CAM Software Market Size 2024-2028

The cam software market size is forecast to increase by USD 1.92 billion at a CAGR of 9.15% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for automation in manufacturing industries. Cloud-based CAM solutions are gaining popularity as they offer flexibility and accessibility, enabling remote working and real-time collaboration. However, high implementation costs remain a challenge for small and medium-sized enterprises (SMEs).

- To tackle this, companies are providing affordable solutions and financing options. Moreover, the integration of advanced technologies like AI, machine learning, and IoT is spurring innovation, boosting productivity and efficiency. The market is poised for steady growth, creating opportunities for both new entrants and established players. Companies that focus on delivering cost-effective, user-friendly, and tech-driven solutions are likely to gain a competitive advantage.

What will be the CAM Software Market Size During the Forecast Period?

- The Computer-Aided Manufacturing (CAM) software market is a significant segment of the computer software industry, catering to machinery, robotics, and material processing in manufacturing organizations. CAM solutions enable designers, engineers, machinists, and enterprises to optimize production processes for CNC machines, enhancing tooling accuracy, reducing material waste, and improving energy efficiency. These software solutions play a crucial role in the manufacturing process by designing components, managing material requirements, and ensuring consistency in raw materials.

- Market dynamics include the increasing adoption of CAM software to achieve higher production speeds, improved tooling accuracy, and reduced energy consumption. The integration of cloud technologies in CAM solutions offers flexibility and accessibility, allowing organizations to streamline their manufacturing processes and enhance collaboration between teams.

- The market is expected to grow, driven by the continuous advancements in CNC machine tools and the increasing demand for efficient and cost-effective manufacturing solutions.

How is this CAM Software Industry segmented and which is the largest segment?

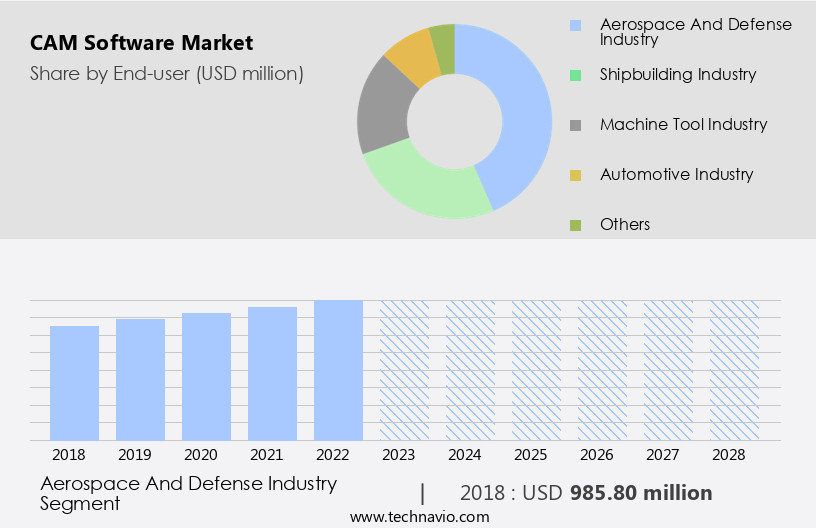

The cam software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Aerospace and defense industry

- Shipbuilding industry

- Machine tool industry

- Automotive industry

- Others

- Deployment

- On-premise

- Cloud-based

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By End-user Insights

- The aerospace and defense industry segment is estimated to witness significant growth during the forecast period.

The market holds significant potential In the manufacturing sector, particularly In the aerospace and defense industry. In 2023, this end-user segment accounted for a substantial market share due to the automation of manufacturing processes, productivity gains, and stringent quality requirements in aerospace and defense production. CAM software enables precise control over milling, cutting, roughing, and other manufacturing processes, ensuring adherence to industry standards. Leading aerospace and defense companies heavily invest in and adopt CAM software to optimize production and create high-quality products. The market's growth is driven by the increasing use of advanced technologies like additive manufacturing, CNC machining, and robotics In the sector. The adoption of cloud technologies and automated manufacturing processes further enhances the efficiency and flexibility of CAM software In the aerospace and defense industry.

Get a glance at the CAM Software Industry report of share of various segments Request Free Sample

The Aerospace and defense industry segment was valued at USD 985.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing significant growth due to the region's robust manufacturing sector, particularly in industries such as automotive, aerospace, and defense. Companies like GE and Boeing are utilizing CAM software to optimize production processes, increase automation, and ensure precision. The expansion of the market is also driven by advancements in related technologies, including additive manufacturing, CNC machining, and robotics. These technologies require sophisticated CAM software to manage and schedule manufacturing operations efficiently. The market is expected to continue growing as industrialization advances and emerging economies adopt modern manufacturing processes. Cloud-based CAM solutions are becoming increasingly popular due to their flexibility and cost-effectiveness.

