Canola Oil Market Size 2025-2029

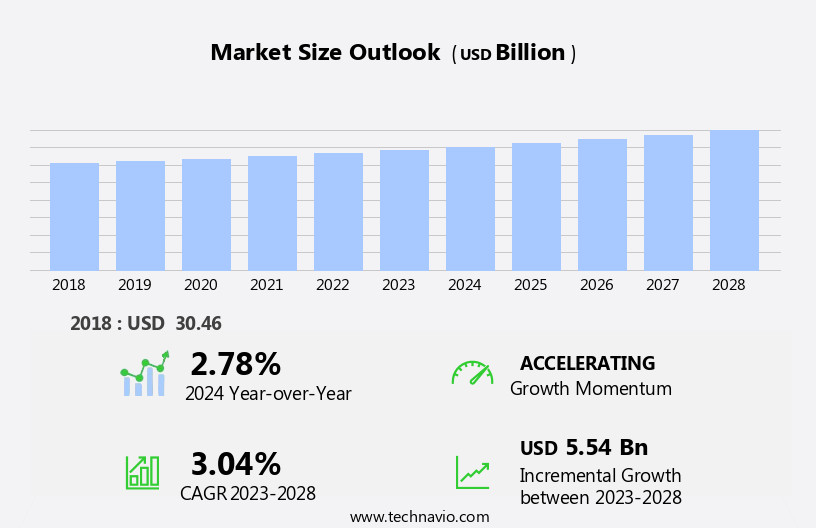

The canola oil market size is forecast to increase by USD 6.91 billion, at a CAGR of 3.3% between 2024 and 2029.

- The market is driven by the increasing awareness of the health benefits associated with this versatile oil. Rich in monounsaturated and polyunsaturated fats, canola oil is a preferred choice for health-conscious consumers, leading to its growing demand in the food industry. Furthermore, the utilization of canola oil extends beyond the culinary sphere, with its application in plasticizers and adhesives industries. However, the market faces challenges from the rising popularity of substitute oils, such as olive oil and coconut oil, which are also promoted for their health benefits.

- Companies in the market must navigate this competitive landscape by focusing on product innovation, cost competitiveness, and effective marketing strategies to maintain their market share. Additionally, ensuring sustainable sourcing and production practices can help bolster brand reputation and consumer trust, providing a strategic advantage in the market.

What will be the Size of the Canola Oil Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, shaped by dynamic market dynamics and various applications across multiple sectors. Canola oil production is a significant contributor to the market, with ongoing efforts in crop breeding and yield optimization driving growth. Simultaneously, biodiesel production from canola oil is gaining traction as a renewable energy source, adding to the market's complexity. The food service industry and retail distribution sectors are major consumers of canola oil, with competition from various edible oils and changing consumer preferences influencing market trends. The competition landscape is diverse, with players focusing on product differentiation through omega-3 fatty acid content, non-GMO and organic offerings, and sustainable agriculture practices.

Oilseed byproducts, such as canola meal, have additional value in animal feed and fertilizer industries, further impacting market dynamics. New technologies, including improved crushing technology and refining methods, are shaping the market, while sustainability concerns and environmental impact assessments influence pricing trends. The fatty acid profile and health benefits of canola oil, including heart health and disease resistance, continue to drive demand. Culinary applications, from salad dressings to frying oil, expand the market's reach. Sustainable agriculture practices, pest control methods, and packaging formats are essential considerations for market players, ensuring a continuous focus on innovation and adaptation. The global production of canola oil is subject to market volatility and supply chain management challenges, with regional production patterns and transportation logistics influencing pricing and availability.

As consumer dietary habits shift, market dynamics will continue to evolve, requiring agility and strategic planning from industry participants.

How is this Canola Oil Industry segmented?

