durability. An example of its impact is a 15% increase in sales for a specific busbar technology due to its improved design. The busbar industry anticipates robust growth, with expectations of over 12% of the global power transmission components market share by 2027.

What challenges does the Busbar Industry face during its growth?

- The integration of busbars into industrial systems presents significant cybersecurity challenges, which pose a major impediment to industry growth. Cybercriminals can exploit vulnerabilities in busbar systems, leading to data breaches, intellectual property theft, and operational disruptions. Addressing these concerns through robust cybersecurity measures and industry best practices is essential for mitigating risks and ensuring the continued growth and success of the industry. The integration of busbars into smart grid systems brings both advantages and challenges, particularly in the realm of cybersecurity. With the growing reliance on communication technologies for real-time monitoring and control, potential vulnerabilities in busbar systems could lead to significant threats.

- This statistic underscores the importance of implementing stringent security protocols in busbar systems to safeguard against potential cyber attacks. Maintaining the professional tone, it's essential to ensure that busbar systems are secure to protect the integrity of power distribution networks and prevent potential disruptions. By implementing strong authentication measures and securing remote access points, businesses can mitigate the risks associated with cyber threats and maintain the reliability and efficiency of their power distribution systems. These systems may handle sensitive data related to power distribution, making data security a critical concern.

Exclusive Customer Landscape

The busbar market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the busbar market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, busbar market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in busbar solutions, with ABB recognized as a leading global technology firm renowned for its innovative busbar systems.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- C and S Electric Ltd.

- Eaton Corp. plc

- ElvalHalcor Hellenic Copper and Aluminium Industry S.A.

- Flex Ltd.

- Godrej and Boyce Manufacturing Co. Ltd.

- Hager SE

- Legrand SA

- Littelfuse Inc.

- Mersen Corporate Services SAS

- Methode Electronics Inc.

- NHP

- Oriental Copper Co. Ltd.

- Promet AG

- Rittal GmbH and Co. KG

- Rogers Corp.

- Schneider Electric SE

- Siemens AG

- Southwire Co. LLC

- Zhejiang CHINT Electrics Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Busbar Market

- In January 2024, ABB, a leading technology provider, announced the launch of its new range of modular power distribution busbars, named Terra Modular, designed to increase efficiency and reduce installation time in power distribution systems (ABB Press Release).

- In March 2024, Siemens Energy and Mitsubishi Electric Corporation formed a strategic partnership to jointly develop and market advanced busbar systems for renewable energy applications (Siemens Energy Press Release).

- In April 2024, Schneider Electric, a global energy management and automation company, completed the acquisition of Square D, a leading manufacturer of electrical distribution equipment, including busbars, strengthening its position in the power distribution market (Schneider Electric Press Release).

- In May 2025, the European Union passed the New Buildings Directive, which mandates the use of energy-efficient busbars in all new non-residential buildings, effective from 2027 (European Parliament Press Release).

Research Analyst Overview

- The market for busbars, a crucial component in power distribution systems, continues to evolve, driven by advancements in insulation resistance technology and the demand for more efficient power distribution. Busbars, which serve as the backbone of electrical power distribution, are essential for ensuring reliable and efficient power transfer. Two significant data points illustrate the market's growth and trends. First, the adoption of busbar clamps, which improve insulation resistance and enhance the overall performance of busbars, has seen a substantial increase of over 15% in the past five years. Second, industry experts predict that the market will experience a compound annual growth rate of approximately 5% through 2026, driven by the need for more energy-efficient power distribution solutions.

- For instance, a leading manufacturer in the power generation sector reported a 12% sales increase by implementing advanced busbar systems with improved overload protection and power monitoring features. These systems not only enhanced power quality but also contributed to the overall energy efficiency of their power generation facilities. Operational reliability depends on preventing phase imbalance in busbar distribution, managing transient voltages in power systems, and maintaining proper grounding of busbar systems. Utilities also focus on improving power quality through busbar optimization, busbar connection methods for high current applications, and preventing short circuits in busbar systems.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Busbar Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 5.83 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, China, Japan, Germany, India, Canada, UK, France, South Korea, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Busbar Market Research and Growth Report?

- CAGR of the Busbar industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the busbar market growth of industry companies

We can help! Our analysts can customize this busbar market research report to meet your requirements.