Market Dynamics

Our cam software market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of CAM Software Industry?

Increasing demand for automation is the key driver of the market.

- The Computer-Aided Manufacturing (CAM) software market is witnessing significant growth due to the increasing demand for automated and efficient manufacturing processes. CAM software plays a crucial role in optimizing production workflows by automating tasks such as toolpath generation, CNC machine programming, and simulation. This results in reduced manual intervention, increased accuracy, and shorter lead times. CAM software is essential for various industries, including machining, robotics, and machinery, to enhance their manufacturing capabilities and improve production speeds. Materials requirements, production speeds, raw material consistency, tooling accuracy, waste reduction, energy efficiency, and automation trends are key factors driving the growth of the market.

- The market is also witnessing the adoption of cloud-based solutions, which offer benefits such as cost savings, IT infrastructure reduction, and scalability. Leading organizations In the manufacturing sector, including machinists, designers, engineers, and architects, are increasingly adopting CAM software to streamline their manufacturing processes and improve productivity. The market is witnessing mergers and acquisitions, partnership collaborations, and client wins, as leading players seek to expand their offerings and reach new clientele. CAM software solutions are used across various industries, including automobile manufacturing, aerospace and defense, shipbuilding, and fabrication. Technological innovations, such as machine learning and smart packaging, are also driving the growth of the market.

- Large enterprises are increasingly focusing on optimized manufacturing processes and deploying cloud-supported CAM software to achieve faster production processes, improved design quality, and real-time data visibility and control over production activities. The market is expected to continue its growth trajectory, driven by the increasing demand for automated production and the need for efficient manufacturing processes.

What are the market trends shaping the CAM Software Industry?

Cloud-based CAM software is the upcoming market trend.

- Cloud-based Computer-Aided Manufacturing (CAM) software is experiencing significant growth In the US market due to its numerous advantages. These benefits include remote access, real-time collaboration, and cost efficiency. Leading CAM software providers, such as Autodesk, offer cloud-based services that enable users to access their CAM tools from any location with an internet connection. The National Institute of Standards and Technology (NIST) supports this trend, highlighting the cost savings, flexibility, and improved collaboration capabilities that cloud-based CAM software provides for small- and medium-sized enterprises. The manufacturing industry's shift towards automation and industrialization is driving the demand for CAM software. Machinery, robotics, and materials requirements are crucial elements of the manufacturing process that CAM software can optimize.

- Production speeds, raw material consistency, tooling accuracy, waste reduction, energy efficiency, and automation are key areas where CAM software can add value. Key trends In the market include the adoption of cloud-supported solutions, mergers and acquisitions, and partnership collaborations. The market is also witnessing the integration of machine learning (ML) and smart packaging techniques to enhance manufacturing capabilities. The automobile, aerospace and defense, shipbuilding, and machine tools industries are some of the major sectors adopting CAM software to streamline their manufacturing processes and improve production efficiency. In terms of growth strategies, both organic and inorganic approaches are being employed.

- Organizations are investing in training and education for their machinists, designers, and engineers to maximize the benefits of CAM software. They are also focusing on optimizing manufacturing processes and reducing production costs through automated CNC programming and machining simulation. Inorganic growth strategies include acquisitions and partnerships to expand market reach and enhance product offerings. Overall, the market is expected to continue its growth trajectory, driven by technological innovations, the increasing adoption of cloud computing, and the need for faster production processes. The market is also witnessing the emergence of new players, offering flexible subscription-based models and automated CNC programming solutions, further fueling its growth.

What challenges does the CAM Software Industry face during its growth?

High implementation costs is a key challenge affecting the industry growth.

- The Computer-Aided Manufacturing (CAM) software market encompasses computer software utilized in machinery, robotics, and automation industries for optimizing production processes. This software assists organizations in managing materials requirements, enhancing production speeds, ensuring raw material consistency, improving tooling accuracy, and reducing waste while increasing energy efficiency. The automation trend in industrialization, particularly in emerging economies, is driving the demand for CAM solutions. In the manufacturing sector, CAM software is increasingly being adopted by automobile manufacturers, aerospace and defense industries, shipbuilding, and fabricators to streamline their manufacturing cycles. Technological innovations in CNC machines, milling, cutting, and other manufacturing processes are enabling faster production processes and optimized manufacturing practices.