The canola oil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Conventional

- Organic

- Application

- Cooking

- Industrial

- Product Type

- Processed

- Virgin

- Cold-pressed

- Extracted

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

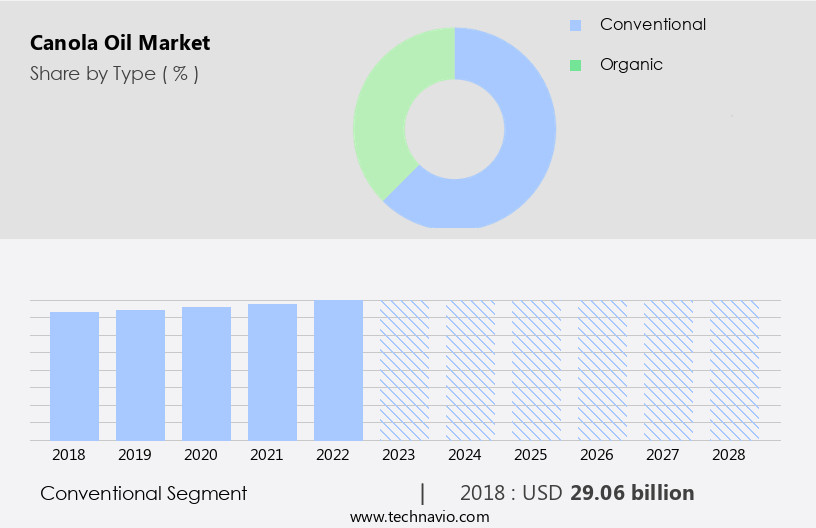

The conventional segment is estimated to witness significant growth during the forecast period.

Canola oil, derived from genetically modified rapeseed, undergoes solvent extraction using hexane for oil separation. This process contrasts with pressing techniques used for other oils. The extracted oil then undergoes refining, bleaching, and deodorization (RBD) for commercial production. The affordability and widespread availability of conventional canola oil contribute to its popularity among consumers, despite its inability to be certified organic. Crop breeding and yield optimization have significantly increased canola oil production, making it a leading vegetable oil in the global market. The oil's health benefits, including heart health, disease resistance, and a favorable fatty acid profile, contribute to its widespread use in various industries.

Food service, retail distribution, and the production of biodiesel are significant sectors for canola oil consumption. Environmental concerns, such as carbon footprint and land use, have led to the development of new technologies and sustainable agriculture practices. These advancements include crushing technology, renewable energy, and fair trade certifications. Consumer preferences for non-GMO, organic, and sustainably produced canola oil have also influenced the market. The competition landscape is diverse, with various players focusing on innovation, pricing, and sustainability. Bulk packaging, wholesale markets, and oilseed processing are essential aspects of the canola oil supply chain. Canola meal, a byproduct of oil production, is used as animal feed, further contributing to the market's economic significance.

Despite the benefits of canola oil, its production involves water consumption and potential market volatility. Genetic modification and pest control practices have also raised concerns regarding environmental impact and health implications. However, ongoing research and development aim to address these challenges and enhance the oil's antioxidant properties.

The Conventional segment was valued at USD 33.55 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

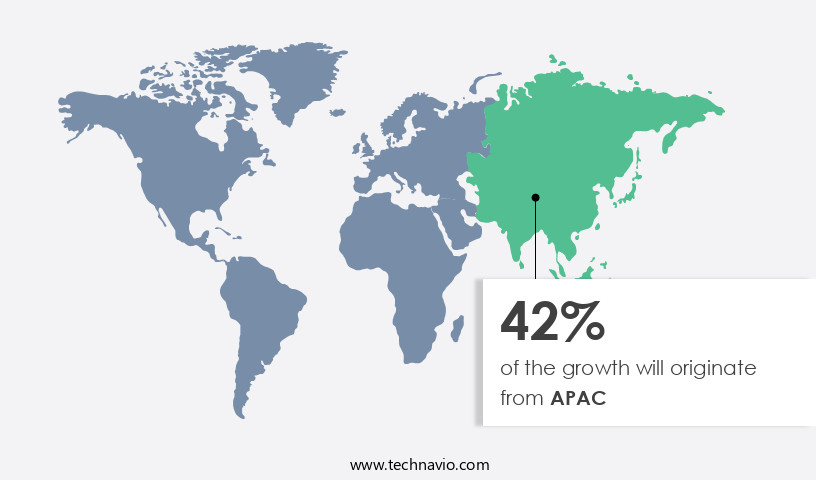

APAC is estimated to contribute 48% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Canola oil, derived from the seeds of the canola plant, is a popular edible oil in the APAC region and globally. Its fatty acid profile, rich in monounsaturated oleic acid and polyunsaturated linoleic acid, contributes to its health benefits, including heart health and disease resistance. The increasing awareness of healthier dietary habits and the growing food service industry are driving the demand for canola oil. The production of canola oil involves several processes, including crop breeding for higher yield and disease resistance, oil refining through solvent extraction or pressing techniques, and storage in facilities to maintain quality.

The environmental impact of canola oil production is a concern due to its carbon footprint and water consumption. However, new technologies and sustainable agriculture practices are being adopted to mitigate these issues. Canola oil is used in various culinary applications, such as salad dressings, cooking, and frying. It is also used as a raw material in the production of biodiesel and canola meal, which is used as animal feed. The competition landscape for canola oil is diverse, with various players offering different grades, such as refined, organic, and fair trade. The major countries contributing to the growth of the market in the APAC region are China, India, Australia, Thailand, and South Korea.

China and India are significant consumers due to their large populations and growing health consciousness. These countries, along with Japan and Australia, account for approximately 40% of the global canola production. The pricing trends for canola oil are influenced by various factors, including supply chain management, market volatility, and oilseed processing. The market is expected to continue growing due to increasing consumer preferences for healthier alternatives and the adoption of new technologies in oilseed processing. However, the market faces challenges such as competition from other edible oils and the availability of genetically modified canola. The market for canola oil is dynamic, with ongoing research and development in areas such as omega-3 fatty acids, antioxidant properties, and sustainable production methods.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Canola Oil Industry?

- The significant growth of the market can be attributed to the rising consumer awareness regarding the health advantages this oil provides.

- Canola oil, recognized for its heart-healthy properties, holds a significant position in the global edible oils market. This oil, approved by the US Food and Drug Administration (FDA) and the American Heart Association, boasts a favorable fatty acid profile. It contains a minimal amount of saturated fat and is rich in monounsaturated fat, which helps decrease bad cholesterol levels and sugar in the blood. The increasing awareness of health-conscious dietary habits has fueled the demand for canola oil in various industries, including food manufacturing and foodservice. New technologies have been introduced for bulk packaging and transportation logistics, ensuring its availability and accessibility to consumers.

- Canola oil's versatility extends beyond cooking applications, as it is also used in the production of biodiesel and canola meal for animal feed. Its renewable energy applications contribute to its growing popularity, making it a sustainable choice for businesses and consumers alike. In the realm of food manufacturing, canola oil is widely used in salad dressings and other processed foods. Its neutral taste and high smoke point make it a preferred choice for commercial applications. Additionally, its health benefits, such as disease resistance and support for heart health, add value to the end products.

- In conclusion, the market is driven by the growing demand for healthy and sustainable food ingredients. Its unique fatty acid profile, versatility, and various applications make it a valuable commodity in the food industry.

What are the market trends shaping the Canola Oil Industry?

- The use of canola oil in plasticizers and adhesives is gaining popularity as a market trend. This renewable resource offers several advantages, including improved product performance and sustainability. Canola oil's versatility makes it an attractive alternative to traditional petroleum-based products. In the plasticizer industry, its biodegradability and reduced toxicity contribute to eco-friendly manufacturing processes. Similarly, in adhesives, canola oil's excellent binding properties and reduced volatility enhance product durability and overall performance.

- Canola oil, derived from the seeds of the canola plant, holds significance in various industries, including biodiesel production and food service. In terms of production, canola ranks among the top oilseeds globally. The oil's versatility extends to its application in the production of biodiesel, contributing to the renewable energy sector. In the food service industry, canola oil's neutral taste and high smoke point make it a preferred choice for culinary applications. Retail distribution channels ensure its availability in supermarkets and grocery stores for consumers. Competition in the market is driven by factors such as consumer preferences for omega-3 fatty acids, sustainability, and the availability of alternatives like GMO and organic canola oil.

- Oilseed byproducts, such as meal, also contribute to the market's value chain. Canola oil's role extends beyond food and fuel. In industrial applications, it is used as a plasticizer in the production of polymers. Its use as a green alternative to traditional petroleum-based plasticizers aligns with the trend towards sustainable agriculture. In conclusion, the market is dynamic, driven by various factors, including industrial applications, food service, and consumer preferences. Its versatility and sustainability make it a valuable commodity in the global market.

What challenges does the Canola Oil Industry face during its growth?

- The escalating demand and preference for substitute products pose a significant challenge to the industry's growth trajectory.