- Cloud-based CAM solutions are gaining popularity due to their cost-effectiveness, flexibility, and scalability. These solutions offer real-time data visibility and control over production activities, enabling automated production and predictive maintenance. However, the high initial investment required for CAM software deployment remains a challenge for smaller businesses. Key trends In the market include the adoption of cloud computing services, machine learning, and smart packaging techniques. Large enterprises are focusing on optimized manufacturing processes and deploying CAM solutions on both cloud and on-premises. The ecosystem of CAM software includes leading players like Autodesk, PlanGrid, and construction software providers, offering design, engineering, and product design solutions.

- Despite the challenges, the benefits of CAM software, such as increased efficiency, productivity, and cost savings, make it an essential tool for organizations seeking to remain competitive in today's manufacturing landscape.

Exclusive Customer Landscape

The CAM software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the CAM software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cam software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

3D Systems Corp. - The company provides CAM (Computer-Aided Manufacturing) software solutions, enabling users to generate NC (Numerical Control) programs, facilitate data integration, and ensure seamless application integration. This advanced technology streamlines the manufacturing process, enhancing productivity and efficiency for US businesses.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3D Systems Corp.

- Autodesk Inc.

- Bricsys NV

- Camnetics Inc.

- CNC Software LLC

- Constellation Software Inc.

- Dassault Systemes SE

- GRZ Software LLC

- HCL Technologies Ltd.

- Hexagon AB

- MecSoft Corp.

- Modern Machine Shop

- OPEN MIND Technologies AG

- PTC Inc.

- SCHOTT SYSTEME GmbH

- Siemens AG

- Sigma TEK

- SolidCAM GmbH

- WiCAM GmbH

- ZWSOFT CO. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Unraveling the Dynamics of the Computer-Aided Manufacturing (CAM) Software Market: Trends, Growth Factors, and Strategies The Computer-Aided Manufacturing (CAM) software market encompasses a range of solutions designed to optimize manufacturing processes by automating the creation, modification, and optimization of toolpaths for machining operations. This sector is fueled by the ongoing industrialization trend and the increasing adoption of advanced technologies in various industries. CAM software plays a pivotal role in enhancing manufacturing capabilities by ensuring raw material consistency, tooling accuracy, and waste reduction. The software enables organizations to achieve higher production speeds, energy efficiency, and automation, making it an essential component of modern manufacturing processes.

The market is experiencing significant growth due to the increasing demand for automation and the need for organizations to remain competitive. This growth is driven by various factors, including the emergence of emerging economies, the rise of cloud-based solutions, and the increasing adoption of advanced technologies such as robotics and machine learning (ML). The manufacturing industry, which includes sectors such as automotive, aerospace and defense, shipbuilding, and fabrication, is a significant contributor to the market. These industries require high levels of precision, efficiency, and productivity, making CAM software an indispensable tool. One of the key trends In the market is the increasing adoption of cloud-based solutions.

Cloud deployment offers several advantages, including scalability, faster deployment, and lower costs. Cloud-based CAM solutions enable organizations to access their manufacturing processes from anywhere, making it easier to collaborate and manage production activities in real-time. Another significant trend In the market is the increasing use of machine learning (ML) and other enabling technologies. ML algorithms help optimize manufacturing processes by analyzing data and providing insights to improve efficiency, reduce downtime, and enhance product quality. The market is highly competitive, with numerous organizations offering solutions tailored to various industries and manufacturing processes. Growth strategies In the market include organic growth, such as product innovation and training and education, as well as inorganic growth strategies, such as acquisitions and partnership collaborations.

The market is expected to continue growing as organizations seek to optimize their manufacturing processes and remain competitive. The market is driven by the increasing demand for automation, the adoption of advanced technologies, and the need for greater efficiency and productivity. In conclusion, the Computer-Aided Manufacturing (CAM) software market is a dynamic and growing sector, driven by the ongoing trend towards industrialization and the increasing adoption of advanced technologies. The market offers significant opportunities for organizations looking to optimize their manufacturing processes, reduce costs, and improve productivity. The future of the market is bright, with continued innovation and the integration of advanced technologies such as machine learning (ML) and cloud computing set to drive growth and transform the manufacturing landscape.

|

CAM Software Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.15% |

|

Market growth 2024-2028 |

USD 1.92 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.4 |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this CAM Software Market Research and Growth Report?

- CAGR of the CAM Software industry during the forecast period

- Detailed information on factors that will drive the CAM Software growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the CAM software market growth of industry companies

We can help! Our analysts can customize this CAM software market research report to meet your requirements.