- Canola oil, a popular edible oil, faces competition from various substitutes in the global market. These alternatives include sunflower oil, olive oil, peanut oil, palm oil, sesame oil, coconut oil, safflower oil, and avocado oil. The demand for these substitutes is increasing significantly due to their diverse applications in both food and non-food industries. For instance, olive oil consumption in the US is projected to reach approximately 406,000 metric tons by 2024. Canola oil substitutes offer several advantages. For example, they come in various packaging formats, catering to different consumer preferences. Refined canola oil alternatives undergo different processing techniques, such as pressing, to produce different grades.

- Some substitutes, like fair trade canola oil, emphasize ethical sourcing and production methods. Substitutes like palm oil and sunflower oil have higher saturated fat content compared to canola oil. However, they offer higher smoke points, making them suitable for frying applications. Some substitutes, like sesame oil and olive oil, have antioxidant properties that contribute to their health benefits. Market dynamics, such as supply chain management and oilseed processing, impact the availability and pricing of canola oil substitutes. Additionally, genetic modification and water consumption are crucial factors to consider when evaluating the sustainability and environmental impact of these alternatives.

- In conclusion, the market for canola oil substitutes is dynamic and diverse. Consumers and businesses have various options to choose from based on their preferences, applications, and sustainability concerns. Understanding the unique features and advantages of each substitute can help make informed decisions.

Exclusive Customer Landscape

The canola oil market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the canola oil market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, canola oil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACH FOOD CO.

- Adams Group

- American Vegetable Oils Inc.

- Archer Daniels Midland Co.

- Borges International Group SLU

- Bunge Global SA

- Cargill Inc.

- Centra Foods

- CHS Inc

- Highwood Crossing Foods Ltd.

- Huiles Titan Inc.

- Jivo Wellness Pvt. Ltd.

- Louis Dreyfus Co. BV

- Parrish and Heimbecker Ltd.

- Paterson GlobalFoods Inc.

- Richardson International Ltd.

- Sunora Foods Inc.

- Ventura Foods LLC

- Viterra Inc.

- Wilmar International Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Canola Oil Market

- In March 2024, Archer Daniels Midland Company (ADM) announced the expansion of its canola processing facility in Manitoba, Canada, increasing its production capacity by 50%. This development aims to meet the growing demand for canola oil in the North American market (ADM press release, 2024).

- In July 2024, Cargill and Dow announced a strategic collaboration to commercialize Dow's Enhanced Canola Technology (ECT2), a high oleic canola oil with improved stability and functionality. This partnership is expected to bring healthier and more sustainable cooking oil options to consumers (Cargill press release, 2024).

- In January 2025, Bunge Limited acquired a 50% stake in the Canadian canola processing joint venture, Canola Grains, from its joint venture partner, Richardson International. This acquisition strengthens Bunge's position in the market and expands its presence in Canada (Bunge press release, 2025).

- In May 2025, the European Commission approved the renewal of the European Union's authorization for the use of canola oil as a feedstock for biodiesel production. This decision supports the continued growth of the European biodiesel market and the demand for canola oil (European Commission press release, 2025).

Research Analyst Overview

- Canola oil, derived from the rapeseed plant, is a prominent player in the global edible oils market. Agricultural practices, including crop rotation and precision agriculture, significantly influence canola seed production. Transgenic canola, engineered through gene editing, has gained traction due to its resistance to pests and herbicides. In the oilseed processing sector, plant-based oils, including canola oil, face labeling requirements disclosing allergen information. Shelf life and food safety are crucial concerns, necessitating advanced refining equipment and quality control measures. Remote sensing technology aids in monitoring agricultural practices, optimizing oilseed farming, and mitigating climate change impacts.

- Canola oil blends, often used as biofuel feedstocks, contribute to the energy sector. Land degradation and water scarcity pose challenges to oilseed farming, necessitating sustainable agricultural practices. Biotechnological advancements, such as gene editing, enhance crop yield and resilience. The oilseed crops market is subject to regulatory oversight, ensuring compliance with food regulations. Rapeseed oil and canola oil processing plants employ packaging machinery to maintain product integrity and meet consumer demands. Canola oil's role as a dietary fat source and its potential as a biofuel feedstock underscores its market significance. Market dynamics are influenced by agricultural practices, oilseed farming, and food regulations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Canola Oil Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 6906 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

China, US, Germany, UK, Japan, France, Canada, India, South Korea, and Russia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Canola Oil Market Research and Growth Report?

- CAGR of the Canola Oil industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the canola oil market growth of industry companies

We can help! Our analysts can customize this canola oil market research report to meet your requirements.